Dollar falls broadly in early US session after much worse than expected jobless claims data. But it’s so far still holding largely in range. Market pricing on whether Fed would hike on June 14 continues to flip-flop (at around 30% for a 25bps hike). For the week, Kiwi is the second worst, after Dollar, followed by Sterling. Aussie remains the strongest one, but Swiss Franc jumped to the second place, followed by Canadian. Euro and Yen are mixed, a bit of the soft side.

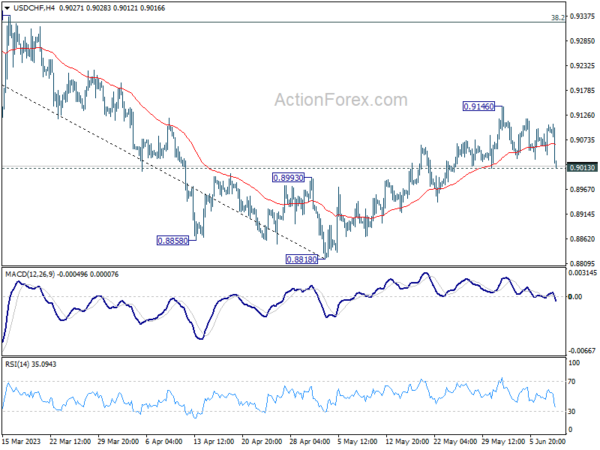

Technically, with today’s selloff in Dollar, focuses is back on near term support levels, including 0.9013 minor support in USD/CHF, 138.22 support in USD/JPY, 1.0778 resistance in EUR/USD and 1.2543 resistance in GBP/USD. Break of any of these levels could be a signal of more weakness in the greenback. Let’s see how it goes.

In Europe, at the time of writing, FTSE is down -0.02%. DAX is up 0.06%. CAC is up 0.28%. Germany 10-year yield is down -0.0316 at 2.427. Earlier in Asia, Nikkei is down -0.85%. Hong Kong HSI rose 0.25%. China Shanghai SSE rose 0.25%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose notably by 0.0234 to 0.442.

US initial jobless claims rose to 261k, highest since Oct 2021

US initial jobless claims rose 28k to 261k in the week ending June 3, well above expectation of 235k. That’s also the highest level since October 30, 2021, when it was 264k. Four-week moving average of initial claims rose 7.5k to 237k.

Continuing claims dropped -37k to 1757k in the week ending May 27. Four-week moving average of continuing claims dropped -12.5k to 1785k.

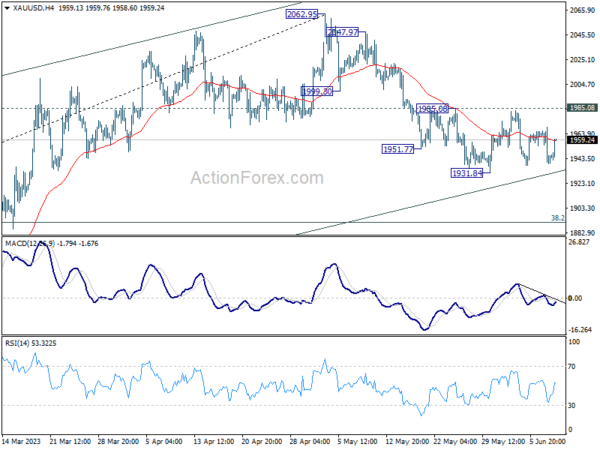

Gold recovering after poor US job data, but bounded in range

Gold recovered notably in early US session, following the selloff in Dollar on much worse than expected US jobless claims data.

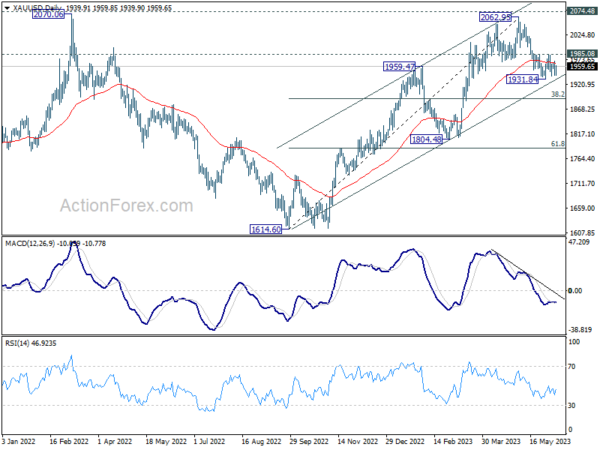

But after all, Gold is just seen as extending the consolidation pattern from 1931.84 short term bottom. That is, another fall remains in favor. Break of 1931.84 support will firstly confirm resumption of whole fall from 2062.95. Secondly, that should also have medium term channel support firmly taken out. In this case, Gold should target 38.2% retracement of 1614.60 to 2062.95 at 1891.68.

