Yen is encountering renewed selling pressure, particularly against European majors. This weakness is partly attributed to the rising treasury yields that have dampened enthusiasm for the Japanese currency. However, its losses remain contained for the moment. On the other hand, Australian Dollar is seeking to prolong its short-term rally, most notably against New Zealand Dollar. The Sterling is trailing closely as the second strongest, buoyed by buying against a weaker Euro. Conversely, the Dollar is currently lagging, second only to Kiwi in terms of weak performance, followed closely by Yen. Canadian Dollar is exhibiting a mixed performance as market participants eagerly await Bank of Canada’s rate decisions.

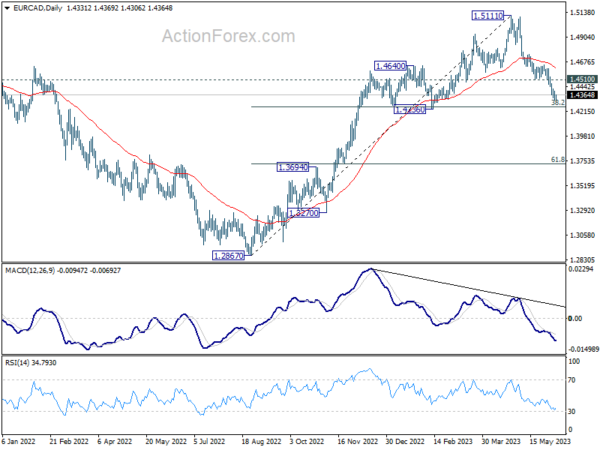

Technically, there is prospect of a bounce in EUR/CAD, considering that it’s now close to 1.4236 cluster support (38.2% retracement of 1.2867 to 1.5111 at 1.4254). Break of 1.4510 minor resistance will suggest that the corrective fall from 1.5111 has completed and bring stronger rebound back to 55 D EMA (now at 1.4615) and above. Nevertheless, decisive break of 1.236 could path the way to 61.8% retracement at 1.3724. Direction of the cross will likely become clear shortly after Bank of Canada’s decision.

ECB Schnabel: Peak in underlying inflation insufficient to declare victory

In an interview by De Tijd, ECB Executive Board member Isabel Schnabel noted that “given the high uncertainty about the persistence of inflation, the costs of doing too little continue to be greater than the costs of doing too much.”

She emphasized “once inflation has become entrenched in the economy, it becomes much more costly to fight it,” adding that “We have more ground to cover. It will depend on the incoming data by how much more rates will have to increase.”

On the topic of market expectations of two more additional 25bps hikes, Schnabel remained data-driven. She responded, “That will depend on the incoming data. Let me be very clear: A peak in underlying inflation would not be sufficient to declare victory: we need to see convincing evidence that inflation returns to our 2% target in a sustained and timely manner. We are not at that point yet.”

Regarding monetary policy transmission precess, Schnabel explained, “A rise in the policy rate first has an impact on financing conditions, then on the real economy, and ultimately on wages and prices.” She revealed that ECB’s staff analysis suggests the effects of tighter monetary policy are currently in progress, with the impact on inflation expected to peak in 2024.

However, Schnabel cautioned that uncertainty persists around the strength and speed of this process, admitting, “it may take longer than was previously the case to see the impact of our policy.”

ECB Knot: Financial markets extraordinarily optimistic on inflation

Speaking at a Dutch parliamentary hearing, ECB Governing Council member and Dutch central bank head Klaas Knot highlighted the optimistic stance of financial markets about inflation, and warned about the potential pitfalls.

“Financial markets are extraordinarily optimistic and are expecting inflation to drop as fast as it rose. For next year even rate decreases are already priced in,” Knot observed.

However, the Dutch central bank chief noted that this rosy outlook might invite unforeseen challenges, especially if the path to inflation stabilization necessitates a longer than anticipated period of monetary tightening. This could potentially reignite tension within the financial markets.

“Exactly in such a situation, a longer than expected period of monetary tightening to keep inflation in check will increase the risk of renewed stress on financial markets,” he cautioned.

