Mixed market sentiment led to a recovery in Yen during Asian session. Nikkei opened higher following a strong close in Wall Street on Friday. Meanwhile, stocks in Hong Kong and China were sluggish despite China’s announcement of an ambitious growth target of around 5% this year. Euro and Swiss Franc are trailing the Yen higher, with the help of buying against the Sterling, Australian Dollar is leading New Zealand Dollar lower, despite expectations of another RBA rate hike tomorrow. Dollar is mixed ahead of Fed Chair Jerome Powell’s testimony and non-farm payroll report later in the week.

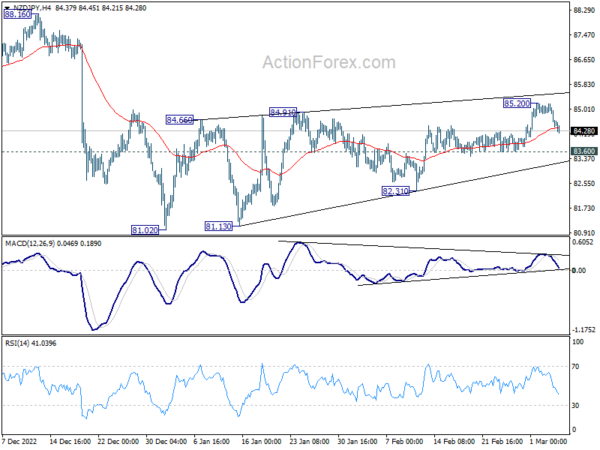

From a technical standpoint, the price actions of NZD/JPY from 81.02 are likely corrective in nature, in form of a five-way triangle pattern that may have completed at 85.20 already. The focus is now on 83.60 support, and a decisive break could add to the bearish view and bring deeper decline to retest 81.02 low. Another rise could still occur as long as 83.60 holds, but upside potential should be limited. Additionally, a break through the 135.24 support in USD/JPY could accelerate the selloff in NZD/JPY.

In Asia, at the time of writing, Nikkei is up 1.16%. Hong Kong HSI is up 0.04%. China Shanghai SSE is down -0.24%. Singapore Strait Times is down -0.17%. Japan 10-year JGB yield is up 0.0043 at 0.510.

ECB Lagarde: Recent economic indicators confirming 50bps hike in March

ECB President Christine Lagarde reiterated that it’s “very, very likely” for the central bank to raise interest rate by 50bps this month. The decision was indicated at the last monetary policy meeting, and all recent economic indicators are confirming that this interest rate hike is likely.

“It is very likely that we will raise interest rates by 50 basis points,” she said in an interview published on Sunday. “This was a decision that was indicated at our last monetary policy meeting and all the numbers we have been seeing in recent days are confirming that this interest rate hike is very, very likely.”

“Headline inflation has gone down in recent months, and will continue to decline in the next few months,” she said. However, “core inflation, which in the euro area excludes energy and food, is too high.”

“The way forward is clear: we have to continue to take the measures needed to bring inflation back to 2%. And we will do so,” she added.

“My main concern is inflation. We don’t want to break the economy; that’s not our goal.” Lagarde said. “Our goal is to tame inflation.”

“As a central bank, interest rate hikes are our main tool to achieve that. Raising interest rates dampens demand and reduces inflationary pressures,” she added.

Fed Daly: Disinflation momentum uncertain, further tightening necessary

San Francisco Fed President Mary Daly said that the uptick in headline and core inflation rates in January indicates that disinflation momentum is uncertain, and further policy tightening is necessary to combat high inflation.

“After months of decline, headline and core inflation both ticked up in January on a 12-month basis, and the monthly inflation rate rose at its fastest pace in seven months,” Daly said in a speech on Saturday. “This suggests that the disinflation momentum we need is far from certain.”

“It’s clear there is more work to do,” she added. “In order to put this episode of high inflation behind us, further policy tightening, maintained for a longer time, will likely be necessary.”

“Achieving our mandated goals takes time and a broader view,” she said. “As policymakers, we have to respond to an economy that is evolving in real time and prepare for what the economy will look like in the future.”

RBA to tighten further, BoC and BoJ to stand pat, Fed Powell to testify

This week, focus in the financial world will be on the meetings of three central banks, as investors keenly await their decisions on interest rates. RBA is widely expected to continue its tightening policy and raise the cash rate by a further 25bps to 3.60%.

