The overall set of US consumer inflation reports appears to have been well received by investors. DOW futures jumped over 200 points following the release and maintained most of the gains before open, while treasury yields tumbled at both short and long ends. Although Fed is still on track to deliver another rate hike in May as core inflation rebounds, there is hope that disinflation is progressing smoothly and may even accelerate, potentially opening the door for Fed to reverse tightening earlier.

In the currency markets, Dollar is clearly under pressure after CPI release, breaking out to the downside against both the Euro and Swiss Franc. However, the situation is not disastrous for the greenback yet, as it’s still holding within range against Sterling, Loonie, and Aussie. Elsewhere, Gold has yet to break through the 2032 high, but WTI crude oil is making small progress in reaching 82 handle.

Technically, while the focus remains on Dollar, some attention is worth paying to the Swiss Franc as well. CHF/JPY broke through 147.58 resistance yesterday to resume the rise from 137.40. Further rally is now favored as long as the 146.06 resistance-turned-support holds. The next target is the 151.43 high. A decisive break there will resume the long-term uptrend and would signal more upside for the Swiss Franc or downside for the Yen elsewhere, or both.

In Europe, at the time of writing, FTSE is up 0.74%. DAX is up 0.54%. CAC is up 0.50%. Germany 10-year yield is down -0.0059 at 2.307. Earlier in Asia, Nikkei rose 0.57%. Hong Kong HSI dropped -0.86%. China Shanghai SSE rose 0.41%. Singapore Strait Times dropped -0.36%. Japan 10-year JGB yield rose 0.0111 to 0.466.

US CPI slowed to 5% yoy and missed expectations, core CPI ticked up to 5.6% yoy

US CPI rose 0.1% mom in March, below expectation of 0.3% mom. CPI core (all items less food and energy) rose 0.4% mom, matched expectations. Energy index decreased -3.5% mom while food index was unchanged.

Over the last 12 months, CPI slowed from 6.0% yoy to 5.0% yoy, below expectation of 5.2% yoy, marked the lowest level since June 2021. CPI core (all items less food and energy) accelerated from 5.5% yoy to 5.6% yoy, matched expectations. Energy index for down -6.4% yoy while food index rose 8.5% yoy.

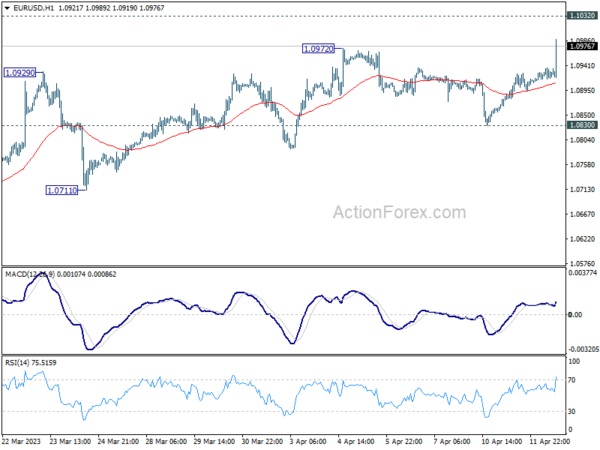

EUR/USD upside breakout, to target this year’s high

EUR/USD has broken out to the upside following a lower-than-expected headline inflation reading in the US. While the uptick in core CPI still supports another rate hike by Fed in May, the overall data set raises hopes that the disinflation process is ongoing and perhaps even gathering momentum. This development bolsters the confidence of those betting on a Fed rate cut later this year.

Technically, EUR/USD is expected to face resistance at 1.1032 shortly. A decisive break above this level would resume the overall uptrend from the 2022 low of 0.9534. Next target is the 61.8% retracement of 1.2348 (2021 high) to 0.9534, which stands at 1.1273.

