The markets have been somewhat directionless this week, with most major currencies remaining within last week’s trading ranges against one another, excluding a few Yen pairs. US stock indexes are consolidating in tight ranges with minor pullbacks, while the 10-year yield struggles below a short-term resistance level. Gold prices are recovering weakly, and oil prices are slightly retreating from last week’s highs.

Today’s UK CPI data will be a key market focus. Sterling gained ground yesterday due to robust job data and strong wage growth, but buying pressure has not followed through. In a recent Reuters poll, 33 out of 61 economists predicted a 25 bps BoE rate hike to 4.50% at the May 11 meeting, while 28 expected rates to remain unchanged. The decision will depend on clear evidence of slowing inflation. Today’s crucial data includes the expected drop in CPI from 10.4% yoy to 9.8% yoy in March and a decline in core CPI from 6.2% to 6.0% yoy.

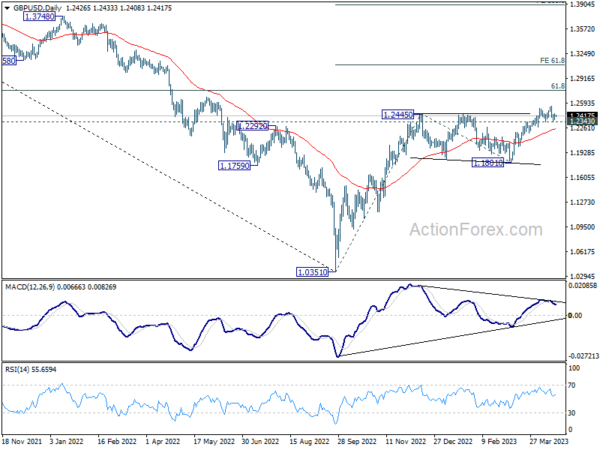

Technically, GBP/USD is visibly losing upside momentum as observed in D MACD. A downside surprise in today’s UK CPI could trigger a selloff below 1.2343, potentially prompting a deeper pullback to the 55 D EMA (now at 1.2243). On the other hand, a bounce from the current level could pave the way for a break through 1.2545 resistance, resuming the overall uptrend from 1.0351.

In Asia, at the time of writing, Nikkei is down -0.37%. Hong Kong HSI is down -0.49%. China Shanghai SSE is down -0.21%. Singapore Strait Times is up 0.17%. Japan 10-year JGB yield is down -0.0001 at 0.476. Overnight, DOW dropped -0.03%. S&P 500 rose 0.09%. NASDAQ dropped -0.04%. 10-year yield dropped -0.019 to 3.572.

ECB Lane signals another hike in May, emphasizes data dependence

ECB Chief Economist Philip Lane has indicated in a Bloomberg TV interview that another rate hike in May is appropriate, given the current economic landscape. He stated, “As of now, two weeks away, I think the baseline is that we should increase interest rates in May but what we do in terms of scale, I’m not going to set a default number.”

However, Lane emphasized the importance of waiting for more data before making a final decision. He highlighted the central bank’s reliance on data, saying, “We are now in an intense phase of data dependence. I’m very much in wait-and-see mode.”

He also discussed the ECB’s deposit rate, which is currently at 3%, and suggested that it would likely remain at its peak for a prolonged period if inflation returns to 2% and the eurozone avoids a recession, as officials predict. “It would be appropriate to keep rates at the plateau level for a while before returning back to normal,” Lane added.

Australia’s Westpac Leading Index signals below-trend growth, RBA expected to hike rates in May

Australia Westpac-Melbourne Institute Leading Index rose slightly from -0.79% to -0.75% in March, marking the eighth consecutive negative reading. This indicates below-trend growth throughout 2023. Westpac forecasts a modest 1% growth for Australia in 2023, while IMF recently revised its growth forecast for the country from 1.9% to 1.6%. RBA also predicts just 1.6% growth in 2023.

Westpac anticipates a further 25bps increase in the cash rate to 3.85% at RBA’s May 2 meeting. The April RBA minutes revealed additional concerns about the inflation outlook, including rising demand due to increased immigration, pressures in the housing market, and risks associated with growing wage growth, particularly in the public sector. The March quarter inflation report, scheduled for release on April 26, will be a crucial data point for the central bank’s decision-making process.

