- GBP/USD bears are in play on the backside of last week’s bullish trend

- 1.1950 is a target on the downside while 1.2070 is a target on the upside.

As per mid-week of last week’s analysis, GBP/USD Price Analysis: Sell-off cutting into Day-3 longs, 1.2050 eyed for days ahead, the price of the Pound Sterling fell to test the 1.2050’s target as the following illustrates:

GBP/USD prior analysis

”A bullish close on the day will be giving us three bullish closes in a row and leaves the risk of another sell-off on Friday:”

GBP/USD update

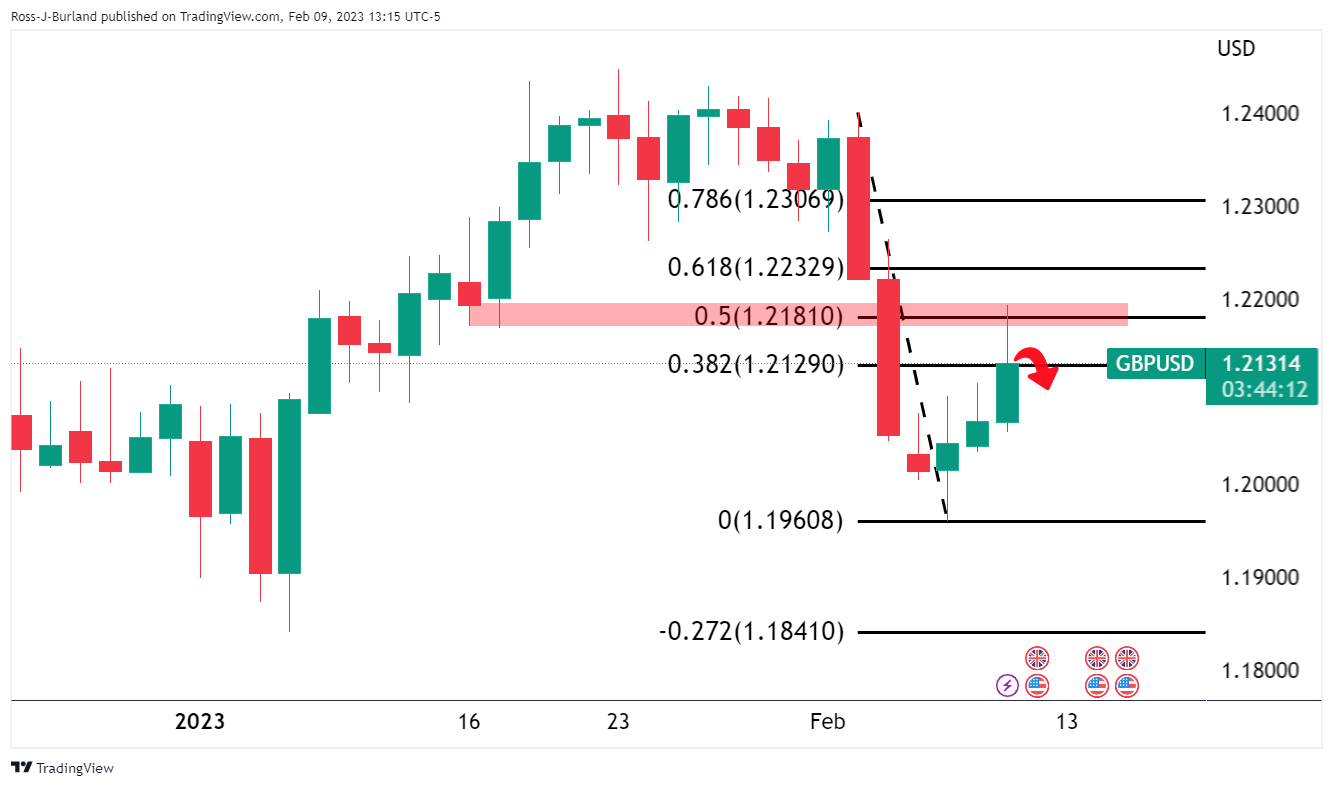

GBP/USD is on the backside of the trend now. The bears are in play and there are prospects of a continuation towards 1.1950 (daily ATR is 114 pips) with the -272% Fibonacci aligned at that juncture that meets the prior structure looking left. Further down we have the bottom of the new 100 pip box at 1.1900 and 1.1800 there after that meets a -61.8% Fibo.

However, that is not to say there will not be a move up for the day ahead as follows:

Asia could be setting up the lows for the near term for London’s session’s rally as the chart above illustrates, taking into account the liquidity above 1.2060 and to 1.2070. Such a move would fall within the average daily range of 114 pips and the outcome would complete the daily chart’s bearish continuation thesis.