Dollar is gaining strength across the board as markets prepare for Fed Chair Jerome Powell’s semi-annual testimony in Congress. Powell’s views on the disinflationary process are expected to be a key focus, with traders also hoping for hints on the size of the upcoming rate hike and the outlook for the terminal rate.

Quick update: Fed Powell: Higher ultimate rate, ready to hike faster, no premature loosening

Australian Dollar is the worst performing currency of the day, following a sell-off post RBA meeting. Sterling and Swiss franc follow closely behind as the second weakest performers. Meanwhile, Kiwi and Euro are the second strongest. Canadian Dollar and Yen remain mixed, awaiting the BoC and BoJ rate decisions later in the week.

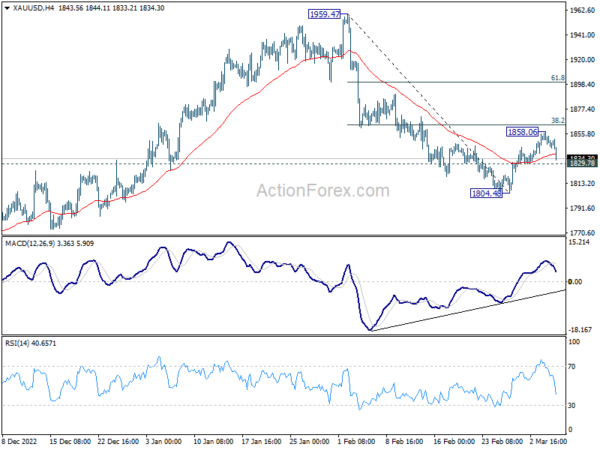

Technically, Gold’s pull back from 1858.06 gains some momentum today. Focus is now on 1829.78 support. Firm break there will argue that rebound from 1804.48 has completed, ahead of 38.2% retracement of 1959.47 to 1804.48. If that happens, the development will keep near term outlook in Gold bearish for another fall through 1804.48 low. That could be a leading signal of revival in Dollar’s rally.

In Europe, at the time of writing, FTSE is up 0.35%. DAX is up 0.11%. CAC is up 0.09%. Germany 10-year yield is down -0.0711 at 2.675. Earlier in Asia, Nikkei rose 0.25%. Hong Kong HSI dropped -0.33%. China Shanghai SSE dropped -1.11%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield rose 0.0017 to 0.505.

BoE Mann: There could be depreciation pressure on Sterling

BoE MPC member Catherine Mann warned that there could be depreciation pressure on Pound exchange rate if investor haven’t fully priced in recent hawkish message from Fed and ECB. Meanwhile, she reiterated that more are needed to be done regarding inflation.

“The important question for me with regard to the pound is how much of that existing hawkish tone (of Fed and ECB) is already priced into the pound”, Mann told BloombergTV. If it’s already priced in, then what we see is what we get. But if it’s not completely priced in, then there could be depreciation pressure” on Sterling.

Regarding interest rates, Mann said, “I’ve had recent speeches where I’ve indicated that I thought more needed to be done in order to ensure that expectations in particular are for a declining rate of inflation and the embeddedness to be mitigated.”

RBA hikes 25bps, notes lower risk of prices-wages spiral

RBA raised the cash rate target by 25bps to 3.60%, which was widely anticipated. The bank also signaled the need for further tightening of monetary policy. Nevertheless, there was a notable dovish twist in the the statement about a lower risk of prices-wages spiral.

The central bank said monthly CPI indicator suggested that “inflation has peaked in Australia”. The central forecasts is for inflation to decline this year and next to around 3% in mid-2025. Medium-term inflation expectations remain “well anchored”.

Growth over the next couple of years is expected to be “below trend”. Labor markets remains “very tight, although conditions have eased a little”. Wage growth is “still consistent with the inflation target” and “recent data suggest a lower risk of a cycle in which prices and wages chase one another”.

It indicated that “further tightening of monetary policy will be needed”. The timing and extent of further interest rate hikes will depend on “developments in the global economy, trends in household spending and the outlook for inflation and the labour market”.

China exports and imports continued to contract, but trade with Russia surged

Latest trade data from China showed that both exports and imports continued to declined in the first two months of the year. Trade with the US and the EU contracted, but trade with Russia was having extraordinary growth.

In the January-February period, China’s exports contracted -6.8% yoy, better than expectation of -9.4% yoy. Imports contracted -10.2% yoy, much worse than expectation of -5.5% yoy. Trade surplus ballooned to USD 116.9B, much larger than expectation of USD 82.5B

The data also revealed that exports to the US decreased by -21.8% yoy while imports dropped -5% yoy. Exports to the EU were also down -12.2% yoy while imports decreased -5.5% yoy. On the other hand, exports to Russia surged 19.8% yoy while imports also jumped by 31.3% yoy

In related news, Chinese Foreign Minister Qin Gang stated today the need to strengthen ties with Russia and suggested using “whatever currency that is efficient, safe and credible.”