However, break of 1985.08 resistance will argue that the channel support is defended, and maintains medium term bullishness. Stronger rise should then be seen to retest 2062.95, even further to 2074.48 high.

SNB Jordan: It’s really important to bring inflation down to price stability level

Swiss National Bank Chairman Thomas Jordan said today “It’s really important to bring Swiss inflation to a level of price stability.”

He added that inflation is more persistent that the bank thought, adding that there are signs of second and third round effects.

Jordan also emphasized that it would not be a good idea to wait for inflation to rise and then have to raise interest rates.

“When inflation remains under 2% for a long time, we don’t have a problem,” Jordan noted.

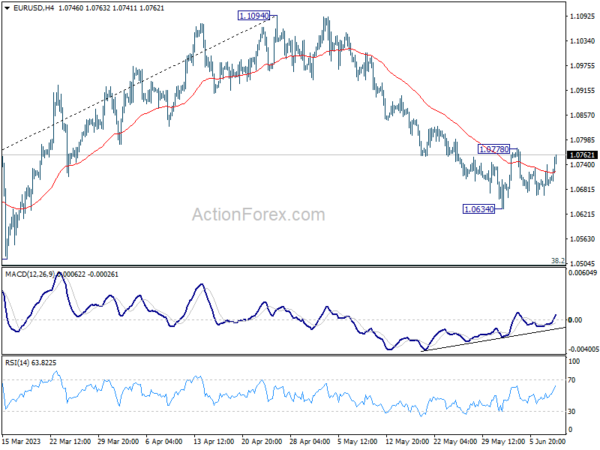

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0665; (P) 1.0703; (R1) 1.0736; More…

Intraday bias in EUR/USD stays neutral for the moment. On the upside, break of 1.0778 resistance will resume the rebound from 1.0634 short term bottom to 55 D EMA (now at 1.0813). Sustained break there could pave the way back to retest 1.1094 high. On the downside, however, break of 1.0634 will resume the corrective decline from 1.1094. Deeper fall should then be seen to 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498.

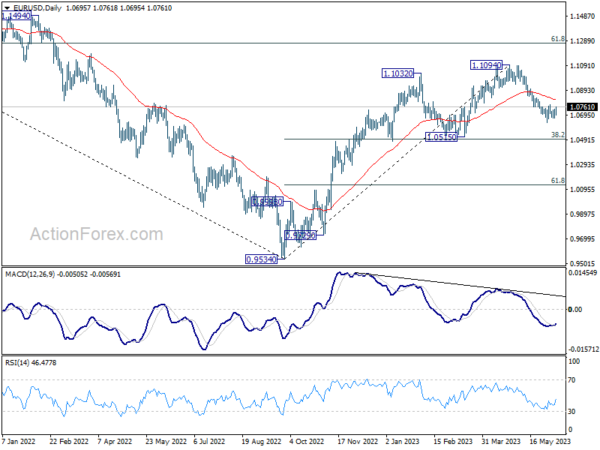

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Manufacturing Sales Q1 | -2.80% | -0.40% | ||

| 23:01 | GBP | RICS Housing Price Balance May | -30% | -37% | -39% | |

| 23:50 | JPY | GDP Q/Q Q1 F | 0.70% | 0.40% | 0.40% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 2.00% | 2.00% | 2.00% | |

| 23:50 | JPY | Bank Lending Y/Y May | 3.40% | 3.10% | 3.20% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.90T | 1.38T | 1.01T | |

| 01:30 | AUD | Trade Balance (AUD) Apr | 11.16B | 14.0B | 15.27B | 14.82B |

| 05:00 | JPY | Eco Watchers Survey: Outlook May | 55 | 54.1 | 54.6 | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 F | -0.10% | 0.00% | 0.10% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q1 F | 0.60% | 0.60% | 0.60% | |

| 12:30 | USD | Initial Jobless Claims (Jun 2) | 261K | 235K | 232K | 233K |

| 14:00 | USD | Wholesale Inventories Apr F | -0.20% | -0.20% | ||

| 14:30 | USD | Natural Gas Storage | 115B | 110B |