Sterling is given a boost in the wake of latest CPI data, which indicated a steady headline inflation rate and a further acceleration in core inflation. This data is likely to solidify BoE’s case for a rate hike in tomorrow’s meeting. However, how long this tightening phase will continue remains uncertain. Notably, the Pound’s buying momentum is presently restrained, and the wider currency market appears to be operating within the confines of yesterday’s range.

As we approach the halfway mark for the week, Dollar and Yen appear to be the slightly stronger ones, as they digest their recent steep losses. However, neither currency has displayed clear reversal sign yet. Direction for the remainder of the week could hinge on Fed Chair Jerome Powell’s testimony today and tomorrow, and its subsequent impact on the broader financial market. Australian and New Zealand Dollars are underperforming, as they consolidate their recent gains. European majors are mixed in anticipation of the upcoming rate decisions by BoE and SNB tomorrow.

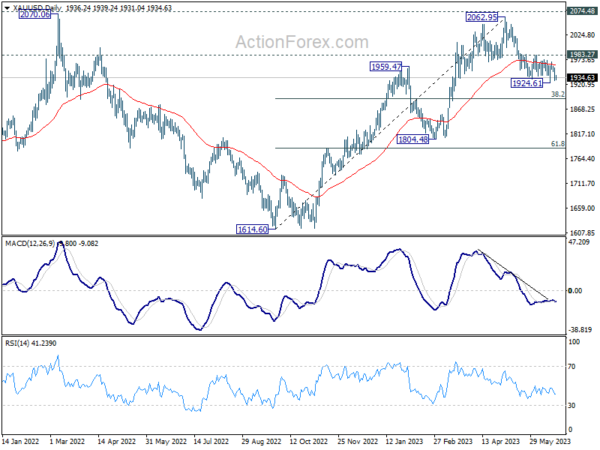

Technically, Gold continues to be a point of attention, as it weakened notably after recovery from 1924.61 was capped by 55 D EMA, and well below 1983.27 resistance. Break of 1924.16 support will resume the fall from 2062.95 to 38.2% retracement of 1614.60 to 2062.95 at 1891.68. Nevertheless, break of 1983.27 will suggest that correction from 2062.95 has completed, and prompt stronger rally back towards this high. As usual, Gold’s next move will be closely watched as an indication or confirmation of Dollar’s trajectory.

In Asia, Nikkei rose 0.56%. Hong Kong HSI is down -2.08%. China Shanghai SSE is down -1.10%. Singapore Strait Times is up 0.24%. Japan 10-year JGB yield dropped another -0.0092 to 0.381. Overnight, DOW dropped -0.72%. S&P 500 dropped -0.47%. NASDAQ dropped -0.16%. 10-year yield dropped -0.0040 to 3.729.

UK CPI unchanged at 8.7% yoy in May, core CPI rose to 7.1% yoy

UK annual CPI was unchanged at 8.7% yoy in May, above expectation of 8.5% yoy. Core CPI (excluding energy, food, alcohol and tobacco) accelerated to 7.1% yoy, up from prior month’s 6.8% yoy, and the highest rate since March 1992. CPI goods eased from 10.0% yoy to 9.7% yoy. But CPI services rose from 6.9% yoy to 7.4% yoy. For the month, CPI rose 0.7% mom, slowed from April’s 1.2% mom, but was well above expectation of 0.4% mom.

Also released. RPI ticked down from 11.4% yoy to 11.3% yoy, above expectation of 11.1% yoy. PPI input came in at -1.5% mom, 0.5% yoy, versus expectation of -0.6% mom, 1.2% yoy. PPI output was at -0.5% mom, 2.9% yoy, versus expectation of -0.1% mom, 3.6% yoy. PPI output core was at -0.3% mom, 4.1% yoy, versus expectation of 0.1% mom, 4.7% yoy.

BoJ Adachi: Appropriate to continue monetary easing with YCC

BoJ board member Seiji Adachi voiced support for continued monetary easing amid a climate of significant uncertainty regarding price outlook. Adachi relayed these views during a discussion with business leaders in Kagoshima.

Adachi said, “My view is that it’s appropriate to continue monetary easing with the yield curve control framework.” He added, “The shape of the yield curve has become smooth overall and there is improvement in market functioning.”

“Amid huge uncertainty over the price outlook, there are upside and downside risks. In the long run, however, the downside risks appear to be larger,” he warned. These risks, according to Adachi, must be carefully considered when deciding on changes to monetary policy.

Adachi also noted an interesting shift in public’s perception of inflation, suggesting that Japan’s long-standing deflationary mindset is starting to change. “We’re seeing some changes in the public’s deflationary mindset, or the perception that prices won’t rise,” he said.

“In a sense, we’re moving closer to achieving our price target. But there’s high uncertainty over our baseline inflation outlook, so it’s premature to tweak monetary policy,” Adachi concluded.

Australia’s Westpac leading index fell to -1.09%, weakness to extend into 2024

Australia Westpac Leading Index growth rate fell from -0.78% to -1.09% in May. This is the lowest read of the growth rate since the pandemic. The tenth consecutive negative print for the index. The negative Index growth rates point to below-trend economic growth.

