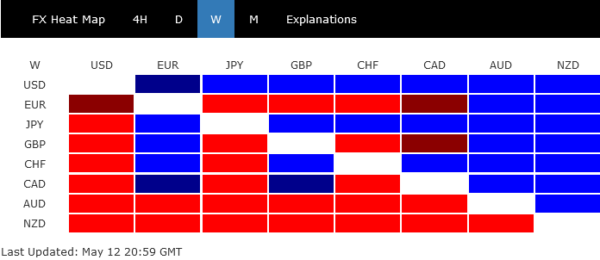

In the currency markets last week, Dollar, Yen, and Swiss franc Emerged as the standout performers. Conversely, New Zealand and Australian dollars lagged, painting a picture suggestive of risk aversion within the markets. However, this sentiment has not yet manifested itself in the stock markets, at least not with major American and European indices. It’s yet to be determined whether these developments in the currency markets are a precursor to trends in other sectors.

Euro and sterling also found themselves on the weaker side of the spectrum. Despite persistently hawkish comments from ECB officials, the common currency was relatively unmoved. The Pound maintained a cautious stance throughout most of the week until comments from BoE Governor concerning the possibility of a pause, following the anticipated 25-basis point rate hike, sent it into a tumble. Despite these fluctuations, the Canadian Dollar held its own, ending the week on a mixed note.

Dollar jumped sharply higher with multidimensional push

Dollar demonstrated a commanding rally as the week drew to a close, with Dollar Index finishing on a high note at 102.68. Some near-term bullish developments are notable in the greenback’s performance, including breaking of near-term resistance against Euro. This suggests the potential for further upside in Dollar, although this remains contingent on developments across multiple fronts.

The factors behind Dollar’s rally were seen as multi-dimensional by some analysts. Concerns about stagflation took center stage after last week’s data releases. At the same time, the market is also grappling with risk-off sentiment related to ongoing regional banking issues and debt ceiling. Moreover, there is growing apprehension regarding a weakening Chinese economy, with the risk of an increasing decoupling from the US and EU economies.

Domestically, on the one hand, initial jobless claims rose notably to 264k in the week ending May 6, a level not seen since October 2021. Additionally, University of Michigan consumer sentiment index fell sharply from 63.5 to 57.7 in May, hitting its lowest level since last November, falling far short of expectations.

On the other hand, University of Michigan five-year inflation expectations rose from 3.0% to 3.2%, marking a 12-year high since 2011. One-year inflation expectations just slightly decreased from 4.6% to 4.5%. Meanwhile, import prices increased by 0.4% mom in April, marking the first rise since December 2022.

These data suggest that while impact of prior tightening is beginning to be felt in the economy, Fed is far from being in a position to cut interest rates in the near future. There might even be a need for another rate hike.

From a technical standpoint, break of 55 D in Dollar Index is a near term bullish signal. Immediate focus is now on 102.80 resistance in the coming days. Decisive break there should confirm completion of the entire decline from 105.88 at 100.78, just ahead of 100.82 low. Further rise should then be seen back towards 105.88 resistance during the rest of the quarter.

However, even if this bullish scenario materializes, it’s too early to call for trend reversal in DXY. Current rise from 100.78 is more likely to be just the third leg of the pattern from 100.82. Strong resistance is expected from 38.2% retracement of 114.77 to 100.82 at 106.14, which should limit upside, at least on the first attempt.

Risk aversion lurks on the horizon, NASDAQ and 10-year yield look vulnerable

While risk aversion isn’t currently overt in US markets, the sharp rebound in the Dollar could be a potential precursor to an overall sentiment shift. Market movements in the coming days are thus expected to draw significant attention.

NASDAQ made slight gains last week, closing at 12284.74, but its momentum has been rather tepid. The pattern from 10088.82 appears more corrective than impulsive, suggesting that upside could be capped by 38.2% retracement of 16212.22 to 10088.82 at 12427.95. This level could mark the completion of the overall corrective rebound, or at the very least, trigger a pullback. A break below 11925.37 support level would confirm initial rejection by 12427.95 level and trigger a more significant downturn towards 10982.80 support.

Meanwhile, 10-year yield experienced a dip to 3.345, before promptly recovering to close at 3.463. The multiple rejections by 55 D EMA (now at 3.529) is a clear near term bearish sign. This suggests the fall from 4.333 is yet to reach its nadir. Deeper decline is in favor to 100% projection of 4.333 to 3.402 from 4.091 at 3.160. Judging from recent intermarket actions, mild decline in TNX might not be too much a drag on Dollar, but rather a lift to Yen.

