Euro’s broad based rally continues today as supported by a chorus of hawkish comments from ECB officials. But Sterling is outperforming on anticipation that BoE will continue with tightening next week, and probably more afterwards.

Despite the strong showings by European majors, Australian Dollar still leads the pack for the week. With the week drawing to a close, it remains to be seen whether Euro and its counterparts can overturn this picture.

Conversely, Yen’s post-BoJ selloff is extending, with fresh decline in early US session. Yen’s fate as the week’s most significant loser is sealed, followed closely by Dollar and then Canadian Dollar.

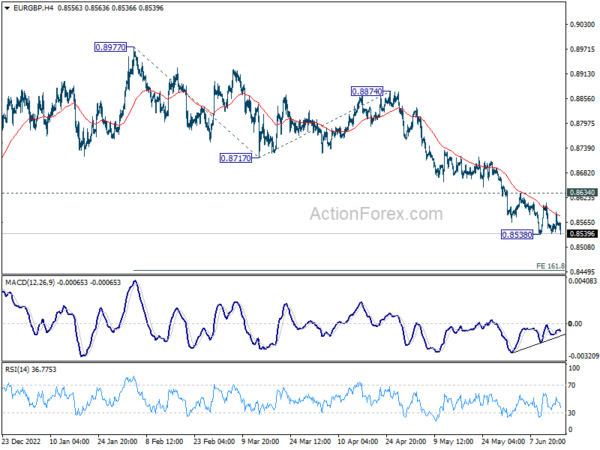

Technically, EUR/GBP appears to be finally breaking out of the near term range to resume the down trend from 0.8997. Next target would be 161.8% projection of 0.8977 to 0.8717 from 0.8874 at 0.8453. If realized, the decline in EUR/GBP is not expected to drag too much on Euro elsewhere. Instead, the fall would more likely give Sterling another lift, in particular against Dollar and Yen.

In Europe, at the time of writing, FTSE is up 0.17%. DAX is up 0.40%. CAC is up 1.01%. Germany 10-year yield is down -0.0402 at 2.467. Earlier in Asia, Nikkei rose 0.66%. Hong Kong HSI rose 1.07%. China Shanghai SSE rose 0.63%. Singapore Strait times rose 0.53%. Japan 10-year JGB yield fell -0.0279 to 0.404.

In Europe, at the time of writing, FTSE is up 0.17%. DAX is up 0.40%. CAC is up 1.01%. Germany 10-year yield is down -0.0402 at 2.467. Earlier in Asia, Nikkei rose 0.66%. Hong Kong HSI rose 1.07%. China Shanghai SSE rose 0.63%. Singapore Strait times rose 0.53%. Japan 10-year JGB yield fell -0.0279 to 0.404.

Fed Governor Waller dismisses concerns over monetary tightening impact on banking system

In a speech, Fed Governor Christopher Waller robustly defended Fed’s tightening of monetary policy, rejecting arguments that such measures have unduly stressed the banking system.

Some critics have posited that Fed’s recent rates hikes significantly contributed to the distress and failures within the banking sector, suggesting that these factors should have been taken into account in the policy setting process.

Waller firmly dismissed these claims, stating, “Let me state unequivocally: The Fed’s job is to use monetary policy to achieve its dual mandate, and right now that means raising rates to fight inflation.”

“It is the job of bank leaders to deal with interest rate risk, and nearly all bank leaders have done exactly that,” he added.

He reinforced his stance by adding, “I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks.”

He reiterated Fed’s commitment to its monetary policy objectives, which ultimately support a healthy financial system.

However, he did acknowledge the importance of Fed’s role in ensuring financial stability, affirming that it would continue to leverage its financial stability tools to prevent the accumulation of risks within the financial system and address any emerging strains when necessary.

Eurozone CPI finalized at 6.1% yoy in May, core at 5.3% yoy

Eurozone CPI was finalized at 6.1% yoy in May, down from April’s 7.0% yoy. CPI core (all-items ex energy, food, alcohol & tobacco) was finalized at 5.3% yoy, down from prior month’s 5.6% yoy.

The highest contribution to the annual Eurozone inflation rate came from food, alcohol & tobacco (+2.54%), followed by services (+2.15%), non-energy industrial goods (+1.51%) and energy (-0.09%).

EU CPI was finalized at 7.1% yoy, down from prior month’s 8.1% yoy. The lowest annual rates were registered in Luxembourg (2.0%), Belgium (2.7%), Denmark and Spain (both 2.9%). The highest annual rates were recorded in Hungary (21.9%), Poland and Czechia (both 12.5%). Compared with April, annual inflation fell in twenty-six Member States and rose in one.

ECB policymakers emphasize need to continue tightening

In a chorus of comments today, ECB Governing Council members underscored the need for continued monetary tightening to combat persistently high inflation.

Bundesbank President Joachim Nagel stressed the central bank “still have more ground to cover”, adding “we may need to keep raising rates after the summer break.”

“Once we have reached the peak, we will stay there until we are sure of a safe and timely return of inflation to our 2% target,” Nagel said. He also highlighted the necessity of reducing the central bank’s balance sheet to support this policy.

Bostjan Vasle, Chief of Slovenia’s central bank, echoed this sentiment. “If it turns out that inflation is more persistent than it seems at the moment…then of course further monetary-policy action will be necessary,” he noted.

In Lithuania, Central Bank Chief Simkus expressed concern about the prolonged high inflation, asserting that “over the medium term, inflation is not coming back to an appropriate level.” He also questioned market expectations for early 2024 rate cuts, suggesting that such a rapid reversal would be perplexing.

Meanwhile, Estonian Central Bank Chief Madis Muller clarified, “Euro zone interest rates have not yet peaked.” He added, “The ultimate goal is clear for the central bank: we need to quickly get the price rise under control.”

Finally, Finland’s Central Bank Chief Olli Rehn, voiced the need for restrictive interest rates to achieve a timely return of inflation to the 2% medium-term target. “The key ECB interest rates will be brought to levels sufficiently restrictive…and will be kept at those levels for as long as necessary,” Rehn concluded.

BoJ holds steady, core CPI to decelerate towards middle of fiscal 2023

In a widely expected move, BoJ today unanimously voted to maintain its existing ultra-loose monetary policy. The central bank kept short-term policy rate at -0.10% under its yield curve control. Yield target on 10-year JGB remains around 0%, with fluctuation band allowed also maintained at about plus and minus 0.50% from the target level. BoJ reiterated its commitment to carry on with its Quantitative and Qualitative Monetary Easing with Yield Curve Control “as long as it is necessary” and affirmed it “will not hesitate to take additional easing measures if necessary.”

In its accompanying statement, BoJ noted that it anticipates Japan’s economy to witness moderate recovery by around middle of the fiscal year 2023. “Thereafter, as a virtuous cycle from income to spending gradually intensifies, Japan’s economy is projected to continue growing at a pace about its potential growth rate,” the central bank said.

Discussing the inflation outlook, the bank stated: “The year-on-year rate of increase in the CPI (all items less fresh food) is likely to decelerate toward the middle of fiscal 2023, with a waning of the effects of the pass-through to consumer prices of cost increases led by the rise in import prices.

“Thereafter, the rate of increase is projected to accelerate again moderately, albeit with fluctuations, as the output gap improves and as medium- to long-term inflation expectations and wage growth rise, accompanied by changes in factors such as firms’ price- and wage-setting behavior.”

BoJ Ueda: It’s probably more difficult to deal with an undershoot of inflation

In the press conference following BoJ’s decision to stand pat, Governor Kazuo Ueda said, “at present, inflation has exceeded 2% for 13 straight months but could fall below that level ahead. That’s why we are not normalizing monetary policy. But if that view changes sharply, we will have to change policy.”

“We expect inflation to moderate, but it’s true the pace of decline is somewhat slow,” he said. “But we’re still in the early stages of the moderation. There’s uncertainty on whether the future slowdown will be a gradual one, or a quite sharp one.”

