Market’s response to the rate hikes by SNB and BoE has been relatively muted. Following today’s rate decisions, SNB signaled the possibility of further tightening, while BoE remains open to either a hike or a pause in the future. Dollar is currently the day’s worst performer, followed by Swiss Franc and Japanese Yen, with commodity currencies showing the most strength. Despite this, a risk-on environment isn’t clearly reflected in European stocks and US futures.

Regarding the week’s performance, Dollar has been the weakest currency so far, primarily due to yesterday’s selloff in response to the less hawkish Fed. Commodity currencies are the next weakest, outpaced by their European counterparts. Euro leads as the strongest currency, trailed by Pound and Swiss Franc, while the Japanese Yen presents a mixed performance.

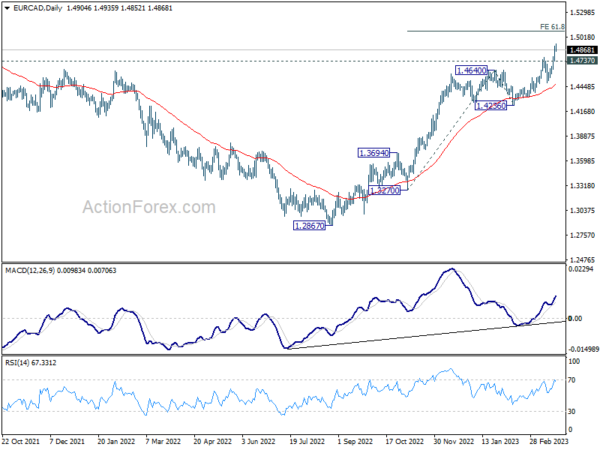

Technically, EUR/CAD’s up trend from 1.2867 resumed today and it’s on track to 61.8% projection of 1.3270 to 1.4640 from 1.4236 at 1.5083. Nevertheless, break of 1.4737 minor support will bring some consolidations first, before staging another rally. The next move might depend on tomorrow’s Eurozone PMIs.

In Europe, at the time of writing, FTSE is down -0.76%. DAX is down -0.31%. CAC is down -0.26%. Germany 10-year yield is down -0.0485 at 2.281. Earlier in Asia, Nikkei dropped -0.17%. Hong Kong HSI rose 2.34%. China Shanghai SSE rose 0.64%. Singapore Strait Times dropped -0.06%. Japan 10-year JGB yield dropped -0.0283 to 0.306.

US initial jobless claims ticked down to 191k

US initial jobless claims dropped -1k to 191k in the week ending March 18, better than expectation of 195k. Four-week moving average of initial claims dropped -250 to 196.25k.

Continuing claims rose 14k to 1694k in the week ending March 11. Four-week moving average of continuing claims rose 8.5k to 1684k.

BoE hikes 25bps, door open for further tightening or pause

BoE raised its Bank Rate by 25 basis points to 4.25% as expected, with a 7-2 vote by the Monetary Policy Committee. MPC members Swati Dhingra and Silvana Tenreyro voted against the rate hike, opting for no change, while no member voted for a larger increase.

The central bank left the possibility of further rate hikes open, stating, “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.” Simultaneously, it also means the door is open for a pause in the rate hike cycle too.

BoE acknowledged that CPI inflation “increased unexpectedly in the latest release” but maintained that it is “likely to fall sharply over the rest of the year.” The central bank emphasized that the degree to which domestic inflationary pressures ease will depend on the economy’s evolution, including the impact of the significant Bank Rate increases so far.

SNB hikes 50bps, signals more tightening possible

SNB raises its policy rate by 50bps to 1.50% as widely expected. The central bank indicated the openness to further tightening while inflation forecasts are raised due to stronger second-round effects and increased overseas inflationary pressure.

The central bank said the rate hike is for “countering the renewed increase in inflationary pressure”. It also noted in the statement, “it cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.” It also remains “willing to be active in the foreign exchange market” with focus on “selling foreign currency” for some quarters.

