The USD was mixed at the start of the trading day. Below are was the dollar changes vs the major currencies near the start of the US session.

The USD at the start of the US trading day

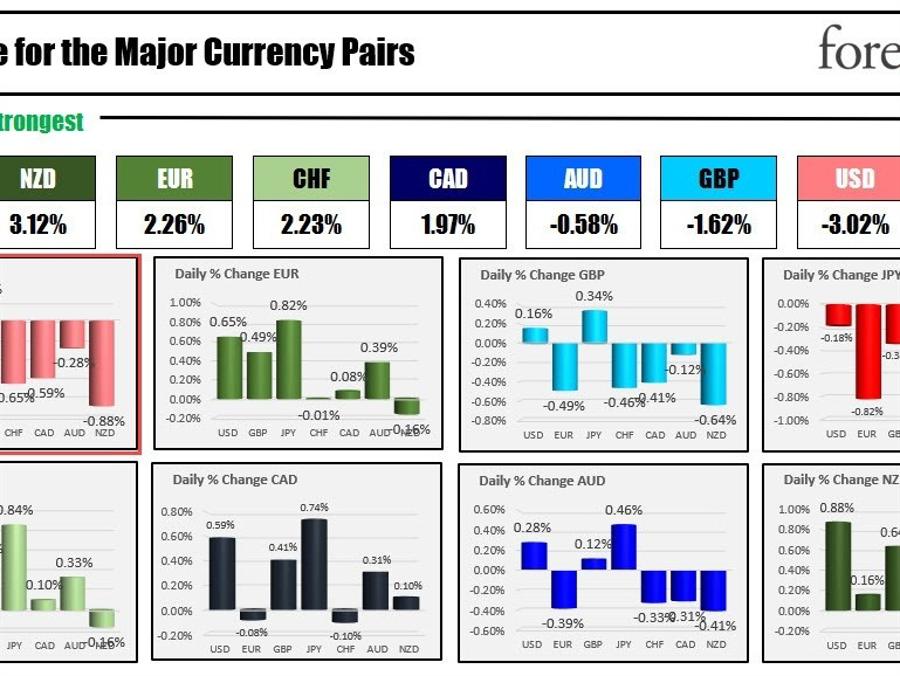

Looking at the snapshot of the strongest to the weakest now shows the USD is lower against all the major currencies with the exception of the JPY. Having said that, the USDJPY is still a bit lower from earlier levels.

The strongest to the weakest of the major currencies

Taking a look at some of the major currencies :

- EURUSD: The EURUSD has broken above swing areas between 1.0933-1.0942 and then 1.09618 – 1.09728. The next major target comes near 1.1000. The high from May 10 reached 1.1006. Recall from the start of day video, the EURUSD had a trading range of 28 pips. There was room to roam. The PIP range is now up to 84 pips. (see video here)

- GBPUSD: The GBPUSD moved down to test the 200-hour MA coming into the US session despite higher CPI inflation. The close support from the earlier video released today was at the high from last Wednesday at 1.26988. That level held the corrective move lower today and the price has surged to a US session high of 1.2785. At the high, the price is retesting the 100-hour MA at 1.2781. Move above, and the high from after the UK CPI comes in at 1.2801. The high last week reached 1.28478.

- USDCAD: The USDCAD is now trading to its lowest level going back to September 2022. In the process today, the price fell below a key swing area between 1.3207 and 1.32299. The next key target on the daily chart comes at 1.3132. That is the 50% midpoint of the move up from the October 2021 level to the high reached in October 2022. Risk on the daily chart is a low back above 1.32299.

- USDJPY: The USDJPY had their shot with a move above the high from yesterday, and the high going back to November 21, 2022. Both those levels came in at 142.246. The high price today reached 142.36. Momentum could not be sustained. The US dollar started to move lower, and so did the USDJPY. Looking at the hourly chart below, the 100-hour moving average stalled the fall yesterday and earlier today (blue line in the chart below). That level comes in at 141.505. Going forward moving below the 100-hour moving average – and staying below – should increase the bearish bias (there is a swing area down to 141.43 as well). So getting below that area would be helpful. Absent a move below that area, and the buyers are still in play. Watch the 100-hour MA.

This article was originally published by Forexlive.com. Read the original article here.