Yen and Swiss Franc recovered today following pullback in benchmark US and European yields. Dollar and Canadian are the softer ones for today while European majors are mixed. Hawkish comments from ECB officials are shrugged off by the common currency. Instead, Euro turned softer after weaker than expected PPI inflation data.

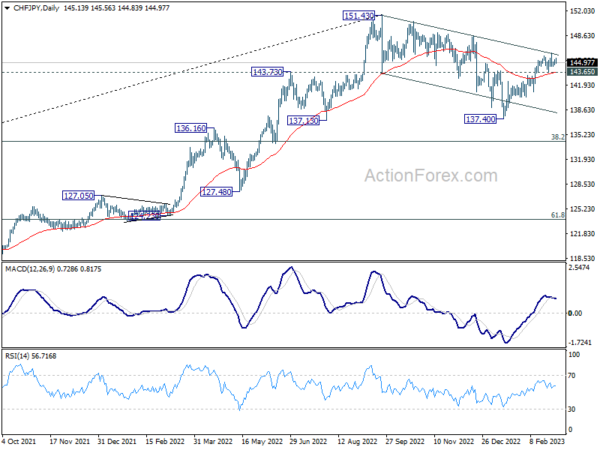

Technically, CHF/JPY’s rebound from 137.40 stalled after touching falling trend line resistance. For now, further rise is in favor as long as 143.65 support holds. Sustained break of the trend line will set the stage to retest 151.43 high. However, break of 143.65 will argue that corrective pattern from 151.43 is still in progress and is starting another falling leg.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is up 0.92%. CAC is up 0.60%. Germany 10-year yield is down -0.032 at 2.718. Earlier in Asia, Nikkei rose 1.56%. Hong Kong HSI rose 0.68%. China Shanghai SSE rose 0.54%. Singapore Strait Times dropped -0.09%. Japan 10-year JGB yield rose 0.0086 to 0.506.

ECB de Guindos: Underlying inflation is very, very important

ECB Vice President Luis de Guindos said that headline inflation could fall from 8.5% to 6% by mid-2023. However, core inflation could be more stable.

“In March we’ll have some projections, we’ll have more data on the evolution of underlying inflation,” Guindos said at CUNEF University. “Underlying inflation is very, very important.”

De Guindos also emphasized that inflation will have to clearly converge towards 2% target before the central bank could pause the tightening cycle.

ECB Muller: March hike likely not the last rise in this cycle

ECB Governing Council member Madis Muller said, “it’s most likely this won’t be the last rate rise in this cycle,” referring the the intended 50bps hike this month.

“It’s quite possible that interest rates will need to stay high for quite some time so that we can be sure that inflation will come back to, and remain at, close to 2%,” he added.

“Headline inflation started to come down toward the end of last year, mainly thanks to a decline in energy prices, and it fell to 8.5% in January. More worrying however is that core inflation has remained persistently high at more than 5%, as the underlying price pressures aren’t yet receding,” Muller said.

“If we hesitate, we may later have to raise interest rates much higher, and keep them high for much longer, in order to get inflation down to the target of 2% and to keep it there” he noted.

ECB Vasle: March rate hike to be followed by additional increases

ECB Governing Council member Bostjan Vasle said,

“my personal expectations is that the increase we intend for our March meeting — that is 0.5 percentage points — will not be the last one.”

March rate hike “will be followed by additional increases before we reach a level that will be sufficient to bring inflation back to the trajectory towards our goal of 2% inflation,” he added.

Eurozone PPI at -2.8% mom, 15.0% yoy in Jan

Eurozone PPI fell -2.8% mom in January, below expectation of -0.3% mom. Compared with January 2022, industrial producer prices increased by 15.0% yoy, below expectation of 17.7% yoy.

For the month, industrial producer prices in Eurozone decreased by -9.4% mom in the energy sector, while prices increased by -0.8% mom for intermediate goods, by -1.2% mom for capital goods, by -1.5% mom for non-durable consumer goods and by -1.6% mom for durable consumer goods. Prices in total industry excluding energy increased by 1.1% mom.

EU PPI was at -2.2% mom, 16.4% yoy. The largest monthly decreases in industrial producer prices were recorded in Ireland (-25.2%), Sweden (-8.0%) and Latvia (-5.8%), while the highest increases were observed in Slovakia (9.0%), Czechia and Hungary (both 5.8%) and Austria (4.9%).

Eurozone PMI composite finalized at 52 in Feb, a resounding expansion of business activity

Eurozone PMI Services was finalized at 52.7 in February, up from January’s 50.8. PMI Composite was finalized at 52.0, up from prior month’s 50.3. Both were at their 8-month highs.

Looking at some member state, PMI composite improved in Spain (55.7, 9-month high), Ireland (54.5, 9-month high), Italy (52.2, 9-month high), France (51.7, 7-month high) and Germany (50.7, 8-month high).

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “A resounding expansion of business activity in February helps allay worries of a eurozone recession, for now. Doubts linger about the underlying strength of demand… Nevertheless, there are clear signs that business confidence has picked up from the lows seen late last year…

“There is a concern, however, that signs of persistent elevated selling price inflation, combined with the surprising resiliency of the economy, will embolden the ECB into more aggressive monetary policy tightening, which poses a downside risk to demand growth in the months ahead.”

