Australian Dollar surges after RBA surprised the markets by resuming rate hike today. In addition, tightening bias is maintained even though the tone is softened. New Zealand and Canadian Dollars trail closely, boosted by a slightly positive risk sentiment. On the other hand, Japanese Yen continues to be the runaway loser in the market. Dollar is reversing some of this week’s gains. European majors are mixed, with Sterling on the weaker side than Euro and Swiss Franc.

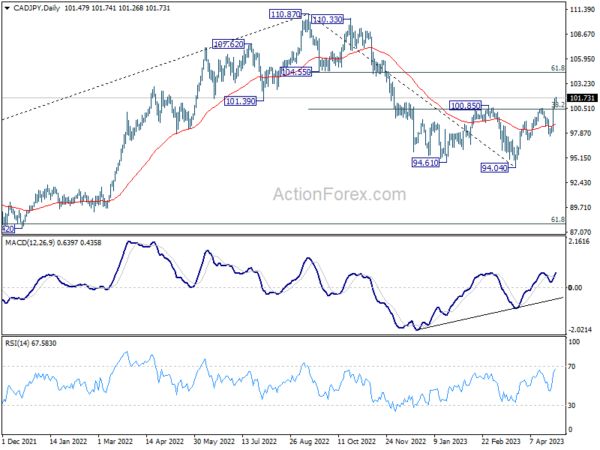

In terms of technical developments, Yen’s performance will likely remain a focal point in the markets. CAD/JPY’s break of 100.85 resistance suggests that the entire decline from 110.87 has concluded at 94.04, potentially leading to further rallies up to the 61.8% retracement of 110.87 to 94.04 at 110.62. A firm break above this level could prompt a retest of 110.87 high. Depending on the overall Yen selloff elsewhere, there is possibility of breaking through 110.87 as CAD/JPY aligns with the broader outlook of other Yen crosses.

In Asia, at the time of writing, Nikkei is up 0.24%. Hong Kong HSI is up 0.09%. China Shanghai SSE is up 1.14%. Singapore Strait Times is up 0.37%. Japan 10-year JGB yield is up 0.0202 at 0.423. Overnight DOW dropped -0.14%. S&P 500 dropped -0.04%. NASDAQ dropped -0.11%. 10-year yield rose 0.122 to 3.574.

RBA defies expectations with rate hike, may still require further tightening

In a surprising move, RBA raises cash rate target by 25bps to 3.85%, contrary to market expectations of a hold. Nevertheless, RBA softened its tightening bias, stating, “some further tightening of monetary policy may be required,” depending on “how the economy and inflation evolve.”

Despite acknowledging that Australian inflation “has passed its peak” and “recent data showed a welcome decline,” the central bank still expects inflation to be at 4.25%, slowing to 3% in mid-2025. That is, “it takes a couple of years before inflation returns to the top of the target range”. RBA added that services price inflation remains “still very high and broadly based” with upside risks, while goods inflation is decelerating.

RBA projects the economy to grow by 1.25% in 2023 and around 2% over the year to mid-2025. With anticipated below-trend economic growth, unemployment rate is forecast to gradually increase to around 4.5% in mid-2025.

RBNZ Hawkesby: Not currently seeing widespread financial distress amongst households or businesses

According to RBNZ Financial Stability Report, debt servicing costs for households with mortgages are expected to more than double by the end of the year. Despite this, household balance sheets remain resilient, with most having substantial equity buffers. Early-stage arrears have increased but remain low compared to post-Global Financial Crisis levels. Banks’ strong capital positions allow them to support customers, and borrowers facing stress are encouraged to seek assistance from their banks.

“We are not currently seeing widespread financial distress amongst households or businesses, which reflects the strength in the economy and labour market to date. However, more borrowers may fall behind on their payments this year, given the ongoing repricing of mortgages and expected weakening in the labour market,”Deputy Governor Christian Hawkesby says.

“Recent profitability and strong capital positions puts banks in a good position to take a long-term view and support their customers. We encourage borrowers encountering stress to talk to their banks, as hardship programmes may be available, and some customers may be able to temporarily switch to interest-only payments or increase the remaining term of their loan.”

IMF raises 2023 Asia growth forecasts on strong emerging markets

IMF raised its 2023 growth forecast for Asia by 0.3% to 4.6%, outpacing the 3.8% growth rate in 2022. For 2024, the growth projection has been slightly downgraded by -0.2% to 4.4%.

