The inflation data for the U.S. came in hot last week, but not as bad as

feared. The fight against inflation is not over yet so the market understands

that rate cuts are not on the table. As a reaction, the U.S. dollar

strengthened.

This week we have a light calendar with a bank holiday in the U.S. and

Canada. On Tuesday we have the monetary policy meeting minutes for Australia;

some PMI’s for the eurozone, the U.K and the U.S.; and the CPI data for Canada.

This will be followed Wednesday with the wage price index q/q print in

Australia; the official cash rate in New Zealand, the RBNZ Monetary policy

statement and press conference and the U.S. FOMC meeting minutes.

Thursday we’ll have the U.S preliminary GDP q/q and unemployment claims and

multiple G20 meetings. The G20 meetings will continue on Friday, when we’ll

also get the national Core CPI y/y for Japan, the U.S. the PCE — the Fed’s

favourite inflation gauge — and the new home sales data. We may also see some

month-end rebalancing flows at the end of the week.

The Eurozone economy has fared better than analysts expected, helped by the

softer energy prices, particularly oil and gas. The manufacturing PMI data was

good for the past four months and the services PMI came into positive territory

as well recently, signalling that the worst has passed. A recession still seems

to be unavoidable, but the prospects are for a short lived one.

For the U.K. the expectation is for both the services and manufacturing PMIs to

reflect some improvement. However, the data doesn’t look as good as for the

eurozone with prints in the past several months painting a mixed picture. The

manufacturing PMI for February is expected at 47.5, while services to print 49.2.

While these are gradual improvements, the outlook for the U.K. economy is still

negative with economic contraction expected this year.

Canadian CPI data is likely to reflect that inflation is cooling down, but

even if it prints above expectations it won’t change the BoC’s decision to

pause the hiking cycle until they observe the effects of cumulative tightening

over a longer period. As a reminder, the BoC was one of the first central banks

to raise interest rates, so it might also be the first ones to start cutting

them. However, for now inflation remains high compared to the bank’s target.

The consensus for headline inflation in January is 6.0%.

Wage data for Australia is eagerly expected as it will have a big impact on

the next steps in monetary policy decisions. According to analysts from ING,

back in 2021 the RBA “tied its cash rate target to wage growth rising to a

level consistent with target inflation of 3.5-4%.” Inflation is currently

running at 8.8% YoY. In the last quarter, the wage price index rose by 3.1% and

there’s room for further growth. If it reaches 3.5%, this could make the RBA

more hawkish.

The consensus for the next RBNZ meeting is for a 50bps rate hike with

analysts from ING arguing the peak is close. However, a small number of analysts

argue there’s a chance for a 75bps rise and if that happens it will be a

hawkish surprise.

The New Zealand housing market was negatively impacted by high mortgage rates

and this might be an argument for a potential peak. Inflation data continues to

be concerning and the bank stressed that the official cash rate needs to be

higher than initially thought. For now a peak is expected at 5.50% versus

4.10%, but there is an argument for a less aggressive path of hiking, such as

the softening labour market. A 50bps rate hike seems to be already priced in

and only a hawkish tone will surprise the market.

The FOMC minutes will be very important to watch because they could provide

clues about the next monetary policy moves. Lately all data in the U.S. has come

in hot so it will be interesting to see how the bank will react.

The expectation for the US PCE is to rise by 0.3% m/m in January, the same

as last month, reaching 4.4% y/y. The data will be closely watched as it might

indicate that inflation is not cooling down in a linear path.

Existing and new home sales data is likely to continue to reflect that

demand is weak, primarily due to elevated mortgage rates. While new home sales

rose over the past few months, the demand for existing homes has declined, but

not as much as expected. Pending home sales based on real estate contracts also

seem to be picking up, rising 2.5% in December.

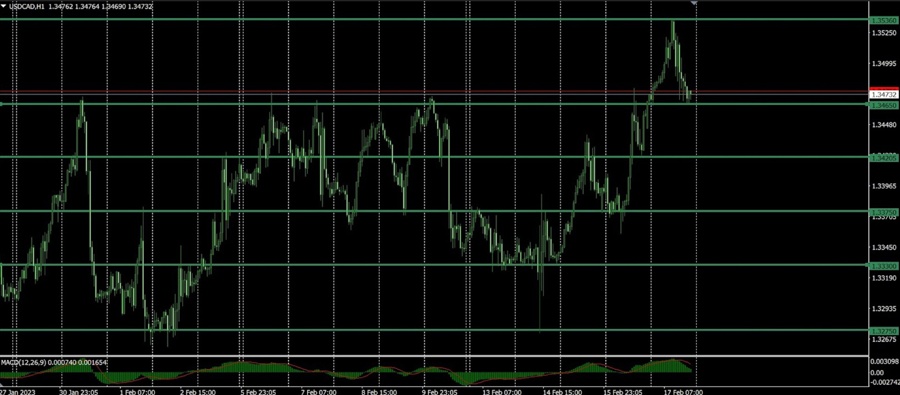

USD/CAD expectations

At the last meeting Governor Macklem stressed there is no need for future

rate hikes if the economy develops as expected.

On the H1 chart, USD/CAD looks good for buying opportunities. As the market

is repricing more hikes from the Fed and a pause from the BoC the pair has

potential for further strengthening. The pair closed the week near the 1.3465

level of support, but a deeper correction is possible until the next level of

support at 1.3420. If that level holds the next target could be the 1.3580

resistance.

On the downside the next levels of support are at 1.3375 and 1.3330.

A risk for this trade is the CPI data for Canada, but only if it prints

well above expectations which seems unlikely at the moment.

AUD/USD expectations

On the H1 chart the pair closed the week near the 0.6900 level of

resistance and it looks good for selling opportunities. However, a bullish

divergence seems to be forming which might suggest a bigger correction until

0.6965 or even 0.6990. From there, the downtrend should resume, targeting

0.6760.

On the upside the next levels of resistance are at 0.6990, 0.7055 and

0.7115.