Sterling rises broadly today as stronger than expected PMI data indicate that near-term recession odds have fallen considerably. European majors are also trading higher after positive Eurozone PMI and Germany ZEW. Nevertheless, Dollar is following the Pound as the second strongest, with some help from risk aversion. Australian Dollar is the worst performing one, followed by Yen, and then other commodity currencies.

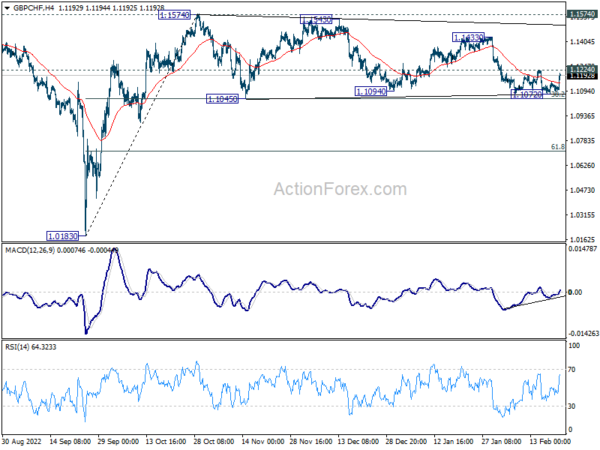

Technically, while the near term reversal is delayed, GBP/CHF’s bounce today argue that fall from 1.1433 might have finally completed at 1.1072. Break of 1.1224 will also suggest that whole consolidation from 1.1574 has completed too, and rise from 1.0183 is ready to resume. Let’s see Sterling could ride on the current momentum further.

In Europe, at the time of writing, FTSE is down -0.41%. DAX is down -0.47%. CAC is down -0.39%. Germany 10-year yield is up 0.0515 at 2.516. UK 10-year yield is up 0.127 at 3.600. Earlier in Asia, Nikkei dropped -0.21%. Hong Kong HSI dropped -1.71%. China Shanghai SSE rose 0.49%. Singapore Strait Times dropped -0.06%. Japan 10-year JGB yield dropped -0.0018 to 0.503.

Canada CPI slowed to 5.9% yoy in Jan, Ex food and energy down to 4.9% yoy

Canada CPI slowed from 6.3% yoy to 5.9% yoy in January. StatsCan noted that “Prices for cellular services and passenger vehicles contributed to the deceleration in the all-items CPI. However, mortgage interest cost and prices for food continue to rise.” Excluding food and energy, CPI also slowed to 4.9% yoy while ex-mortgage CPI slowed to 5.4% yoy.

CPI median was unchanged at 5.0% yoy. CPI trimmed slowed form 5.3% yoy to 5.1% yoy. CPI common was unchanged at 6.6% yoy.

On a monthly basis, CPI rose 0.5% mom. Higher gasoline prices contributed the most to the month-over-month increase, followed by a rise in mortgage interest cost and meat prices.

Canada retail sales rose 0.5% mom in Dec

Canada retail sales rose 0.5% mom to CAD 62.1B in December. Sales increased in 7 of 11 subsectors, representing 75.1% of retail trade. Higher sales at motor vehicle and parts dealers (+3.8%) and general merchandise stores (+1.7%) led the increase. Ex-gasoline and auto sales rose 0.4% mom. In volume term, retail sales increased 1.3% mom.

Advance estimate suggests that retail sales rose further by 0.7% mom in January.

UK PMI composite jumped to 53, near-term recession odds fallen considerably

UK PMI Manufacturing rose from 47.0 to 49.2 in February, a 7-month high. PMI Services rose sharply from 48.7 to 53.3, an 8-month high. PMI Composite jumped from 48.5 to 53.0, an 8-month high.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said: “Much better than anticipated PMI data for February indicate encouraging resilience of the economy in the face of headwinds which include rising interest rates, the ongoing cost of living crisis, labour shortages and strikes…

“However, while the data suggest that near-term recession odds have fallen considerably, elevated inflation pressures clearly remain a concern, especially in the service sector. As such, the resilience of the economy and the stickiness of the survey’s inflation gauges add to the likelihood of the Bank of England tightening policy further, and potentially more aggressively, which may dampen future growth expectations and suggests that the possibility of recession later in the year should not be ruled out.”