However, in an unexpected case of a firm break of 3.160, and sustained trading below 55 W EMA (now at 3.279), TNX could accelerate to the downside through 3% handle. Such a scenario could signal significant turbulence in risk markets, warranting heightened caution.

China’s post-lockdown rebound stalled, SSE and CNH vulnerable

Recent data from China suggested that the post-lockdown rebound had been modest at best. April data showed unexpected sharp contraction of -7.9% yoy in imports. That could be a signal of lackluster domestic demand, which is reflected in the mere 0.1% yoy rise in CPI in the month. But placed alongside the latest contractionary reading in PMI manufacturing, that could be seen even worse as a result of global supply chain reshuffling.

China Shanghai SSE reversed after initial rally to 3418.95. Friday’s steep fall might be exaggerated by the cautious sentiment ahead of G7 finance minister meeting in Japan. But there is risk of developing into a more persistent near-term decline.

Immediate focus will be on 3229.4 support in SSE in the coming days. Decisive break there would suggest topping at 3418.95, ahead of 3424.83 resistance, on bearish divergence condition in D MACD. If materializes, that could also be mean firm break of 55 W EMA (now at 3252.39). Adding to that, the whole corrective pattern might have completed with three waves to 3418.95. Even in a less bearish scenario, deeper fall would then be likely back towards 2863.64 low.

USD/CNH resumed the rally from 0.6810 last week, partly on strength in Dollar and partly on weakness of Yuan. Prior support from 55 D EMA is a near term bullish sign. Further rise is expected as long as 0.6859 support holds, back to 6.9963.

It should be noted 6.9963 might be a big hurdle to overcome given the risk of intervention by China at 7.0000 psychological. But a firm break there would be a nod by the authority to let Yuan depreciation further. USD/CNH could then target cluster resistance at around 7.1 (100% projection of 6.6971 to 6.9963 from 6.8100 at 7.1092, 61.8% retracement of 7.3745 to 6.6971 at 7.1157).

AUD/USD and NZD/USD ready for down trend resumption?

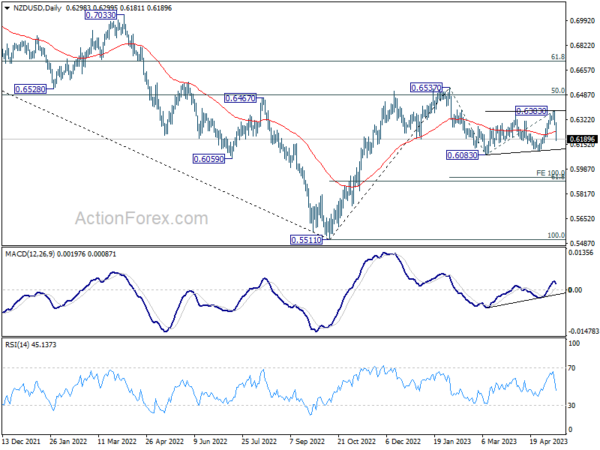

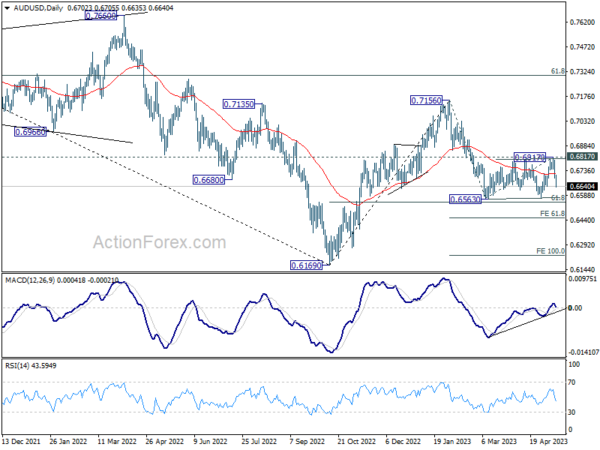

Both Australian and New Zealand Dollars emerged as the week’s biggest losers, each impacted to varying degrees by the increasingly pessimistic view on economy of China. Australian dollar was notably affected by plummeting copper price, which touched its lowest level for the year. Meanwhile, New Zealand dollar was burdened by declining consumer inflation expectations.

