Canadian Dollar weakens broadly in early US session, after data showed that consumer inflation slowed notably in March, in line with market expectations. However, Dollar has emerged as the day’s worst performer, reversing some of this week’s gains, even when compared to Yen. In contrast, Australian and New Zealand Dollars are performing strongly, buoyed by better-than-expected Chinese GDP and robust retail sales data. British Pound is also faring well due to encouraging job data and solid wage growth, while Euro and Swiss Franc lag behind.

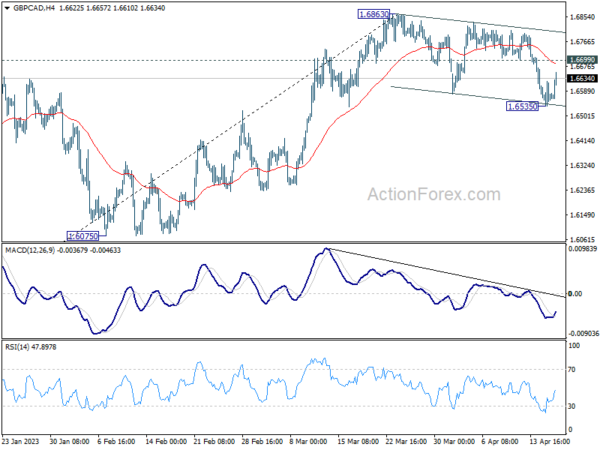

Following up on GBP/CAD, today’s bounce is raising the chance that corrective pattern from 1.6863 has completed with three waves down to 1.6535, after drawing support from 55 D EMA (now at 1.6562). Next focus is 1.6699 minor resistance. Sustained break there will solidify this bullish case and bring further rise through 1.6863 to resume larger up trend. However, sustained break of the 55 D EMA will argue that it’s already in correction to whole up trend from 1.4069, and open up deeper decline to 1.6075 support and below.

In Europe, at the time of writing, FTSE is up 0.22%. DAX is up 0.73%. CAC is up 0.72%. Germany 10-year yield is down -0.0005 at 2.469. Earlier in Asia, Nikkei rose 0.51%. Hong Kong HSI dropped -0.63%. China Shanghai SSE rose 0.23%. Singapore Strait Times dropped -0.29%. Japan 10-year JGB yield dropped -0.0059 to 0.476.

Canada CPI slowed to 4.3% yoy in Mar, lowest since Aug 2021

Canada CPI slowed from 5.2% yoy to 4.3% yoy in March, matched expectations. That was also the smallest annual increase since August 2021. Excluding food and energy, CPI slowed from 4.8% yoy to 4.5% yoy. Excluding mortgage interest costs CPI also slowed from 4.7% yoy to 3.6% yoy.

Statistics Canada noted, “As a result of the steep monthly increase in prices in March 2022 (+1.4%), base-year effects, notably gasoline prices, continued to have a strong downward impact on consumer inflation, contributing to the year-over-year deceleration in March 2023.”

Meanwhile, CPI median slowed from 4.9% yoy to 4.6% yoy, above expectation of 4.5% yoy. CPI trimmed slowed from 4.8% yoy to 4.4% yoy, matched expectation. CPI common slowed from 6.4% yoy to 5.9% yoy, below expectation of 6.0% yoy.

German ZEW falls sharply to 4.1, financial market experts still uncertain

ZEW Economic Sentiment Index for Germany experienced a significant drop in April, falling from 13 to 4.1, well below the anticipated 15.1. This suggests that a considerable improvement in the economic situation is unlikely over the next six months. Although the Current Situation Index rose from -46.5 to -32.5, surpassing the forecast of -40.0, the overall economic situation remains relatively negative.

Similarly, the Eurozone’s ZEW Economic Sentiment Index dipped from 10 to 6.4, underperforming the expected 11.2. However, the Current Situation Index increased by 14.4 points to -30.2.

