- AUD/USD bears are in the money but bulls are lurking from daily support.

- A move back to challenge channel resistance could be on the cards for the initial balance at the start of the week.

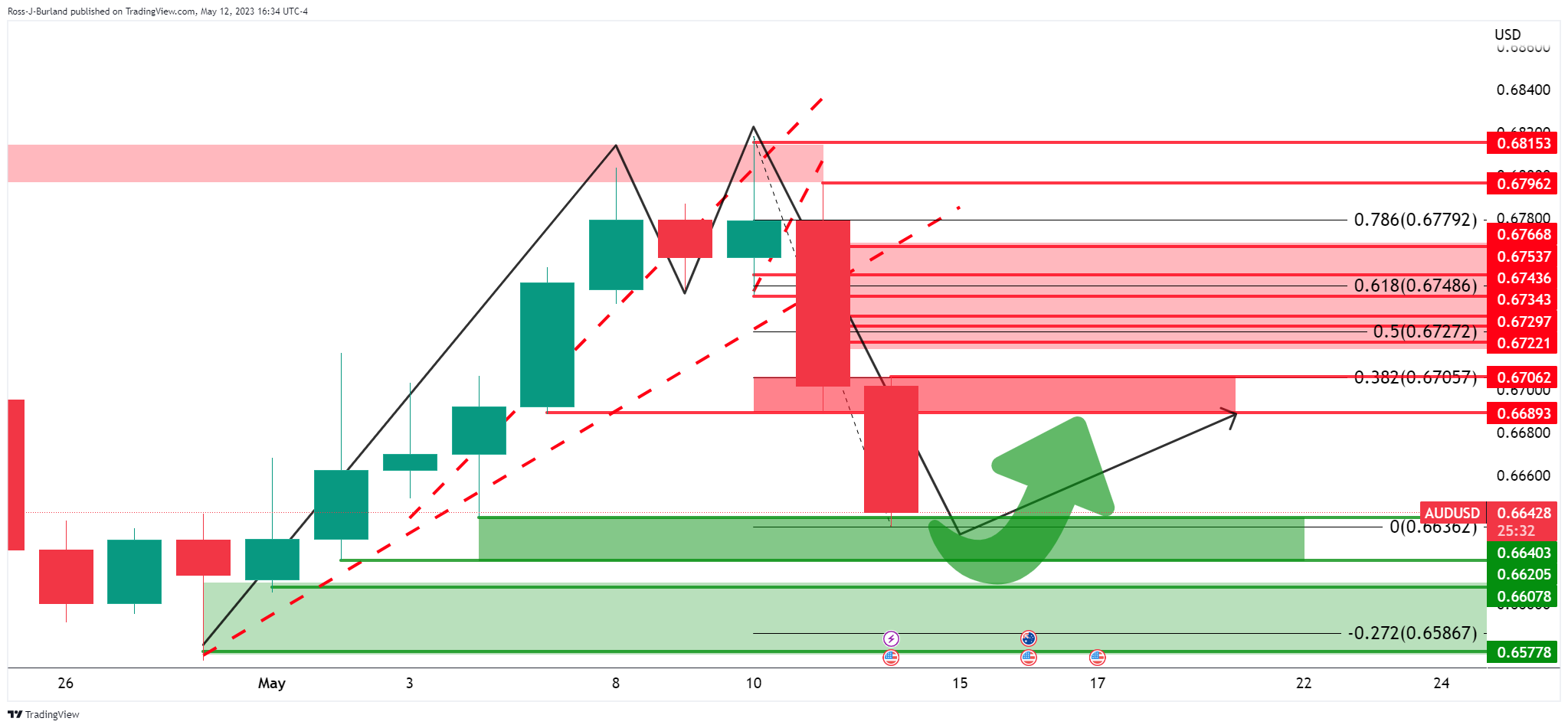

AUD/USD could be on the verge of moving back inside of the sell-off range. The M-formation is a reversion pattern and a deceleration of the sell-off would be expected as the market moves in on support. The following illustrates this on the daily charts and also looks at the prospects on the hourly chart for the open next week.