Japan’s Wage Growth Disappoints in January, Real Earnings Fall the Most Since 2014

Japan’s nominal labor cash earnings rose by 0.8% yoy in January, below expectations of 1.9% yoy. The strong growth rate of 4.1% yoy in December was an anomaly due to lump-sum payments, rather than regular wage rises. The level of wage growth is far below the required level needed to maintain a 2% inflation rate, as indicated by outgoing BoJ Governor Haruhiko Kuroda.

Moreover, real cash earnings of workers have declined by -4.1% yoy, indicating that their real wages have fallen the most since 2014. The continuous decline in real wages for ten consecutive months shows that inflation has surpassed earnings.

Later in the week, BoJ is expected to keep its ultra-loose monetary policy unchanged, including the negative short-term interest rate of -0.10% and the 10-year yield cap at 0.50% at Kuroda’s final meeting before handing over the reins to Kazuo Ueda. The declining real wages poses a challenge for the incoming governor to achieve the inflation target set by the central bank.

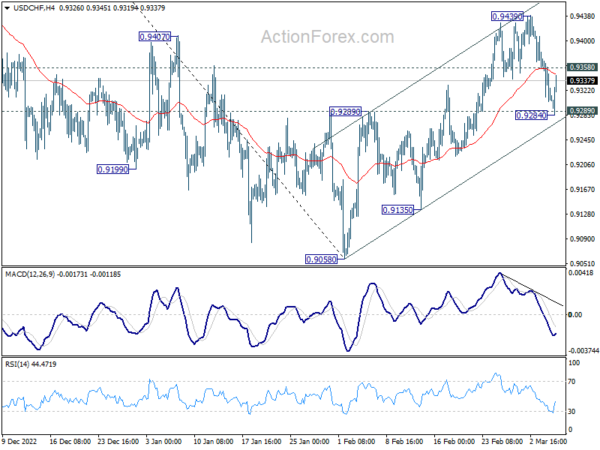

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9286; (P) 0.9330; (R1) 0.9353; More…

USD/CHF recovered notably after brief breach of 0.9289 resistance turned support, and intraday bias is turned neutral first. The favored case is still that corrective rebound from 0.9058 has completed at 0.9439, ahead of 38.2% retracement of 1.0146 to 0.9058 at 0.9474. Sustained break of 0.9289 resistance turned support will pave the way to retest 0.9058 low. However, break of 0.9358 minor resistance will revive near term bullishness and turn bias back to the upside for 0.9439 again.

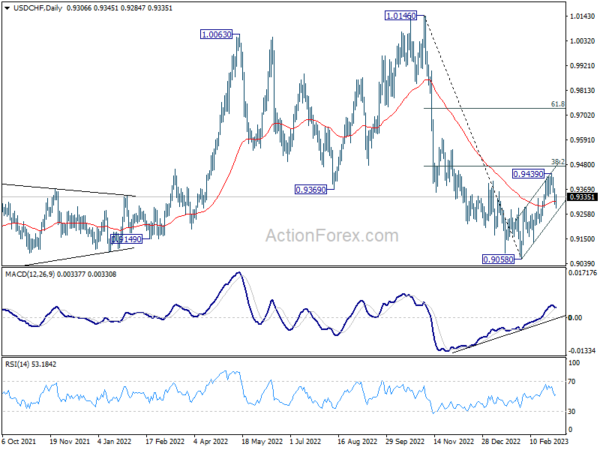

In the bigger picture, decline from 1.0146 is seen as part of a long term sideway pattern. As long as 38.2% retracement of 1.0146 to 0.9058 at 0.9474 holds, another fall is in favor through 0.9058. However, sustained trading above 0.9474 will indicate that the medium term trend has reversed, and open up further rally to 61.8% retracement at 0.9730 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jan | 0.80% | 1.90% | 4.80% | 4.10% |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Feb | 4.90% | 3.90% | ||

| 00:30 | AUD | Trade Balance (AUD) Jan | 11.69B | 12.25B | 12.24B | 12.99B |

| 03:30 | AUD | RBA Interest Rate Decision | 3.60% | 3.60% | 3.35% | |

| 06:45 | CHF | Unemployment Rate Feb | 1.90% | 1.90% | 1.90% | |

| 07:00 | EUR | Germany Factory Orders M/M Jan | 1.00% | -0.90% | 3.20% | 3.40% |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 771B | 784B | 785B | |

| 15:00 | USD | Fed Chair Powell Testifies | ||||

| 15:00 | USD | Wholesale Inventories Jan F | -0.40% | -0.40% |