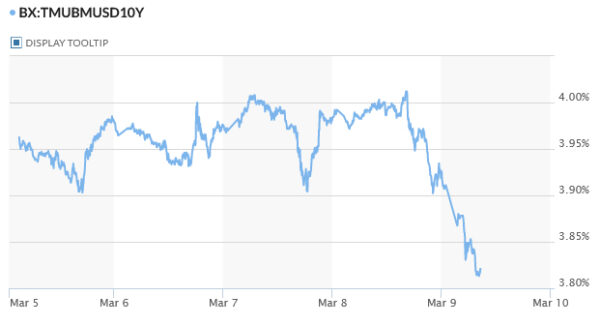

Investor sentiment is growing increasingly negative, as the steep selloff in US stocks carried over to the Asian session. Additionally, US 10-year yield is taking a significant plunge and is threatening 3.8 handle. Traders are bracing for more bearish developments, which could be sparked by today’s non-farm payroll report. Swiss Franc has surged broadly on risk-off sentiment, while Euro and Sterling have also recovered. However, Yen is lagging far behind Franc after BoJ maintained its ultra-loose monetary policy. Dollar is trading lower and continuing to digest this week’s gains, while commodity currencies remain heavy, led by Australian Dollar.

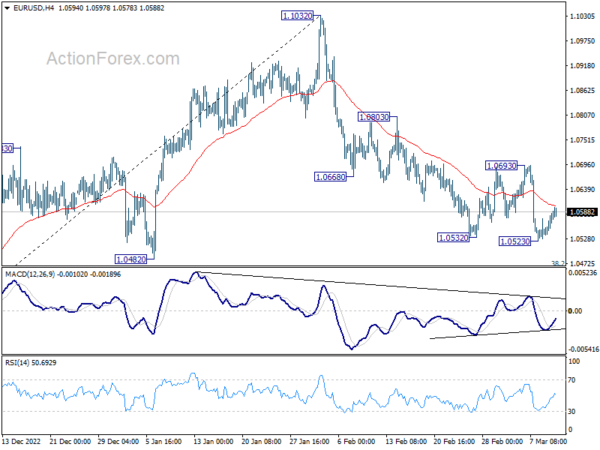

Technically, EUR/USD is holding above 1.0482 support despite this week’s decline attempt. Fall from 1.1032 could still turn out to be just a correction in the larger up trend. Break of 1.0693 resistance will confirm short term bottoming and bring stronger rally. If that happens, other European majors could be taken higher against the greenback too. However, another sharp decline through 1.0482 will raise the chance of bearish trend reversal. The next move could be decided after today’s NFP, or next week’s US CPI by latest.

In Asia, at the time of writing, Nikkei is down -1.57%. Hong Kong HSI is down -2.40%. China Shanghai SSE is down -1.02%. Singapore Strait Time is down -1.01%. Overnight, DOW dropped -1.66%. S&P 500 dropped -1.85%. NASDAQ dropped -2.05%. 10-year yield dropped -0.051 to 3.925.

BoJ stands pat and maintains easing bias

As anticipated, BoJ left its monetary policy unchanged today, maintaining its easing bias. Despite a rise in inflation expectations, CPI is projected to slow down during the current fiscal year before experiencing a moderate increase once again.

Under yield curve control, short-term policy rate was held at -0.10%. Long-term interest rate will remain at around 0% with necessary purchase of JGBs without an upper limit. The band for 10-year JGB yield to fluctuate stayed at plus and minus 0.5%.

BoJ maintained the pledge to continue with QQE with YCC for “as long as it is necessary”. It “will not hesitate to take additional easing measures if necessary”. It also expects “short- and long-term policy interest rates to remain at their present or lower levels”.

BoJ said the economy “has picked up” with exports and industrial production “more or less flat”. The economy is projected to “continue growing at a pace above its potential growth rate” as a virtuous cycle form income to spending intensifies gradually.

Inflation expectations “have risen”. But, CPI is “likely to decelerate toward the middle of fiscal 2023”, then “accelerate moderately” on the back of improvement in output gap, rises in medium- to long-term inflation expectations in wage growth, and waning down of energy prices measures.”