AUD/USD daily charts

Zooming in, we have the 0.6640s and 0.6620s and space in between that is highlighted as the first support zone. There could be a correction from this point. However, as per the hourly chart, there are prospects of a downside continuation:

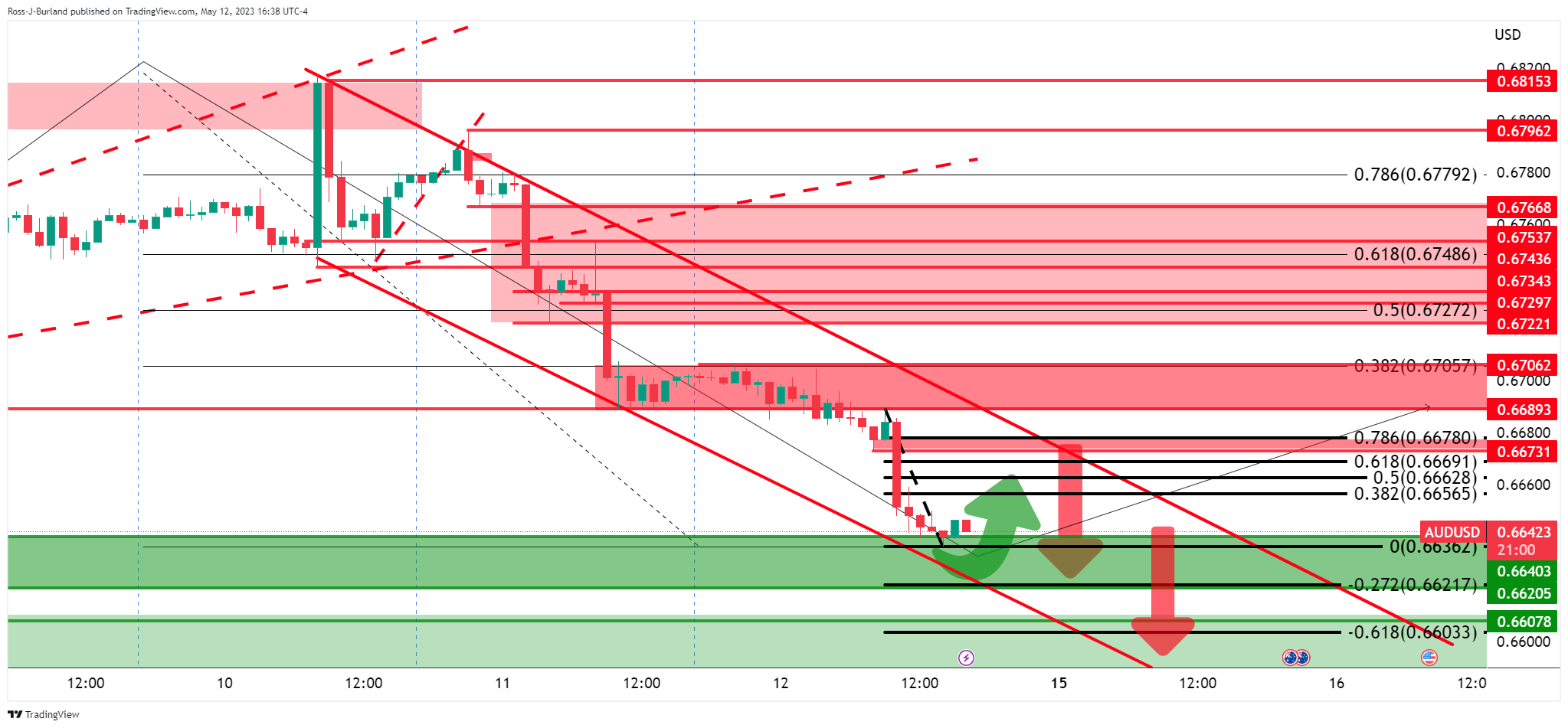

AUD/USD H1 chart

The bias is bearish while inside of the bearish channel. However, the bulls seem to be moving in from support which could be a theme for the open. There are prospects of a move into the trendline resistance prior to the next bear continuation for the forthcoming initial balance next week. To the contrary, a move above 0.6670 and outside of teh channel would put the bias in favour of the bulls.