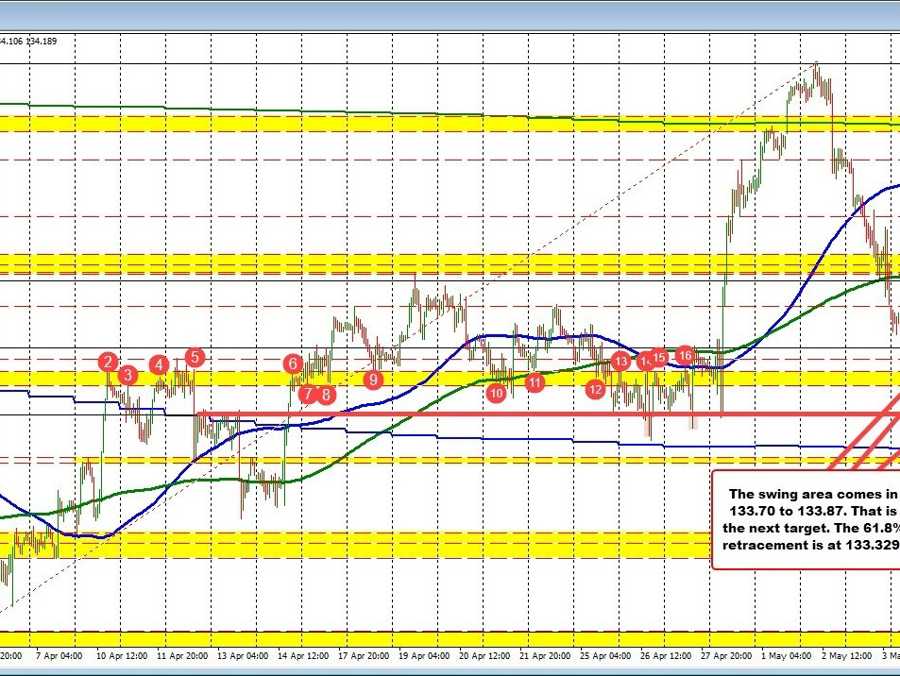

The USDJPY is moving to a new session low and in the process is moving away from the 50% midpoint of the move up from the April low to the May high reached earlier this week.

The midpoint level comes in at 134.177. The current price trades at 134.00 . The next target comes between 133.70 and 133.873 (see red numbered circles on the chart above). Below that the 61.8% retracement at 133.329 would be targeted (see chart below).

USDJPY falls below the 50% midpoint of the April – May range

US rates are lower in the short end with the two-year down -14 basis points at 3.796%. The 10 year yield is now down -8.4 basis points to 3.316%.

The January 2024 Fed funds contract implies a rate of 3.25% now. That is a full 100 basis points below the top range of the current fed funds target.

KRE ETF is down -9.22%

Regional banks are looking in trouble:

Regional banks under pressure