Market sentiments show signs of revival today, appeared to be buoyed by optimism over a potential debt ceiling agreement between US Democrats and Republicans. Over the weekend, Treasury Secretary Janet Yellen delivered upbeat remarks, indicating that negotiations were in full swing and marked by “some areas of agreement.”

This optimism has brought a ripple effect in the currency markets, with commodity currencies experiencing a rise, led by Australian Dollar, with British Pound in between. Japanese Yen is having a significant slump, trailed by Dollar, Euro, and Swiss Franc.

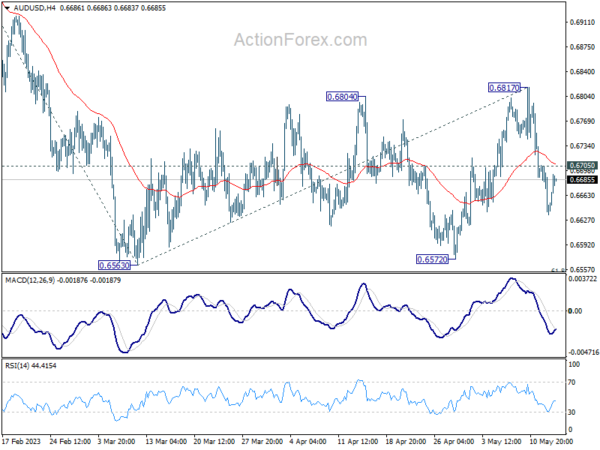

However, the durability of these risk rallies for the remainder of the week remains uncertain. From a currency market standpoint, a convincing break of 0.6705 minor resistance by AUD/USD would be needed to neutralize its near-term bearish stance. Absent such a breakthrough, risk of dipping to retest the 0.6563 low remains an imminent possibility, probably alongside another bearish turn in risks.

In Europe, at the time of writing, FTSE is up 0.29%. DAX is down -0.10%. CAC is down -0.01%. Germany 10-year yield is up 0.038 at 2.312. Earlier in Asia, Nikkei rose 0.81%. Hong Kong HSI rose 1.75%. China Shanghai SSE rose 1.17%. Singapore Strait Times rose 0.19%. Japan 10-year JGB yield rose 0.0191 to 0.408.

Fed’s Bostic indicates bias towards further hikes, no cut until well into 2024

In an interview with CNBC, Atlanta Fed President Raphael Bostic emphasized the importance of combating inflation, which he deems as “job No. 1”. He expressed his readiness to bear the cost necessary to achieve the Fed’s target, underscoring the need for a more aggressive stance on rate hikes given the current economic scenario.

Bostic stated, “What we’ve seen is that inflation has been persistently high, consumers have been really resilient in terms of their spending, and labor markets remain extremely tight. All of those suggests that there’s still going to be upward pressure on prices.” His comments highlight the ongoing pressures that may trigger further inflationary spikes.

He showcased leaning towards a proactive approach in dealing with inflation, stating, “If there’s going to be a bias to action, for me it would be a bias to increase a little further as opposed to cut.”

Bostic remained confident in Fed’s policy measures, asserting, “There’s still a lot of confidence that our policies are going to be able to get inflation back down to our 2% target.” He made clear Fed’s determination to ensure this target is met, even if it means holding off on rate cuts until well into 2024.

US Empire State business conditions index plunges, fueling recession fears

In a significant downturn, New York Fed Empire State Business Conditions Index plummeted to -31.8 in May, a drastic drop of -42.6 points from its April reading of 10.8. This disappointing figure significantly underperforms market expectations of -1.9, and any reading below zero signals deteriorating conditions.

This precipitous drop comes just a month after the index defied expectations with a 35.4 point surge to 10.8 in April. The recent plunge not only eradicates last month’s gains but also heightens concerns about a potential recession.

In parallel with the overall index, new orders sub-index fell a whopping -53.1 points to -28 in May, effectively erasing the sharp 46.7 point increase seen in April. Additionally, shipments index witnessed a substantial decline, falling -40.3 points to -16.4, negating the 37.3 point gain from the previous month.

Interestingly, amid this overall downturn, the six-month expectations measure managed to tick up slightly, gaining 3.2 points to reach 9.8.

EU Spring Forecast: Upgraded GDP growth and inflation

In its Spring 2023 Economic Forecast, European Commission presented a cautiously optimistic outlook for the Eurozone, with GDP growth projections revised upwards to 1.1% and 1.6% for 2023 and 2024 respectively. This positive adjustment, credited to a stronger-than-expected start to the year, exceeds winter forecasts of 0.9% in 2023 and 1.5% in 2024.

However, the report did not shy away from the challenges posed by inflation. Persisting core price pressures have led the Commission to revise its inflation forecasts for Eurozone to 5.8% in 2023 and 2.8% in 2024, up from winter’s projected 5.6% and 2.5% respectively. On an annual basis, core inflation is set to average 6.1% in 2023 before falling to 3.2% in 2024, remaining above headline inflation in both forecast years.

