Euro dips initially after ECB stepped down tightening pace with a 25bps rate hike today. But it then quickly recovers after ECB President Christine Lagarde firmly said in the press conference, “We are not pausing. That’s very clear… We know we have more ground to cover.” Overall though, Euro is on the weaker side today, just performing slightly better than Swiss France. New Zealand and Canadian Dollar are the better performances together with Sterling. Dollar and Yen are mixed for now. With ECB risk cleared, focuses will turn to tomorrow’s US non-farm payrolls.

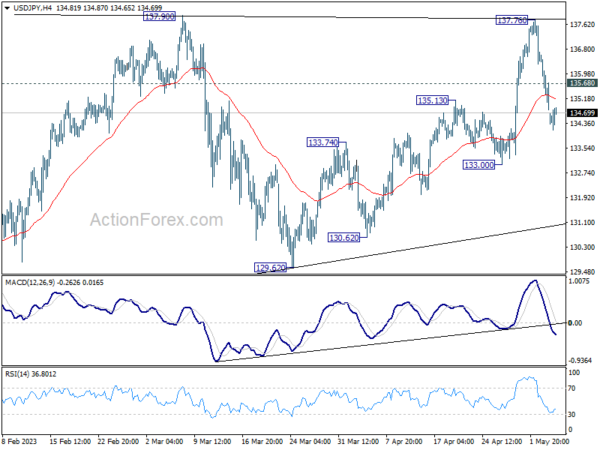

Technically, USD/JPY would be worth a watch in the time leading up to NFP tomorrow. For now, 137.76 should be a short term top and fall from there is in favor to extend lower as long as 135.68 minor resistance holds. Renewed decline in US treasury yields and stocks could prompt deeper fall in the pair through 133.00 support. That would be a sign of investor positioning ahead of the last key event of the week.

In Europe, at the time of writing, FTSE is down -0.76%. DAX is down -0.62%. CAC is down -0.96%. Germany 10-year yield is up 0.0254 at 2.277. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 0.82%. Singapore Strait Times rose 0.22%.

US initial jobless claims jumped to 242k

US initial claims rose 13k to 242k in the week ending April 29, higher than expectation of 235k. Four-week moving average of continuing claims rose 3.5k to 239k.

Continuing claims dropped -38k to 1805k in the week ending April 22. Four-week moving average of continuing claims dropped -4.5k to 1828k.

ECB hikes 25bps, reiterates data-dependent approach

ECB raised its three key interest rates by 25bps today, with main refinancing rate, marginal lending rate, and deposit rate becoming 3.75%, 4.00%, and 3.25%, respectively, effective May 10.

In the accompanying statement, ECB explained that incoming information broadly supports the assessment of the medium-term inflation outlook that the Governing Council formed at its previous meeting.” While headline inflation has declined recently, the ECB noted that “underlying price pressures remain strong.”

The central bank acknowledged that the transmission of past rate increases to euro area financing and monetary conditions has been forceful, but added that “the lags and strength of transmission to the real economy remain uncertain.”

ECB emphasized its commitment to ensuring that policy rates are “sufficiently restrictive” to achieve a timely return of inflation to the 2% medium-term target, stating that rates will be kept at these levels “for as long as necessary”.

The Governing Council will continue to follow a data-dependent approach, basing its policy rate decisions on assessments of inflation outlook in light of incoming economic and financial data, underlying inflation dynamics, and strength of monetary policy transmission.

Eurozone PPI at -1.6%mom, 5.9% yoy in Mar

Eurozone PPI came in at -1.6% mom, 5.9% yoy in March, versus expectation of -1.4% mom, 5.9% yoy. For the month, industrial producer prices decreased by -4.8% in energy sector and by -0.4% for intermediate goods, while prices increased by 0.2% for capital goods, by 0.3% for durable consumer goods and by 0.9% for non-durable consumer goods. Prices in total industry excluding energy increased by 0.2%.

EU PPI came in at -1.5% mom, 7.0% yoy. The largest monthly decreases in industrial producer prices were recorded in Greece (-7.3%), Ireland (-4.6%) and Lithuania (-4.0%), while the highest increases were observed in Cyprus (+2.4%), France (+2.0%) and Croatia (+0.5%).

Eurozone PMI services finalized at 12-month High, growth to continue in months ahead

Eurozone PMI Services were finalized at 56.2 in April, up from March’s 55.0, marking a 12-month high. PMI Composite was finalized at 54.1, up from March’s 53.7, an 11-month high.

Among member states, Italy’s PMI composite rose to 55.3, a 17-month high, while Germany’s increased to 54.2, a 12-month high. Ireland rose to 53.5, a 2-month high. However, Spain dropped to a 2-month low of 56.2, and France fell to a 2-month low of 52.4.

HCOB noted that the service sector is robust across Eurozone, with companies able to pass on at least some inflation in intermediate inputs to customers. Service firms’ confidence was reflected in the solid index reading for business expectations and increased staffing levels compared to the previous month.

However, HCOB also highlighted that Eurozone order backlog grew at a weaker pace, nearly stagnating in Germany and falling slightly in Italy. Despite this, all PMI indicators suggest that growth in the Eurozone services sector will continue in the months ahead.

UK PMI services finalized at 55.9, reignited inflationary pressures

UK PMI Services were finalized at 55.9 in April, marking a significant increase from March’s 52.9 and the highest reading since April 2022. S&P Global highlighted that demand conditions continued to improve, with higher salary payments contributing to steeper cost inflation. PMI Composite was finalized at 54.9, up from March’s 52.2.