“What’s important is not just our median forecast but how certain that forecast is … We won’t act just by looking at the median forecast. We’d like to look comprehensively at various data including distribution”

“We have to consider what tools we have at our disposal when inflation overshoots, and when it undershoots. When we compare these, it’s probably more difficult to deal with an undershoot of inflation.”

NZ BNZ PMI ticked up to 48.9, staying in relatively tight band of contraction

New Zealand BusinessNZ Performance of Manufacturing Index ticked up from 48.8 to 48.9 in May, staying well below long-term average activity rate of 53.0. Looking at some details, production dropped from 47.0 to 45.7. Employment rose from 47.7 to 49.5. New orders rose from 49.6 to 50.8. Finished stocks dropped from 52.5 to 51.5. Deliveries dropped from 50.7 to 46.0.

BusinessNZ’s Director, Advocacy Catherine Beard said: “New Zealand’s manufacturing sector has remained in a relatively tight band of contraction for the last three months. While the overall activity result has crept upwards over that time.”

BNZ Senior Economist, Craig Ebert stated that “the range of results in the sub-components is mirrored in the breadth of issues manufacturers are now highlighting in the survey. Gone is the dominance of supply-side laments, especially regarding staff. But new negatives have arisen, for all of them to (still be) outnumbering the positive issues referenced”.

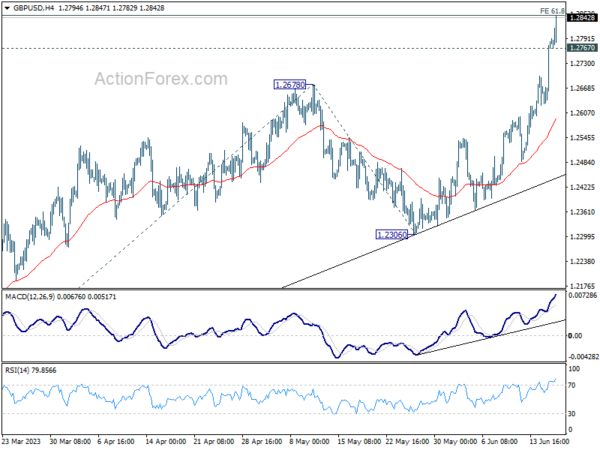

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2681; (P) 1.2734; (R1) 1.2837; More…

GBP/USD rises to as high as 1.2847 so far today, just an inch below 61.8% projection of 1.1801 to 1.2678 from 1.2306 at 1.2848. intraday bias stays on the upside for the moment. Decisive break of 1.2848 will extend the rally to 100% projection at 1.3183 next. On the downside, below 1.2697 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

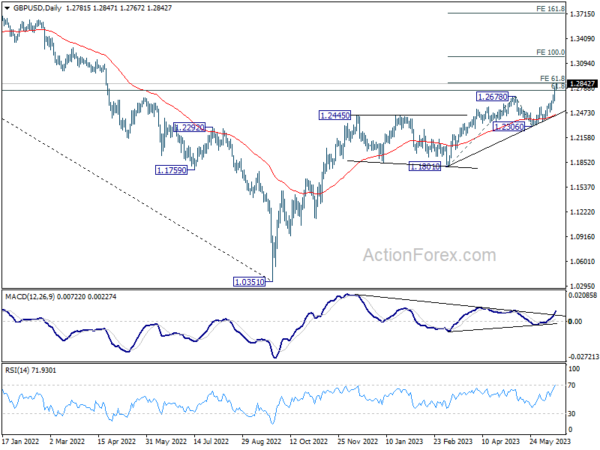

In the bigger picture, as long as 1.2306 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. Next medium term target will then be 1.4248 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI May | 48.9 | 49.1 | 48.8 | |

| 02:47 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 08:30 | GBP | Consumer Inflation Expectations | 3.50% | 3.90% | ||

| 09:00 | EUR | Eurozone CPI Y/Y May F | 6.10% | 6.10% | 6.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y May F | 5.30% | 5.30% | 5.30% | |

| 12:30 | CAD | Wholesale Sales M/M Apr | -1.40% | 0.00% | -0.10% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Jun P | 60.2 | 59.2 |