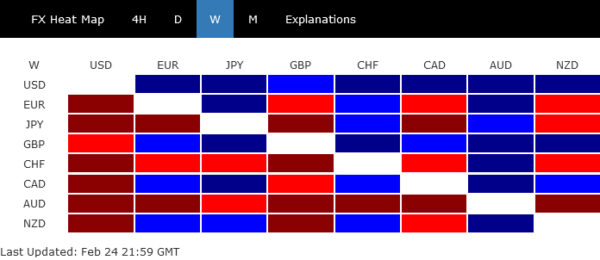

Dollar rose broadly last week and ended as the strongest one, as markets added bets on a higher Fed terminal rate after re-acceleration in inflation data. Sterling ended as second after strong services data, which also supported Euro, while Canadian was the third after higher than expected inflation reading. Aussie was the worst performer on deteriorating risk sentiment, followed by Yen and Swiss Franc on rising benchmark yields.

So far, the pull back in stock indexes was not disastrous. Rebound in the Dollar index could still be a corrective move. But first few weeks in March would be crucial. Technically, the next moves should decide the overall tone for the rest of the first half, for stocks, yields, and forex.

Strong data dashed Fed’s disinflation hope

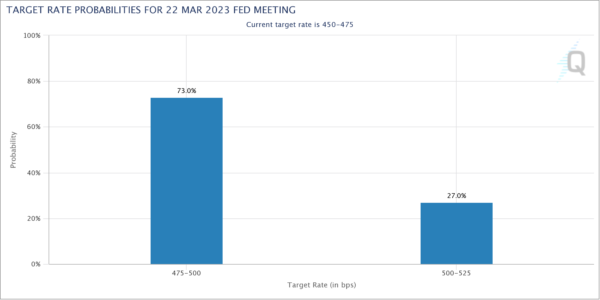

January data from the US released last week showed both headline and core PCE inflation reaccelerated, dashing hope of continuation of the disinflation process. While there were talks that Fed could revert to 50bps rate hike at next meeting, they’re not much translated to market pricing yet. There are still a lot of important data between now and March 22, including ISMs next week, NFP the week after, and then CPI and retail sales two weeks from now. Traders might find it still a bit early to bet on Fed pushing the panic button.

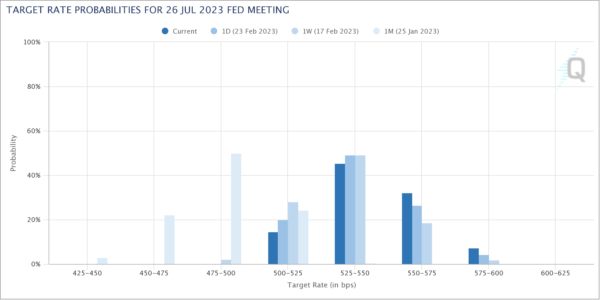

As indicated by Fed fund futures, there is still 73% chance of another 25bps hike in March to 4.75-5.00%, just 27% chance of a 50bps hike. What’s more important is that markets are pricing in nearly 40% chance of one more hike in July to 5.50-5.75%, i.e. a higher terminal rate, comparing to just 20% a week ago and 0% a month ago. Pricing for July should be watched together with March in the coming weeks.

Meanwhile, economic data from some other countries were also supportive to more tightening. PMI data from Eurozone and the UK indicated that service sectors picked up much momentum in February, and are leading the economies out of recession risk.

As for ECB, a 50bps hike in March is a done deal and terminal rate would be reached in summer. Questions are whether rate will peak at the beginning or the end of summer, and what will happen in between. For now, an expectation of 3.75% peak of the main refinancing rate, i.e. one more 25bps hike after March, looks like an under-estimate. Meanwhile, BoE’s tightening should continue in March, probably with a slower pace of 25bps to 4.25%. May’s decision for BoE is uncertain.

While inflation in Canada slowed, the readings were stronger than expected. One month of data will certainly not pull BoC out of the pause. Also, February job data will only be released after March 8 BoC meeting. Yet, there is no guarantee that the next move after the pause, no matter how long, is a cut. Indeed, markets are pricing in the chance of one more hike this year, before a another pause and then a cut by the end of next year.

US stocks closed lower, but not disastrous (…yet?)

US stocks closed deeply lower last week but overall development was not disastrous yet. DOW is still holding in range for now and the price actions from 34712.28 could still be just a sideway consolidation pattern. As long as 38.2% retracement of 28600.94 to 34712.28 at 32400.66 holds, rise from 28660.94 should resume sooner rather than later. However, firm break of 32400.66 will at least bring deeper fall to 61.8% retracement at 30972.55, with risk of resuming whole down trend from 36952.65 high.