The growth forecast for advanced economies in the region was downgraded by -0.4% to 1.6% in 2023 and by -0.2% to 1.7% in 2024. Meanwhile, emerging markets and developing economies experienced an upgraded growth forecast of 0.3% to 5.3% in 2023, although their 2024 projections were downgraded by -0.1% to 5.1%.

IMF highlighted that “Asia’s domestic demand has so far remained strong despite monetary tightening, while external appetite for technology products and other exports is weakening”.

However, the organization warned that “Global growth is poised to decelerate as rising interest rates and Russia’s war in Ukraine weigh on activity. Inflation remains stubbornly high, and banking strains in the United States and Europe have injected greater uncertainty into an already complex economic landscape.”

Looking ahead

Germany retail sales, Swiss SEO consumer climate and PMI manufacturing; Eurozone PMI manufacturing final and CPI flash, and UK PMI manufacturing final will be released in European session. Later in the day, US will publish factory orders.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6603; (P) 0.6635; (R1) 0.0.6663; More…

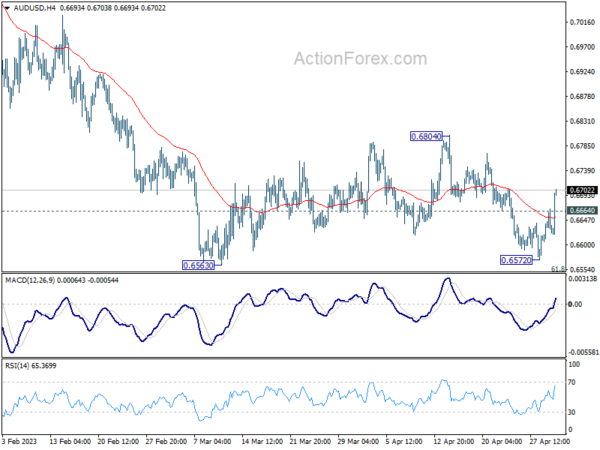

AUD/USD’s extended rebound and break of 0.6664 minor resistance suggests that fall from 0.6804 has completed ahead of 0.6563 low. Intraday bias is back on the upside for stronger rise. Still, outlook remains bearish as long as 0.6804 resistance holds, and down trend resumption through 0.6563 low is in favor at a later stage. Nevertheless, sustained break of 0.6804 should indicate completion of whole fall from 0.7156, and turn near term outlook bullish for retesting this high instead.

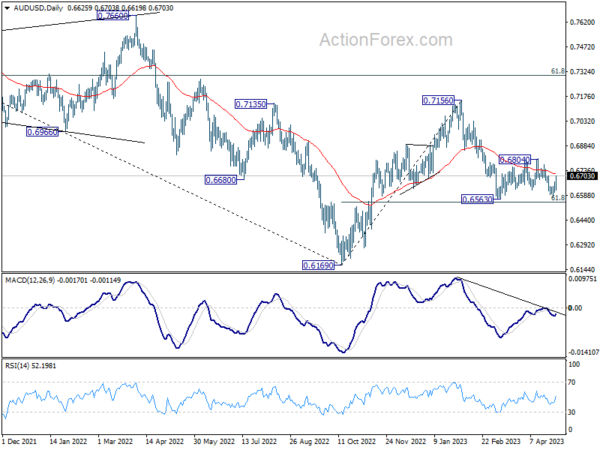

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Apr | -1.70% | -1.50% | -1.00% | |

| 04:30 | AUD | RBA Interest Rate Decision | 3.85% | 3.60% | 3.60% | |

| 06:00 | EUR | Germany Retail Sales M/M Mar | 0.40% | -1.30% | ||

| 07:00 | CHF | SECO Consumer Climate Q2 | -22 | -30 | ||

| 07:30 | CHF | Manufacturing PMI Apr | 50 | 47 | ||

| 07:45 | EUR | Italy Manufacturing PMI Apr | 49 | 51.1 | ||

| 07:50 | EUR | France Manufacturing PMI Apr F | 45.5 | 45.5 | ||

| 07:55 | EUR | Germany Manufacturing PMI Apr F | 44 | 44 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Apr F | 45.5 | 45.5 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Mar | 3.10% | 2.90% | ||

| 08:30 | GBP | Manufacturing PMI Apr F | 46.6 | 46.6 | ||

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 6.90% | 6.90% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Apr P | 5.70% | 5.70% | ||

| 14:00 | USD | Factory Orders M/M Mar | 0.80% | -0.70% |

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading