As we wind down the week, dollar seems to have resumed its inverse relationship with risk sentiment. Major European stock indices are trending upwards, with Germany’s DAX reaching hitting a new record high. Meanwhile, Euro and other European currencies are registering notable gains against Yen and the greenback. However, these European majors are trailing behind commodity currencies, with New Zealand dollar standing firm as this week’s strongest performer.

Earlier today, Yen’s brief and weak recovery came to an abrupt halt and selling pressure has once again taken hold. Barring any last-minute changes, the Japanese currency is poised to end the week as the most underperforming currency.

Technically, GBP/JPY’s breach of 172.30 resistance today suggests that recent up trend is ready to resume for 100% projection of 148.93 to 172.11 from 155.33 at 178.51. CHF/JPY also looks ready to break through 153.93 towards 161.8% projection of 137.40 to 147.58 from 140.21 at 156.68. The question is when EUR/JPY would follow and break through 151.60 resistance too.

In Europe, at the time of writing, FTSE is up 0.42%. DAX is up 0.74%. CAC is up 0.76%. Germany 10-year yield is up 0.0397 at 2.488. Earlier in Asia, Nikkei rose 0.77%. Hong Kong HSI dropped -1.40%. China Shanghai SSE dropped -0.42%. Singapore Strait Times rose 0.63%. Japan 10-year JGB yield closed up 0.0222 at 0.407.

Canada retail sales down -1.4% mom in March

Canada retail sales decreased -1.4% mom to CAD 65.3B in March, slightly worse than expectation of -1.3% mom. Sales decreased in 5 of the 9 subsectors, representing 55.5% of retail trade, led by decreases at motor vehicle and parts dealers (-4.4%) and gasoline stations and fuel vendors (-3.9%). Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—increased 0.3% mom. In volume terms, retail sales decreased -1.0% mom.

Advance estimate suggests that sales increased 0.2% mom in April.

BoJ Ueda: It’s necessary to continue with monetary easing

BoJ Governor Kazuo Ueda said in a speech today, “At present, it’s necessary to continue with monetary easing,” as Japan’s economy faces risks from slowing global growth and uncertainty on whether wage rises will be sustained.

“The cost of prematurely shifting policy, and nipping the bud towards achieving 2% inflation, is extremely large,” Ueda he said. “It’s appropriate to take time judging (when to) tweak ultra-easy policy toward a future exit.”

Earlier today, Ueda told the parliament that U.S. debt default could trigger market turmoil, and will likely have a huge impact on the global economy. “There’s a chance it would cause turmoil in various markets … and affect a vast array of financial transactions.”

“The Bank of Japan will strive to maintain market stability based on its pledge to respond flexibly with an eye on economic, price and financial developments,” he said.

Japan CPI core rose back to 3.5% in April, core-core hit 42-yr high

April saw Japanese consumer prices accelerating, with CPI accelerated from 3.2% yoy to 3.5% yoy. That put a halt to the slowdown of headline inflation from 4.3% in January.

Even more significantly, core CPI (which excludes fresh food) rose from 3.1% yoy to 3.4%. This metric has been above BoJ’s 2% target for an uninterrupted 13 months, signifying persistent inflationary pressure.

In the realm of core-core CPI, which excludes both fresh food and energy, the increase is even starker, rising from 3.8% yoy to 4.1%. This figure is the highest it has been since September 1981, marking a nearly 42-year peak.

Looking at some details, services inflation increased from 1.5% yoy to 1.7%, the highest in 28 years since 1995 (excluding the impact of sales tax hikes). Durable goods prices soared 9.8% yoy, and food prices accelerated from 8.2% yoy to 9.0%, hitting the highest level in almost 47 years since 1976. Energy prices, however, bucked the trend with a yoy decrease of -4.4% yoy.

Despite these inflationary pressures, there is no clear indication that BoJ is preparing to exit its ultra-loose monetary policy. The bank projected CPI to average 1.8% and core CPI at 2.5% for the current fiscal year, but given the current data, it is likely that these projections will be revised upward in the next release.

New Zealand exports rise 10% yoy with China leading, EU tops 12% imports growth

New Zealand’s trade balance in April reported a surplus of NZD 427m, defying expected deficit of NZD -1310m. Both imports and exports experienced significant year-on-year growth, with exports rising 10% yoy (NZD 641m) to NZD 6.8B and imports increasing 12% yoy (NZD 683m) to NZD 6.4B.