NASDAQ is currently trying to draw support from 55 day EMA (now at 11374.29). Rebound from current level will maintain near term bullishness, for at least one more take on 38.2% retracement of 16212.22 to 10207.47 at 12415.87. However, sustained break of 55 day EMA will raise the chance of resuming larger down trend from 16212.22.

Development in S&P 500 is relatively more bearish, with break of 55 day EMA (now at 4003.19) and trendline support. Deeper decline towards 3764.49 will raise the chance that rebound from 3491.58 has completed with three waves up to 4195.44. Further break there could also set the stage for resuming the down trend from 4818.62 high. Let’s see if SPX’s dip was an overreaction (relative to DOW and NASDAQ), or an early warning.

10-year yield heading back to 4.333 high

US 10-year yield finally broke through 3.905 near term resistance last week. The development affirmed that whole correction from 4.333 has completed with three waves down to 3.373. Further rise is now expected as long as 55 day EMA (now at 3.677) holds. Retest of 4.333 high would be seen next. A break there is not envisaged for now, but even in that case, strong resistance should be seen from 61.8% projection of 2.525 to 4.333 from 3.334 at 4.451 to limit upside.

Dollar index extended rebound, still seen as a corrective rise

Dollar index’s rebound from 100.82 continued last week as expected, but slight acceleration is a surprise. For now, such rise is still seen as a corrective move only. Strong resistance could be seen from 38.2% retracement of 114.77 to 100.82 at 106.14 to limit upside. Firm break of 55 day EMA (now at 104.05) will bring retest of 100.82 low.

However, decisive break of 106.14 will raise the chance of trend reversal, and bring stronger rally back to 61.8% retracement at 109.44 at least. If happens, that would most likely mean a turn in overall risk sentiment, with the bearish scenario in US stocks as mentioned above playing out. Also, that might be accompanied by strong break of 4.451 projection level in 10-year yield.

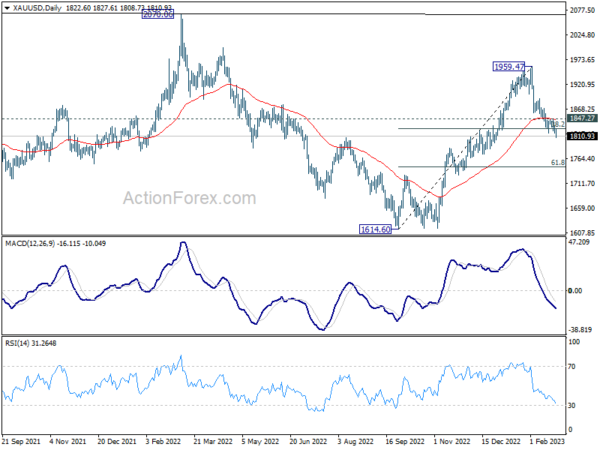

Gold extended decline, a hint on more Dollar upside?

Gold’s development would be used as a gauge on Dollar as usual. Decline from 1959.47 extended last week and the rejection by 55 day EMA is a sign of bearishness. Sustained trading below 38.2% retracement of 1614.50 to 1959.47 at 1827.72 will raise the chance of near term reversal and bring deeper fall to 61.8% retracement at 1746.34 and possibly below. Such bearish development could be accompanied by break firm break of 106.14 fibonacci support in Dollar Index mentioned above.

On the other hand, rebound from current level, followed by break of 1847.27 resistance, will revive near term bullishness and bring stronger rebound back towards 1959.47 high. That could be accompanied by Dollar Index’s rejection by 106.14.

Bitcoin still struggling to break through 25198 resistance

Development in Bitcoin will also be used as a gauge to overall risk sentiment. For now, Bitcoin has yet to overcome 25198 resistance firmly. It had indeed retreated from there. But downside is support well above 21357 support so far. Thus, near term bullishness is maintained for breaking through 25198/242 soon.

However, firm break of 21357 would indicate the rebound from 15452 has completed and risk deeper fall back to retest this low. That, if happens, could be accompanied by deeper selloff in NASDAQ back towards 10088.82 low.

