Euro is making notable gains following ECB’s decision to increase interest rates by a widely anticipated 25bps. The real kicker, however, is the significant upward revision of core inflation forecasts for both the current and following years, pushing the common currency up across the board. Swiss Franc capitalized on Euro’s rally, securing its spot as the day’s next strongest performer. Sterling, on the other hand, delivered a mixed performance, selloff against Euro. Australian Dollar emerges as the third strongest player, buoyed by robust jobs data released earlier in Asian trading session.

On the flip side, Japanese Yen continues to languish as the weakest performer, with verbal interventions from Japanese officials having done little to stem its downward trajectory. There was, however, a slight recovery during early US session, likely attributable to traders engaging in short covering in advance of BoJ rate decision in the upcoming Asian session. New Zealand Dollar is the day’s second weakest currency, followed closely by Canadian Dollar. Dollar, meanwhile, exhibited a mixed performance, largely brushing off the retail sales and jobless claims data.

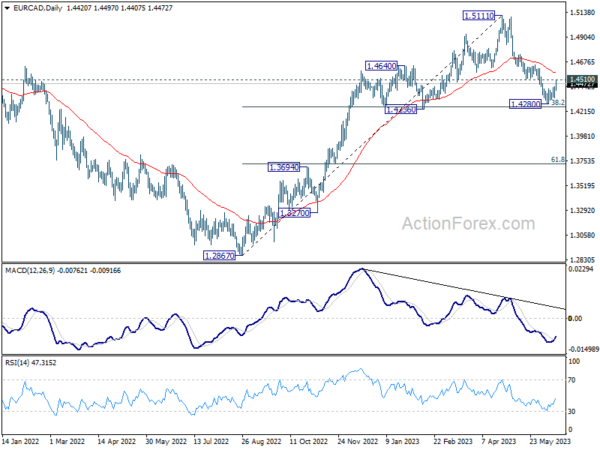

Technically, EUR/CAD’s rebound from 1.4280 is finally taking up some momentum. Immediate focus is now on 145.10 support turned resistance. Decisive break there should confirm that corrective fall from 1.5111 has completed, just ahead of 1.4236 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254). Stronger rally should then be seen through 55 D EMA (now at 1.4570). If realized, the rally in EUR/CAD could also be accompanied by break of 1.6101 resistance in EUR/AUD.

In Europe, the time of writing, FTSE is up 0.01%. DAX is down -0.72%. CAC is down -0.95%. Germany 10-year yield is up 0.047 at 2.500. Earlier in Asia, Nikkei dropped -0.05%. Hong Kong HSI surged 2.17%. China Shanghai SSE rose 0.74%. Singapore Strait Times rose 0.77%. Japan 10-year JGB yield rose 0.0009 to 0.432.

US retail sales rose 0.3% mom in May, ex-auto sales up 0.1% mom

US retail sales rose 0.3% mom to USD 686.6B in May, above expectation of 0.0% mom. Ex-auto sales rose 0.1% mom to USD 554.5B, matched expectations. Ex-gasoline sales rose 0.6% mom to USD 633.5B. Ex-auto and gasoline sales rose 0.4% mom to USD 501.5B

In the three months to may, sales were up 1.7% from the same period a year ago.

US initial jobless claims unchanged at 262k

US initial jobless claims was unchanged at 262k in the week ending June 10, well above expectation of 246k. Four-week moving average of initial claims rose 9k to 247k, highest since November 20, 2021 when it was 249k.

Continuing claims rose 20k to 1775k in the week ending June 3. Four-week moving average of continuing claims dropped -6k to 1778k.

ECB hikes 25bps, core inflation forecast raised sharply higher

ECB raises its key interest rates by 25bps as widely expected. The main refinancing rate, marginal lending facility rate, and deposit rates will be 4.00%, 4.25% and 3.50% after the hike.

In the accompanying statement, it’s reiterated that the Governing Council will continued to follow a “data-dependent approach” in future decisions, to bring rates to levels “sufficiently restrictive” to achieve timely return of inflation to 2% target. Rates will also be kept at that level “for as long as necessary”.

In the updated economic projections, core inflation projection is revised up notably in 2023 and 2024, and slightly in 2025. Growth projection was revised down slightly in both 2023 and 2024.

- Inflation is projected to average 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025. (March: 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025).