In the export sector, notable growth was observed in shipments to China, Australia, and the US. Specifically, total exports to China rose by NZD 259m (16% yoy), to Australia by NZD 67m (10% yoy), and to the US by NZD 109m (17% yoy). However, exports experienced a slight downturn to the EU, falling by NZD -2.2m (-0.4% yoy), and a more substantial drop to Japan, decreasing by NZD -53m (-12% yoy).

On the import side, the European Union led the surge with total imports up by NZD 108m (13% yoy). Imports from the US also experienced growth, with an increase of NZD 46m (7.6% yoy). Conversely, imports from China, Australia, and South Korea all fell, with decreases of NZD -29m (-2.4% yoy), NZD -37m (-5.1% yoy), and NZD -28m (-8.3% yoy) respectively.

EUR/USD Mid-Day Outlook

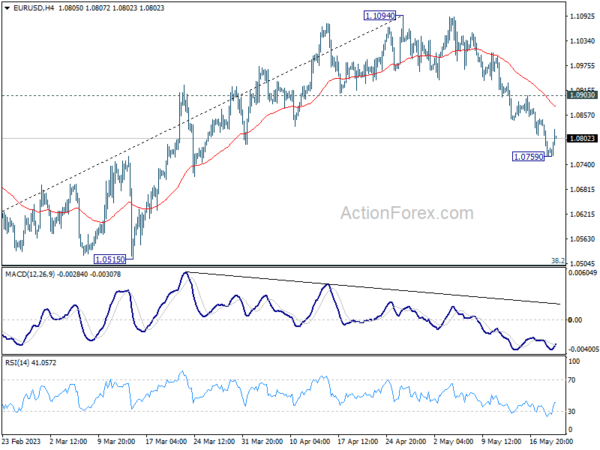

Daily Pivots: (S1) 1.0739; (P) 1.0794; (R1) 1.0824; More…

Intraday bias in EUR/USD is turned neutral first with today’s recovery. But further decline will remain in favor as long as 1.0903 resistance holds. Fall from 1.1094 is seen as a correction to whole up trend from 0.9534. Below 1.0759 will resume the decline to 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498. On the upside, though, firm break of 1.0903 will bring stronger rebound back to retest 1.1094 high instead.

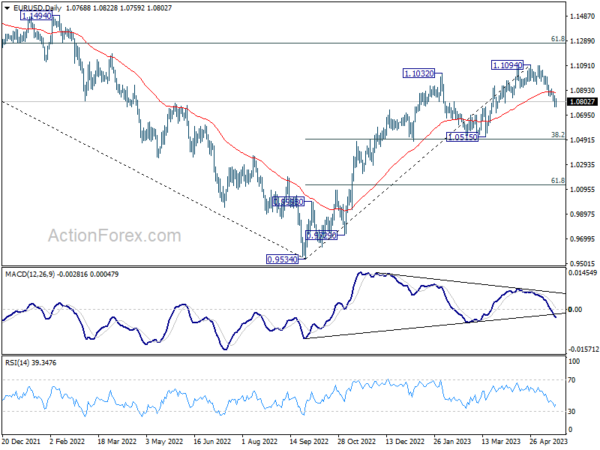

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Apr | 427M | -1310M | -1273M | -1586M |

| 23:01 | GBP | GfK Consumer Confidence May | -27 | -30 | ||

| 23:30 | JPY | National CPI Y/Y Apr | 3.50% | 3.20% | ||

| 23:30 | JPY | National CPI Core Y/Y Apr | 3.40% | 3.40% | 3.10% | |

| 23:30 | JPY | National CPI Core-core Y/Y Apr | 4.10% | 3.80% | ||

| 04:30 | JPY | Tertiary Industry Index M/M Mar | -1.70% | -0.10% | 0.70% | 1.70% |

| 06:00 | EUR | Germany PPI M/M Apr | 0.30% | -0.50% | -2.60% | -1.40% |

| 06:00 | EUR | Germany PPI Y/Y Apr | 4.10% | 4.00% | 7.50% | 6.70% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | CAD | Retail Sales M/M Mar | -1.40% | -1.30% | -0.20% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | -0.30% | -0.80% | -0.70% |