The meeting was the last one to be chaired by Governor Haruhiko Kuroda. Kazuo Ueda was approved by both houses of the parliament this week as the next BoJ Governor.

New Zealand BNZ manufacturing rose to 52, gearshift but not strong

New Zealand BusinessNZ Performance of Manufacturing Index rose from 51.2 to 52.0 in February, signalling further increase in expansion. But the reading was still below its long-term average of 53.0.

Looking at some details, production dropped from 52.0 to 49.4. Employment rose from 51.6 to 54.0. New orders rose from 49.2 to 52.0. Finished stocks rose from 52.7 to 55.8. Deliveries was unchanged at 51.8.

BNZ Senior Economist, Craig Ebert stated that “it’s been a New Year gearshift, out of reverse. However, these are not what you’d call strong results – in total, and especially when delving into the details. That said, February’s PMI, like January’s, did denote expansion, overall, and is not all that far shy of its long-term average of 53.0”.

BoC Rogers: More evidence needed to decide whether policy is restrictive enough

BoC Senior Deputy Governor Carolyn Rogers reiterated in a speech yesterday that tightening is in a “conditional pause”. More evidence is needed to decide whether policy is restrictive enough. Services price inflation will need to cool further.

The decisive to leave policy rate unchanged at 4.50% on Wednesday was a “conditional pause”. “If economic developments unfold as we projected and inflation comes down as quickly as we forecast in the January Monetary Policy Report (MPR), then we shouldn’t need to raise rates further,” she said. “But if evidence accumulates suggesting inflation may not decline in line with our forecast, we’re prepared to do more.”

Economic data since January showed a “mixed picture”. While “things are unfolding broadly in line with our outlook,” she added, ” We’ll need to see more evidence to fully assess whether monetary policy is restrictive enough to return inflation to 2%.”

Rogers also noted that inflation is “coming down largely as expected” with a “clear momentum shift in goods prices”. However, “services price inflation needs to cool further”. Companies need to “return to more normal pricing behavior”.

“Year-over-year and three-month rates of core inflation will both need to come down more than they have for inflation to return sustainably to 2%, as will short-term inflation expectations,” she said.

DOW broke key support as focus turns to NFP

DOW suffered a sharp decline overnight, losing -543.5 points or -1.66%, and broke an important near term support level. The banking sector led the sell-off, with the S&P 500’s bank index finishing down -6.6%. Investor caution was also evident ahead of today’s job data release. If the data shows strength, it would back up Fed Chair Jerome Powell’s indications of a 50bps rate hike, which could lead to higher rates that remain for longer. Good news could become bad news again, as investors remain wary of the potential consequences of higher interest rates on the market.

The non-farm payroll report is expected to show a growth of 200k jobs for February. Investors will also be closely monitoring any revisions made to January’s stellar 517k job growth. Unemployment rate is predicted to remain steady at 3.4%, while wage growth is expected to continue its momentum with a 0.3% mom rise.

Related data includes ADP private job report, which demonstrated a 242k increase in jobs for the same month, mostly driven by a 190k rise in the services sector. Meanwhile, ISM manufacturing employment index dropped from 50.6 to 49.1, while the ISM services employment index rose sharply from 50.0 to 54.0. The four-week moving average of initial jobless claims remained relatively stable at 197k. Overall, the data indicated a strong employment market, led by services.

Technically, the close below 38.2% retracement of 28660.94 to 34712.28 at 32400.66 suggests fall from 34712.28 is going to be a deep correction at least, with potential of being bearish reversal. Prior rejection by the 55 day EMA is also not a positive sign. Deeper decline is now in favor back to 61.8% retracement at 30972.55, if DOW couldn’t rebound in the coming days. Reactions from 30972 would reveal whether DOW is heading back through 28660.94 low to resume the down trend from last year’s high at 36952.65.

Looking ahead

UK GDP will be the main focus in European session with production and trade balance featured too. Later in the day, employment data from the US and Canada will take center stage.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3760; (P) 1.3788; (R1) 1.3831; More….

