Dollar appears to be finally staging a broad based upside breakout today, with help from mild risk aversion. This week’s inflation and retail sales data suggested that risk to Fed tightening is more on the upside, and interest rate would at least stay high for longer. For now, Euro is following Dollar as the strongest for the week, then Swiss Franc and Sterling. Yen is the worst performer, followed by commodity currencies.

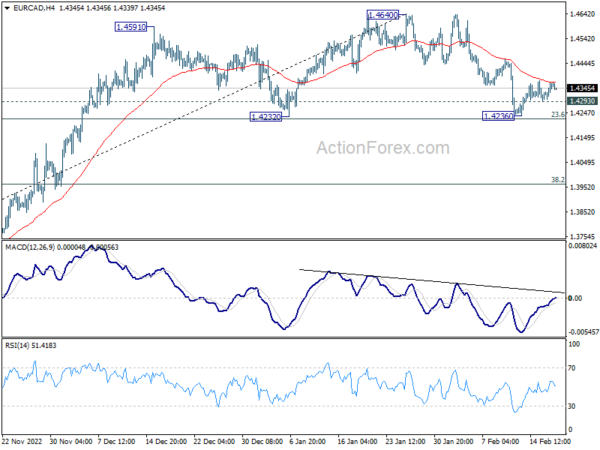

Technically, current development argues that Dollar’s strength is going to extend for a while. The question is which currencies would be the main casualties. EUR/CAD’s correction from 1.4640 might have completed just ahead of 1.4232 support. Sustained trading above 4 hour 55 EMA (now at 1.4368) could prompt upside acceleration to retest 1.4640 high. However, rejection by 4 hour 55 EMA, followed by break of 1.4293 minor support could resume the decline through 1.4232/6.

In Asia, at the time of writing, Nikkei is down -0.73%. Hong Kong HSI is down -0.72%. China Shanghai SSE is down -0.31%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is down -0.0001 at 0.507. Overnight, DOW dropped -1.26%. S&P 500 dropped -1.38%. NASDAQ dropped -1.78%. 10-year yield rose 0.034 to 3.843.

Fed Bullard: Continued policy rate increases can lock in disinflationary trend

St. Louis Fed President James Bullard said yesterday, “I was an advocate for a 50-basis-point hike and I argued that we should get to the level of rates the committee viewed as sufficiently restrictive as soon as we could.”

Bullard said “inflation remains too high but has declined,” adding that “continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets.”

BoE Pill: MPC needs to ensure it does either too much or too little

BoE Chief Economist Huw Pill said in a speech yesterday, “recognising that its earlier actions are now gaining traction, the MPC needs to ensure that it does enough to return inflation to target, while guarding against the possibility that it does either too much or – for that matter – too little.”

“Finding that balance is the central challenge for monetary policy at present,” he said.

Pill also noted, “continuing to raise rates at the pace and magnitude seen over the past year would eventually – and perhaps soon – imply that monetary policy had cumulatively been tightened too much.”

Yet, “the MPC’s need to be watchful for signs of greater-than-expected persistence in inflationary pressure,” he emphasized. “I would flag the need for the Committee to maintain a readiness to act to address any such persistence should it emerge.”

On the economy, Pill said Tuesday’s labor market data “pointed to signs that the UK labour market loosened a little in the fourth quarter”. But, “these indicators suggest the labour market remains tight in an absolute sense relative to historical experience.”

CPI data showed inflation fell to 10.1% in January, from 10.5% in December. “On the month, this mainly owed to an easing in services and fuel price inflation, although developments in historically very volatile components such as airfares counted for a large part of the former.”

BoC Macklem: Additional monetary tightening if inflation gets stuck above 2% target

BoC Tiff Macklem told a parliament committee yesterday, “we expect CPI inflation to fall to around 3% in the middle of this year and reach the 2% target in 2024.”

“For inflation to get back to 2%, the effects of higher interest rates need to work through the economy and restrain spending enough for supply to catch up.”

“The tightness in the labour market needs to ease, wage growth needs to moderate, and service price inflation needs to cool.”

“Inflation expectations also need to come down and businesses return to more normal pricing behaviour.”

“If those things don’t happen, inflation will get stuck above our 2% target, and additional monetary tightening will be required.”

RBA Lowe: We need to make clear to the community we were not done yet

In the second parliamentary grilling today, RBA Governor Philip Lowe said, “based on the currently available information, the board expect that further increases will be needed over the months ahead to ensure that inflation returns to target.”

“Given there is a significant demand element to inflation, we need to respond to that with further monetary policy and we need to make that clear to the community that we were not done yet,” Lowe said.

“The RBA and many other central banks are managing two risks,” he said. “One is the risk of not doing enough, which would result in high inflation persisting and then later proving very costly to get down. The other is the risk that we move too fast, or too far.”

Looking ahead

UK retail sales is the main focus today. Eurozone current account, Canada IPPI and RMPI, and US import price index will be released too.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6835; (P) 0.6885; (R1) 0.6930; More…

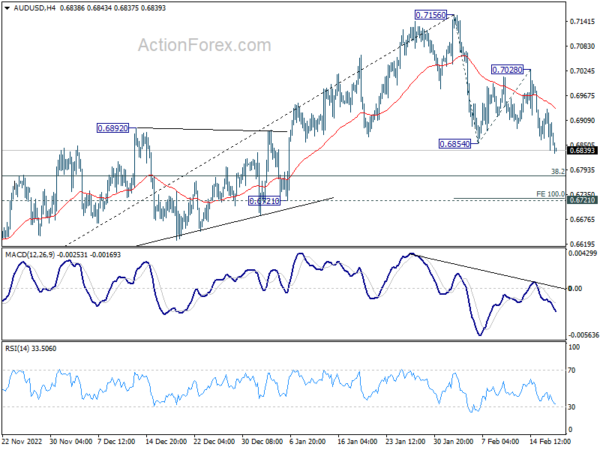

AUD/USD’s break of 0.6854 support confirms resumption of corrective decline from 0.7156. Intraday bias is back on the downside. Next target is 100% projection of 0.6854 to 0.7028 from 0.6854 at 0.6736, which is close to 0.6721 key structural support. Strong support is expected there to bring rebound. But still, break of 0.7028 resistance is needed to confirm completion of the correction. Otherwise, further fall is in favor in case of recovery.

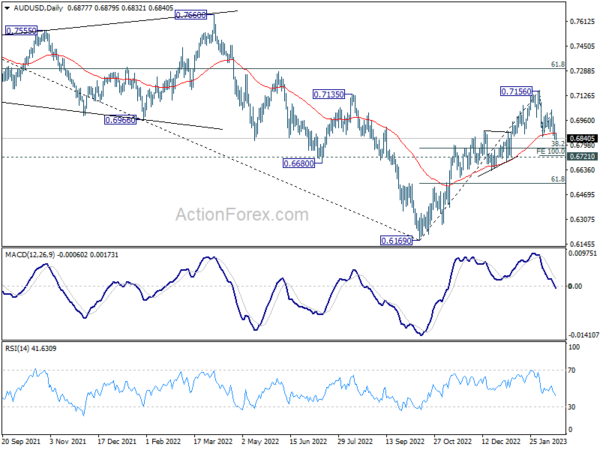

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | GBP | Retail Sales M/M Jan | -0.20% | -1.00% | ||

| 07:00 | GBP | Retail Sales Y/Y Jan | 1.80% | -5.80% | ||

| 07:00 | GBP | Retail Sales ex-Fuel M/M Jan | 0.00% | -1.10% | ||

| 07:00 | GBP | Retail Sales ex-Fuel Y/Y Jan | -4.40% | -6.10% | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 5.1B | 13.6B | ||

| 13:30 | CAD | Industrial Product Price M/M Jan | -0.10% | -1.10% | ||

| 13:30 | CAD | Raw Material Price Index Jan | -0.20% | -3.10% | ||

| 13:30 | USD | Import Price Index M/M Jan | -0.10% | 0.40% |