The financial markets are once again in a state of panic as Credit Suisse saw its shares plummet by over -20% and hit a new record low, dragging European stocks deeply down with it. Bonds are becoming the go-to for worried investors again, with US 10-year yield breaking the 3.5 handle and Germany 10-year yield breaking the 2.2 handle. There are serious concerns that recent bank routs would develop into another global financial crisis.

In the currency markets, the Euro is suffering from a steep sell-off, with the case for the ECB to deliver a 50bps rate hike in doubt given the current state of the region. Swiss Franc and Sterling are also among the weakest currencies, indicating funds flowing out of Europe. The Yen is experiencing a strong rally, while the Dollar trails behind as the second strongest performer.

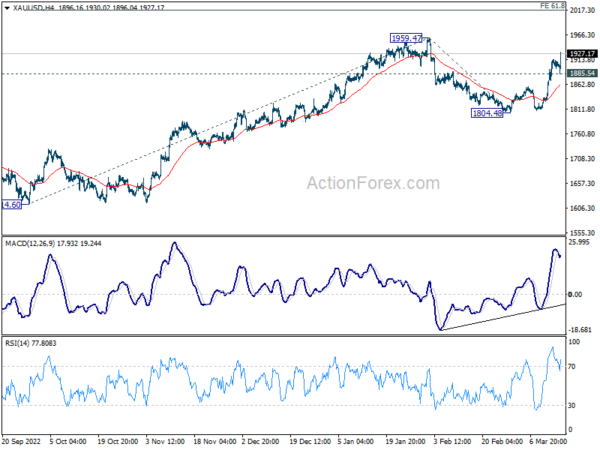

Technically, Gold’s rise from 1804.48 resumes today and hit as high as 1930.02 so far. Further rise is expected as long as 1885.54 support holds, for 1959.47 high next. Decisive break there will resume whole rally from 1614.60 to 61.8% projection of 1614.60 to 1959.47 from 1804.48 at 2017.60.

In Europe, at the time of writing, FTSE is down -2.92%. DAX is down -3.00%. CAC is down -3.58%. Germany 10-year yield is down -0.2464 at 2.168. Earlier in Asia, Nikkei rose 0.03%. Hong Kong HSI rose 1.52%. China Shanghai SSE rose 0.55%. Singapore Strait Times rose 1.38%. Japan 10-year JGB yield is up 0.0328 at 0.316.

US retail sales down -0.4% mom in Feb, ex-auto sales dropped -0.1% mom

US retail sales declined -0.4% mom to USD 697.9B, below expectation of 0.2% mom. Ex-auto sales fell -0.1% mom to USD 567.2B, matched expectations. Ex-gasoline sales dropped -0.4% mom to USD 639.5B. Ex-auto, gasoline sales was flat over the month at USD 508.9B.

Total sales for the December 2022 through February 2023 period were up 6.4% from the same period a year ago.

US PPI down -0.1% mom in Feb, goods fell -0.2% mom, services dropped -0.1% mom

US PPI for final demand dropped -0.1% mom in February, below expectation of 0.3% mom. Prices for goods dropped -0.2% mom while prices for services was down -0.1% mom. Prices less foods, energy, and trade services rose 0.2% mom.

For the 12 months ended in February, PPI slowed from 5.7% yoy to 4.6% yoy, below expectation of 5.1% yoy. Prices for final demand less foods, energy, and trade services advanced 4.4yoy .

Eurozone industrial production rose 0.7% mom in Jan, EU up 0.3% mom

Eurozone industrial production rose 0.7% mom in January, above expectation of 0.5% mom. Production of intermediate goods grew by 1.5%, while production of capital goods fell by -0.2%, durable consumer goods by -0.7%, energy by -0.8% and non-durable consumer goods by -2.1%.

EU industrial production rose 0.3% mom. Among Member States for which data are available, the highest monthly increases were registered in Ireland (+9.3%), Sweden (+5.0%) and Romania (+2.0%). The largest decreases were observed in Denmark (-7.1%), Hungary (-5.0%) and the Netherlands (-4.3

Ifo Spring Forecast: German economy to contract slightly in 2023

According to the Spring 2023 economic forecast released by Germany’s Ifo, the country’s economy is expected to contract by -0.1% in 2023 before growing 1.7% in 2024. Headline inflation is projected to slow slightly to 6.2% in 2023 before dropping to 2.2% in 2024. However, core inflation, which excludes energy prices, is expected to rise further to 6.3% in 2023 and then decline to 2.8% in 2024.

Ifo stated that the “subdued performance of the global economy is dampening German exports,” while high inflation rates are “depressing consumer spending and construction activity through declining purchasing power and significantly increased financing costs.” The report also noted that inflation has become increasingly broad-based over the past year, remaining at historic highs for several months. While the direct contribution of energy prices has weakened, inflation in all other goods and services has increased steadily, reaching 7.6% in February.

The report added, “In addition to higher production costs passed on by companies to consumers, a noticeable widening of profit margins in some, particularly consumer-related, areas of the economy also contributed to this.”

China posts mixed economic data in Jan-Feb period

China’s economic data for the first two months of 2023 showed mixed results, with industrial production growth falling short of expectations but retail sales and fixed asset investment exceeding them.

According to China’s National Bureau of Statistics, industrial production grew by 2.4% yoy, below the forecasted 2.6% yoy. Retail sales, on the other hand, rose by 3.5% yoy, slightly above expectations of 3.4% yoy.

Fixed asset investment also exceeded expectations, growing by 5.5% yoy, compared to the forecasted 4.5% yoy. Infrastructure investment saw a rise of 9.0% yoy. However, property investment showed a decline of -5.7% yoy, indicating a slowdown in the real estate sector.