Eurozone PMI composite rose to 52.3, accelerating growth and stubbornly elevated price pressures

Eurozone PMI Manufacturing dropped from 48.5 to 48.8 in February. PMI Services rose from 50.8 to 53.0, an 8-month high. PMI Composite rose from 50.3 to 52.3, a 9-month high.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Business activity across the eurozone grew much faster than expected in February, with growth hitting a nine-month high thanks to resurgent service sector activity and a recovering manufacturing economy. February’s PMI is broadly consistent with GDP rising at a quarterly rate of just under 0.3%….

“However, although inflationary pressures have continued to moderate in February, the survey hints at persistent elevated price trends in the service sector, linked in part to higher wage growth, which will concern ECB policymakers. The combination of accelerating growth and stubbornly elevated price pressures will naturally encourage a bias towards further policy tightening in the months ahead.”

German ZEW rose to 28.1, but current situation still unfavorable

Germany ZEW Economic Sentiment rose form 16.9 to 28.1 in February, above expectation of 22.8. Current Situation index rose from -58.6 to -45.1, above expectation of -50.0.

Eurozone ZEW Economic sentiment rose form 16.7 to 29.7, above expectation of 22.3. Current Situation Index rose 13.2 pts to -41.6.

ZEW President Professor Achim Wambach said: “Meanwhile a large fraction of the survey participants expects the economic situation to improve in six months’ time. However, the current situation is still assessed as relatively unfavourable.

“As in the previous month, the increase in expectations can be traced back to higher profit expectations in the energy- and export-oriented sectors as well as the consumer-related parts of the economy. Expectations for long-term interest rates are also rising and the banking sector indicator has reached its highest level since 2004.”

RBA minutes: 25bps and 50bps hike considered at Feb meeting

Minutes of RBA’s February 7 meeting revealed that both the options of 25bps and 50bps hike were considered. But the case for a 25bps hike was stronger, with “the monthly meetings provided the Board with frequent opportunities to assess how these uncertainties were being resolved and to adjust policy if needed”.

The minutes also noted, “members agreed that further increases in interest rates are likely to be needed over the months ahead to ensure that inflation returns to target and that the current period of high inflation is only temporary.”

Australia PMI composite rose to 49.2, on the narrow path to achieve soft landing

Australia PMI Manufacturing ticked up from 50.0 to 50.1 in February. PMI Services rose from 48.6 to 49.2. PMI Composite also rose from 48.5 to 49.2.

Warren Hogan, Chief Economic Advisor at Judo Bank said: “Australian business activity improved in February 2023 with a second consecutive small rise in the flash composite output index to 49.2. The economy has slowed from the strong rates of growth in 2022 to be on a more sustainable footing in early 2023. We still appear to be on the narrow path to achieve a soft landing for the economy in 2023…

“At this stage the Judo Bank PMIs are pointing to a welcome slowdown in the economy that may help take upward pressure off interest rates. While this will do little to alter the RBA’s intentions to raise interest rates further over the months ahead, it does indicate that we may be close to the point where the RBA Board can pause the current tightening cycle.”

Japan PMI manufacturing dropped to 47.4, services rose to 53.6

Japan PMI Manufacturing dropped from 48.9 to 47.4 in February, below expectation of 49.3. It’s also the worst reading in over two-and-a-half years. Manufacturing Output dropped sharply from 47.2 to 44.9. PMI services, on the other hand, rose from 52.3 to 53.6. PMI Composite was unchanged at 50.7.

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“The modest, stable growth signalled by the au Jibun Bank Flash Japan Composite PMI in February masked widely differing trends between the manufacturing and service sectors midway through the first quarter of the year.

“Service providers posted sharper rises in activity and new business as the latest wave of the COVID-19 pandemic faded, providing a boost to demand.

“The picture was much less positive in the manufacturing sector, however, where new orders and production dropped to the greatest extents in just over two-and-a-half years.”

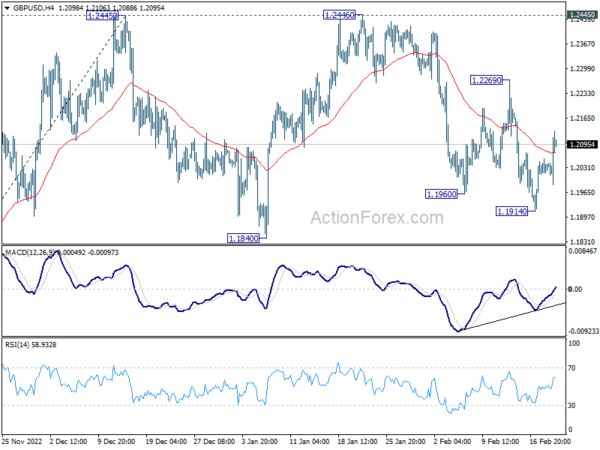

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2018; (P) 1.2037; (R1) 1.2060; More…