ZEW President Professor Achim Wambach stated that several factors negatively affect economic expectations, including experts’ anticipation of banks being more cautious with loans and the ongoing impact of high inflation rates and restrictive international monetary policies. Nevertheless, Wambach highlighted that the risk of an acute international financial market crisis appears to have been mitigated.

UK payrolled employment grew 31k in Mar, wage growth maintained in Feb

In March, UK payrolled employment grew 31k , or 0.1% mom. Compared with March 2022, payrolled employment rose 533k, or 1.8% yoy. Median monthly pay increased by 6.3% yoy, highest in finance and insurance sector with 10.1% yoy, and lowest in the education sector, with an increase of 3.6%. Claimant count rose 28.2k, above expectation of 10.2k.

In the three month to February, unemployment rate rose to 3.8%, above expectation of 3.7%, and 0.1% higher the previous three-month period. Employment rate was estimated at 75.8%, 0.2% higher than the previous three-month period. Average earnings excluding bonus rose 6.6% 3moy, unchanged from January’s rate and above expectation of 6.2%. Average earnings including bonus was up 5.9% 3moy, unchanged from prior month’s figure, beat expectation of 5.1%.

BoJ Governor Ueda: No immediate need to revise joint statement with government

In an appearance at the lower house financial committee of parliament today, BoJ Governor Kazuo Ueda stated that there is no immediate need to review a joint statement issued with the government about a decade ago. This statement, which is not legally binding, outlines the roles that the government and the BOJ should each assume in order to lift Japan out of deflation.

“We are going to approach meeting the 2% inflation target by keeping to monetary easing, although it may take time.” He added that “the joint statement is appropriate and I don’t see any immediate need to revise the target.” Ueda’s remarks point to a commitment to maintaining monetary easing in pursuit of the inflation target, while also urging companies to drive economic growth through higher wages and sustained inflation.

In an earlier session, Ueda clarified that the BoJ’s Japanese Government Bond (JGB) purchases are managed in the context of achieving the 2% price stability target, and not to assist the government in acquiring financial resources.

RBA minutes reveal considerations of rate hike and pause

The minutes from the RBA April 4 monetary policy meeting revealed that the Board weighed the options of a 25bps rate hike and a pause. On balance, there was a “a stronger case to pause at this meeting and reassess the need for further tightening at future meetings”, after having “additional data and an updated set of forecasts”. But members emphasized the to communicate clearly that “monetary policy may need to be tightened at subsequent meetings”. RBA kept cash rate target unchanged at 3.6% at that meeting.

The case for a 25bps hike was primarily driven by concerns over high inflation and a tight labor market. The potential persistence of high inflation and two additional factors—upgraded near-term population growth projections and the risk of larger wage increases in parts of the economy—also supported further tightening.

On the other hand, the case for a pause stemmed from the already restrictive monetary policy following significant tightening in a short period, with the full effects on the economy yet to be observed. Tighter monetary policy had contributed to a housing market slowdown, decelerated consumption growth, and financial pressure on some households with housing loans. The value of pausing lay in the opportunity to gather additional data on various economic indicators and to receive updated forecasts from the staff, which would be invaluable in reassessing the economic outlook and determining the extent of further tightening needed.

China’s Q1 GDP growth surpasses expectations, retail sales bounce

China’s Q4 GDP growth outperformed expectations at 4.5% yoy, up from 2.9% in Q4, and beat expectation of 4.0% yoy. Retail sales in March saw a 10.6% yoy increase, the largest since June 2021. Despite the positive figures, industrial production rose by only 3.9% yoy in March, missing the anticipated 4.7%. Additionally, fixed asset investment saw a 5.1% ytd yoy growth in March, falling short of the expected 5.8%.