The big question is whether RBA will revert to hinting at a pause in rate hikes. In December, the central bank indicated that rate hikes were “not on a pre-set course,” but then dropped this language in February’s statement, with minutes suggesting a pause was not being even considered. The indication of an imminent pause, of the lack thereof, could be a sign of whether rate will peak at 3.85% in April or 4.10% in May.

Meanwhile, BoC and the BoJ are both expected to keep their monetary policies unchanged. The BoC has indicated that it is now in a conditional pause in tightening, while the BoJ is likely to leave any potential adjustments to its incoming governor, Kazuo Ueda.

In the US, Federal Reserve Chair Jerome Powell will testify before Congress, where market participants will be looking for clues on the potential for a 50bps rate hike this month and where interest rates may peak. However, Powell is likely to hold his cards until the Fed’s announcement on March 22, two weeks away.

In terms of data, US non-farm payrolls will be a major highlight, while Canada will also publish its employment report. UK GDP and production data, Eurozone Sentix investor confidence and retail sales, Australia retail sales, and China inflation data will also be watched closely.

Here are some highlights for the week:

- Monday: Swiss CPI; Eurozone Sentix investor confidence, retail sales; UK PMI construction; Canada Ivey PMI; US factory orders.

- Tuesday: Japan average cash earnings; RBA rate decision, Australia trade balance, retail sales; Swiss unemployment rate, foreign currency reserves; Germany factory orders

- Wednesday: Japan current account, leading indicators; Germany industrial production, retail sales; Eurozone GDP final; US ADP employment, trade balance, Fed Beige Book; BoC rate decision, Canada trade balance.

- Thursday: Japan GDP final, M2 money supply; China CPI, PPI; US Challenger job cuts, jobless claims.

- Friday: New Zealand BusinessNZ manufacturing, manufacturing sales; BoJ rate decision, Japan PPI, household spending; Germany CPI final; UK GDP, trade balance, productions; Canada employment; US non-farm payrolls.

USD/JPY Daily Outlook

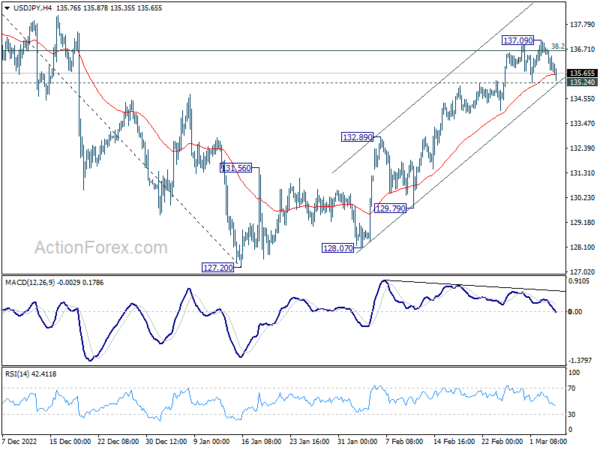

Daily Pivots: (S1) 135.45; (P) 136.12; (R1) 136.50; More…

Intraday bias in USD/JPY stays neutral for the moment. On the downside, break of 135.24 support will indicate short term topping, after rejection by 38.2% retracement of 151.93 to 127.20 at 136.64. Intraday bias will be turned back to the downside for 55 day EMA (now at 133.96) first. Sustained break of 55 day EMA will indicate that whole rebound from 127.20 has completed. On the upside, however, sustained break of 136.64 will indicate that fall from 151.93 has completed, and bring further rally to 61.8% retracement at 142.48.

In the bigger picture, focus remains on 38.2% retracement of 151.93 to 127.20 at 136.64. Sustained break there will indicate that price actions from 151.93 medium term are merely a corrective pattern. Such development will maintain long term bullishness. Rejection by 136.64 will, on the other hand, extend the fall from 151.93 to 61.8% retracement of 102.58 to 151.93 at 121.43 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | TD Securities Inflation M/M Feb | 0.40% | 0.90% | ||

| 07:30 | CHF | CPI M/M Feb | 0.40% | 0.60% | ||

| 07:30 | CHF | CPI Y/Y Feb | 2.90% | 3.30% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Mar | -5.6 | -8 | ||

| 09:30 | GBP | Construction PMI Feb | 48.5 | 48.4 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Feb | 1.00% | -2.70% | ||

| 15:00 | USD | Factory Orders M/M Jan | -1.50% | 1.80% | ||

| 15:00 | CAD | Ivey PMI Feb | 55.9 | 60.1 |