- Core inflation is projected to reach 5.1% in 2023, before it declines to 3.0% in 2024 and 2.3% in 2025. (March: 4.6% in 2023, 2.5% in 2024 and 2.2% in 2025).

- Growth is projected to be at 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025. (March: 1.0% in 2023, 1.6% in 2024, 1.6% in 2025).

Eurozone exports down -3.6% yoy in Apr, imports down -11.9% yoy

Eurozone exports of goods to the rest of the world decreased -3.6% yoy in April to EUR 216.0B. Imports decreased -11.9% yoy to EUR 227.7B. A EUR -11.7B trade deficit was recorded. Intra-Eurozone trade was also down by -5.2% yoy to EUR 208.3B.

In seasonally adjusted term, exports fell -3.2% mom to EUR 234.5B. Imports rose 5.9% mom to EUR 241.5B. Trade balance turned into EUR -7.1B deficit, versus expectation of EUR 5.7B surplus. Intra-Eurozone trade fell from EUR 224.1B in March to 222.4B in April.

Swiss SECO: Economic growth to be significantly below average

Swiss SECO expert group on business cycles expect “significantly below average growth for the Swiss economy”, at 1.1% in 2023, and then 1.5% in 2024. Both were unchanged from prior forecast in March. It added that while the economy started the year “vigorously”, “inflationary pressures remain high internationally and there are pronounced economic risks”.

Regarding inflation, the group expects inflation to stabilize at 2.3% in 2024 (down from March forecast of 2.4%), and then falls to 1.5% average in 2024 (unchanged from prior forecast). Unemployment rate is expected to average 2.0% in 2023, and then rise to 2.3% in 2024.

Australia employment grew 75.6k in May, unemployment rate back to 3.6%

Australia employment rose 75.6k in May, well above expectation of 16.5k. Full time jobs grew 61.7k while part-time jobs grew 14.3k.

Unemployment rate dropped from 3.7% to 3.6%, below expectation of 3.7%. Participation rate rose from 66.7% to 66.9%. Monthly hours worked dropped -1.8% mom. Employment-to-population ratio rose 0.2% to 64.5%, a record high.

Bjorn Jarvis, ABS head of labour statistics, said: “Looking over the past two months, the employment increases average out to around 36,000 extra employed people each month. This is still around the average over the past year of 39,000 people a month.”

“Just before the start of the pandemic almost 13 million people were employed in Australia. In May 2023, this had risen to just over 14 million people.”

NZ GDP down -0.1% qoq in Q1, driven by inventory rundown and services exports

New Zealand GDP contracted -0.1% qoq in Q1 as expected. Primary industries fell -0.5%. Service industries fell -0.6%. Goods producing industries fell -0.4%.

StatsNZ noted, “The expenditure measure of GDP fell 0.2 percent this quarter. This decline was driven by run downs in inventories held by businesses, and a fall in exports of services.”

“A 2.4 percent increase in household consumption expenditure and 2.0 percent growth in investment in fixed assets partially offset the falls.”

China production and investment data show struggling private sector

China’s industrial production growth for May came in at 3.5% yoy, aligning with market expectations. However, a discrepancy was observed in growth rates of private and state-owned businesses. Industrial output from private businesses only managed to expand by 0.7% yoy, a stark contrast to the 4.4% yoy growth posted by state-owned enterprises.

Furthermore, China’s fixed asset investment rose 4.0% ytd yoy, a figure falling short of the anticipated 4.4% and a marked deceleration from 4.7% recorded during the first four months of 2023. Notably, private businesses experienced a dip in their fixed asset investment by -0.1% ytd yoy, while state-owned enterprises reported robust growth of 8.4%.

Meanwhile, retail sales failed to meet expectations, recording a rise of 12.7% yoy, lower expectation of 13.9% yoy increase.

In a separate but related development, People’s Bank of China announced a cut in rate on its one-year medium-term lending facility loans to financial institutions. The rate was lowered from 2.75% to 2.65%, following the bank’s decision to cut seven-day reverse repo and standing lending facility rate earlier this week.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0783; (P) 1.0823; (R1) 1.0872; More…

