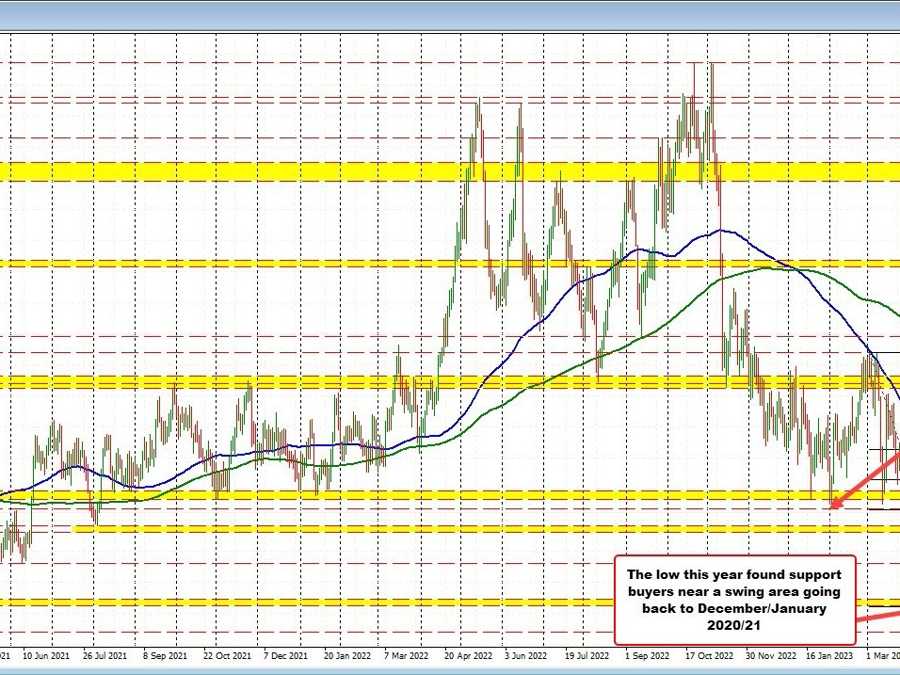

USDCHF moves up to test 38.2% and swing low from February

The USDCHF ran to the upside with the broader dollar buying and the pair moved up to a high price of 0.9062. That took the price just above the 38.2% retracement of the move down from 2023 high. That retracement level comes in at 0.90582. The current price trades at 0.9051 just below the retracement level. Also in play is a swing low from February at 0.90587.

The 38.2% retracement is the minimum retracement if buyers are to take back more control. For the last 2+ months, the trend has been to the downside with the price moving over 600 pips lower (621 pips to be exact). However, since bottoming on May 4 at 0.8819, the price has moved up around 243 pips of that 621 point decline.

Drilling down to the 4 hour chart below, there is a swing area between 0.9070 and 0.9080 above the 38.2% retracement level (see red number circles on the chart below). Getting above the 38.2% retracement in the swing area would open the door toward the 50% retracement at 0.91311.

USDCHF tests 38.2% retracement