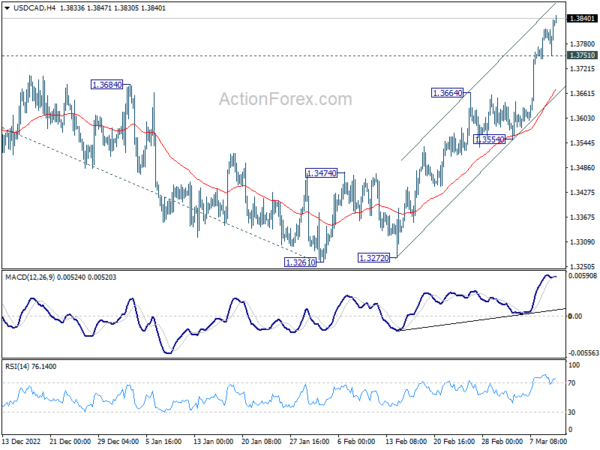

Intraday bias in USD/CAD remains on the upside for the moment. Rise from 1.3261 is in progress for retesting 1.3976 high. Firm break there will resume larger up trend and target 1.4234 projection level. On the downside, break of 1.3751 minor support will turn intraday bias neutral and bring consolidations. But retreat should be contained well above 1.3554 support to bring another rally.

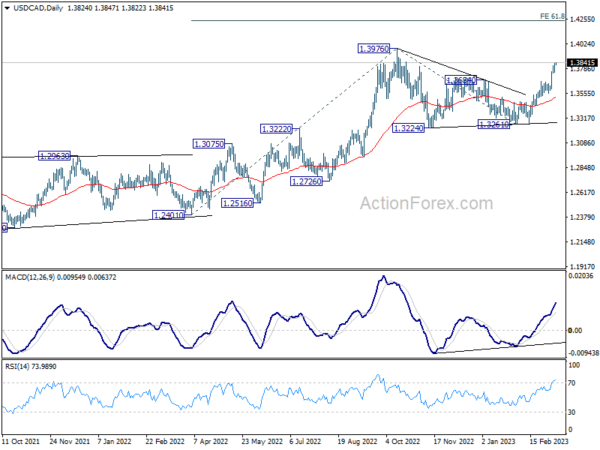

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, break of 1.3261 support is needed to confirm medium term topping. Otherwise, outlook remains bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Feb | 52 | 50.8 | 51.2 | |

| 21:45 | NZD | Manufacturing Sales Q4 | -0.40% | 5.10% | ||

| 23:30 | JPY | Household Spending Y/Y Jan | -0.30% | -0.20% | -1.30% | |

| 23:50 | JPY | PPI Y/Y Feb | 8.20% | 8.60% | 9.50% | |

| 02:31 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 07:00 | EUR | Germany CPI M/M Feb F | 0.80% | 0.80% | ||

| 07:00 | EUR | Germany CPI Y/Y Feb F | 8.70% | 8.70% | ||

| 07:00 | GBP | GDP M/M Jan | 0.10% | -0.50% | ||

| 07:00 | GBP | Manufacturing Production M/M Jan | -0.10% | 0.00% | ||

| 07:00 | GBP | Manufacturing Production Y/Y Jan | -5.70% | |||

| 07:00 | GBP | Industrial Production M/M Jan | -0.10% | 0.30% | ||

| 07:00 | GBP | Industrial Production Y/Y Jan | -4.00% | |||

| 07:00 | GBP | Goods Trade Balance (GBP) Jan | -17.5B | -19.3B | ||

| 12:00 | GBP | NIESR GDP Estimate (3M) Feb | -0.10% | |||

| 13:30 | USD | Nonfarm Payrolls Feb | 200K | 517K | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.30% | 0.30% | ||

| 13:30 | USD | Unemployment Rate Feb | 3.40% | 3.40% | ||

| 13:30 | CAD | Net Change in Employment Feb | 2.5K | 150.0K | ||

| 13:30 | CAD | Unemployment Rate Feb | 5.10% | 5.00% | ||

| 13:30 | CAD | Capacity Utilization Q4 | 83.30% | 82.60% |