RBA Lowe: Some further tightening of monetary policy may be required

In a speech, RBA Governor Philip Lowe revealed further insight into the central bank’s decision-making process and concerns regarding inflation. Lowe underscored RBA’s decision to raise interest rates once more yesterday as an effort to confidently bring inflation back to target within a reasonable timeframe.

Governor Lowe said, “Yesterday’s decision to increase interest rates again was taken to provide greater confidence that inflation will return to target within a reasonable timeframe.”

He attributed this decision to a recent influx of data, suggesting “greater upside risks” to the Bank’s inflation outlook. Persistent inflation in services prices, both domestically and abroad, combined with recent data on inflation, wages, and housing prices outpacing forecasts, were contributing factors.

The Governor noted, “Given this shift in risks and the already fairly drawn-out return of inflation to target, the Board judged that a further increase in interest rates was warranted.”

However, he also highlighted various factors the Board will monitor closely in the coming months, including developments in the global economy, domestic household spending, the growth rate in unit labour costs, and inflation expectations.

While acknowledging that the RBA remains on a narrow path, Lowe pointed out “significant risks”, particularly the possibility that “inflation stays too high for too long”.

He concluded, “Some further tightening of monetary policy may be required, but that will depend upon how the economy and inflation evolve. The Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market.”

Australia’s Q1 GDP grew only 0.2% qoq, domestic price growth decelerated

Australia’s GDP expanded by 0.2% qoq in Q1, missing expectations of 0.3% qoq growth. This marked the slowest rate of growth since the September 2021 quarter.

Head of National Accounts at the Australian Bureau of Statistics, Katherine Keenan, remarked on this development. “This is the sixth straight rise in quarterly GDP but the slowest growth since the COVID-19 Delta lockdowns in September quarter 2021,” she said.

The GDP implicit price deflator, a measure of price changes, climbed by 1.9% in the quarter and by 6.8% from March 2022. A significant contributor to this increase was rise in terms of trade by 2.8%, led by steeper decline in import prices (-4.0%) than export prices (-1.4%).

Fall in import prices, the largest since December 2010, was propelled by global drop in oil prices and appreciation of Australian dollar. Meanwhile, a decrease in export prices was led by rural and mining commodities.

Domestic price growth decelerated to 1.1% as goods inflation eased. This is a downturn from the 1.4% increase observed in the December 2022 quarter.

China’s exported fell -7.5% yoy in May, trade surplus shrank to USD 65.8B

In May, China’s exports significantly contracted, defying expectations. The country’s exports shrunk by -7.5% yoy to USD 283.5B, which was far below expectation of -0.4% yoy contraction. This marks the second-lowest export value since May 2022, with the only lower figure being the seasonally affected USD 213.8B recorded in February. Imports also contracted by -4.5% yoy to USD 217.7B, outperforming the forecasted 8.0% yoy contraction.

However, the most striking observation comes in the form of China’s trade surplus. It fell sharply from USD 90.2B to USD 65.8B, defying the predicted figure of USD 94.2B. This represents the lowest level since the COVID-driven decline observed in April 2022.

OECD upgrades global growth outlook, advocates for restrictive monetary policies

In the latest Economic Outlook, OECD has slightly upgraded global growth forecasts, and stressed the need for central banks to maintain restrictive monetary policies to curtail inflation.

OECD now projects global economic expansion at 2.7%, a slight upgrade from its previous forecast of 2.6% in March. The US and China, the world’s two largest economies, saw their growth forecasts for 2023 nudged upwards by 0.1%, to 1.6% and 5.4% respectively.

In Eurozone, growth forecast was modestly bumped up by 0.1 points to 0.9%. However, Germany, the zone’s largest economy, saw a significant downgrade with zero growth now expected. UK, on the other hand, received a boost with OECD predicting 0.3% growth rather than an economic contraction. Japan’s GDP growth forecast was slightly revised down to 1.3%.

Despite the optimistic revisions, OECD chief economist Clare Lombardelli underscored the challenges ahead in a commentary accompanying the report.

“The global economy is turning a corner but faces a long road ahead to attain strong and sustainable growth,” Lombardelli stated. She added, “The recovery will be weak by past standards.”