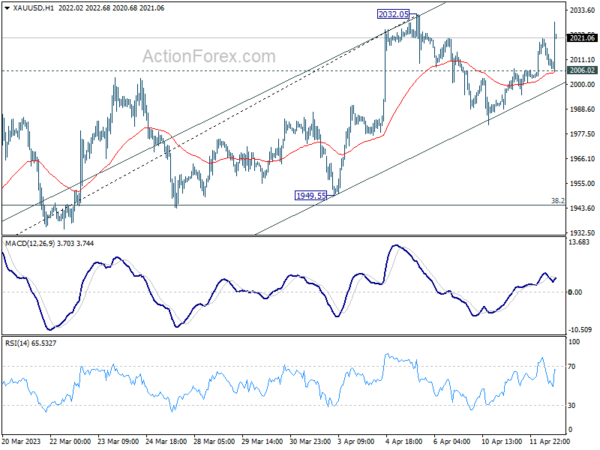

Can gold ride on Dollar selloff to extend near term rally?

As Dollar is sold off broadly after CPI release, a focus is now on Gold, which also jumps higher. The first hurdle is 2032.05 near term resistance. Rejection by this level, followed by break of 2006.02 support, will extend the corrective pattern from 2032.05 with another falling leg. However, firm break of 2023.05 will resume whole rally from 2022 low at 1614.60 and target 2070.06/2073.84 key resistance zone. If realized, an upside break should confirm underlying downside momentum in Dollar elsewhere.

Meanwhile, next hurdle would be 2070.06/2073.84 key resistance zone. Sustained break there will confirm long term up trend resumption for new record highs.

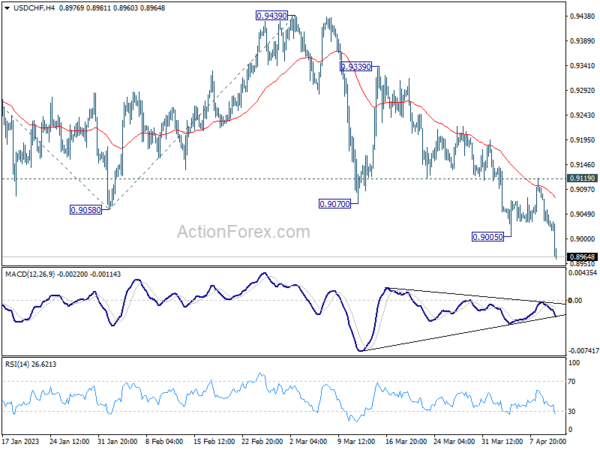

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9006; (P) 0.9055; (R1) 0.9081; More…

USD/CHF’s strong break of 0.9005 confirms resumption of whole down trend from 1.0146. Intraday bias is back on the downside. Next target is 61.8% projection of 1.0146 to 0.9058 from 0.9439 at 0.8767, which is close to 0.8756 long term support. On the upside, break of 0.9119 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, outlook will stay bearish as long as 0.9439 resistance holds, and fall from 1.1046 (2022 high) is still in progress. Prior rejection by 55 week EMA was a medium term bearish sign. Sustained of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, this fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Mar | 3.00% | 3.60% | 3.30% | |

| 23:50 | JPY | PPI Y/Y Mar | 7.20% | 7.10% | 8.20% | |

| 23:50 | JPY | Machinery Orders M/M Feb | -4.50% | -7.80% | 9.50% | |

| 12:30 | USD | CPI M/M Mar | 0.10% | 0.30% | 0.40% | |

| 12:30 | USD | CPI Y/Y Mar | 5.00% | 5.20% | 6.00% | |

| 12:30 | USD | CPI Core M/M Mar | 0.40% | 0.40% | 0.50% | |

| 12:30 | USD | CPI Core Y/Y Mar | 5.60% | 5.60% | 5.50% | |

| 14:00 | CAD | BoC Interest Rate Decision | 4.50% | 4.50% | ||

| 14:30 | USD | Crude Oil Inventories | -1.0M | -3.7M | ||

| 15:00 | CAD | BoC Press Conference | ||||

| 18:00 | USD | FOMC Minutes |