Mixed market sentiment prevails in the Asian session today, as Nikkei is weighed down by selloff in bank stocks, while Hong Kong’s HSI sees a recovery. US futures are also seeing a strong rebound. The announcement of measures by the US government and Fed to stabilize the situation surrounding the collapse of Silicon Valley Bank has helped to ease concerns for now. Market’s focus is expected to gradually shift back to economic data event, particularly US CPI data and ECB rate decision, which are scheduled for this week.

Dollar continues its decline from last week, along with treasury yields. The 10-year yield has dropped below the 3.7% handle. Meanwhile, Yen and Swiss Franc are also showing weakness. Among commodity currencies, Australian dollar is leading, while the Sterling is seeing some recovery. Euro is also trading slightly higher.

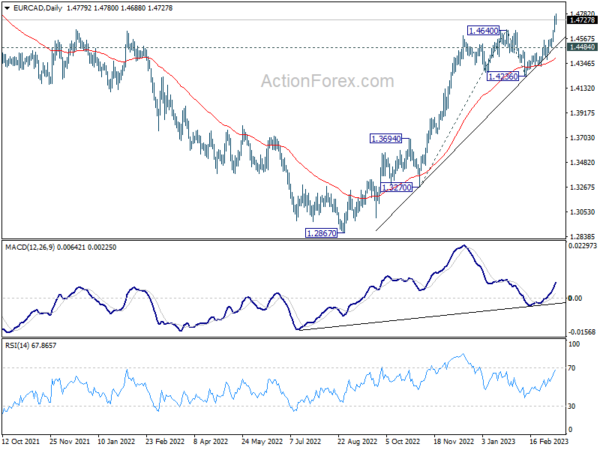

EUR/CAD is a pair to note this week, especially with the possibility of a hawkish surprise from ECB. Last week, the cross managed to break through the 1.46460 resistance level, which signals a resumption of larger uptrend from 1.2867. As long as the 1.4484 minor support level holds, near-term outlook for will remain bullish. The next target for1.5083, which represents the 61.8% projection of the move from 1.3270 to 1.4640 from 1.4236. Let’s see how it plays out.

In Asia, Nikkei closed down -1.11%. Hong Kong HSI is up 2.01% at the time of writing. China Shanghai SSE is up 0.89%. Singapore Strait Times is down -0.99%. Japan 10-year JGB yield is down further by -0.0785 at 0.315.

US Treasury, FDIC, and Fed announce measures to stabilize banking system

The US government has announced on Sunday measures to stabilize the banking system and alleviate concerns over the potential fallout from the collapse of Silicon Valley Bank. The Federal Deposit Insurance Corporation (FDIC) has ensured that depositors will have access to their funds at SVB, and taxpayers will not bear any losses associated with the bank’s resolution. However, shareholders and some unsecured debt holders will not be protected. In addition, a similar exception was announced for Signature Bank in New York.

Meanwhile, the Federal Reserve has established a new Bank Term Funding Program to provide additional funding to eligible depository institutions, ensuring that banks have the capability to meet the needs of all depositors. This move aims to bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy. These measures are expected to ease concerns over potential systemic risks and promote stability in the banking sector.

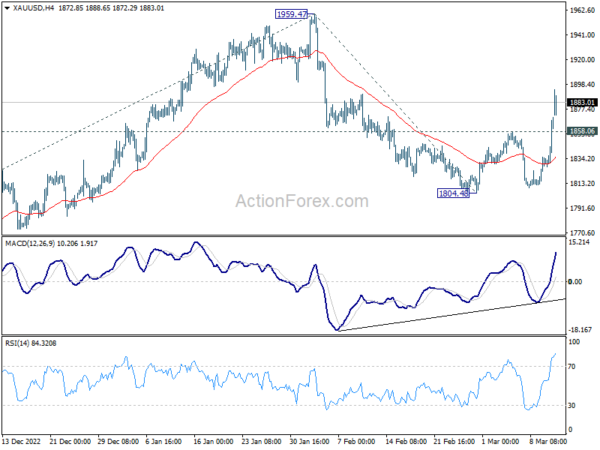

Gold heading back to 1959 high on weak Dollar

Gold prices surged in the Asian session today, following a 2% rally on Friday. At the same time, Dollar and Treasury yield were also trading lower. The market was rocked by the bankruptcy of Silicon Valley Bank, which triggered panic and furthered risk aversion. Moreover, it lowered expectations for interest rate hikes as the failure of the second-largest collapse of an American lender in history has raised concerns of potential spillover effects on the financial system.

Current development argues that Gold’s decline from 1959.47 has completed at 1804.48 already, on bullish convergence condition in 4 hour MACD. The rise back above 55 day EMA is also a bullish signal. Further rally is expected as long as 1858.06 resistance turned support holds. to retest 1959.47 high.

It’s still early to call for an upside breakout. But decisive break of 1959.47 will resume whole up trend from 1614.60 to 61.8% projection of 1614.60 to 1959.47 from 1804.48 at 2017.60.

However, break of 1858.06 will mix up the near term outlook.

NZ BNZ services rose to 55.8, activity growing relatively well

New Zealand BusinessNZ Performance of Services Index rose from 54.7 to 55.8 in February. The move further above the trend in the index indicates a more favorable comparison to its long-term average of 53.6.

