The fallout from the collapse of Silicon Valley Bank continues to unsettle investors. Despite measures announced on Sunday by US Treasury, FDIC and Fed to calm the markets, concerns remain. European indexes saw sharp declines led by bank stocks, while benchmark treasury yields fell.

Additionally, the market is also showing signs of pricing out a rate hike by the Fed on March 22, with Goldman Sachs predicting no change. Fed fund futures indicate only an 80% chance of a 25bps hike, though the situation remains fluid.

In the currency markets, Swiss Franc and Yen have emerged as the clear winners today, supported by risk aversion as well as falling major benchmark yields. The Dollar is the weakest performer as traders shift their expectations regarding the Fed. While there is no change in expectation for a 50bps hike by the ECB this Thursday, the Euro is the second weakest currency.

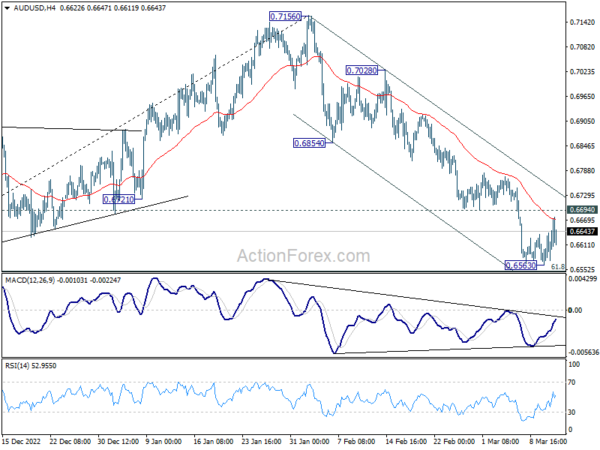

Technically, it should be noted that while Dollar weakens, the selloff against commodity currencies is not severe. AUD/USD is holding below 0.6694 minor resistance, NZD/USD below 0.6275, and USD/CAD above 1.3664 minor support. Risk of resumed selloff in commodity currencies currently outweigh the chance of extended decline in Dollar slightly.

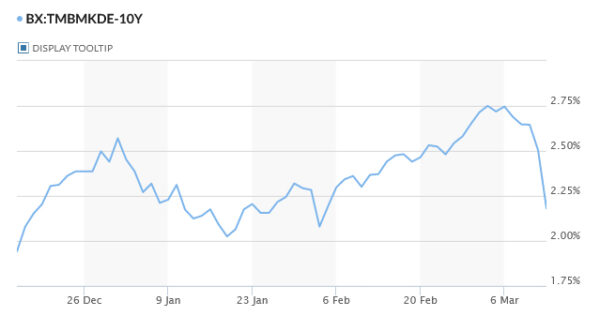

In Europe, at the time of writing, FTSE is down -2.32%. DAX is down -2.63%. CAC is down -2.47%. Germany 10-year yield is down -0.3141 at 2.190. Earlier in Asia, Nikkei dropped -1.11%. Hong Kong HSI rose 1.95%. China Shanghai SSE rose 1.20%. Singapore Strait Times dropped -1.42%. Japan 10-year JGB yield dropped -0.875 to 0.306.

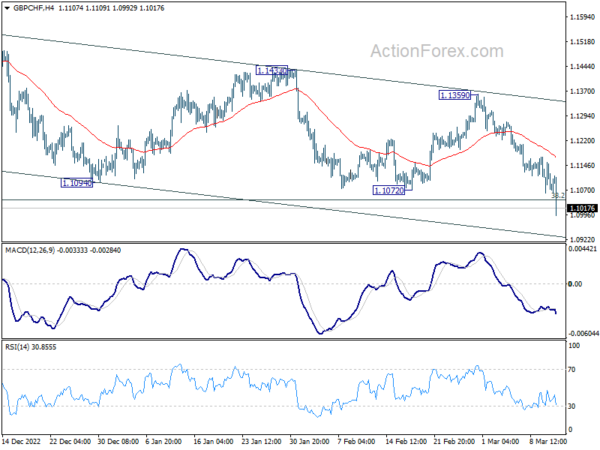

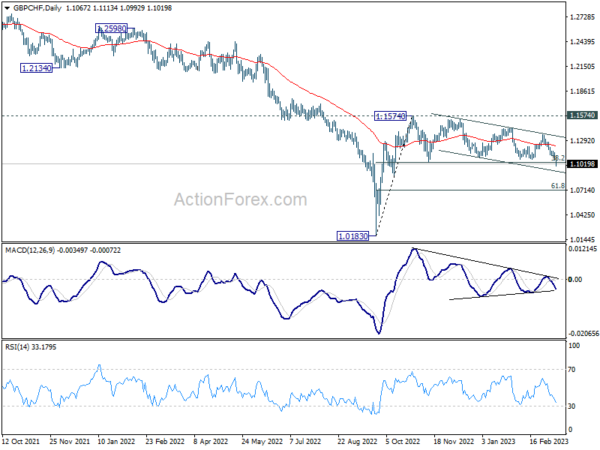

GBP/CHF and USD/JPY break important support

GBP/CHF breaks through an important support level at 38.2% retracement of 1.0183 to 1.1574 at 1.1043. Deeper fall is expected to lower channel support (now at 1.0922). Decisive break there could prompt downside acceleration to 61.8% retracement at 1.0714.

