The USD started the NY session as the strongest of the major currencies (see post here), but lost some of it’s luster when US traders entered for the day. The greenback moved lower vs the US opening levels during the session (with the exception vs the CAD). There was no discernible US catalyst for the decline. The US did not have any data released during the session, nor was there any Fed speakers.

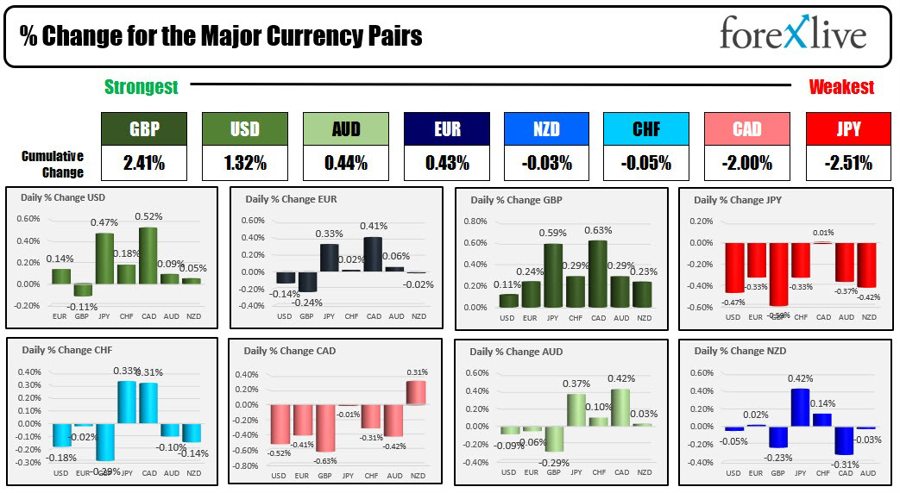

At the end of the day, the GBP is ending as the strongest of the majors while the JPY is the weakest.

The strongest to the weakest of the major currencies

In the UK, the inflation data released during their session was higher than expectations with an accompanied tilt higher in the terminal rate. Deutsche Bank now see two more rate hikes that would take the terminal rate up to 4.75% in June. The GBPUSD initially moved higher off the news, but reversed and opened the US session making new session lows down at 1.23914..

Those declines in the GBPUSD were reversed with the price of the GBPUSD moving back above the 200/100 hour MAs which are now near converged at 1.2334. The price is trading at 1.2438 just above those MA levels heading into the close after reaching a US session high of 1.24736 during the US session.

In the new trading day, the converged moving averages at 1.2334 will be the barometer for buyers and sellers. Stay above is more bullish. Move below is more bearish.

GBPUSD had a volatile up and down trading day

The EURUSD also bounced off early NY/late London morning session lows at 1.09165. That low was about 8 pips short of the low from Monday’s trade at 1.0908. The subsequent rise also took the price above it 200 hour moving average at 1.09547, but fell short of the following 100 hour moving average currently at 1.0979. The current price into the close is trading right around the 200 hour moving average of 1.0954. That level will be the barometer for the new trading day. On a move higher, getting above the 100 hour moving average would be needed to increase the bullish bias.

The USDJPY moved higher and in the process tested a swing area on the topside at 135.11 up to 135.36. The high price reached 135.14 before rotating back to the downside and stalling near 134.25. The current price is trading near 134.75 that is also where the 61.8% retracement of the range since the March high. The retracement level will be the barometer in the new trading day. Getting above would have traders targeting the key swing area between 135.11 and 135.36.

The AUDUSD is trading at 0.6714 to start the new trading day which puts the price between the 200 hour moving average below and 0.6701 and the 100 hour moving average above and 0.67266. Traders will be anticipating a break in either direction as the technical level start to converge in that currency pair. It is time to move (see video HERE)

In other markets:

- Spot gold is trading down $10.43 or 0.52% at $1994.40.

- Spot silver is trading up $0.10 or 0.35% and $25.28.

- WTI crude oil is trading down $1.90 at $79

- Bitcoin fell sharply today and is trading at $29,256. 24 hours ago, the price was trading at around $30,445

in the US debt market, yields moved higher with the shorter end leading the way:

- 2 year yield 4.252% up 5.3 basis points

- 5 year yield 3.706%, up 3.2 basis points

- 10 year yield 3.596% up 2.5 basis points

- 30 year yield 3.789% unchanged

In the US stock market, the broader S&P and NASDAQ index closed near unchanged for the 2nd consecutive day. The Dow industrial average rose modestly lower:

- Dow industrial average -79.62 points or -0.23% at 33897.02

- S&P index -0.35 points or -0.01% at 4154.51

- NASDAQ index up 3.8 points or 0.03% at 12157.22

- Russell 2000 rose 3.89 points or 0.22% at 1799.44

European shares close mostly higher today with the UK FTSE 100 the only decliner

- German DAX up 0.08%

- Frances CAC up 0.21%

- UK’s FTSE 100 -0.13%

- Spain Ibex +0.77%

- Italy’s FTSE MIB +0.15%

The UK benchmark 10 year yield rose 10.4 basis points at 3.85% on the back of the stronger inflation data. The German 10 year rose 3.3 basis points to 2.50%. Italy’s 10 year moved up to 20 basis points to 4.353%