UK PMI services finalized at 53.5, fading recession fears and improving business confidence

UK PMI Services was finalized at 53.5 in February, up from January’s 48.6. PMI Composite was finalized at 53.1, up from prior month’s 48.5. Both were their strongest readings since June 2022.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “UK service providers moved back into expansion mode in February as fading recession fears and improving business confidence resulted in the strongest rise in new orders since May 2022. However, elevated borrowing costs and stretched household finances remained constraints on growth.

“There was clear evidence that input price inflation has peaked, with the latest increase in average cost burdens the weakest since June 2021… Tight labour market conditions and the need to alleviate squeezed margins continued to limit the degree to which falling cost pressures were passed on to end consumers.”

China PMI services rose to 55.0, composite rose to 54.2

China Caixin PMI Services rose from 52.9 to 55.0 in February, above expectation of 54.7. That’s also the highest reading since April 2021. PMI Composite rose from 51.1 to 54.2, highest since May 2021.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Both manufacturing and services activity recovered gradually. Production, demand, including external demand, and employment all grew, with services activity showing a stronger recovery than manufacturing output. Input costs and prices charged remained stable, and business owners were highly optimistic.”

USD/JPY Mid-Day Outlook

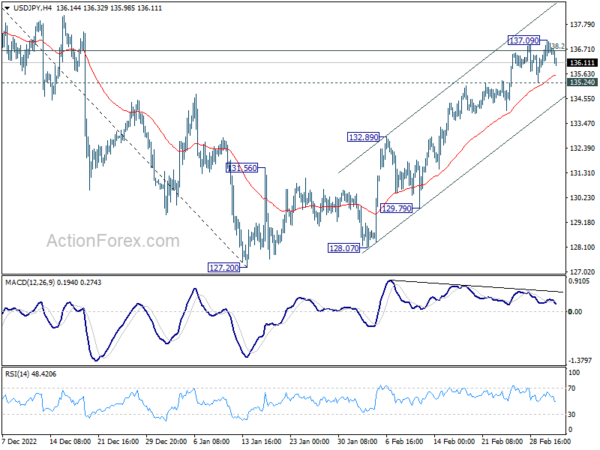

Daily Pivots: (S1) 136.16; (P) 136.63; (R1) 137.23; More…

Intraday bias in USD/JPY is turned neutral again with current retreat. On the downside, break of 135.24 support will indicate rejection by 38.2% retracement of 151.93 to 127.20 at 136.64. Intraday bias will be back on the downside for 55 day EMA (now at 133.92) first. On the upside, however, sustained break of 136.64 will indicate that fall from 151.93 has completed, and bring further rally to 61.8% retracement at 142.48.

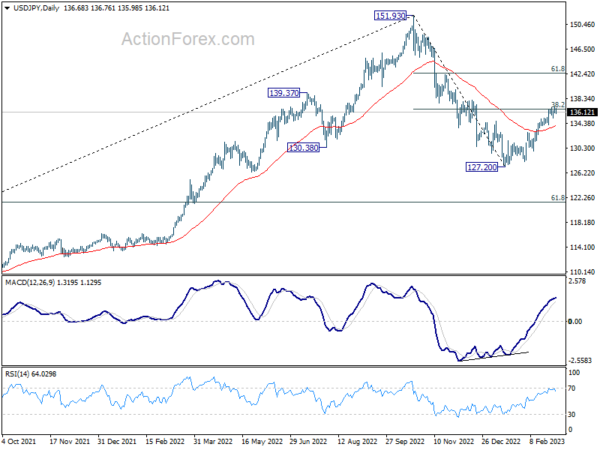

In the bigger picture, focus is now on 38.2% retracement of 151.93 to 127.20 at 136.64. Sustained break there will indicate that price actions from 151.93 medium term are merely a corrective pattern. Such development will maintain long term bullishness. Rejection by 136.64 will, on the other hand, extend the fall from 151.93 to 61.8% retracement of 102.58 to 151.93 at 121.43 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Feb | 3.30% | 3.30% | 4.30% | |

| 23:30 | JPY | Unemployment Rate Jan | 2.40% | 2.50% | 2.50% | |

| 01:45 | CNY | Caixin Services PMI Feb | 55 | 54.7 | 52.9 | |

| 07:00 | EUR | Germany Trade Balance (EUR) Jan | 16.7B | 11.2B | 10.0B | |

| 07:45 | EUR | France Industrial Output M/M Jan | -1.90% | -0.2 | 1.10% | 1.50% |

| 08:45 | EUR | Italy Services PMI Feb | 51.6 | 52.4 | 51.2 | |

| 08:50 | EUR | France Services PMI Feb F | 53.1 | 52.8 | 52.8 | |

| 08:55 | EUR | Germany Services PMI Feb F | 50.9 | 51.3 | 51.3 | |

| 09:00 | EUR | Eurozone Services PMI Feb F | 52.7 | 53 | 53 | |

| 09:30 | GBP | Services PMI Feb F | 53.5 | 53.3 | 53.3 | |

| 10:00 | EUR | Eurozone PPI M/M Jan | -2.80% | -0.30% | 1.10% | |

| 10:00 | EUR | Eurozone PPI Y/Y Jan | 15.00% | 17.70% | 24.60% | |

| 13:30 | CAD | Building Permits M/M Jan | -4.00% | 1.70% | -7.30% | |

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -0.50% | 0.20% | 0.60% | |

| 14:45 | USD | Services PMI Feb F | 50.5 | 50.5 | ||

| 15:00 | USD | ISM Services PMI Feb | 54.4 | 55.2 |