The National Bureau of Statistics (NBS) report on Tuesday cited challenges faced by China in the first quarter, including a “grave and complex international environment” and domestic tasks for reform, development, and stability.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 133.93; (P) 134.25; (R1) 134.79; More…

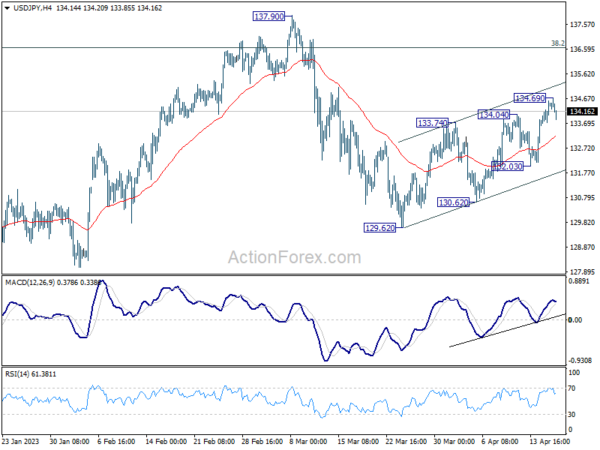

A temporary top is formed at 134.69 in USD/JPY with current retreat. Intraday bias is turned neutral first. But further rally will remain in favor as long as 312.03 support holds. Above 134.69 will resume the rally from 129.62, towards 137.90 resistance next.

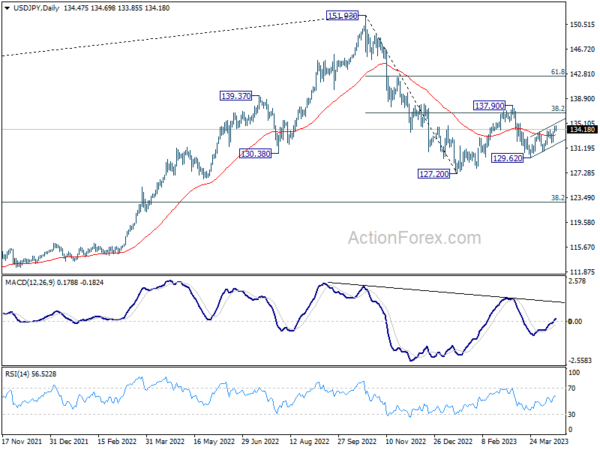

In the bigger picture, corrective pattern from 127.20 might be extending. But after all, down trend from 151.93 is expected to resume at a later stage. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 02:00 | CNY | GDP Y/Y Q1 | 4.50% | 4.00% | 2.90% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Mar | 5.10% | 5.80% | 5.50% | |

| 02:00 | CNY | Industrial Production Y/Y Mar | 3.90% | 4.70% | 2.40% | |

| 02:00 | CNY | Retail Sales Y/Y Mar | 10.60% | 8.00% | 3.50% | |

| 06:00 | GBP | Claimant Count Change Mar | 28.2K | 10.2K | -11.2K | |

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 3.80% | 3.70% | 3.70% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 6.60% | 6.20% | 6.50% | 6.60% |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 5.90% | 5.10% | 5.70% | 5.90% |

| 08:00 | EUR | Italy Trade Balance (EUR) Feb | 2.11B | -3.23B | -4.19B | -4.24B |

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 4.1 | 15.1 | 13 | |

| 09:00 | EUR | Germany ZEW Current Situation Apr | -32.5 | -40 | -46.5 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 6.4 | 11.2 | 10 | |

| 12:30 | USD | Building Permits Mar | 1.41M | 1.46M | 1.52M | 1.55M |

| 12:30 | USD | Housing Starts Mar | 1.42M | 1.41M | 1.45M | 1.43M |

| 12:30 | CAD | CPI M/M Mar | 0.50% | 0.60% | 0.40% | |

| 12:30 | CAD | CPI Y/Y Mar | 4.30% | 4.30% | 5.20% | |

| 12:30 | CAD | CPI Median Y/Y Mar | 4.60% | 4.50% | 4.90% | |

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 4.40% | 4.40% | 4.80% | |

| 12:30 | CAD | CPI Common Y/Y Mar | 5.90% | 6.00% | 6.40% |