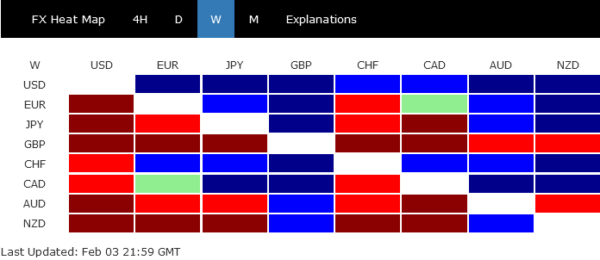

With the help from strong economic data, Dollar struck back to end as the strongest one, after a week full of heavy weight events. Traders might start to give up on fighting the Fed on the topic of terminal interest rate and the timing of a cut, given the underlying resilience of the economy. At the same time, American and European investors appear to be optimistic that economy is going to withstand extending tightening well. FTSE even made a new record high. The development to monitor now is whether the greenback would have a near term decoupling from risk sentiment.

Elsewhere in the forex markets, Swiss Franc ended the second strongest, followed by Euro and Canadian. Sterling was the worst, thanks to selloff against European majors in particular. Australian Dollar and New Zealand Dollar came as next weakest, without much help from risk-on sentiment. Yen was mixed, facing some pressure from rebound in American and European benchmark yields.

Fed, ECB, and BoE recap

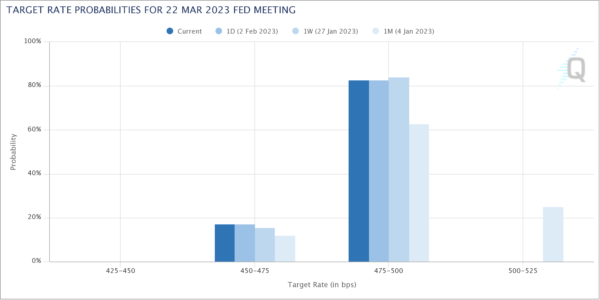

In the US, Fed hike federal funds rate target range by 25bps to 4.50-4.75% as widely expected. While some may disagree, Chair Jerome Powell’s post-meeting press conference was not dovish at all. He didn’t deviate from the message that rates will peak above 5%. Additional, he deliberately noted that “If the economy performs broadly in line with those expectations, it will not be appropriate to cut rates this year.”

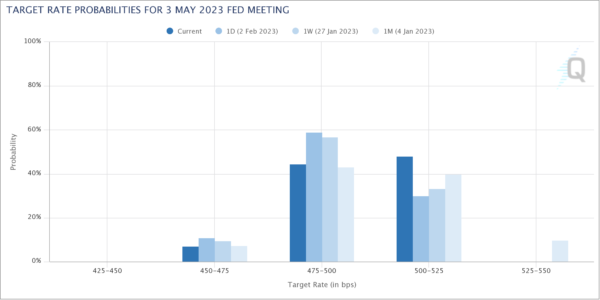

More importantly, economic data published were impressively strong, with more than 500k growth in non-farm payroll employment. ISM services PMI jumped from 49.6 to 55.2 even though ISM manufacturing dropped from 48.4 to 47.4. The markets might be starting to realize that it’s really not a good idea to fight the Fed.

Fed fund futures are now pricing in 82.7% chance of another 25bps hike in March,, pretty much the same as 84.3% a week ago. But more importantly, they’re pricing in 48.2% change of another 25bps hike in May, comparing to 33.5% a week ago.

ECB “stayed the course” and hike interest rate by 50bps to 3.00% as expected. It explicitly mentioned in the statement that the “Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March.” Comments from ECB official after the meeting indicated that the rate hike in March might not the last one. ECB continue to “outhawk” other major central banks for a while in this phase of the cycle.

BoE also hiked by 50bps to 4.00% as expected, with two doves voted for no change. Governor Andrew Bailey indicated that inflation may have “turned a corner”. While other Fed and ECB officials have given similar message on inflation, markets seemed to be giving more weight to Bailey’s as recession in the UK could last longer and deeper, even if in slight extent. As indicated in BoE’s projections, interest rate might peak at 4.50%, and there’re some speculations that it would be below that level.

Risk sentiment stayed positive despite extended tightening

Risk sentiment remained positive after a full week of heavy weight events. Investors appeared to be staying optimistic that the underlying strength of major economies is going to withstand extended monetary tightening well. Also, even if recessions do happen, they’ll be relatively shallow ones.

While US stocks pulled back notably on Friday after strong NFP and ISM services, overall risk sentiment was positive. S&P 500 resumed the rise from 3491.58 to close at 4136.48. Near term outlook will stay bullish as long as 4015.55 support holds. Next target is 100% projection of 3491.58 to 4100.51 from 3764.49 at 4373.42, which is close to 4325.28 resistance.

NASDAQ also accelerated up to close at 12006.95. Near term outlook remains bullish as long as 1388.54 support holds. Next target is 38.2% retracement of 16212.22 to 10207.47 at 12427.95. But the real test would be on 13181.08 cluster resistance (50% retracement at 13150.52.

