Dollar falls broadly today, despite strong job data, as near term consolidations continues. The odds of a June Federal Reserve rate hike seem to be dwindling, following recent comments that emphasized the likelihood of a hold. However, the overall landscape could alter significantly following tomorrow’s non-farm payroll report. Notably, the greenback still retains its position above near-term support levels against most major currencies, with the exception of the British Pound.

Staying in the currency markets, overall development is indeed mixed. Sterling is emerging as one of the day’s strongest currencies, largely propelled by purchases against Euro and Swiss Franc. Australian Dollar stands out as the top performer, while its trans-Tasman cousin, New Zealand dollar, ranks among the worst. Japanese Yen is fluctuating, still attempting to prolong this week’s corrective recovery.

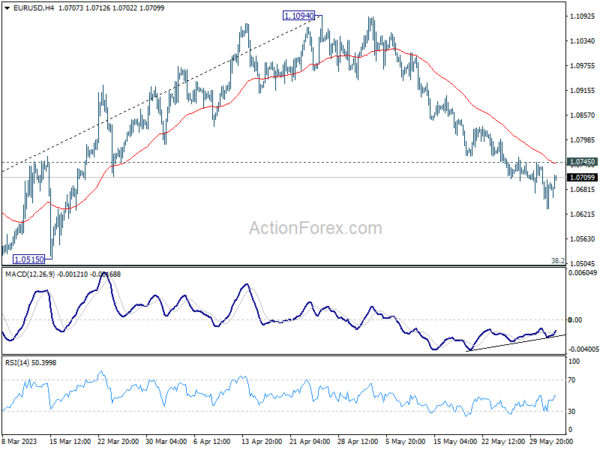

Technically, levels to watch in Dollar pairs include 1.0745 resistance in EUR/USD, 0.6558 resistance in AUD/USD, 0.9013 support in USD/CHF, 138.22 support in USD/JPY, and 1.3483 support in USD/CAD. As long as these levels hold, Dollar’s rally could resume any time.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is up 0.66%. CAC is up 0.16%. Germany 10-year yield is down -0.0263 at 2.258. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI dropped -0.10%. China Shanghai SSE rose 0.00%. Singapore Strait Times rose 0.24%. Japan 10-year JGB yield dropped -0.0123 to 0.420.

US ADP jobs grew 278k, pay growth slowing substantially

US ADP private employment grew 278k in May, well above expectation of 167k. By sector, goods-producing jobs grew 110k while service-providing jobs grew 168k. By establishment size, small companies added 235k jobs, medium companies added 140k, large companies cut -106k.

Job changers saw a gain of 12.1% yoy, down a full percentage point from April. For job stayers, the increase was 6.5% yoy in May, down from 6.7% yoy.

“This is the second month we’ve seen a full percentage point decline in pay growth for job changers. Pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring.” Nela Richardson, Chief Economist, ADP said.

US jobless claims rose to 232k, slightly below expectations

US initial jobless claims rose 2k to 232k in the week ending May 27, slightly below expectation of 236k. Four-week moving average of initial claims dropped -2.5k to 229.5k.

Continuing claims dropped -6k to 1795k in the week ending May 20. Four-week moving average of continuing claims dropped -1.5k to 1789k.

Eurozone CPI slowed to 6.1% yoy in May, core CPI down to 5.3% yoy

Eurozone CPI slowed from 7.0% yoy to 6.1% yoy in May, below expectation of 6.3% yoy. CPI core (ex-energy, food, alcohol & tobacco) slowed from 5.6% yoy to 5.3% yoy, below expectation of 5.3% yoy.

Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in May (12.5%, compared with 13.5% in April), followed by non-energy industrial goods (5.8%, compared with 6.2% in April), services (5.0%, compared with 5.2% in April) and energy (-1.7%, compared with 2.4% in April).

Eurozone PMI manufacturing finalized at 44.8, weakness in demand increasingly evident

Eurozone PMI Manufacturing was finalized at 44.8 in May, down from April’s 45.8, hitting the worst level in 36 months. PMI Manufacturing output dropped from 58.5 to 46.4, a 6-month low. Factor gate prices declined fro the first time since September 2020.

Looking at some member states, Ireland (47.5), Italy (45.9), the Netherlands (44.2) and Germany (43.2) were all at 36-month low. Austria hit 37-month low at 39.7. France recovered to 2-month high at 45.7.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “The weakness in demand in the manufacturing sector, which has become increasingly evidence since the beginning of the year in falling PMI readings, has now led the surveyed companies to reduce their production for the second month in a row”.

UK PMI manufacturing finalized at 47.1, downturn deepened

UK PMI Manufacturing was finalized at 47.1 in May, down from April’s 47.8, hitting the lowest level in four-months. S&P Global noted the output contracted in investment and intermediate goods sectors. Input costs fell and supply chain pressured subsided.

Rob Dobson, Director at S&P Global Market Intelligence, said:

“The UK manufacturing downturn deepened in May, with output, new orders and employment all falling at increased rates. Manufacturers are finding that any potential boost to production from improving supply chains is being completely negated by weak demand, client destocking and a general shift in spending in the UK away from goods to services.

” These factors are also driving a broad decrease in demand from overseas amid reports of lost orders from the US and mainland Europe. The retrenchment in export demand is also being exacerbated by some EU clients switching to more local sourcing to avoid post-Brexit trade complications.”

