- Gold price rallies on the knee-jerk after Nonfarm Payrolls.

- Gold price bulls eye a break of $1,850 to take back control.

Gold price had been moving higher for a third consecutive day on Friday but the yellow metal was on track for a weekly fall as prospects of further interest rate hikes dented the precious metal’s allure, while traders awaited a US Nonfarm Payrolls report.

The Nonfarm Payrolls report has arrived as follows:

US Nonfarm Payrolls

- US change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K).

- REVISIONS – US Change in Nonfarm Payrolls Feb: 311K (exp 225K; prev 517K; prevR 504K).

- US Unemployment Rate Feb: 3.6% (exp 3.4%; prev 3.4%).

- US Average Hourly Earnings (MoM) Feb: 0.2% (exp 0.3%; prev 0.3%).

- Average Hourly Earnings (YoY) Feb: 4.6% (exp 4.7%; prev 4.4%).

On the knee-jerk, Gold price has rallied to a fresh corrective high near $1,845 as markets price out the odds of a 50 basis point rate hike from the Federal Reserve this month. The main disappointments come in the Unemployment Rate that might have been expected to remain unchanged at a historically low level of 3.4%; while average hourly earnings were a big disappointment also.

However, when combined with yesterday’s JOLTS whereby the Federal Reserve’s favorite gauge of labor demand strength, the vacancies-over-unemployed ratio (“V/U ratio”), these reports do not bode well for a Fed that is hoping for a meaningful slowing of the labor market.

The analysts at TD Securities explained that yesterday, ”the V/U ratio remained at a historical high of 1.9 vacancies per unemployed person. In terms of quits, the quits rate did decline to 2.5%, a two-year low, but the lay-offs rate remained quite low at 1.1% and in line with what we’ve seen in 2022. Overall, a robust report in line with continued labor market strength,” the analysts argued.

Nevertheless, the Nonfarm Payrolls has missed the mark in some key areas although this could be regarded as a mean-revert in February after the gangbuster report that saw job creation surge to an unexpected 517k in January.

In the previous session, Jobless Claims surprised to the upside during the first week of March, jumping to above the 200k level for the first time in 8 weeks. The series printed 211k, up from 190k. This data took some sting out of the Federal Reserve chair Jerome Powell’s hawkish tones when he testified to Congress and warned that a 50 basis point hike was not off the table. However, it is worth noting that the average for claims in 2018-19 was 220k, so the series still remains somewhat below the pre-Covid trend.

Fed funds futures had already been showing that investors had decreased the likelihood of a 50bp hike by the Fed in March to 56%, after being as high as 75% following Powell’s speech this week.

Gold technical analysis

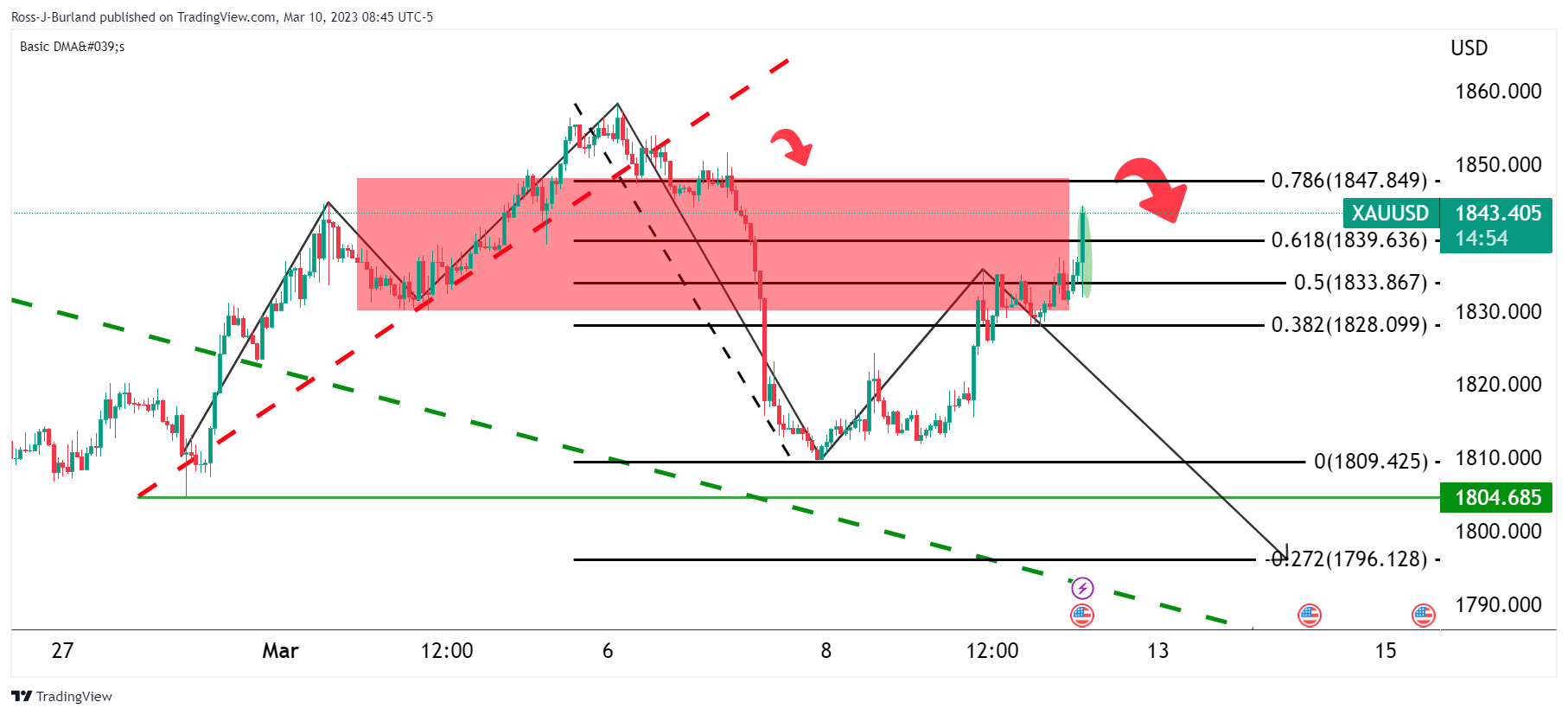

Leading into the event, Gold price crossed back above the $1,825 mark in the pursuit of the M-formation’s neckline around the 50% mean reversion mark:

Gold price update

As illustrated, Gold price has rallied on knee-jerk. There is a support location down at $1,804 with resistance above $1,850. If the bears move in again, then there will be prospects of a move to test the Gold price 200 DMA in the coming days with the $1,1770s eyed in that regard. If the $1,850 give way to bulls then there are prospects of a move above the M-formation’s double top with the $1900s exposed: