Australian Dollar is staying generally firm in Asian session today, as supported by hawkish comments from RBA Governor Philip Lowe. More tightening could still be underway after yesterday’s surprised rate hike. Aussie basically shrugged off Weaker than expected Q1 GDP growth. Meanwhile, market reactions to the poor set of trade data from China was surprisingly indifferent.

The forex markets are generally quiet though, with most major pairs and crosses stuck inside yesterday’s range. Canadian Dollar softens slightly as focus turns to BoC rate decision. There is room for an hawkish twist even if there is no surprised rate hike, which could give the Loonie a lift. Dollar, Euro are the weaker ones for now while Yen is trying to resume its near term recovery.

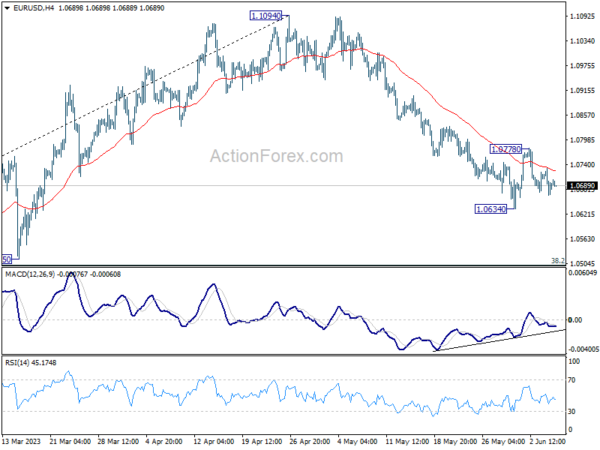

Technically, the main focus continues to be on the overdue breakout of Dollar from its narrow range against European majors and Yen. A few critical thresholds are under the spotlight and could catalyze significant market moves. Key levels to watch include 1.0634 support in EUR/USD, 1.2306 support in GBP/USD, 0.9146 resistance in USD/CHF, and 140.90 resistance in USD/JPY. Firm break of any of these levels could ring the bell for Dollar’s resurgence.

In Asia, at the time of writing, Nikkei is down -1.00%. Hong Kong HSI is up 0.97%. China Shanghai SSE is up 0.02%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is down -0.0054 at 0.418. Overnight, DOW rose 0.03%. S&P 500 rose 0.24%. NASDAQ rose 0.36%. 10-year yield rose 0.006 to 3.699.

RBA Lowe: Some further tightening of monetary policy may be required

In a speech, RBA Governor Philip Lowe revealed further insight into the central bank’s decision-making process and concerns regarding inflation. Lowe underscored RBA’s decision to raise interest rates once more yesterday as an effort to confidently bring inflation back to target within a reasonable timeframe.

Governor Lowe said, “Yesterday’s decision to increase interest rates again was taken to provide greater confidence that inflation will return to target within a reasonable timeframe.”

He attributed this decision to a recent influx of data, suggesting “greater upside risks” to the Bank’s inflation outlook. Persistent inflation in services prices, both domestically and abroad, combined with recent data on inflation, wages, and housing prices outpacing forecasts, were contributing factors.

The Governor noted, “Given this shift in risks and the already fairly drawn-out return of inflation to target, the Board judged that a further increase in interest rates was warranted.”

However, he also highlighted various factors the Board will monitor closely in the coming months, including developments in the global economy, domestic household spending, the growth rate in unit labour costs, and inflation expectations.

While acknowledging that the RBA remains on a narrow path, Lowe pointed out “significant risks”, particularly the possibility that “inflation stays too high for too long”.

He concluded, “Some further tightening of monetary policy may be required, but that will depend upon how the economy and inflation evolve. The Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market.”

Australia’s Q1 GDP grew only 0.2% qoq, domestic price growth decelerated

Australia’s GDP expanded by 0.2% qoq in Q1, missing expectations of 0.3% qoq growth. This marked the slowest rate of growth since the September 2021 quarter.

Head of National Accounts at the Australian Bureau of Statistics, Katherine Keenan, remarked on this development. “This is the sixth straight rise in quarterly GDP but the slowest growth since the COVID-19 Delta lockdowns in September quarter 2021,” she said.

The GDP implicit price deflator, a measure of price changes, climbed by 1.9% in the quarter and by 6.8% from March 2022. A significant contributor to this increase was rise in terms of trade by 2.8%, led by steeper decline in import prices (-4.0%) than export prices (-1.4%).

