Dollar is facing renewed selling in early US session as data reveals a further slowdown in upstream inflation via PPI. All eyes are now on the much-anticipated FOMC rate decision where a ‘hold’ is broadly expected. However, the possibility of an upside surprise in both inflation projections and the dot plot remains, suggesting that we could be in for some choppy waters ahead.

Indeed, the overall market reaction could be multifaceted, especially when the equities and bond markets are added to the equation. So, market participants should buckle up for potential volatility.

In the meantime, Aussie and Kiwi dollars continue to flex their muscles, being the day’s strongest performers. A noticeable rebound the Swiss Franc is also evident. British Pound isn’t too far behind after GDP data matched expectations. Canadian dollar trails Dollar as the next weakest performer, followed by Euro and Yen.

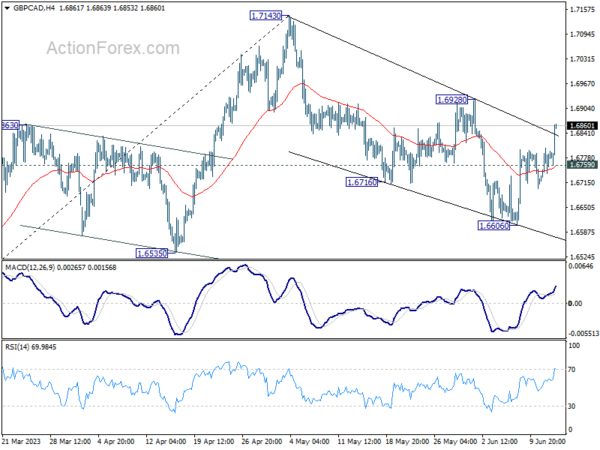

Technically, GBP/CAD’s break of near term falling trend line today is taken as the first signal that whole correction from 1.7143 has completed with three waves down to 1.6606. Further rally is now expected as long as 1.6759 support holds. Firm break of 1.6928 will solidify the case of larger up trend resumption through 1.7143 high. Let’s see if that will happen before BoE rate decision next week.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 0.47%. CAC is up 0.74%. Germany 10-year yield is up 0.0140 at 2.439. Earlier in Asia, Nikkei rose 1.47%. Hong Kong HSI dropped -0.58%. China Shanghai SSE dropped -0.14%. Singapore Strait Times rose 0.90%. Japan 10-year JGB yield rose 0.0099 to 0.431.

US PPI at -0.3% mom, 2.8% yoy in May

US PPI for final demand fell -0.3% mom in May, below expectation of -0.1% mom rise. PPI goods fell -1.6% mom while PPI services rose 0.2% mom. PPI less foods, energy, and trade services was flat mom.

For the 12 months ended in May, PPI slowed from 3.1% yoy to 2.8% yoy, below expectation of 2.9% yoy. PPI for less foods, energy, and trade services slowed from 3.3% yoy to 2.8% yoy.

UK GDP grew 0.2% mom in Apr led by 0.3% growth in services

UK GDP grew 0.2% mom in April, matched expectations. Services rose 0.3% mom. Production declined by -0.3% mom. Construction fell -0.6% mom. In the three months to April, GDP grew 0.1%, compared with the three months to January 2023, with falls in 8 of the 14 sub-sectors.

Also released, industrial production fell -0.3% mom, -1.9% yoy in April, versus expectation of -0.1% mom, -2.6% yoy. Manufacturing production declined -0.3% mom, -0.9% yoy, versus expectation of -0.1% mom, -1.8% yoy. Goods trade deficit narrowed from GBP -16.4B to GBP -15.0B, versus expectation of GBP -16.5B.

NIESR forecasts anemic UK growth amid BoE rate hikes

NIESR projects that UK monthly GDP will “remain flat” in May compared to April. The institute added “Higher-frequency data suggest that continued growth in services in May be partially offset by a further decline in manufacturing activity.”

For the second quarter, NIESR anticipates a rather lukewarm GDP growth of merely 0.1%, a pace that “broadly consistent with the longer-term trend of low economic growth”.

Paula Bejarano Carbo, Associate Economist, NIESR, noted, “With the Bank Rate set to rise further over the coming months, curbing demand, it is likely that UK growth will continue to be anaemic at best.”

