Market volatility could see a significant uptick today with three heavyweight events on the schedule. US consumer inflation data for March has the potential to shift market expectations regarding the Fed’s rate path. While headline CPI is expected to drop for the ninth consecutive month to 5.2%, core inflation is forecast to break its five-month downward trend and rise to 5.6%. Currently, fed funds futures indicate a 67% chance of another 25bps hike in May. But more importantly, there is also near 57% chance a cut in July. Both probabilities could be influenced notably by today’s data.

As for central bank events, BoC is widely expected to continue its pause and keep interest rates at 15-year high of 4.50%. Given Governor Tiff Macklem’s indication that an “accumulation of evidence” would be necessary before considering resuming tightening, the odds of a surprise move are slim. Nevertheless, the tone of the statement may provide hints regarding the possibility of an additional rate hike later this year. Meanwhile, the release of FOMC’s March meeting minutes is unlikely to reveal anything substantial.

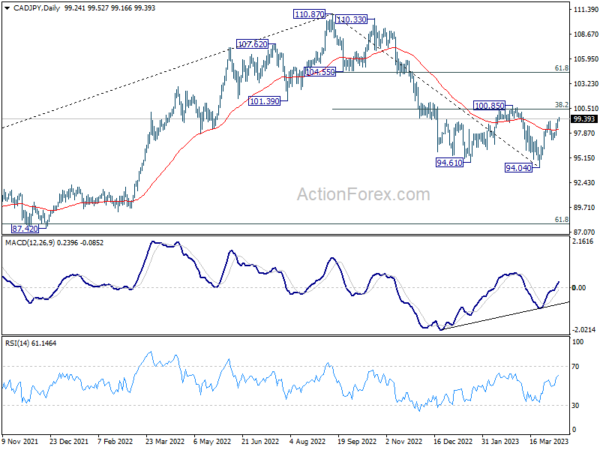

In currency markets, Canadian Dollar is currently the strongest performer for the week, followed by Swiss Franc and Euro. Japanese Yen is the weakest, trailed the New Zealand Dollar and US Dollar. Technically, CAD/JPY’s rebound from 94.04 low resumed this week by breaking through 99.16 resistance. Further rally is now anticipated to reach 100.85 resistance zone (38.2% retracement of 110.82 to 94.04 at 100.46). Strong resistance should emerge there to limit upside, at least on first attempt. However, sustained break of this level could trigger a more robust rally to 61.8% retracement at 104.44, even just as the second leg of the pattern from 110.87 high.

In Asia, at the time of writing, Nikkei is up 0.62%. Hong Kong HSI is down -0.59%. China Shanghai SSE is up 0.47%. Singapore Strait Times is down -0.40%. Japan 10-year JGB yield is up 0.0129 at 0.467. Overnight, DOW rose 0.29%. S&P 500 closed flat. NASDAQ dropped -0.43%. 10-year yield rose 0.019 to 3.434.

Fed’s Goolsbee urges prudence and patience amid financial stress

Chicago Fed President Austan Goolsbee stressed the importance of a cautious approach to monetary policy during times of financial stress. He stated yesterday, “At moments like this, of financial stress, the right monetary approach calls for prudence and patience – for assessing the potential impact of financial stress on the real economy.”

Goolsbee highlighted the need to understand credit tightening before Fed’s next meeting in May, saying, “The foremost thing on my mind before our next meeting in May is trying to get a handle on this question about credit: is it actually credit tightening?”

Emphasizing the current uncertainty, Goolsbee urged caution, adding, “We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.” He noted that if the response to recent banking issues leads to financial tightening, “monetary policy has to do less.”

Fed’s Harker supports hiking rates above 5% before assessing disinflation progress

Philadelphia Fed Bank President Patrick Harker expressed his support for raising interest rates above 5% and then assessing the impact on inflation. He noted yesterday, “I’m in the camp of getting up above 5 and then sitting there for a while.”

Harker acknowledged that recent inflation readings showed a slow disinflation process, which he described as “disappointing.” Despite this, he pointed out promising signs that Fed’s rate hikes are working.

He stated, “If we see inflation not budging, then I think we’ll have to take more action. But at this point, I don’t see why we would just continue to go up, up, up and then go, whoops! And then go down, down, down very quickly. Let’s sit there.”

Harker also emphasized the commitment to bringing inflation back down to the 2% target and highlighted that the full impact of monetary policy actions could take up to 18 months to work through the economy. He said, “We will continue to look closely at available data to determine what, if any, additional actions we may need to take.”

Fed’s Kashkari cautions against potential economic downturn and recession

Minneapolis Federal Reserve Bank President Neel Kashkari warned that tightening credit conditions due to banking stress and monetary policy actions could lead to an economic downturn or even a recession.

He said, “It could be that our monetary policy actions and the tightening of credit conditions because of this banking stress lead to an economic downturn. That might even lead to a recession.”

Kashkari acknowledged that bond markets seem to expect a quick drop in inflation, allowing Fed to cut rates. However, he expressed less optimism, predicting inflation to reach “the mid threes” by the end of the year, which remains above the Fed’s 2% target.

Regarding recent financial stress, Kashkari cautiously noted that there are hopeful signs that risks are better understood and calm is being restored, but he is not yet ready to declare all clear.

ECB’s Villeroy warns of entrenched inflation risk, shifts focus to long-distance race

ECB Governing Council member Francois Villeroy de Galhau has warned of the risk of entrenched inflation yesterday, stating, “We now face the risk of entrenched inflation, which lies in the underlying or core component. In other words, inflation has become more widespread, and potentially more persistent.”

Villeroy emphasized that the ECB’s monetary policy response to rising inflation has been strong and swift. However, he also noted a shift in focus, saying, “We at the ECB are now moving from a ‘sprint’ to a ‘long-distance race’.” He added that the inflation outlook, underlying inflation readings, and the effectiveness of policy transmission will be the key factors in upcoming decisions on potential new rate hikes.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9006; (P) 0.9055; (R1) 0.9081; More…

USD/CHF is staying in range above 0.9005 and intraday bias stays neutral first. With 0.9118 resistance intact, further decline is expected. On the downside, break of 0.9005 and sustained trading below 38.2% projection of 1.0146 to 0.9058 from 0.9439 at 0.9023 will extend the down trend from 1.0146 to 61.8% projection at 0.8767. However, firm break of 0.9118 will indicate short term bottoming, and turn bias to the upside for stronger rebound.

In the bigger picture, outlook will stay bearish as long as 0.9439 resistance holds, and fall from 1.1046 (2022 high) is still in progress. Prior rejection by 55 week EMA was a medium term bearish sign. Sustained of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, this fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Mar | 3.00% | 3.60% | 3.30% | |

| 23:50 | JPY | PPI Y/Y Mar | 7.20% | 7.10% | 8.20% | |

| 23:50 | JPY | Machinery Orders M/M Feb | -4.50% | -7.80% | 9.50% | |

| 12:30 | USD | CPI M/M Mar | 0.30% | 0.40% | ||

| 12:30 | USD | CPI Y/Y Mar | 5.20% | 6.00% | ||

| 12:30 | USD | CPI Core M/M Mar | 0.40% | 0.50% | ||

| 12:30 | USD | CPI Core Y/Y Mar | 5.60% | 5.50% | ||

| 14:00 | CAD | BoC Interest Rate Decision | 4.50% | 4.50% | ||

| 14:30 | USD | Crude Oil Inventories | -1.0M | -3.7M | ||

| 15:00 | CAD | BoC Press Conference | ||||

| 18:00 | USD | FOMC Minutes |