Fall in import prices, the largest since December 2010, was propelled by global drop in oil prices and appreciation of Australian dollar. Meanwhile, a decrease in export prices was led by rural and mining commodities.

Domestic price growth decelerated to 1.1% as goods inflation eased. This is a downturn from the 1.4% increase observed in the December 2022 quarter.

China’s exported fell -7.5% yoy in May, trade surplus shrank to USD 65.8B

In May, China’s exports significantly contracted, defying expectations. The country’s exports shrunk by -7.5% yoy to USD 283.5B, which was far below expectation of -0.4% yoy contraction. This marks the second-lowest export value since May 2022, with the only lower figure being the seasonally affected USD 213.8B recorded in February. Imports also contracted by -4.5% yoy to USD 217.7B, outperforming the forecasted 8.0% yoy contraction.

However, the most striking observation comes in the form of China’s trade surplus. It fell sharply from USD 90.2B to USD 65.8B, defying the predicted figure of USD 94.2B. This represents the lowest level since the COVID-driven decline observed in April 2022.

BoC in focus, a coin flip for hold or hike?

As BoC meets today, many observers anticipate the bank will maintain its pause, leaving interest rates untouched at 4.50%. However, recent economic developments have injected a dose of doubt into the mix. Market speculation reveals that there is approximately a 45% probability of a 25-basis point adjustment, making this rate decision look more like a coin toss.

The prevailing viewpoint among economists is that BoC might defer any rate changes until its July meeting. Two crucial reasons fortify this standpoint. First, the July assembly aligns with the release of a fresh batch of economic projections, offering BoC ground to justify any rate recalibrations. Second, the subsequent press conference would grant Governor Tiff Macklem the opportunity to explain their decision to a watchful audience.

However, if the central bank is indeed leaning towards a rate adjustment in July, then today’s announcement might carry a hint of hawkishness. If so, this shift could be a strategic move to prepare the markets for potential changes ahead, and give Canadian Dollar a lift.

Some previews on BoC:

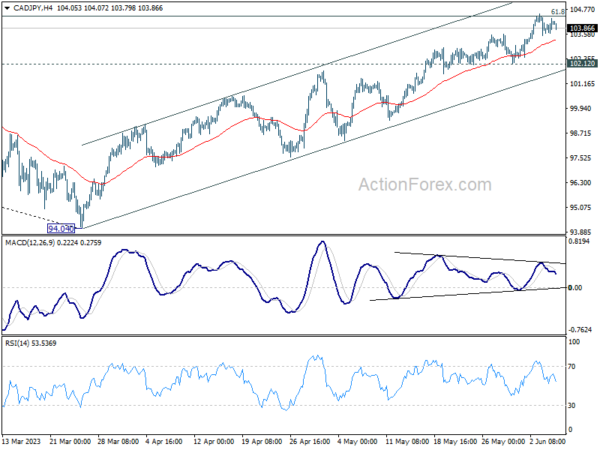

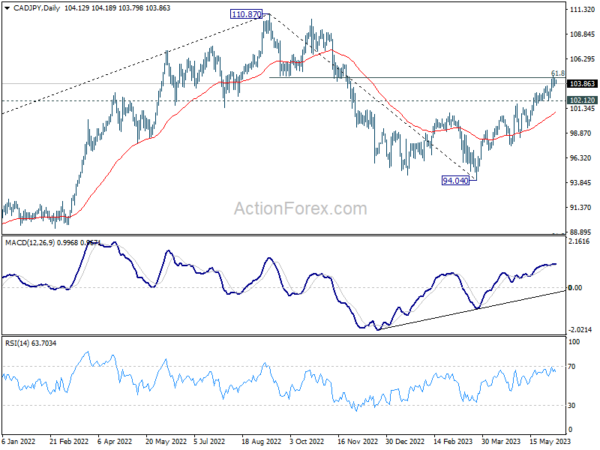

CAD/JPY has been losing upside momentum as seen in 4H MACD, even though the rally from 94.04 extended. Such rise is seen as the second leg of the corrective pattern from 110.87. It’s now pressing an important fibonacci resistance of 61.8% retracement of 110.87 to 94.04 at 104.44.

Decisive break of 104.44, as prompted by hawkish BoC, could trigger upside re-acceleration to retest 110.87 high. But for now, firm break there is not expected yet.

