In today’s Asian trading session, Dollar witnessed a remarkable bounce as concerns over inflation reemerged, driven by a sudden upswing in oil prices. WTI crude oil fleetingly broke the 80 level after Saudi Arabia and other OPEC+ oil producers made an unforeseen announcement on Sunday, revealing additional oil output cuts of around 1.16 million barrels per day. Initially, market participants anticipated OPEC+ to maintain the current 2 million bpd cuts through the end of 2023. However, the updated total of 3.66 million bpd cuts, accounting for 3.7% of global demand, caught many by surprise.

In the realm of currency trading, Canadian Dollar is hot on the heels of the greenback, emerging as the second strongest performer for the day so far, followed closely by Australian Dollar. On the flip side, New Zealand Dollar, Yen, and Swiss Franc lag behind as the weakest. As the week unfolds, traders will keep a keen eye on RBA and RBNZ rate decisions, in addition to crucial US economic data, including ISM indexes and non-farm payroll employment figures.

From a technical standpoint, the spotlight now falls on 80.82 resistance level in WTI crude oil. Should this level hold, price actions originating from 64.19 will likely maintain a sideways trajectory. A breach of the 55 Day EMA (now at 75.08) could trigger a more significant decline, revisiting the 64.19 low. However, if 80.82 is sustainably surpassed, it could mark the onset of a more substantial bullish trend reversal, potentially fueling a more vigorous rally toward the subsequent resistance level at 94.25. If this scenario unfolds, it could further rekindle anxieties surrounding inflation.

Japan Tankan: Manufacturing deteriorates while non-manufacturing improves

In Q1, Japan’s Tankan large manufacturing index dropped for the fifth consecutive quarter, falling from 7 to 1, below the expected 3, and marking the lowest level since December 2020. The large manufacturing outlook also tumbled from 6 to 3, missing the anticipated 4. This decline was attributed to rising raw material and fuel costs, slowing overseas growth, and slumping chip demand.

Conversely, the non-manufacturing index improved for the fourth straight quarter, ticking up from 19 to 20, in line with expectations. The non-manufacturing outlook rose from 11 to 15, although it fell short of the expected 16.

Despite these mixed results, large Japanese firms plan to increase capital expenditure by 3.2% in the fiscal year that began in April, which is lower than the market’s forecast for a 4.9% gain. The Tankan survey also revealed that Japanese firms anticipate inflation to reach a record 2.8% a year from now and remain above the BoJ’s target for the next three to five years.

Japan PMI manufacturing finalized at 49.2, signs of improvement at the end of Q1

Japan PMI Manufacturing was finalized at 49.2 in March, up from prior month’s 47.7.

Economist Usamah Bhatti from S&P Global Market Intelligence highlighted that the Japanese manufacturing sector showed signs of improvement at the end of Q1 2023, despite marking a fifth consecutive contraction.

Output and new orders experienced their softest declines in five months, but subdued market demand persisted in both domestic and international markets.

The lack of new incoming business led to firms preparing for an eventual rise in demand, with backlogs of work falling sharply for the sixth consecutive month. Additionally, manufacturers were increasingly stockpiling finished goods.

While input cost inflation slowed to its lowest rate since August 2021, selling price inflation remained high and accelerated, as Japanese goods producers partially passed on higher cost burdens to clients.

China Caixin PMI manufacturing dropped to 50, slowdown of recovery

China Caixin PMI Manufacturing dropped from 51.6 to 50.0 in March, below expectation of 51.7. It signalled stable business conditions at the end of the first quarter.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In a nutshell, the economy saw a marginal slowdown of recovery in March as the expansion in both manufacturing supply and demand significantly weakened from the previous month.

“Overseas demand dragged, employment worsened, inventories dropped slightly, prices remained largely stable, logistics was gradually restored to normal, and businesses were still highly confident in the economic outlook.”

RBA to pause, RBNZ continues tightening, busy economic calendar with NFP and ISMs

In the holiday shortened week, the calendar is packed with two central bank meetings, plus some important economic data releases including US non-farm payroll employment and ISM indexes.

RBA is widely anticipated to maintain its interest rate at 3.60%. As stated in the minutes from their March meeting, RBA members plan to “reconsider the case for a pause” in the upcoming meeting, allowing for more time to assess the economy’s outlook. February’s employment data showed a robust labor market, with unemployment rate dropping from 3.67% to 3.54%. However, retail sales only saw a modest 0.2% growth, and monthly CPI decelerated more than expected from 7.4% yoy to 6.8% yoy. These factors provide enough leeway for the central bank to adopt a wait-and-see approach.

For the May meeting, some have called for an additional 25 basis point hike to conclude the tightening cycle, but it remains too early to say. The RBA staff will complete new economic forecasts using fresh quarterly CPI data from Q1, including the underlying inflation measure Trimmed Mean CPI. RBA Governor Philip Lowe is expected to emphasize the importance of a meeting-by-meeting approach to monetary policy.

In contrast, RBNZ is expected to raise the Official Cash Rate by 25bps to 5.00%. In February’s Monetary Policy Statement, RBNZ projected that the interest rate would peak at 5.50% this year, equivalent to two more 25 basis point hikes. As such, it is more likely that the RBNZ will signal in its statement that the tightening cycle is not over, and further rate increases are on the horizon.