AUD/USD Weekly Report

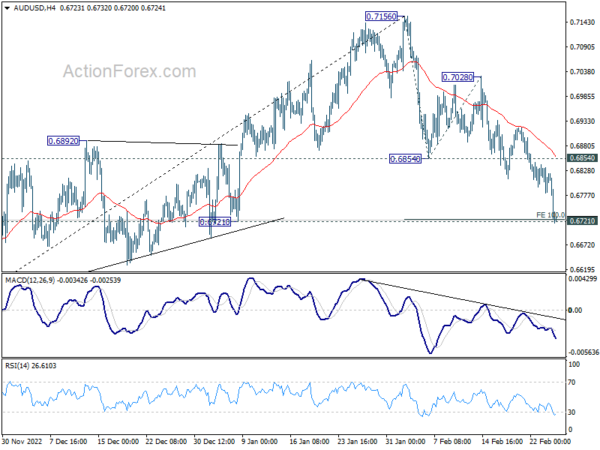

AUD/USD’s decline from 0.7156 continued last week and accelerated to as low as 1.6716. There is no sign of bottoming yet. Immediate focus is on 0.6721 support this week. Decisive break there will carry larger bearish implication. Next target is 161.8% projection of of 0.6854 to 0.7028 from 0.6854 at 0.6539. On the upside, break of 0.6854 support turned resistance will argue that the pull back has completed, and turn bias back to the upside.

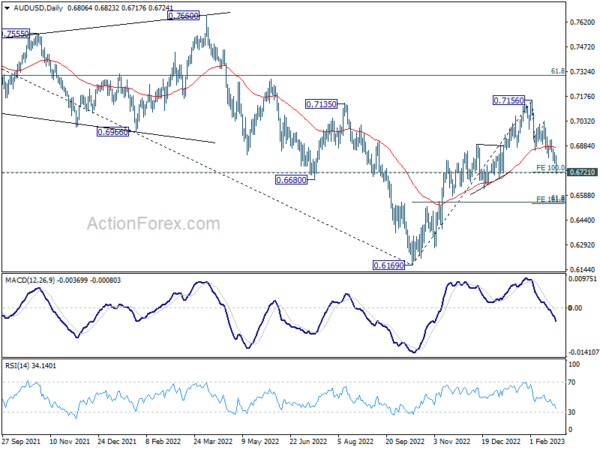

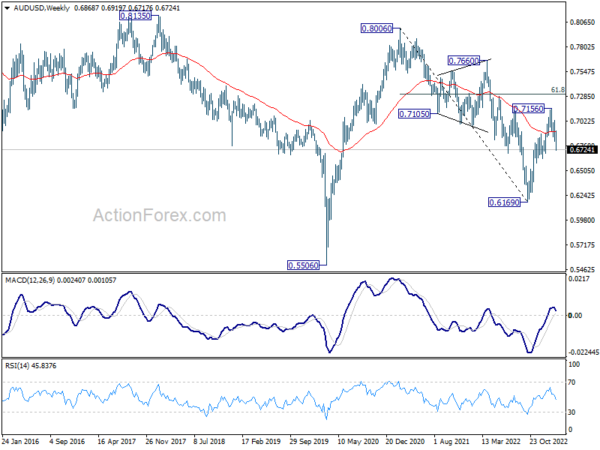

In the bigger picture, focus is now on 0.6721 structural support. Sustained break there will argue that whole rise from 0.6169 (2022 low) has completed at 0.7156, after rejection by 55 month EMA (now at 0.7179). Deeper decline would then be see back to 61.8% retracement of 0.6169 to 0.7156 at 0.6546, even as a corrective fall. Nevertheless, strong rebound from current level will retain medium term bullishness for another rise through 0.7156 later.

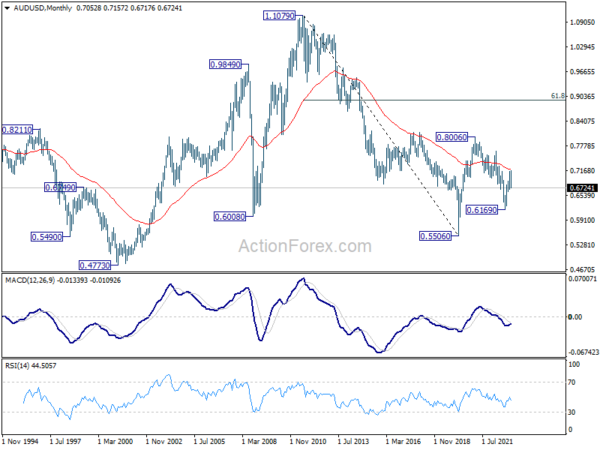

In the long term picture, initial rejection by 55 month EMA (now at 0.7179) retains long term bearishness. That is, down trend from 1.1079 (2011 high) could still resume through 0.5506 (2020 low) on resumption.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)