Highlighting the ongoing inflationary pressures globally, Lombardelli advocated for a continued restrictive monetary stance from central banks. “Central banks need to maintain restrictive monetary policies until there are clear signs that underlying inflationary pressures are abating,” she urged.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 139.16; (P) 139.57; (R1) 140.05; More…

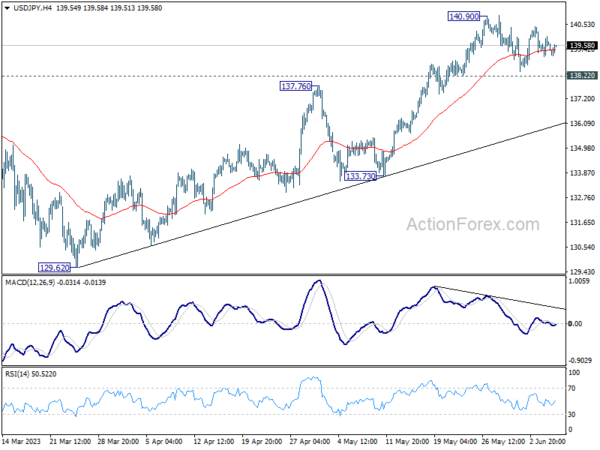

USD/JPY is still extending the consolidation from 140.90 and intraday bias stays neutral for the moment. With 138.22 minor support intact, further rally is expected. On the upside, break of 140.90 will resume larger rise from 127.20 to 142.48 fibonacci level. However, considering bearish divergence condition in 4 hour MACD, break of 138.22 will confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 136.35).

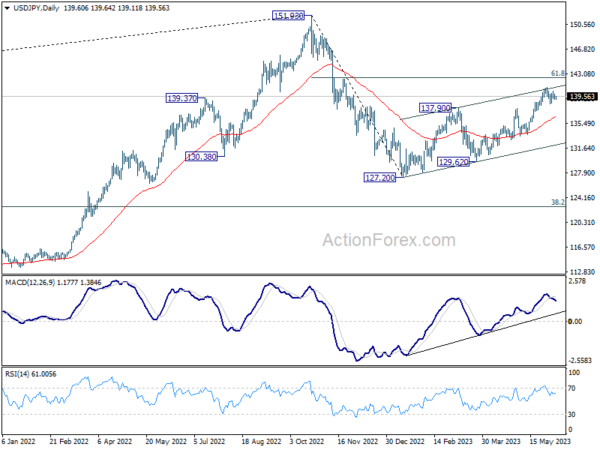

In the bigger picture, rise from 127.20 is seen as the second leg of the corrective pattern from 151.93 high. Stronger rally would be seen to 61.8% retracement of 151.93 to 127.20 at 136.34. Sustained break there will pave the way back to retest 151.93. On the downside, however, break of 133.73 support will argue that the pattern could have started the third leg through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | GDP Q/Q Q1 | 0.20% | 0.30% | 0.50% | 0.60% |

| 03:00 | CNY | Trade Balance (USD) May | 65.8B | 94.2B | 90.2B | |

| 05:00 | JPY | Leading Economic Index Apr P | 97.60% | 98.30% | 97.50% | 97.70% |

| 05:45 | CHF | Unemployment Rate M/M May | 2.00% | 1.90% | 1.90% | |

| 06:00 | EUR | Germany Industrial Production M/M Apr | 0.30% | 0.80% | -3.40% | -2.10% |

| 06:45 | EUR | France Trade Balance (EUR) Apr | -9.7B | -7.7B | -8.0B | -8.4B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) May | 734B | 732B | ||

| 08:00 | EUR | Italy Retail Sales M/M Apr | 0.20% | 0.40% | 0.00% | |

| 12:30 | USD | Trade Balance (USD) Apr | -74.6B | -75.3B | -64.2B | -60.6B |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | -0.60% | 0.00% | -0.50% | |

| 12:30 | CAD | Trade Balance (CAD) Apr | 1.9B | 0.1B | 1.0B | 0.2B |

| 14:00 | CAD | BoC Interest Rate Decision | 4.50% | 4.50% | ||

| 14:30 | USD | Crude Oil Inventories | 1.2M | 4.5M |