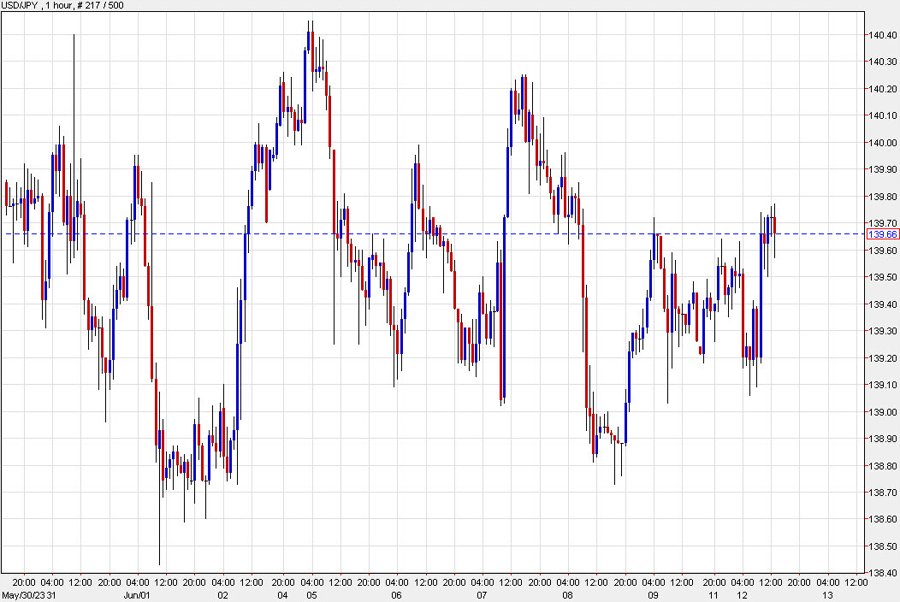

USD/JPY looked like it only needed a nudge to break out of the two-day range capped near 139.70 but when higher-than-expected yields materialized at a 10-year Treasury auction, it still couldn’t get through. The 2 bps tail at the 10-year sale would usually lead to US dollar buying, especially on that cross but instead it indicated that buying interest was running dry.

With that, the pair sagged slightly and the US dollar lost momentum. Even in bonds, the selloff stopped after the sale with 10s unable to get above 3.80%.

To me, this looks like a flurry of flow-driven trade ahead of the CPI report, FOMC decision and retail sales over the coming three days. The summation of that trio will set the stage for the month ahead in financial markets.

USDJPY 1 hour