Tim Moore, Economics Director at S&P Global Market Intelligence, stated, “A strong rate of service sector growth meant that the UK economy started the second quarter of 2023 in positive fashion. Overall private sector output expanded at the fastest pace for one year, despite another fall in manufacturing production during April.”

Moore added that service providers experienced the steepest upturn in new work for 13 months, as resilient consumer spending combined with a turnaround in demand for business services to boost overall order books. However, he also noted that the swift rebound in customer demand appears to have reignited inflationary pressures, with around 34% of the survey panel reporting a rise in their prices charged in April, roughly three times higher than the pre-pandemic average.

China Caixin PMI manufacturing contracts in Apr, demand softens and prices plunge

China’s Caixin PMI Manufacturing dropped to 49.5 in April, down from 50.0 and below the expected 50.8, marking the first contraction reading in three months. According to Caixin, output expanded only marginally due to softening demand conditions. Input costs and selling prices fell at the quickest pace in over seven years.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In a nutshell, manufacturing activity weakened in April. Manufacturing supply saw a marginal slowdown of expansion, demand dipped month-on-month, the labor market worsened further, logistics was relatively smooth, inventories remained stable, and prices plunged. Despite all these factors, businesses maintained high confidence in the economic outlook.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1010; (P) 1.1051; (R1) 1.1103; More…

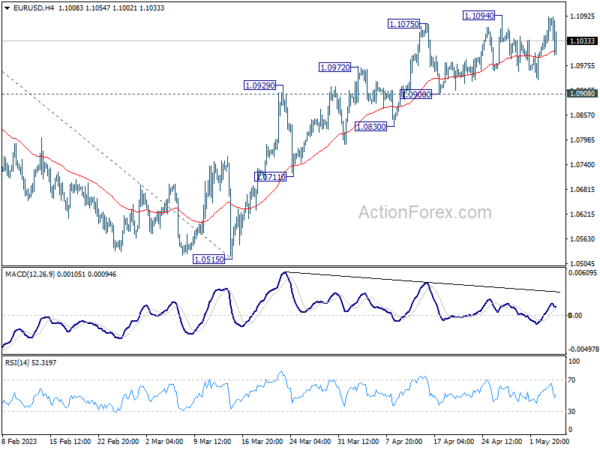

Intraday bias in EUR/USD remains neutral as it retreated ahead of 1.1094 resistance but stays well above 1.0908 support. Further rally remains in favor for now. On the upside, firm break of 1.1094 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441 However, considering bearish divergence condition in 4H MACD, break of 1.0908 support will indicate short term topping and turn bias back to the downside.

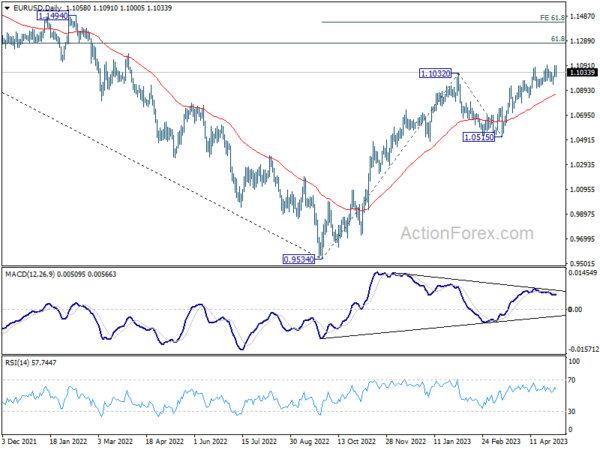

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | 7.00% | -9.00% | -9.40% | |

| 01:30 | AUD | Trade Balance (AUD) Mar | 15.27B | 13.00B | 13.87B | |

| 01:45 | CNY | Caixin Manufacturing PMI Apr | 49.5 | 50.8 | 50 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Mar | 16.7B | 17.1B | 16.0B | |

| 07:45 | EUR | Italy Services PMI Apr | 57.6 | 56 | 55.7 | |

| 07:50 | EUR | France Services PMI Apr F | 54.6 | 56.3 | 56.3 | |

| 07:55 | EUR | Germany Services PMI Apr F | 56 | 55.7 | 55.7 | |

| 08:00 | EUR | Eurozone Services PMI Apr F | 56.2 | 56.6 | 56.6 | |

| 08:30 | GBP | Services PMI Apr F | 55.9 | 54.9 | 54.9 | |

| 08:30 | GBP | Mortgage Approvals Mar | 52K | 46K | 44K | |

| 08:30 | GBP | M4 Money Supply M/M Mar | -0.60% | 0.10% | -0.40% | -0.30% |

| 09:00 | EUR | Eurozone PPI M/M Mar | -1.60% | -1.40% | -0.50% | -0.40% |

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 5.90% | 5.90% | 13.20% | 13.30% |

| 12:15 | EUR | ECB Main Refinancing Rate | 3.75% | 3.75% | 3.50% | |

| 12:30 | CAD | Trade Balance (CAD) Mar | 1.0B | 1.0B | 0.4B | |

| 12:30 | USD | Initial Jobless Claims (Apr 28) | 242K | 235K | 230K | |

| 12:30 | USD | Trade Balance (USD) Mar | -64.2B | -68.9B | -70.5B | |

| 12:30 | USD | Nonfarm Productivity Q1 P | -2.70% | -0.70% | 1.70% | |

| 12:30 | USD | Unit Labor Costs Q1 P | 6.30% | 8.40% | 3.20% | |

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | CAD | Ivey PMI Apr | 59 | 58.2 | ||

| 14:30 | USD | Natural Gas Storage | 51B | 79B |