Hello Traders! Today, we will look at the shorter cycles of Micron Technology Inc ($MU) and explain why the stock should remain supported in the near term. This is how we saw it back in March 2023 expecting a bounce to take place first before lower again.

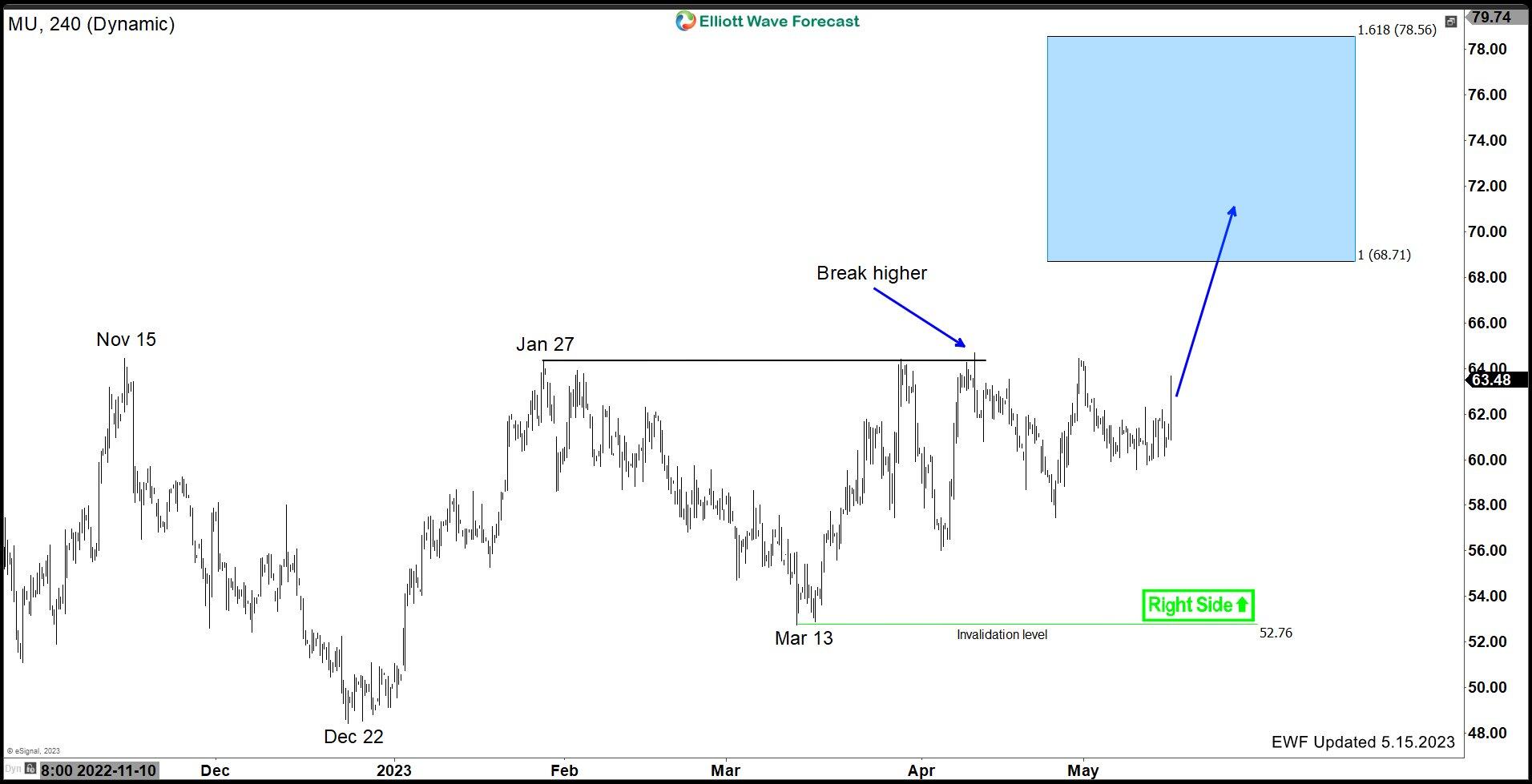

$MU 4H Elliott Wave Analysis May 15th 2023

The stock has been choppy and trading sideways since the peak on Nov 15, 2022 and the low on Dec 22, 2022. Unable to make new highs or new lows below those 2 pivots kept it trapped in a sideways range until April 2022. The break higher triggered multiple bullish sequences against Mar 13th and Dec 22nd. One can also observe the price action making higher lows since Dec 2022. Every pullback was being bought and now with a break higher, it is expected to remain supported towards the extreme area at $68.71 – 78.56 before a pullback can happen. We like buying dips in 3, 7 or 11 swings at extreme areas until that target is reached.

The stock has been choppy and trading sideways since the peak on Nov 15, 2022 and the low on Dec 22, 2022. Unable to make new highs or new lows below those 2 pivots kept it trapped in a sideways range until April 2022. The break higher triggered multiple bullish sequences against Mar 13th and Dec 22nd. One can also observe the price action making higher lows since Dec 2022. Every pullback was being bought and now with a break higher, it is expected to remain supported towards the extreme area at $68.71 – 78.56 before a pullback can happen. We like buying dips in 3, 7 or 11 swings at extreme areas until that target is reached.