In addition to the central bank decisions, the economic calendar is filled with important data releases. Most attention will be on US non-farm payroll employment and ISM indexes, but other significant releases include Canada employment, Japan’s Tankan survey, and China’s Caixin PMIs.

Here are some highlights for the week:

- Monday: Japan Tankan survey, PMI manufacturing final; Australia MI inflation gauge, building approvals, retail sales; China Caixin PMI manufacturing; Swiss CPI, PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final; US ISM manufacturing, construction spending.

- Tuesday: Japan monetary base; RBA rate decision; Germany trade balance; Eurozone PPI, Canada building permits; US factory orders.

- Wednesday: RBNZ rate decision; Germany factory orders; France industrial production; Eurozone PMI services final; UK PMI services final; US ADP employment, trade balance, ISM services; Canada trade balance.

- Thursday: Australia trade balance; China Caixin PMI services; Swiss unemployment rate, foreign currency reserves; UK PMI construction; Germany industrial production; Canada employment, Ivey PMI; US jobless claims.

- Friday: Japan average cash earnings, household spending, leading indicators; France trade balance; US non-farm payrolls.

GBP/USD Daily Outlook

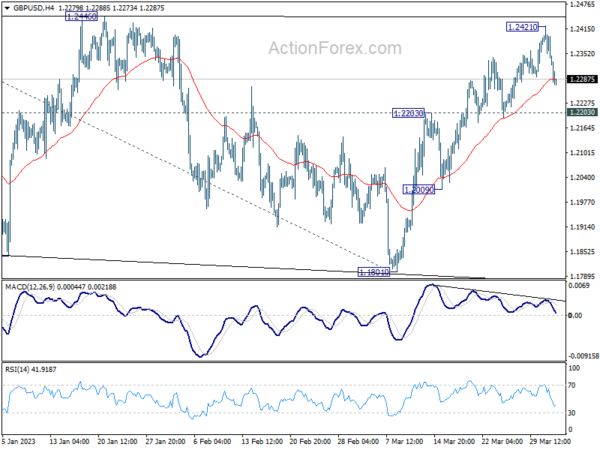

Daily Pivots: (S1) 1.2296; (P) 1.2360; (R1) 1.2394; More…

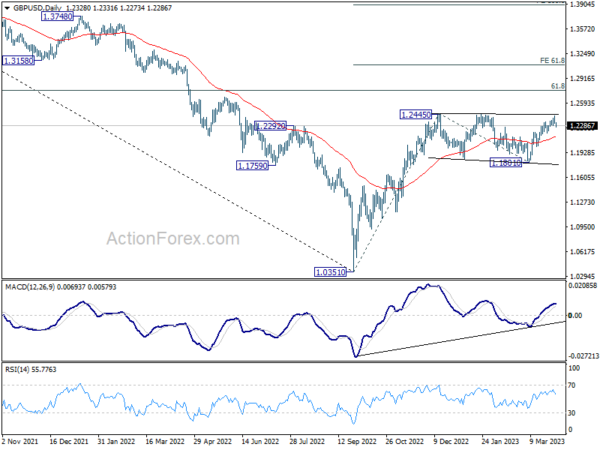

GBP/USD’s retreat from 1.2421 continues today but stays above 1.2203 resistance turned support. Intraday bias remains neutral for the moment and further rally is in favor. On the upside, decisive break of 1.2445/6 resistance zone will resume larger rally from 1.0351, and target 1.2759 fibonacci level. However, break of 1.2203 resistance turned support will extend the corrective pattern from 1.2445 with another falling leg, and turn bias back to the downside.

In the bigger picture, the rise from 1.0351 medium term term bottom (2022 low) is in progress for 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. Sustained break there will add to the case of long term bullish trend reversal. Further break of 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095 could prompt upside acceleration to 100% projection at 1.3895. For now, this will remain the favored case as long as 1.1801 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 3 | 4 | 6 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 1 | 3 | 7 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | 15 | 16 | 11 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 20 | 20 | 19 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 3.20% | 9.90% | 19.20% | |

| 00:30 | JPY | Manufacturing PMI Mar F | 49.2 | 48.6 | 48.6 | |

| 01:00 | AUD | TD Securities Inflation M/M Mar | 0.30% | 0.40% | ||

| 01:30 | AUD | Building Permits M/M Feb | 4.00% | 10.20% | -27.60% | -27.10% |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 50.0 | 51.7 | 51.6 | |

| 06:30 | CHF | CPI M/M Mar | 0.40% | 0.70% | ||

| 06:30 | CHF | CPI Y/Y Mar | 3.20% | 3.40% | ||

| 07:30 | CHF | SVME PMI Mar | 48.9 | 48.9 | ||

| 07:45 | EUR | Italy Manufacturing PMI Mar | 51 | 52 | ||

| 07:50 | EUR | France Manufacturing PMI Mar F | 47.7 | 47.7 | ||

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 44.4 | 44.4 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 47.1 | 47.1 | ||

| 08:30 | GBP | Manufacturing PMI Mar F | 48 | 48 | ||

| 13:30 | CAD | Manufacturing PMI Mar | 52.4 | |||

| 13:45 | USD | Manufacturing PMI Mar F | 49.3 | 49.3 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 47.5 | 47.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 50 | 51.3 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 49.1 | |||

| 14:00 | USD | Construction Spending M/M Feb | 0.00% | -0.10% | ||

| 14:30 | CAD | BoC Business Outlook Survey |