While the overall picture painted by the Commission is one of steady recovery, it also acknowledges increase in downside risks to economic outlook. The report warned that persistent core inflation could continue to squeeze household purchasing power and necessitate stronger response from monetary policy, leading to wider macro-financial implications.

Potential threats also include renewed financial stress, which could trigger tightening of lending standards, and exacerbation of inflation by expansionary fiscal policies.

The forecast also flagged the ongoing turmoil in the banking sector and broader geopolitical tensions as possible sources of further economic challenges. On the other hand, the Commission noted that more favorable developments in energy prices could lead to a faster decline in headline inflation, boosting domestic demand.

Eurozone industrial production down -4.1% mom in Mar

Eurozone industrial production contracted -4.1% mom in March, much worse than expectation of -1.2% mom. Production of capital goods fell by -15.4% mom, intermediate goods by -1.8% mom, energy by -0.9% mom and non-durable consumer goods by -0.8% mom, while production of durable consumer goods rose by 2.8% mom.

EU industrial production declined -3.6% mom. Among Member States for which data are available, the largest monthly decreases were registered in Ireland (-26.3%), Sweden (-3.9%) and Germany (-3.1%). The highest increases were observed in Finland (+3.0%), Slovenia (+2.3%), Czechia and Slovakia (both +1.7%).

Japan cabinet office stresses importance of avoiding relapse into deflation

Japan’s Cabinet Office emphasized, at a meeting of the government’s economic council, the need for stability and sustainability in these positive signs to ensure that Japan does not fall back into a deflationary spiral. They stated, “While there have been some positive signs in recent data, we must ensure they are stable and sustainable so that Japan won’t revert to deflation.”

In a separate discussion involving academics and private-sector experts, some participants called for BoJ to end quantitative easing once inflation stabilizes around its 2% target. Meanwhile, some participants suggested BoJ should mull over altering its extraordinary stimulus measures if inflation and wages continue their upward trajectory.

Prime Minister Fumio Kishida emphasized the need for a coordinated approach between the government and the BoJ amidst the growing uncertainty surrounding the economic outlook. He said, “We’re aiming to pull Japan out of deflation and achieve sustained, private demand-driven economic growth” by influencing public perceptions that growth and inflation will continue to rise.

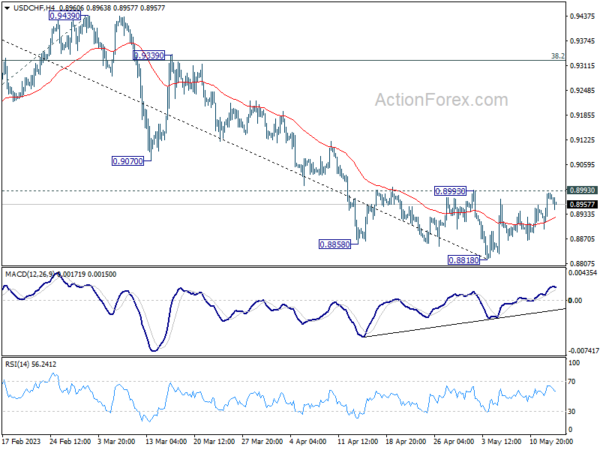

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8925; (P) 0.8956; (R1) 0.9016; More…

No change in USD/CHF’s outlook and intraday bias stays neutral with immediate focus on on 0.8993 resistance. Decisive break there will confirm short term bottoming at 0.8818, on bullish convergence condition in 4H MACD. Intraday bias will be turned back to the upside for 55 D EMA (now at 0.9052) and possibly above. In case of another fall, strong support should be seen from 61.8% projection of 1.0146 to 0.9058 from 0.9439 at 0.8767, which is close to 0.8756 long term support, to bring rebound.

In the bigger picture, fall from 1.1046 (2022 high) is seen as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal. Sustained break of 0.9058 support turned resistance will be the first sign of medium term bottoming. However, decisive break of 0.8756 will carry larger bearish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Apr | 49.8 | 54.4 | 53.8 | |

| 23:50 | JPY | PPI Y/Y Apr | 5.80% | 5.60% | 7.20% | 7.40% |

| 06:30 | CHF | Producer and Import Prices M/M Apr | 0.20% | -0.10% | 0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | 1.00% | 1.10% | 2.10% | |

| 09:00 | EUR | EU Economic Forecasts | ||||

| 09:00 | EUR | Eurozone Industrial Production M/M Mar | -4.10% | -1.20% | 1.50% | |

| 12:15 | CAD | Housing Starts Y/Y Apr | 262K | 221K | 214K | |

| 12:30 | USD | Empire State Manufacturing Index May | -31.8 | -1.9 | 10.8 |