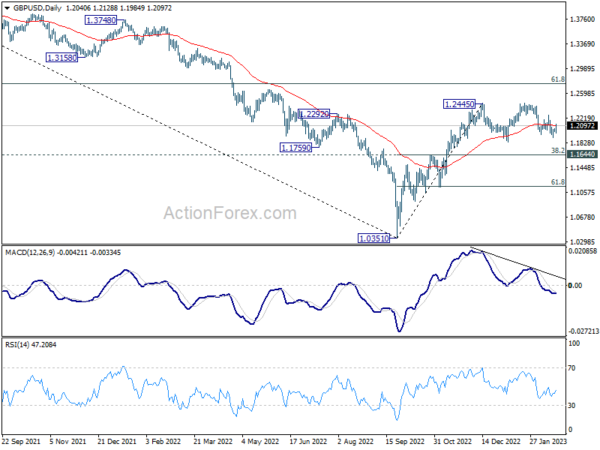

GBP/USD’s rebound from 1.1914 extends higher today but stays well below 1.2269 resistance. Intraday bias remains neutral and another fall could still be seen. Below 1.1914 will resume the fall from 1.2446, as the third leg of the corrective pattern from 1.2445, to 1.1840 support and possibly below. Nevertheless, firm break of 1.2269 will bring retest of 1.2445/6 resistance.

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Input Q/Q Q4 | 0.50% | 0.50% | 0.80% | |

| 21:45 | NZD | PPI Output Q/Q Q4 | 0.90% | 0.40% | 1.60% | |

| 22:00 | AUD | Manufacturing PMI Feb P | 50.1 | 50 | ||

| 22:00 | AUD | Services PMI Feb P | 49.2 | 48.6 | ||

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 00:30 | JPY | Manufacturing PMI Feb P | 47.4 | 49.3 | 48.9 | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 5.08B | 3.75B | 2.83B | 2.77B |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Jan | -6.2B | 2.3B | 26.6B | 24.8B |

| 08:15 | EUR | France Manufacturing PMI Feb P | 47.9 | 50.7 | 50.5 | |

| 08:15 | EUR | France Services PMI Feb P | 52.8 | 50 | 49.4 | |

| 08:30 | EUR | Germany Manufacturing PMI Feb P | 46.5 | 48 | 47.3 | |

| 08:30 | EUR | Germany Services PMI Feb P | 51.3 | 51 | 50.7 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Feb P | 48.5 | 49.4 | 48.8 | |

| 09:00 | EUR | Eurozone Services PMI Feb P | 53 | 51 | 50.8 | |

| 09:30 | GBP | Manufacturing PMI Feb P | 49.2 | 47.5 | 47 | |

| 09:30 | GBP | Services PMI Feb P | 53.3 | 49.4 | 48.7 | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Feb | 28.1 | 22.8 | 16.9 | |

| 10:00 | EUR | Germany ZEW Current Situation Feb | -45.1 | -50 | -58.6 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 29.7 | 22.3 | 16.7 | |

| 13:30 | CAD | Retail Sales M/M Dec | 0.50% | 0.50% | -0.10% | 0% |

| 13:30 | CAD | Retail Sales ex Autos M/M Dec | -0.60% | -0.10% | -0.60% | -0.50% |

| 13:30 | CAD | CPI M/M Jan | 0.50% | 0.20% | -0.60% | |

| 13:30 | CAD | CPI Y/Y Jan | 5.90% | 5.70% | 6.30% | |

| 13:30 | CAD | CPI Core M/M Jan | 0.10% | 0.30% | ||

| 13:30 | CAD | CPI Median Y/Y Jan | 5.00% | 4.90% | 5.00% | |

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 5.10% | 5.20% | 5.30% | |

| 13:30 | CAD | CPI Common Y/Y Jan | 6.60% | 6.50% | 6.60% | |

| 14:45 | USD | Manufacturing PMI Feb P | 47.4 | 46.9 | ||

| 14:45 | USD | Services PMI Feb P | 47.3 | 46.8 | ||

| 15:00 | USD | Existing Home Sales Jan | 4.06M | 4.02M |