On the other hand, break of 102.12 support will indicate rejection by 104.44. More importantly, the pattern from 110.87 might have then started the third leg. Sustained trading below 55 D EMA (now at 100.88) would bring deeper fall back towards 94.04.

Elsewhere

Swiss unemployment rate and foreign currency reserves, Germany industrial production, France trade balance, and Italy retail sales will be released in European session. Later in the day, both US and Canada will publish trade balance.

AUD/USD Daily Report

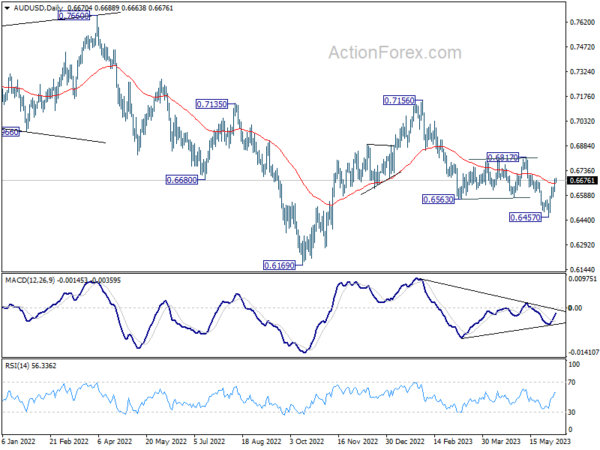

Daily Pivots: (S1) 0.6626; (P) 0.6656; (R1) 0.6701; More…

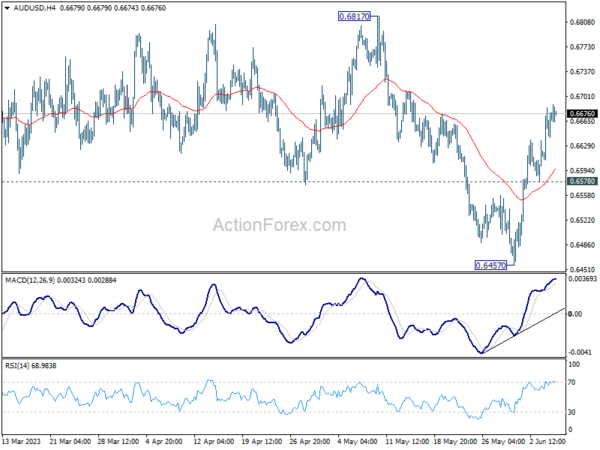

AUD/USD’s rise from 0.6457 is still in progress and intraday bias stays on the upside for 0.6817 key structural resistance. On the downside, though, break of 0.6578 minor support will retain near term bearishness, and turn bias back to the downside for retesting 0.6457 low instead.

In the bigger picture, rejection by 55 W EMA (now at 0.6811) keeps medium term outlook bearish. Current development suggests that down trend from 0.8006 (2021 high) is possibly still in progress. Retest of 0.6169 (2022 low) should be seen next. Firm break there will confirm down trend resumption. For now, this will remain the favored case as long as 0.6817 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | GDP Q/Q Q1 | 0.20% | 0.30% | 0.50% | 0.60% |

| 03:00 | CNY | Trade Balance (USD) May | 65.8B | 94.2B | 90.2B | |

| 05:00 | JPY | Leading Economic Index Apr P | 97.6% | 98.30% | 97.50% | 97.7% |

| 05:45 | CHF | Unemployment Rate M/M May | 1.90% | 1.90% | ||

| 06:00 | EUR | Germany Industrial Production M/M Apr | 0.80% | -3.40% | ||

| 06:45 | EUR | France Trade Balance (EUR) Apr | -7.7B | -8.0B | ||

| 07:00 | CHF | Foreign Currency Reserves (CHF) May | 732B | |||

| 08:00 | EUR | Italy Retail Sales M/M Apr | 0.40% | 0.00% | ||

| 12:30 | USD | Trade Balance (USD) Apr | -75.3B | -64.2B | ||

| 12:30 | CAD | Labor Productivity Q/Q Q1 | 0.00% | -0.50% | ||

| 12:30 | CAD | Trade Balance (CAD) Apr | 0.1B | 1.0B | ||

| 14:00 | CAD | BoC Interest Rate Decision | 4.50% | 4.50% | ||

| 14:30 | USD | Crude Oil Inventories | 1.2M | 4.5M |