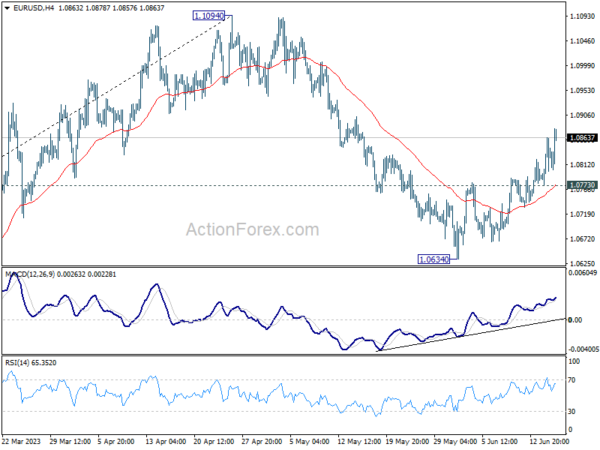

EUR/USD’s rally from 1.0634 short term bottom continues today and intraday bias stays on the upside. Corrective fall from 1.1094 could have completed already. Further rally would be seen back to retest 1.1094 high. On the downside, though, below 1.0773 minor support will mix up the outlook and turn intraday bias neutral first.

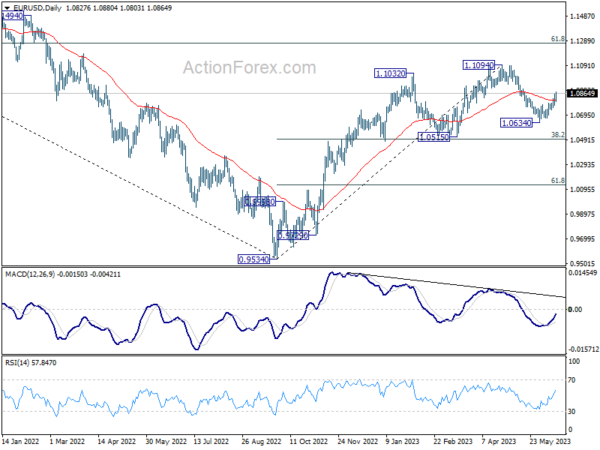

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | GDP Q/Q Q1 | -0.10% | -0.10% | -0.60% | |

| 23:50 | JPY | Trade Balance (JPY) May | -0.78T | -0.78T | -1.02T | -1.04T |

| 23:50 | JPY | Machinery Orders M/M Apr | 5.50% | 3.00% | -3.90% | |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 5.20% | 5.00% | ||

| 01:30 | AUD | Employment Change May | 75.9K | 16.5K | -4.3K | -4.0K |

| 01:30 | AUD | Unemployment Rate May | 3.60% | 3.70% | 3.70% | |

| 02:00 | CNY | Retail Sales Y/Y May | 12.70% | 13.90% | 18.40% | |

| 02:00 | CNY | Industrial Production Y/Y May | 3.50% | 3.50% | 5.60% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y May | 4.00% | 4.40% | 4.70% | |

| 04:30 | JPY | Tertiary Industry Index M/M Apr | 1.20% | 0.50% | -1.70% | |

| 06:30 | CHF | Producer and Import Prices M/M May | -0.30% | 0.10% | 0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y May | -0.30% | -0.20% | 1.00% | |

| 07:00 | CHF | SECO Economic Forecasts | ||||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Apr | -7.1B | 5.7B | 17.0B | 14.0B |

| 12:15 | EUR | ECB Main Refinancing Rate | 4.00% | 4.00% | 3.75% | |

| 12:30 | CAD | Manufacturing Sales M/M Apr | 0.30% | -0.20% | 0.70% | 0.80% |

| 12:30 | USD | Empire State Manufacturing Index Jun | 6.6 | -14.6 | -31.8 | |

| 12:30 | USD | Retail Sales M/M May | 0.30% | 0.00% | 0.40% | |

| 12:30 | USD | Retail Sales ex Autos M/M May | 0.10% | 0.10% | 0.40% | |

| 12:30 | USD | Initial Jobless Claims (Jun 9) | 262K | 248K | 261K | 262K |

| 12:30 | USD | Import Price Index M/M May | -0.60% | -0.10% | 0.40% | |

| 12:30 | USD | Philadelphia Fed Manufacturing Survey Jun | -13.7 | -12.7 | -10.4 | |

| 12:45 | EUR | ECB Press Conference | ||||

| 13:15 | USD | Industrial Production M/M May | 0.10% | 0.50% | ||

| 13:15 | USD | Capacity Utilization May | 79.70% | 79.70% | ||

| 14:00 | USD | Business Inventories Apr | 0.20% | -0.10% | ||

| 14:30 | USD | Natural Gas Storage | 97B | 104B |