Looking at some details, activity/sales rose from 52.1 to 53.6, while employment dipped from 51.6 to 51.2. New orders/business increased from 54.8 to 57.1, and stocks/inventories went up from 54.7 to 58.3. Additionally, supplier deliveries improved from 52.3 to 55.9.

BNZ Senior Economist Craig Ebert said that “the strongly expanding PSI, along with the recovered tone of the PMI, suggests economic activity is growing relatively well in the early stages of this year”.

ECB Expected to Hike 50bps, US CPI in Focus

ECB is widely anticipated to announce a 50bps hike in interest rates during its upcoming meeting on Thursday, bringing the main refinancing rate to 3.50% and the deposit rate to 3.00%. Investors will be looking ahead to the new economic projections, which will be released following the meeting, to gain an insight into future policy moves.

Some analysts are expecting an additional 50bps increase in May, with 25bps hikes predicted for both June and July. ECB’s interest rates will likely reach their peak in the summer, with the main refinancing rate and deposit rate expected to be 4.50% and 4.00%, respectively. Still, much will depend on the evolving economic outlook.

In the US, attention will be on the CPI data, which is expected to shed light on the likelihood of a 25 or 50bps hike by Fed on March 22. Expectations have been shifting in the past week, and the inflation data could provide a clearer picture. Other data important releases from the US include PPI and retail sales.

Other major economic events include UK employment data, Australia’s employment and consumer sentiment reports, New Zealand’s GDP figures, and a range of data from China.

Here are some highlights for the week.

- Monday: New Zealand BNZ services index; Japan BSI manufacturing.

- Tuesday: Australia Westpac consumer sentiment, NAB business confidence; UK employment; Swiss PPI; US CPI; Canada manufacturing sales.

- Wednesday: BoJ minutes; China industrial production, retail sales, fixed asset investment; Eurozone industrial production; US PPI, retail sales, Empire State manufacturing, business inventories, NAHB housing index; Canada housing starts.

- Thursday: New Zealand GDP; Australia employment; Japan trade balance; Swiss SECO economic forecasts; ECB rate decision; Canada wholesale sales; US Philly Fed survey, jobless claims, housing starts and building permits, import prices.

- Friday: Japan tertiary industry index; Eurozone CPI final; Canada foreign securities purchases, IPPI and RMPI; US industrial production, U of Michigan consumer sentiment.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0575; (P) 1.0638; (R1) 1.0702; More…

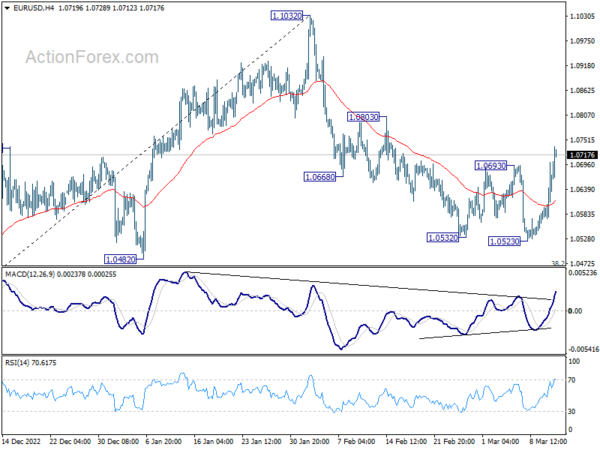

EUR/USD’s break of 1.0693 resistance indicates short term bottoming at 1.0523, on bullish convergence condition in 4 hour MACD. More importantly, the corrective decline from 1.1032 should have completed too, ahead of 1.0482 key support. Intraday bias is back on the upside for 1.0803 resistance first. Firm break there will target a retest on 1.1032 high. For now, risk will stay on the upside as long as 1.0523 support holds, in case of retreat.

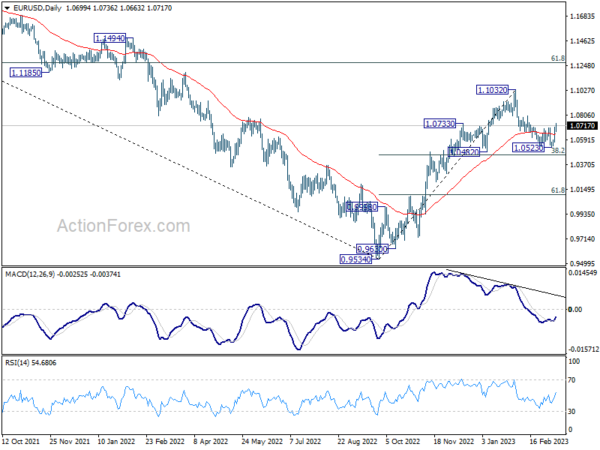

In the bigger picture, as long as 1.0482 support holds, rise from 0.9534 (2022 low) should continue to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. However, sustained break of 1.0482 will bring deeper fall to 61.8% retracement of 0.9534 to 1.1032 at 1.0106, even as a corrective pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Feb | 55.8 | 54.5 | ||

| 23:50 | JPY | BSI Large Manufacturing Index Q1 | -10.5 | -4.2 | -3.6 | |

| 15:30 | USD | 3-Month Bill Auction | ||||

| 15:30 | USD | 6-Month Bill Auction |