Dollar and Yen are striking back on mild risk-off sentiment while Commodity currencies are paring some gains too. Eyes will be on the meeting between US President Joe Biden and Republican House Speaker Kevin McCarthy on debt ceiling. A final agreement on raising the debt limit is not expected today, but any rhetorics will be closely scrutinized, especially by American stocks and bonds investors.

Euro continues to be under broad based pressure today, shrugging off hawkish comments from ECB policymakers. Though, for now, Swiss Franc is slightly worse. Sterling is regaining some ground, with weak momentum, with traders largely holding their bets ahead of BoE rate decision and economic projections later this week.

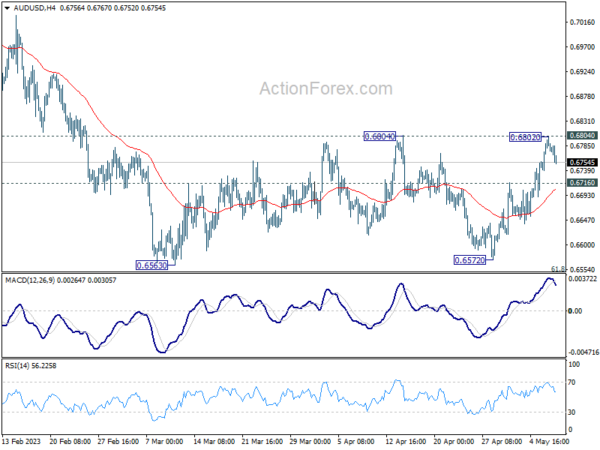

Technically, AUD/USD retreats just ahead of 0.6804 resistance. Break of 0.6716 support will turn near term bias back to the downside back towards 0.6563 low. Meanwhile, USD/CAD also recovers ahead of 1.3299 support. Reversal in risk sentiment could list USD/CAD back towards 1.3668 resistance.

In Europe, at the time of writing, FTSE is down -0.44%. DAX is down -0.38%. CAC is down -0.97%. Germany 10-year yield is down -0.0074 at 2.322. Earlier in Asia, Nikkei rose 1.01%. Hong Kong HSI dropped -2.12%. China Shanghai SSE dropped -1.10%. Singapore Strait Times dropped -0.45%. Japan 10-year JGB yield rose 0.0121 to 0.425.

ECB Kazaks asserts need for further rate hikes

In face of high inflation, ECB Governing Council member Martins Kazaks has voiced his belief that further interest rate hikes will be necessary to contain it. His remarks counter market expectations for borrowing costs to be cut as early as next spring, a notion Kazaks has described as “significantly premature.”

He outlined a dual strategy to bring the current inflation rate of 7% back to ECB’s target of 2%. “The first is raising the rates and of course we don’t know where the terminal rate is,” he commented. “Another thing is keeping those rates at elevated and sufficiently restrictive levels.”

Despite concerns about potential economic risks from higher interest rates, Kazaks emphasized that the risk of doing too little to counter inflation was far greater than the risk of over-tightening. “Persistently high inflation is a bigger problem for society than a relatively short and shallow recession,” he warned.

Underlining the importance of effective policy response, Kazaks cautioned, “Failing to contain inflation would be a failure because then the policy response in the second go would then need to be much tighter.”

ECB Kazimir: We will have to keep raising interest rates for longer than anticipated

ECB might need to keep raising interest rates for longer than initially anticipated, according to Governing Council member Peter Kazimir. His comments indicate an evolving stance within ECB as it grapples with stubbornly high inflation in the Eurozone.

“Based on today’s data, we will have to keep raising interest rates for longer than anticipated,” Kazimir stated. He suggested a slower pace of rate hikes, at 25 basis points increments, as a measured approach that allows for longer-term adjustments, should incoming data warrant it. “So, slowing down the pace to 25 bps is a step that will allow us to go gradually higher for longer, should that be necessary and warranted by incoming data,” he explained.

Kazimir pointed to core inflation trends, rising wage pressures, and high-profit margins as factors necessitating vigilance and the continued pursuit of ECB’s current monetary policy trajectory. “The development of core inflation, the continued buildup of wage pressures, and high-profit margins call for vigilance and reconfirm the need to continue on our path,” he said.

However, the true effectiveness of ECB’s measures and the trajectory of inflation towards the target will not be fully assessed until the September forecast. “Our September forecast will be the earliest date to answer how effective our measures are and whether inflation is moving towards the target,” Kazimir added.

BoJ Ueda sees position signs in trend inflation

BoJ Governor Kazuo Ueda pointed to encouraging signs in trend inflation during a recent parliamentary session. “We’re seeing some positive signs in trend inflation, including inflation expectations,” Ueda said. He added that once the BOJ could foresee inflation stably and sustainably meeting their 2% target, they would “abandon yield curve control and then move towards shrinking the bank’s balance sheet.”