Notably, technical developments in AUD/USD and NZD/USD pairs showed some similarities. The steep decline in NZD/USD suggests that consolidation pattern from 0.6083 might have concluded with three waves to 0.6383. The near-term focus is now set on 0.6083 low. Decisive break from this level would confirm resumption of the whole downtrend from 0.6537. Next target will be 100% projection of 0.6537 to 0.6083 from 0.6383 at 0.5929, which is close to 61.8% retracement of 0.5511 to 0.6537 at 0.5903.

AUD/USD outlook is somewhat similar but carries a more negative tone. Consolidation from 0.6563 may have ended with three waves to 0.6817. Retest of 0.6563 support could be imminent. Decisive break of this level should drive AUD/USD to 61.8% projection of 0.7156 to 0.6563 from 0.6817 at 0.6451 at least.

EUR/USD Weekly Outlook

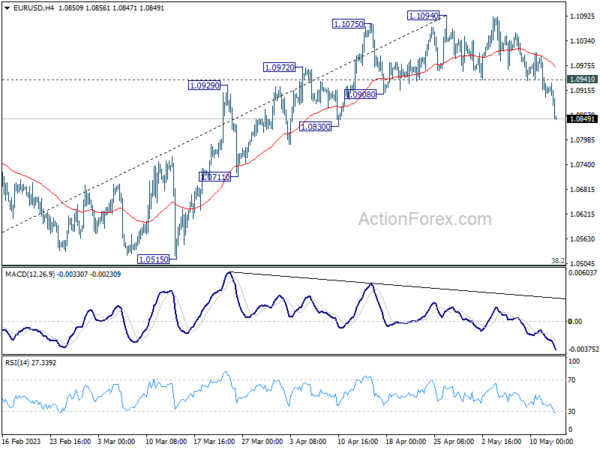

EUR/USD reversed after failing to break through 1.1094 resistance last week, and break of 1.0908 support confirmed short term topping. More importantly, considering bearish divergence condition in D MACD and break of 55 D EMA (now at 1.0880), it’s possibly in correction to whole up trend from 0.9534 already. Initial bias stays on the downside this week for 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498. On the upside, though, above 1.0941 resistance will turn bias back to the upside for retesting 1.1094 high.

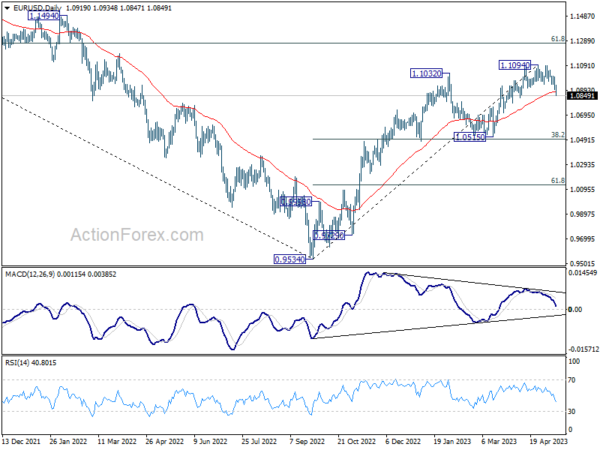

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

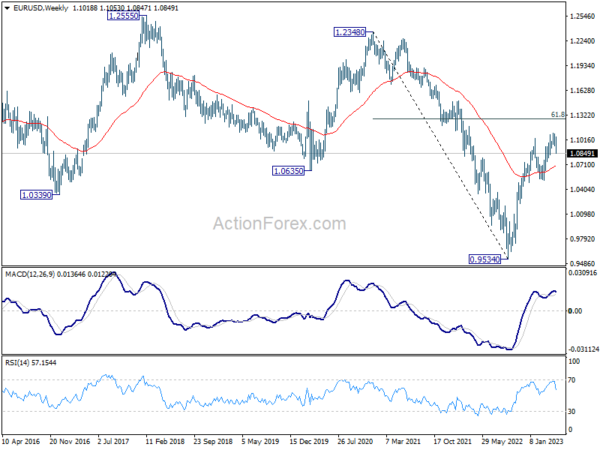

In the long term picture, while it’s still early to call for long term trend reversal at this point, the strong break of 1.0635 support turned resistance (2020 low) should at least turn outlook neutral. Focus is now on 55 M EMA (now at 1.1156). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be an indication underlying bullishness and target 1.2348 resistance next.