The global forex markets are in a state of relative tranquillity today, as the dust begins to settle following two central bank surprises. With a light economic calendar on the horizon, trading activity is predicted to stay muted. Australian Dollar currently retains its pole position, closely pursued by its Canadian counterpart. However, with the release of Friday’s job data, the latter has the potential to clinch the top spot for the week. New Zealand Dollar finds itself at the other end of the spectrum as the week’s poorest performer, followed by Dollar and then Swiss Franc. Euro is mixed together with Yen.

Technically, though, there is risk of a more violent move in Yen today and tomorrow, subject to development in treasury yields. US 10-year yield received notable support from 55 D EMA (now at 3.602) and recovered notably this week. The development keeps near term bullish bias intact. Break of 3.859 resistance will confirm resumption of whole rise from 3.253. Further break of trend line resistance will solidify upside momentum to 4.091 resistance next. If realized, Yen pairs could follow in tandem, in particular, with USD/JPY breaking through 140.90.

In Asia, Nikkei closed down -0.86%. Hong Kong HSI is down -0.04%. China Shanghai SSE is up 0.55%. Singapore Strait Times is down -0.22%. Japan 10-year JGB yield is up 0.436 at 0.0174. Overnight, DOW rose 0.27%. S&P 500 dropped -0.38%. NASDAQ dropped -1.29%. 10-year yield rose 0.085 to 3.784.

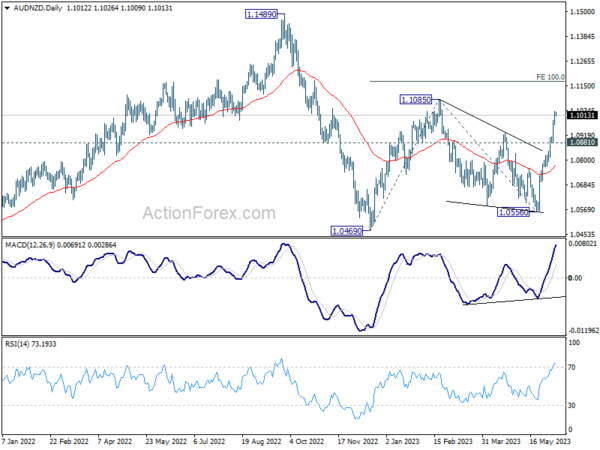

Top mover AUD/NZD on track to 1.1085, what next?

AUD/NZD is currently the biggest mover for the week, trading up around 1%. Near term rally from 1.0556 accelerated further after surprised RBA rate hike earlier in the week. At the same time, market participants are also factoring in the possibility of further rate hikes from RBA.

In a recent Reuters poll, a snapshot of economists’ expectations reveals a divide: 16 out of 26 expect RBA to hit the pause button in August, while 10 predict another 25bps hike. Looking beyond, a majority (20 out of 26) anticipate another 25bps increase by the end of September.

There’s a consensus among the major local banks – ANZ, CBA, and NAB – that a pause in July is likely, while Westpac is bracing for another 25bps bump. All four banks foresee a terminal rate of 4.35% by the close of September. However, given the uncertainty that even RBA is grappling with regarding the road ahead, these forecasts are subject to revision ahead of each upcoming meeting.

Contrarily, the question of whether RBNZ rate has already peaked at the current 5.50% is under debate. Views are split on the prospect of a further 25bps hike in August.

Technically, this week’s rally should confirm that AUD/NZD’s correction from 1.1085 has completed with three waves down to 1.0556. Near term outlook will stay bullish as long as 1.0881 support holds. Next target is 1.1086 resistance. Firm break there will resume whole rise from 1.0469 (2022 low) to 100% projection of 1.0469 to 1.1085 from 1.0556 at 1.1172.

The second half of the year will likely be marked by whether AUD/NZD can hurdle this key 1.1172 projection level. Rejection at this level could frame the rise from 1.0469 as merely a corrective move, and potentially set the stage for a later resumption of overall decline from 2022 high of 1.1489 at a later stage However, a decisive break above 1.1172 could catalyze a more substantial upside move, potentially retesting 1.1489 high.

The outcome will largely hinge on the future steps of RBA and RBNZ post their next move.