Ueda also spoke about the upcoming monetary policy review, stating it would critically examine the benefits and side effects of past monetary policies. The review process will include workshops with private academics. However, the governor clarified that the central bank did not have any preconceived notions about how the review could influence future monetary policy decisions.

“We will take necessary policy steps at each of our rate reviews, with an eye on financial and price developments, even while we conduct the review,” Ueda stated.

Australia sees second consecutive quarter of falling retail sales volume amidst rising living costs

Australia’s retail sales volume declined by -0.6% qoq to AUD 96.17 billion in Q1 2023. Through the year, sales volume only managed to register a modest 0.3% yoy growth in the quarter.

ABS’s head of retail statistics, Ben Dorber, noted that this marked the second consecutive quarter of falling retail sales volumes, primarily influenced by mounting cost of living pressures that continue to burden household spending.

“Outside of the COVID-19 pandemic period, this is the largest fall in retail sales volumes since the September quarter of 2009,” Dorber stated, underlining the gravity of the situation.

Meanwhile, retail prices growth has slowed to 0.6% qoq in Q1. “Retail prices rose for the sixth straight quarter, but price growth this quarter is the smallest since September 2021,” Dorber added.

He attributed the slowdown in price growth mainly to discounts on clothing and larger household items such as furniture and electronic goods. However, he noted that food retailing prices continued their upward trajectory.

China exports rose 8.5% yoy in Apr, exports to Russia surged 153% yoy

China’s April exports outperformed expectations, growing by 8.5% yoy to reach USD 295.4B. This marked the second consecutive month of growth, exceeding anticipated 8.0% yoy. However, imports dropped by -7.9% yoy to USD 205.2B, falling short of expected 0.0% yoy. As a result, trade surplus widened from USD 88.2B to USD 90.2B, significantly surpassing the forecasted USD 69.0B.

Breaking down the numbers, exports to EU experienced a modest growth of 3.7% yoy, while imports from the bloc saw a slight decrease of -0.12% yoy. Trade with the US reflected a downturn, with exports dropping by -6.5% yoy and imports declining by -3.1% yoy.

Trade relations with ASEAN region were mixed, with exports increasing by 4.49% yoy, while imports fell by -6.25% yoy. Meanwhile, trade with Russia exhibited a significant surge. Chinese exports to Russia skyrocketed by a staggering 153.09% yoy, and imports also rose, though at a more modest rate of 8.06% yoy.

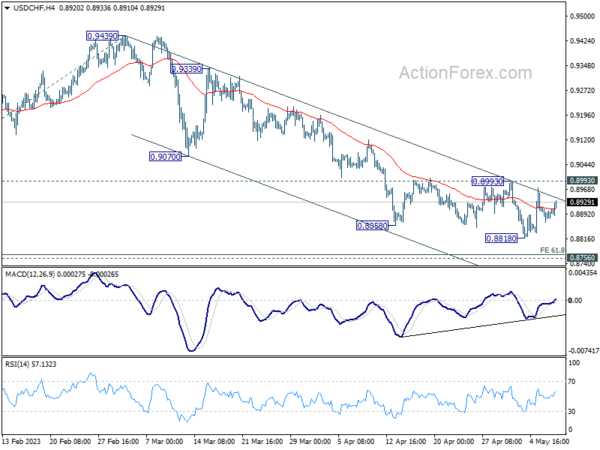

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8871; (P) 0.8892; (R1) 0.8915; More…

Range trading continues in USD/CHF and intraday bias remains neutral first. While down trend from 1.0146 could still extend lower, strong support should be seen from 61.8% projection of 1.0146 to 0.9058 from 0.9439 at 0.8767, which is close to 0.8756 long term support, to bring rebound, at least on first attempt. On the upside, break of 0.8993 resistance will indicate short term bottoming, on bullish convergence condition in 4H MACD, and turn bias back to the upside for stronger rebound.

In the bigger picture, fall from 1.1046 (2022 high) is seen as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal. Sustained break of 0.9058 support turned resistance will be the first sign of medium term bottoming. However, decisive break of 0.8756 will carry larger bearish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Mar | 0.80% | 1.00% | 1.10% | |

| 23:30 | JPY | Overall Household Spending Y/Y Mar | -1.90% | 0.40% | 1.60% | |

| 03:00 | CNY | Trade Balance (USD) Apr | 90.2B | 69.0B | 88.2B | |

| 06:45 | EUR | France Trade Balance (EUR) Mar | -8.0B | -9.5B | -9.9B | -9.3B |

| 10:00 | USD | NFIB Business Optimism Index Apr | 89.0 | 89.6 | 90.1 |