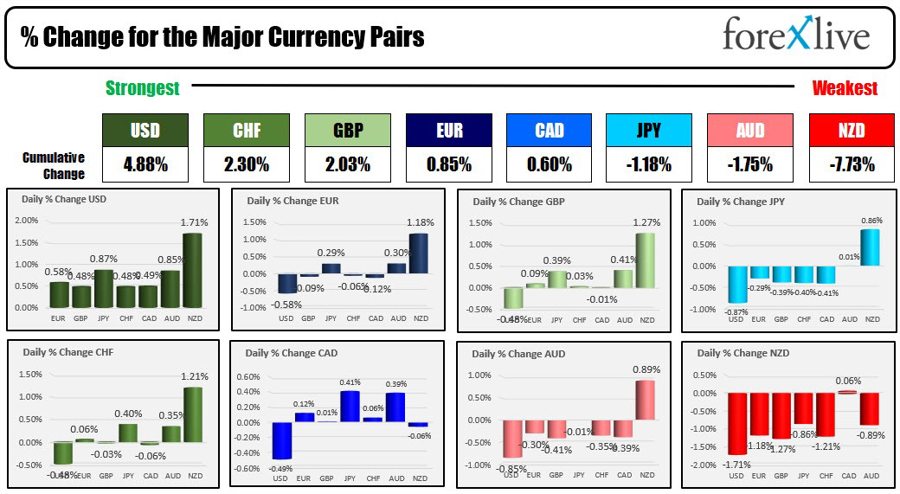

The USD is the ending the day as the strongest of the major currencies, while the NZD is the weakest.

The strongest of the weakest of the major currencies

The move higher in the greenback can be attributed to:

- Higher inflation expectations from the University of Michigan Consumer survey

- Concerns about the debt ceiling leading to a flight to safety flow into the greenback

- Technical breaks in some of the major currency pairs.

In May 2023, the University of Michigan Index of Consumer Sentiment dropped by 9.1% MoM to 57.7 (from 63.5 last month), representing a 1.2% YoY decrease from May 2022. The Current Economic Conditions index experienced a -5.4% MoM decline to 64.5 (from 68.2), but increased by 1.9% YoY. Meanwhile, the Index of Consumer Expectations saw a significant 11.7% MoM drop to 53.4 from 60.5 last month, accompanied by a 3.3% YoY decline.

The fall was attributed to renewed concerns about the economy’s trajectory, erasing more than half of the gains since last June’s historic low. Despite the absence of recession indicators in macroeconomic data, consumers’ worries escalated in response to negative economic news, including the debt crisis standoff. It was the inflation expectations that got the most attention. The 1-year inflation expectations slightly decreased to 4.5% in May from 4.6% in April, but the long-run 5-year inflation expectations, after two years of stability, reached its highest level since 2011, increasing from 3.0% to 3.2% this month.

Regarding the extension of the debt ceiling, the Congressional Budget Office (or CBO) released projections for cash flow absent legislation to extend the debt ceiling. According to projections they see the US treasury running out of money in the 1st 2 weeks of June (dependent on inflows and outflows and the timing of such). If things are just right and they get passed mid-month when additional tax inflows are expected, the government may cobble along to the July. However, there is also a chance they could also run out of money more toward the beginning of the month.

This week, the congressional leaders met with Pres. Biden with little progress made. They were expected to meet again today, but that meeting was postponed in favor of having staff members continue to work on a solution. Leaders are not expected to get together again until Monday or Tuesday of next week.

The full details, led to additional dollar buying as the fears of default started to enter into the markets.

Finally, technical breaks and some of the major currency pairs help to push the US dollar higher.

- NZDUSD: The NZDUSD was the biggest mover with a 1.71% decline. New Zealand inflationary expectations fell to 2.79% from 3.3% last quarter, sending the pair to the downside. The fall took the price below the 200-hour moving average of 0.8287, the 100-day moving average of 0.62776, and the 50% and 61.8% retracement of the move up from the April 26 low at 0.62475 and 0.62155. The low price reached down to 0.6181 before stalling and trading in a narrow range up to 0.6194. The 200-day moving average lose below at 0.6159. The price moved above that 200-day moving average back on April 28 near the same level.

NZDUSD breaks its way lower yesterday and today

- EURUSD: The EURUSD saw the price this week fall below the 100 bar moving average on the 4-hour chart, initially find support against the 200 bar moving average and a lower swing area (see green number circles), but then right below and use the consolidation area below near 1.0935 and resistance. The inability to move above the lower swing area in the “red box” below gave the sellers the go-ahead to push to the downside. The 38.2% retracement of the move up from the March low was broken at 1.08735. The next key target area comes against the 50% retracement level, the swing area between 1.0798 and 1.0805, and the rising 100-day moving average in the same area roughly around the 1.0800 level. Breaking outside of the red box put sellers in firm control in the short term at least.

EURUSD broke outside of Red Box

- GBPUSD: The GBPUSD made a new high going back to April 2022 this week at 1.26793. The high took out May 2022 high at 1.2665 in the process, but could not sustain the upside momentum. Buyers turned sellers. On Thursday, a swing area between 1.2536 and 1.2547 was broken, and held resistance on the corrective high price in trading on Friday. The 100 bar moving average on the 4 hour chart at 1.25227, and the 200 bar moving average on the same chart at 1.24701 was broken during training today with the pair stalling within a swing area between 1.2435 and 1.2445 (see red number circles). Stay below the 200 bar moving average of 1.24701 keeps the sellers and play and with short-term control in the new trading week.

GBPUSD falls below 200 bar MA on 4-hour chart

For the current week, the US dollar rose against all the major currencies. Looking at the greenbacks changes:

- EUR, up 1.53%

- GBP, up 1.46%

- JPY, up 0.68%

- CHF, up 0.85%

- CAD, up 1.366%

- AUD, up 1.644%

- NZD, up 1.657%

The biggest gain came against the AUD and the NZD on risk-off flows. Those currencies also move lower after weaker China data this week.

In the US stock market today the major indices all moved marginally lower with the NASDAQ index leading the way with a decline of -0.36%. The Dow industrial average was near and change but still cause lower for the 5th consecutive day this week and the 9th time in 10 trading days since the beginning of May. The Dow industrial average fell -0.03%. The S&P index fell -0.16%.

For the trading week, the Dow industrial average fell -1.11%, the S&P index fell -0.29% but the NASDAQ index squeaked out a small 0.4% gain.

In the US debt market today yields moved higher after the stronger inflation expectations data. Yields were modestly higher for the week:

- 2-year yield rose 8.5 basis points to 3.99%. For the week, the 2-year was up 7.4 basis points

- 5-year yield rose 8.9 basis points to 3.46%. For the week the 5-year yield was up 3.8 basis points

- 10-year yield rose 6.6 basis points to 3.462%. For the week, that 10-year was up 2.9 basis points

- 30-year yield rose 3.9 basis points to 3.782%. For the week, the 30-year was up 3.6 basis points

in other markets:

- Crude oil fell for the 4th consecutive week. For the day, the price fell $0.83 or -1.17% to $70.04. For the week, the price fell $1.30 or -1.82%

- Gold fell $4 today or -0.20% at $2110.90. For the trading week gold fell $-5.04 or -0.25%.

- Bitcoin is trading at $26,724 after reaching an intraday low of $25,800. The price is down $1748 this week currently or -6%.

Thanks for all the support. Hope you have a good weekend.