Japan PMI manufacturing finalized at 50.6, a decisive turnaround

Japan PMI Manufacturing was finalized at 50.6 in May, up from April’s 49.5. That’s the first expansionary reading since October 2022, signalling a modest overall improvement in operating conditions. Also, business optimism reached highest level since January 2022, while supplier performance stabilized.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “The latest au Jibun Bank PMI survey highlights a decisive turnaround in manufacturing sector performance during May and brings to an end a six-month period of weakening business conditions.”

China Caixin PMI manufacturing rose to 50.9, activity improved

China Caixin PMI Manufacturing rose from 49.5 to 50.9 in May, signaling the first improvement in the health of the sector since February. Caixin noted stronger increase in output as firms saw fresh upturn in new business. Input costs fell solidly. Employment, however, continued to decline as business confidence softened.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In a nutshell, manufacturing activity improved in May. Both supply and demand expanded, but employment sank to a three-year low. Businesses stepped up purchasing, inventories of raw materials grew marginally, logistics picked up, prices continued to slump, and manufacturers’ optimism wavered.”

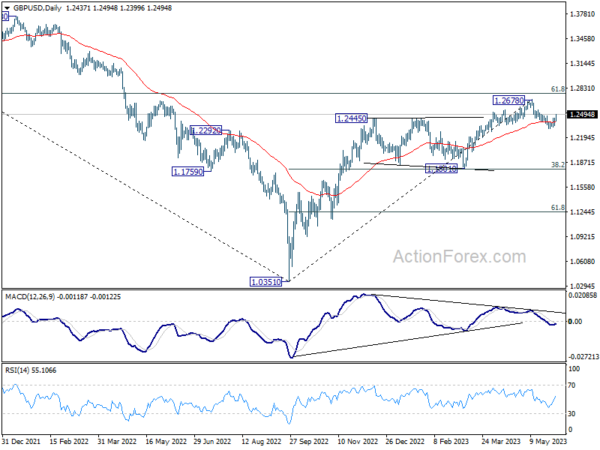

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2378; (P) 1.2411; (R1) 1.2474; More…

GBP/USD’s break of 1.2468 minor resistance today argues that corrective pull back from 1.2678 has completed at 1.2306. Intraday bias is back on the upside for retesting 1.2678 high next. But strong resistance could be seen there to limit upside on the first attempt. Meanwhile, break of 1.2306 will resume the correction towards 1.1801 cluster support (38.2% retracement of 1.0351 to 1.2678 at 1.1789).

In the bigger picture, as long as 1.1801 support holds, rise from 1.0351 medium term bottom (2022 low) is expected to extend further. Sustained break of 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759 will add to the case of long term bullish trend reversal. However, firm break of 1.1801 will indicate rejection by 1.2759, and bring deeper decline, even as a correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Capital Spending Q1 | 11.00% | 5.50% | 7.70% | |

| 00:30 | JPY | Manufacturing PMI May F | 50.6 | 50.8 | 50.8 | |

| 01:30 | AUD | Private Capital Expenditure Q1 | 2.40% | 1.10% | 2.20% | 3.00% |

| 01:45 | CNY | Caixin Manufacturing PMI May | 50.9 | 49.5 | ||

| 06:00 | CHF | Trade Balance (CHF) Apr | 2.6B | 3.73B | 4.53B | |

| 06:00 | EUR | Germany Retail Sales M/M Apr | 0.80% | 0.90% | -2.40% | -2.20% |

| 07:30 | CHF | Manufacturing PMI May | 43.2 | 44.5 | 45.3 | |

| 07:45 | EUR | Italy Manufacturing PMI May | 45.9 | 45.8 | 46.8 | |

| 07:50 | EUR | France Manufacturing PMI May F | 45.7 | 46.1 | 46.1 | |

| 07:55 | EUR | Germany Manufacturing PMI May F | 43.2 | 42.9 | 42.9 | |

| 08:00 | EUR | Eurozone Manufacturing PMI May F | 44.8 | 44.6 | 44.6 | |

| 08:30 | GBP | Manufacturing PMI May F | 47.1 | 46.9 | 46.9 | |

| 08:30 | GBP | Mortgage Approvals Apr | 49K | 54K | 52K | 51K |

| 08:30 | GBP | M4 Money Supply M/M Apr | 0.00% | -0.20% | -0.60% | |

| 09:00 | EUR | Eurozone Unemployment Rate Apr | 6.50% | 6.50% | 6.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y May P | 6.10% | 6.30% | 7.00% | |

| 09:00 | EUR | Eurozone CPI Core May P | 5.30% | 5.50% | 5.60% | |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 11:30 | USD | Challenger Job Cuts May | 286.70% | 175.90% | ||

| 12:15 | USD | ADP Employment Change May | 278K | 167K | 296K | 291K |

| 12:30 | USD | Initial Jobless Claims (May 26) | 232K | 236K | 229K | |

| 12:30 | USD | Nonfarm Productivity Q1 | -2.10% | -2.70% | -2.70% | |

| 12:30 | USD | Unit Labor Costs Q1 | 4.20% | 6.30% | 6.30% | |

| 13:30 | CAD | Manufacturing PMI May | 50.2 | |||

| 13:45 | USD | Manufacturing PMI May F | 48.5 | 48.5 | ||

| 14:00 | USD | ISM Manufacturing PMI May | 47 | 47.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid May | 52.5 | 53.2 | ||

| 14:00 | USD | ISM Manufacturing Employment Index May | 50.2 | |||

| 14:00 | USD | Construction Spending M/M Apr | 0.10% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 106B | 96B | ||

| 15:00 | USD | Crude Oil Inventories | -1.4M | -12.5M |