The NBS released a statement that highlighted the challenges facing China’s economy. “The external environment is even more complex, inadequate demand remains prominent and the foundation for economic recovery is not solid yet,” the statement said.

The economic data for January and February is combined to smooth out the impact of the Lunar New Year holiday, which falls at different times during the two months in different years.

BoJ minutes: Basic stance to continue with current monetary easing

BoJ has reaffirmed its commitment to continuing with its current monetary easing policy, including yield curve control, to achieve the price stability target, according to the minutes of its meeting in January 17-18.

One member noted that there is “still a long way to go to achieve the price stability target”, and thus the Bank should continue with the current monetary easing to firmly support the economy.

To encourage firms’ efforts with regard to business transformation until sustained wage increases can be expected, the Bank needs to “curb interest rate rises across the entire yield curve” while paying attention to the functioning of bond markets, according to another member.

Another member added that it was “inappropriate to rush to an exit” from the current monetary policy, as overseas economies were currently heading toward slowdowns.

However, one member recognized that “at some point in the future”, it will be necessary to examine and assess the balance between the positive effects and side effects of the current monetary easing policy.

The Bank’s “basic stance on its future conduct of monetary policy” is to “continue with the current monetary easing — including the conduct of yield curve control — and thereby achieve the price stability target in a sustainable and stable manner accompanied by wage increases,” the minutes read.

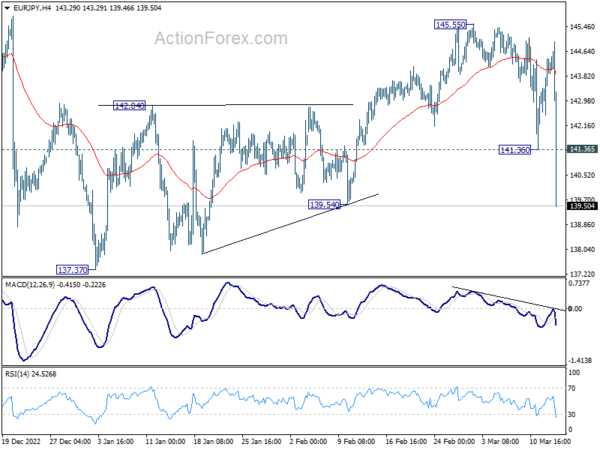

EUR/JPY Mid-Day Outlook

Daily Pivots: (S1) 142.92; (P) 143.67; (R1) 144.79; More….

EUR/JPY’s steep decline today and strong break of 141.36 confirms resumption of the decline from 145.55. The development also solidify the case that whole correction from 148.38 is in its third leg. Intraday bias is back on the downside for retesting 137.37 low, and then 135.40 fibonacci level. For now, risk will stay heavily on the downside as long as 141.36 resistance holds.

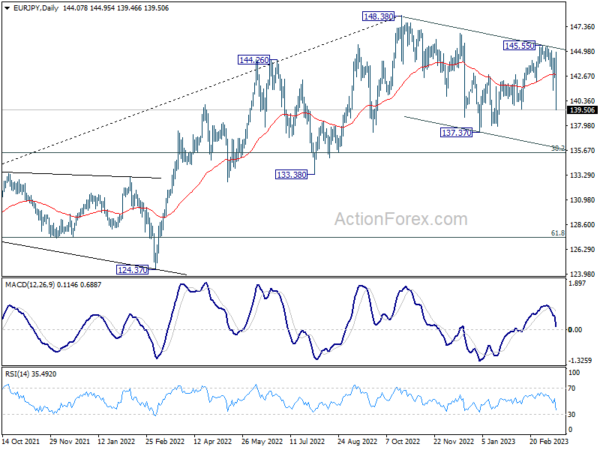

In the bigger picture, as long as 55 week EMA (now at 139.54) holds, larger up trend from 114.42 (2020 low) is still in progress for 149.76 long term resistance. However, firm break of 55 week EMA will bring deeper fall to 38.2% retracement of 114.42 to 148.38 at 135.40. Sustained break there will raise the chance of trend reversal, and target 61.8% retracement at 127.39.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q4 | -9.46B | -7.65B | -10.21B | -11.40B |

| 23:50 | JPY | BoJ Minutes | ||||

| 02:00 | CNY | Retail Sales Y/Y Feb | 3.50% | 3.40% | -1.80% | |

| 02:00 | CNY | Industrial Production Y/Y Feb | 2.40% | 2.60% | 1.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Feb | 5.50% | 4.50% | 5.10% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 0.70% | 0.50% | -1.10% | -1.30% |

| 12:15 | CAD | Housing Starts Feb | 225K | 215K | ||

| 12:30 | USD | Empire State Manufacturing Index Mar | -24.60% | -7.5 | -5.8 | |

| 12:30 | USD | Retail Sales M/M Feb | -0.40% | 0.20% | 3.00% | 3.20% |

| 12:30 | USD | Retail Sales ex Autos M/M Feb | -0.10% | -0.10% | 2.30% | 2.40% |

| 12:30 | USD | PPI M/M Feb | -0.10% | 0.30% | 0.70% | |

| 12:30 | USD | PPI Y/Y Feb | 4.60% | 5.10% | 6.00% | 5.70% |

| 12:30 | USD | PPI Core M/M Feb | 0% | 0.40% | 0.50% | 0.10% |

| 12:30 | USD | PPI Core Y/Y Feb | 4.40% | 5.00% | 5.40% | |

| 14:00 | USD | Business Inventories Jan | 0.00% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Mar | 42 | 42 | ||

| 14:30 | USD | Crude Oil Inventories | -0.2M | -1.7M |