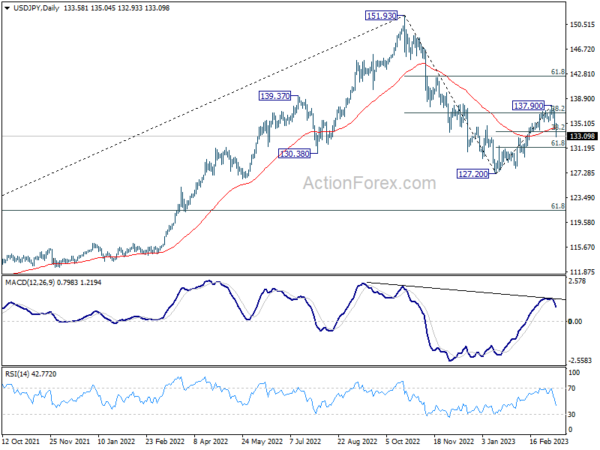

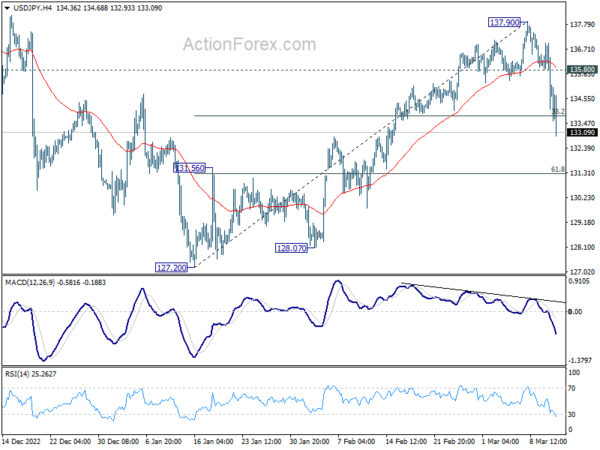

USD/JPY’s strong break of 38.2% retracement of 127.20 to 137.90 at 133.81 and 55 day EMA argues that whole rebound from 127.20 has completed at 137.90. Deeper fall should be seen to 61.8% retracement at 131.28. Sustained break there will raise the chance of resumption of whole fall from 151.93 through 127.20 low.

NZ BNZ services rose to 55.8, activity growing relatively well

New Zealand BusinessNZ Performance of Services Index rose from 54.7 to 55.8 in February. The move further above the trend in the index indicates a more favorable comparison to its long-term average of 53.6.

Looking at some details, activity/sales rose from 52.1 to 53.6, while employment dipped from 51.6 to 51.2. New orders/business increased from 54.8 to 57.1, and stocks/inventories went up from 54.7 to 58.3. Additionally, supplier deliveries improved from 52.3 to 55.9.

BNZ Senior Economist Craig Ebert said that “the strongly expanding PSI, along with the recovered tone of the PMI, suggests economic activity is growing relatively well in the early stages of this year”.

USD/CHF Mid-Day Outlook

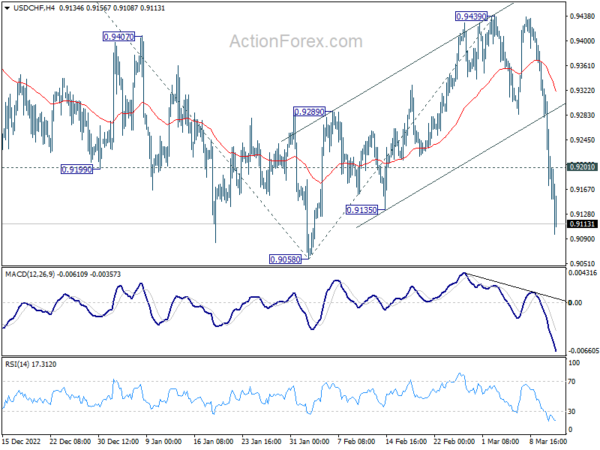

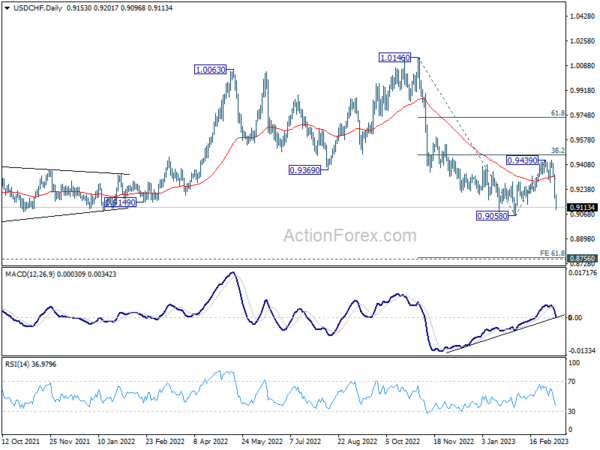

Daily Pivots: (S1) 0.9144; (P) 0.9244; (R1) 0.9313; More…

USD/CHF’s decline accelerates to as low as 0.9096 so far today and intraday bias stays on the downside for 0.9058 low. Decisive break there will resume larger down trend from 1.0146. Next target is 61.8% projection of 1.0146 to 0.9058 from 0.9439 at 0.8767. On the upside, above 0.9218 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, fall from 1.1046 (2022 high) is should still be in progress with 38.2% retracement of 1.0146 to 0.9058 at 0.9474 intact. Rejection by 55 week EMA is also a medium term bearish sign. Break of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, such fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal. For now, this will remain the favored case as long as 0.9439 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PSI Feb | 55.8 | 54.5 | ||

| 23:50 | JPY | BSI Large Manufacturing Index Q1 | -10.5 | -4.2 | -3.6 | |

| 15:30 | USD | 3-Month Bill Auction | ||||

| 15:30 | USD | 6-Month Bill Auction |