Looking ahead

UK CPI is the major focus in European session while RPI and PPI will also be released. Eurozone will also publish March CPI final. Later in the day, Canada will release housing starts, IPPI and RMPI. Fed will publish Beige Book economic report.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 166.20; (P) 166.60; (R1) 167.04; More…

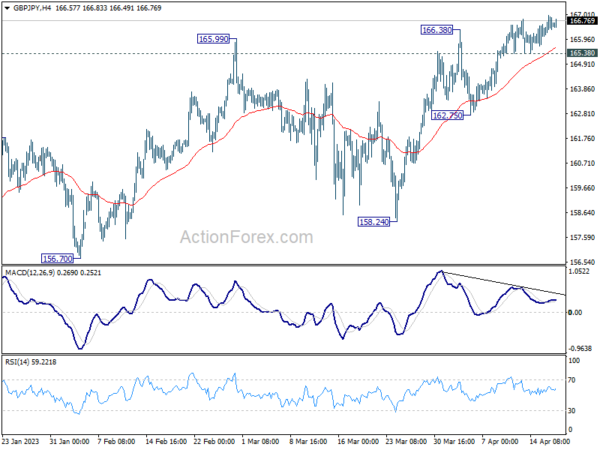

Intraday bias in GBP/JPY remains on the upside for the moment. Current rally is part of the whole rise from 155.33. Next target is 169.26 resistance first. However, considering bearish divergence condition 4 H MACD. Break of 165.38 minor support will argue that a short term top was already formed. Intraday bias will be turned back to the downside for 162.75 support instead.

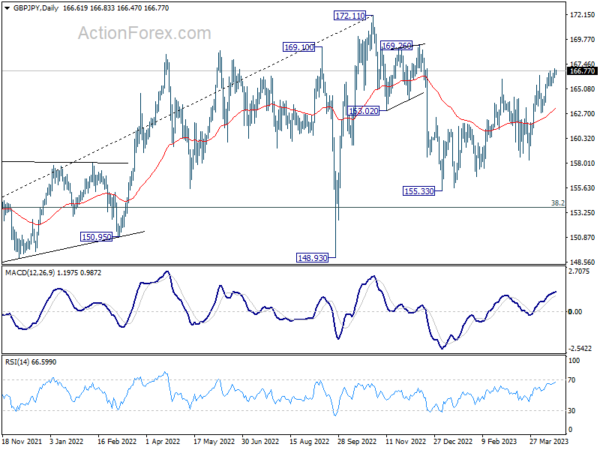

In the bigger picture, as long as 38.2% retracement of 123.94 (2020 low) to 172.11 (2022 high) at 153.70 holds, medium term bullishness is retained. That is, larger up trend from 123.94 (2020 low) is still in progress. Break of 172.11 high to resume such up trend is expected at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Mar | 0.00% | -0.06% | ||

| 04:30 | JPY | Industrial Production M/M Feb F | 4.50% | 4.50% | ||

| 06:00 | GBP | CPI M/M Mar | 0.50% | 1.10% | ||

| 06:00 | GBP | CPI Y/Y Mar | 9.80% | 10.40% | ||

| 06:00 | GBP | Core CPI Y/Y Mar | 6.00% | 6.20% | ||

| 06:00 | GBP | RPI M/M Mar | 0.60% | 1.20% | ||

| 06:00 | GBP | RPI Y/Y Mar | 13.30% | 13.80% | ||

| 06:00 | GBP | PPI Input M/M Mar | -0.40% | -0.10% | ||

| 06:00 | GBP | PPI Input Y/Y Mar | 9.80% | 12.70% | ||

| 06:00 | GBP | PPI Output M/M Mar | -0.10% | -0.30% | ||

| 06:00 | GBP | PPI Output Y/Y Mar | 8.70% | 12.10% | ||

| 06:00 | GBP | PPI Core Output M/M Mar | 0.20% | -0.20% | ||

| 06:00 | GBP | PPI Core Output Y/Y Mar | 9.80% | 10.40% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Feb | 10.3B | 17.1B | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar F | 6.90% | 6.90% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Mar F | 5.70% | 5.70% | ||

| 12:15 | CAD | Housing Starts Mar | 260K | 244K | ||

| 12:30 | CAD | Industrial Product Price M/M Mar | -0.40% | -0.80% | ||

| 12:30 | CAD | Raw Material Price Index Mar | -0.70% | -0.40% | ||

| 14:30 | USD | Crude Oil Inventories | -0.4M | 0.6M | ||

| 18:00 | USD | Fed’s Beige Book |