Westpac expects the weakness to extend through 2023 and into 2024. Westpac recently revised down growth forecast 2023 and 2024, from 1% and 1.5% to 0.6% and 1.0% respectively. This weakness in the economy is centred around consumers but also reflects slowing global economy; downturn in dwelling construction; and progressive weakening in labour market.

Regarding RBA policy, Westpac expects the central bank to raise cash rate by a further 0.25% at July 4 meeting. “As we saw at the June Board meeting, we expect that the July meeting will see these considerations of inflation risks again overriding concerns about the poor growth outlook.”

Fed nominees Jefferson, Cook and Kugler prioritize tackling inflation

Three nominees for key roles at Fed, including two sitting Fed Governors, have pledged to make tackling inflation their primary concern if their nominations are confirmed. This commitment was made in prepared remarks ahead of confirmation hearings before Senate Banking Committee on Wednesday.

Philip Jefferson, the nominee for vice chair, recognized the multifaceted challenges facing the economy including inflation, banking-sector stress, and geopolitical instability. Jefferson said, “The Federal Reserve must remain attentive to them all. Inflation has started to abate, and I remain focused on returning it to our 2 percent target.”

Lisa Cook, who is nominated for a new 14-year term, echoed Jefferson’s concerns about inflation. She stated, “The American economy is at a critical juncture, and it will be essential for the FOMC to act as needed to bring inflation back to our 2% inflation target.”

Adriana Kugler, the nominee chosen by President Joe Biden to fill the vacancy left by Lael Brainard earlier this year, reiterated the same sentiment. Kugler emphasized, “If confirmed, I am deeply committed to setting monetary policy to reduce inflation and promote maximum employment, and to foster the resilience of the financial sector to support job creation and economic growth.”

Looking ahead

Canada will release retail sales and new housing price index. Fed Chair Jerome Powell’s two-day congressional testimony will start today too.

GBP/JPY Daily Outlook

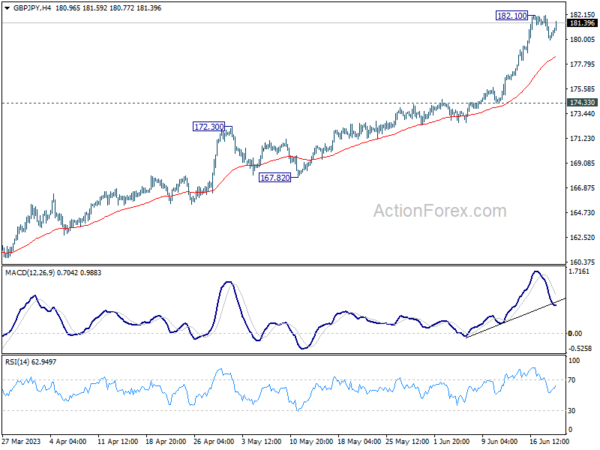

Daily Pivots: (S1) 179.62; (P) 180.85; (R1) 181.78; More…

GBP/JPY recovers notably today but stays below 182.10 temporary top. Intraday bias stays neutral first and more consolidations could be seen. But downside of retreat should be contained above 174.33 to bring another rally. Break of 182.10 will resume larger up trend to 138.2% projection of 148.93 to 172.11 from 155.33 at 187.36.

In the bigger picture, up trend from 123.94 (2020 low) is extending. Next target is 195.86 (2015 high). For now, medium term outlook will remain bullish as long as 172.11 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | -0.30% | |||

| 00:30 | AUD | Westpac Leading Index M/M May | -0.03% | |||

| 06:00 | GBP | CPI M/M May | 0.70% | 0.40% | 1.20% | |

| 06:00 | GBP | CPI Y/Y May | 8.70% | 8.50% | 8.70% | |

| 06:00 | GBP | Core CPI Y/Y May | 7.10% | 6.80% | 6.80% | |

| 06:00 | GBP | RPI M/M May | 0.70% | 0.50% | 1.50% | |

| 06:00 | GBP | RPI Y/Y May | 11.30% | 11.10% | 11.40% | |

| 06:00 | GBP | PPI Input M/M May | -1.50% | -0.60% | -0.30% | 0.10% |

| 06:00 | GBP | PPI Input Y/Y May | 0.50% | 1.20% | 3.90% | 4.20% |

| 06:00 | GBP | PPI Output M/M May | -0.50% | -0.10% | 0.00% | -0.2% |

| 06:00 | GBP | PPI Output Y/Y May | 2.9% | 3.60% | 5.40% | 5.20% |

| 06:00 | GBP | PPI Core Output M/M May | -0.30% | 0.10% | 0.00% | |

| 06:00 | GBP | PPI Core Output Y/Y May | 4.10% | 4.70% | 6.00% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) May | 19.2B | 20.3B | 24.7B | |

| 12:30 | CAD | New Housing Price Index M/M May | 0.00% | -0.10% | ||

| 12:30 | CAD | Retail Sales M/M Apr | 0.30% | -1.40% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Apr | 0.30% | -0.30% |