The bank’s conditional inflation forecast assumes an interest rate of 1.5% over the horizon. Average inflation estimates for 2023 and 2024 were raised from 2.4% to 2.6% and from 1.8% to 2.0%, respectively. Inflation is projected to average 2.0% in 2025, a new forecast.

SNB statement highlighted that “stronger second-round effects and the fact that inflationary pressure from abroad has increased again mean that, despite the raising of the SNB policy rate, the new forecast is higher through to mid-2025 than in December.”

The central bank anticipates a modest GDP growth of around 1% for the year, citing subdued foreign demand and the dampening effect of inflation on purchasing power.

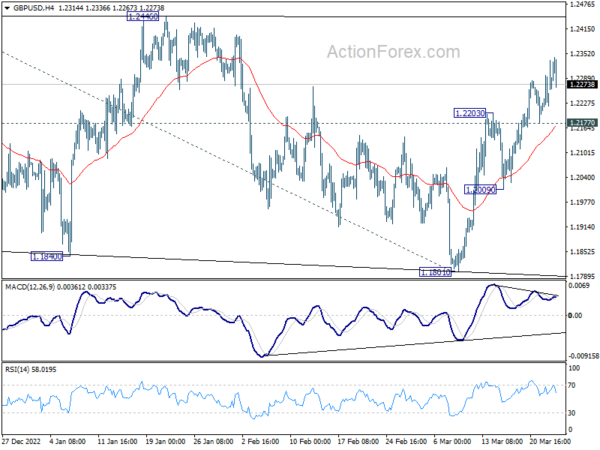

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2207; (P) 1.2271; (R1) 1.2333; More…

Intraday bias in GBP/USD stays on the upside despite current retreat. Rise from 1.1801 is in progress for retesting 1.2445/6 resistance zone. Decisive break there will resume larger rise from 1.0351, and target 1.2759 fibonacci level. On the downside, break of 1.2177 minor support will argue that corrective pattern from 1.2445 is extending with another falling leg, and turn bias to the downside for 1.2009 support instead.

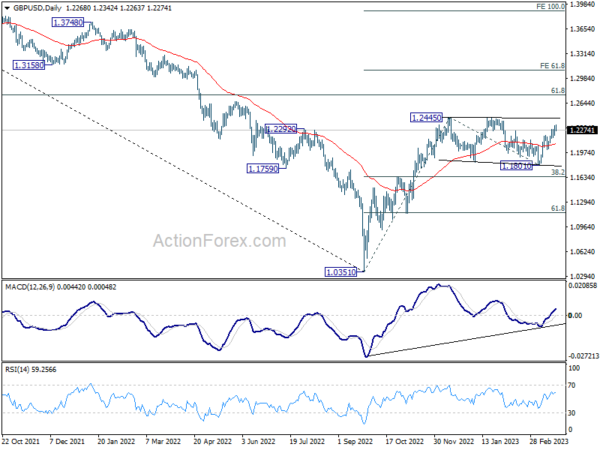

In the bigger picture, price action from 1.2445 are seen as a corrective pattern to rise from 1.0351 medium term bottom (2022 low). Resumption of the rally from 1.0351 is expected and break of 1.2446 will target 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. This will remain the favored case as long as 38.2% retracement of 1.0351 to 1.2445 at 1.1645 holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:30 | CHF | SNB Interest Rate Decision | 1.50% | 1.50% | 1.00% | |

| 12:00 | GBP | BoE Rate Decision | 4.25% | 4.25% | 4.00% | |

| 12:00 | GBP | MPC Official Bank Rate Votes | 7–0–2 | 7–0–2 | 7–0–2 | |

| 12:30 | USD | Current Account (USD) Q4 | -206.8B | -217B | -219B | |

| 12:30 | USD | Initial Jobless Claims (Mar 17) | 191K | 195K | 192K | |

| 14:00 | USD | New Home Sales Feb | 650K | 670K | ||

| 14:30 | USD | Natural Gas Storage | -75B | -58B |