Eurozone industrial production rose 1.0% mom, EU up 0.7% mom

Eurozone industrial production rose 1.0% mom in April, below expectation of 1.2% mom. Production of capital goods grew by 14.7% mom and energy by 1.0% mom, while production of intermediate goods fell by -1.0% mom, durable consumer goods by -2.6% mom and non-durable consumer goods by -3.0% mom.

EU industrial production rose 0.7% mom. Among Member States for which data are available, the highest monthly increases were registered in Ireland (+21.5%), Lithuania (+2.8%) and Sweden (+1.4%). The largest decreases were observed in Slovenia (-7.9%), Portugal (-5.5%) and the Netherlands (-3.5%).

GBP/USD Mid-Day Outlook

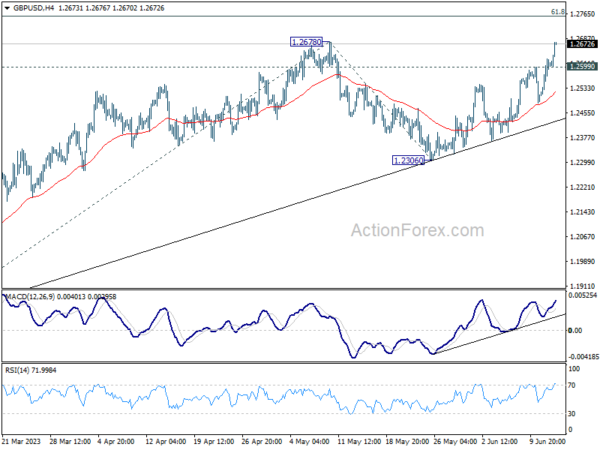

Daily Pivots: (S1) 1.2532; (P) 1.2579; (R1) 1.2657; More…

Intraday bias in GBP/USD remains on the upside with focus on 1.2678 resistance. Decisive break there will confirm resumption of whole up trend from 1.0351. Further rally should then be seen through 1.2759 fibonacci level to 61.8% projection of 1.1801 to 1.2678 from 1.2306 at 1.2848. On the downside, below 1.2599 minor support will turn intraday bias neutral first.

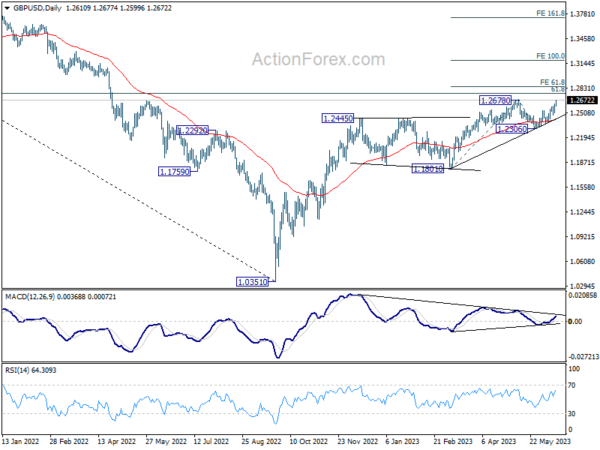

In the bigger picture, as long as 1.2306 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. However, firm break of 1.2306 will indicate rejection by 1.2759, and bring deeper decline, even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account Q1 | -5.22B | -6.95B | -9.46B | |

| 06:00 | GBP | GDP M/M Apr | 0.20% | 0.20% | -0.30% | |

| 06:00 | GBP | Industrial Production M/M Apr | -0.30% | -0.10% | 0.70% | |

| 06:00 | GBP | Industrial Production Y/Y Apr | -1.90% | -2.60% | -2.00% | |

| 06:00 | GBP | Manufacturing Production M/M Apr | -0.30% | -0.10% | 0.70% | |

| 06:00 | GBP | Manufacturing Production Y/Y Apr | -0.90% | -1.80% | -1.30% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Apr | -15.0B | -16.5B | -16.4B | |

| 09:00 | EUR | Eurozone Industrial Production M/M Apr | 1.00% | 1.20% | -4.10% | |

| 12:30 | USD | PPI M/M May | -0.30% | -0.10% | 0.20% | |

| 12:30 | USD | PPI Y/Y May | 1.10% | 1.50% | 2.30% | |

| 12:30 | USD | PPI Core M/M May | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | PPI Core Y/Y May | 2.80% | 2.90% | 3.20% | 3.10% |

| 14:30 | USD | Crude Oil Inventories | -1.3M | -0.5M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.25% | 5.25% | ||

| 18:30 | USD | FOMC Press Conference |