Last week the Fed raised the federal funds rates by 25bps, which was seen

as a mildly dovish decision. The FOMC’s post-meeting statement and the latest

projections suggest that current events in the financial system are a cause of

concern and might put an end to the tightening cycle.

One more 25bps rate hike is expected in May and then the Fed might pause

until the end of the year, holding the rate at 5.00%-5.25%, which is the

projection based on the current dot plot that remained unchanged since

December.

The SNB raised the rate by 50bps to 1.50% and stressed that it doesn’t rule out

further hikes and mentioned price stability and FX intervention again.

Inflation remains the main concern and is clearly above the target which the

SNB equates with price stability.

As far as economic growth goes, it is likely to remain modest in the near

future despite a slight uptick in activity. As market reaction to the SNB hike,

the CHF saw a slight appreciation.

It’s going to be a light week ahead for the FX market with just a few

economic events in focus. On Tuesday, BoE Gov Bailey will speak about the

collapse of Silicon Valley Bank before the Treasury Select Committee, in

London. Meanwhile in the U.S. we’ll get the CB consumer sentiment.

The CPI data for Australia and the U.S. pending home sales will be released

Wednesday, followed Thursday by the eurozone inflation data and the U.S. final

GDP q/q and unemployment claims. Friday we’ll get the Tokyo Core CPI y/y, the

U.S. Core PCE price index m/m and the revised UoM consumer sentiment.

Due to recent events in the financial system, we might see a small decline

in consumer sentiment about financial stability. Concerns about inflation and

the layoffs seen in the tech and finance sectors are also likely to contribute

to the decrease in confidence, even though overall the labour market remains

strong.

Inflation data for the Australian economy is expected to cool down a bit,

from 7.4% in January to 7.2%. However, inflation is likely to remain high for

longer than previously anticipated, well above the RBA’s target of 2-3%.

Inflation data for the eurozone could also cool down due to softness in

energy prices, but the Core CPI is expected to rise.

The U.S. GDP print is not likely to create market volatility, but it’s

worth keeping an eye on it. There are no expectations for a major revision this

week of the headline GDP, but the data could provide hints of corporate profits

for Q4, with a consensus for a rise at 2.7% annualized rate.

The nationwide core CPI in Japan is expected to show signs of cooling down

to 2.8% y/y from 3.1% y/y in February. The decrease might be the result of

government actions to curb electricity and gas prices.

If we exclude energy and other special factors, core CPI is expected to

rise 3.61% y/y in February from 3.33% in January. Citi analysts expect rises of

2.8% y/y in March and 2.6% in April, as the impact of past commodity price

surges and Yen depreciation softens.

U.S. PCE deflator m/m is expected to drop to 0.3% from 0.6% and PCE y/y to

5.1% from 5.4%. Analyst expectations are that goods prices will fuel

disinflation, while the prices for shelter and other services continue to put

pressure.

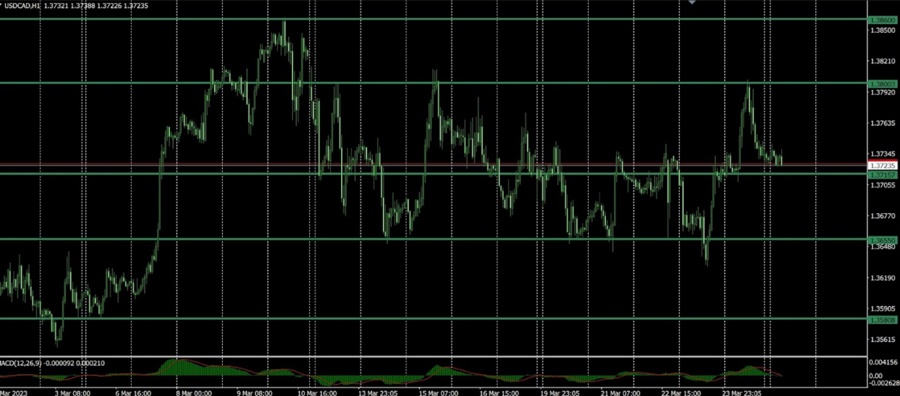

USD/CAD expectations

There are no significant economic events this week for

the CAD, but some important data for the USD, so the pair might strengthen in

the near future as the overbought conditions for the USD continue to ease.

On Wednesday, BoC DG Gravelle is scheduled to deliver

a speech regarding market liquidity measures adopted during the Covid outbreak.

He is unlikely to make any significant comments on the current outlook for

monetary policy but the summary of the deliberations for the March policy

decision clearly showed the rate policy will remain on hold for some time. Some

Fed members are also scheduled to speak this week.

The pair is near the 1.3715 level of support. If that

level holds the next target could be the 1.3800 or even 1.3860 levels of

resistance.

On the downside the next levels of support are at

1.3655 and 1.3580.

This article

was written by Gina Constantin.