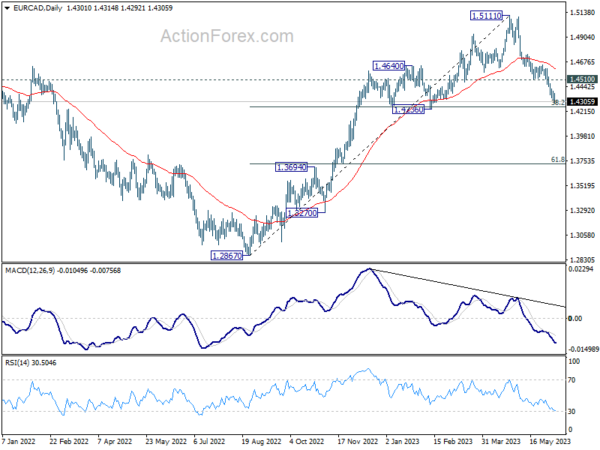

USD/CAD and EUR/CAD eyeing important cluster support levels

Canadian Dollar is currently the second best performer of the week after yesterday’s surprised 25bps rate hike by BoC to 4.75%. Most economists see the move after a 2-meeting pause as a “restart” of the tightening cycle rather than a “one-off”. Another rate hike is now generally expected in July to bring interest rate to 5.00% level.

The biggest question is whether 5.00% is “sufficiently restrictive” enough to bring supply and demand back into balance and return inflation to 2% target. It’s a big unknown for the markets as well as BoC.

Technically, while Canadian Dollar is strong this week, tough resistance levels lie just ahead. The key level is 1.3224 cluster support, with 38.2% retracement of 1.2005 to 1.3976 at 1.3233. Price actions from 1.3976 could still be considered a sideway corrective pattern as long as 1.3224/33 holds. That is, larger up trend would remain intact.

However, firm break of 1.3299 support would risk downside acceleration to push USD/CAD through 1.3224/33 decisively. 100% projection of 1.3860 to 1.3299 from 1.3653 at 1.3092 would be the immediate target, with risk of even deeper decline in the medium term.

As for EUR/CAD, it’s now quickly approaching the key zone of 1.4236 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254). There is still prospect of a bounce from the zone. Break of 1.4510 minor resistance will suggest that the corrective fall from 1.5111 has completed and bring stronger rebound back to 55 D EMA (now at 1.4601) and above.

However, sustained decisive break of 1.236 could trigger further downside acceleration to 61.8% retracement at 1.3724, even just as a deep corrective move.

Looking ahead

Eurozone will release Q1 GDP final in European session. US will publish jobless claims and wholesale inventories later in the day.

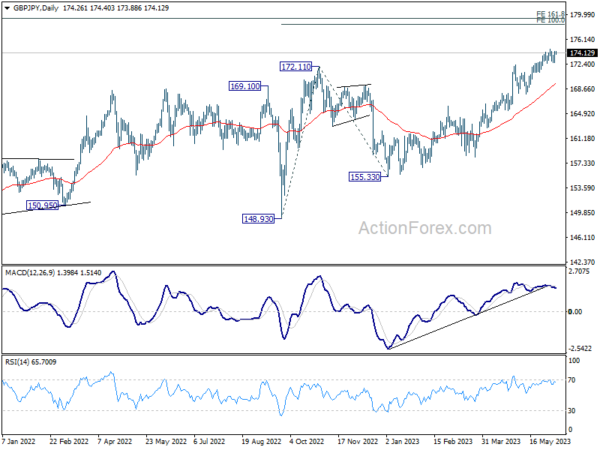

GBP/JPY Daily Outlook

Daily Pivots: (S1) 173.21; (P) 173.82; (R1) 174.98; More…

GBP/JPY is staying in consolidation from 174.66 and intraday bias remains neutral first. Deeper pull back cannot be ruled out, but outlook will stay bullish as long as 167.82 support holds. On the upside, break of 174.66 will resume larger up trend to 100% projection of 148.93 to 172.11 from 155.33 at 178.51.

In the bigger picture, up trend from 123.94 (2020 low) is extending. Next target will be 161.8% projection of 122.75 (2016 low) to 156.59 (2018 high) from 123.94 at 178.69. For now, medium term outlook will remain bullish as long as 165.99 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q1 | -2.80% | -0.40% | ||

| 23:01 | GBP | RICS Housing Price Balance May | -30% | -37% | -39% | |

| 23:50 | JPY | GDP Q/Q Q1 F | 0.70% | 0.40% | 0.40% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 2.00% | 2.00% | 2.00% | |

| 23:50 | JPY | Bank Lending Y/Y May | 3.40% | 3.10% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.90T | 1.38T | 1.01T | |

| 01:30 | AUD | Trade Balance (AUD) Apr | 11.16B | 14.0B | 15.27B | 14.82B |

| 05:00 | JPY | Eco Watchers Survey: Outlook May | 55 | 54.1 | 54.6 | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 F | 0.00% | 0.10% | ||

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 F | 0.60% | 0.60% | ||

| 12:30 | USD | Initial Jobless Claims (Jun 2) | 235K | 232K | ||

| 14:00 | USD | Wholesale Inventories Apr F | -0.20% | -0.20% | ||

| 14:30 | USD | Natural Gas Storage | 115B | 110B |