In the UK, FTSE resumed the near term rise from 6707.62 to close 7901.79, after hitting new intraday record high at 7706.58. For the near term, outlook will stay bullish as long as 7708.33 support holds. Next target is 61.8% projection of 5525.52 to 7687.27 from 6707.62 at 8043.58.

DAX also resumed the rally from 11862.84 and it’s now pressing 61.8% projection of 11862.84 to 14675.84 from 13791.52 at 15529.95. Near term outlook stays bullish as long as 14988.98 support holds. Sustained break of 15529.95 could prompt upside acceleration to 100% projection of 16604.52, which is above record high at 16290.19.

US 10-year yield might have completed corrective pattern

Back in the US, 10-year yield staged a notable rebound on Friday after strong economic data. It appears that corrective pattern from 4.333 might have completed with three waves down to 3.334, after hitting medium term trend line support, and missing 61.8% projection of 4.333 to 3.402 from 3.905 at 3.329 by an inch.

Near term immediate focus is now on 55 day EMA (now at 3.591). Sustained break there will affirm this bullish case and pave the way for stronger rise for at least a test on 3.905 resistance.

Dollar might decouple from risk sentiment for a while

As for the Dollar index, it should be note that firstly, extended rebound in 10-year yield would give the DXY an extra boost. But secondly and more importantly, a near term decoupling of Dollar and risk sentiment might be starting to emerge. The latter development is an important one to monitor and verify in the days ahead.

For now, the conditions for a bounce is there for DXY, considering bullish convergence condition in daily MACD. Break of 103.44 resistance should confirm short term bottoming, and bring further rebound to 55 day EMA (now at 104.14) and above. But the real test would lie in 38.2% retracement of 114.77 to 100.82 at 106.14.

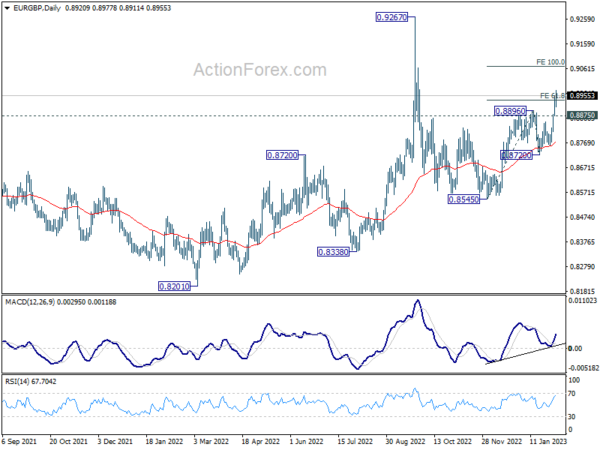

EUR/GBP resumes rally as ECB expected to “outhawk” BoE

Meanwhile in crosses, EUR/GBP’s rally reflected the perception that ECB is going to “outhawk” BoE for a while. Further rise is expected as long as 0.8875 minor support holds. 61.8% projection of 0.8545 to 0.8896 from 0.8720 at 0.8937 was already taken out. Next target is 100% projection at 0.9071.

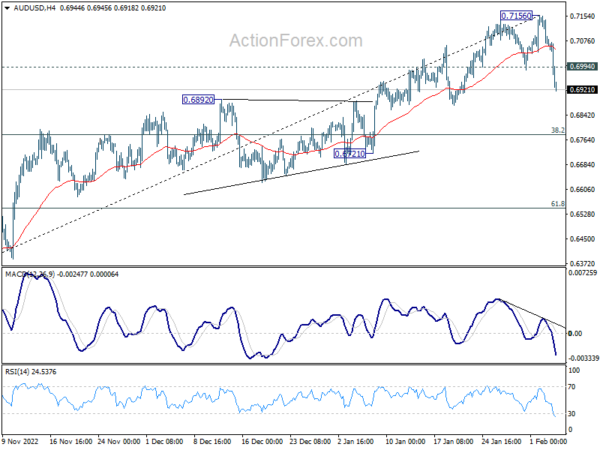

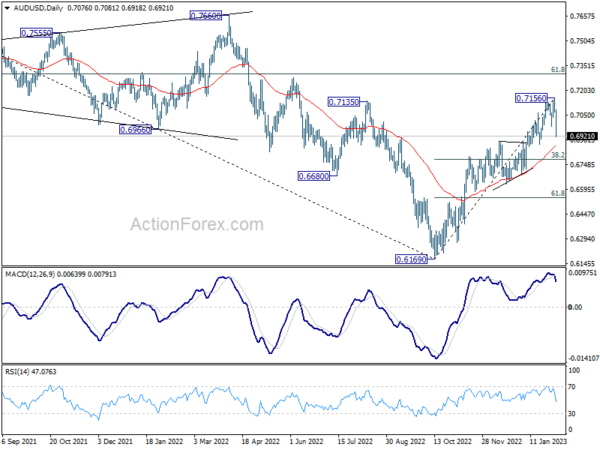

AUD/USD Weekly Outlook

AUD/USD edged higher to 0.7156 last week, but subsequent steep pull back indicates short term topping. Initial bias is now on the downside this week for 55 day EMA (now at 0.6806) and possibly below. But downside should be contained by 38.2% retracement of 0.6169 to 0.7156 at 0.6779 to bring rebound. On the upside, above 0.6994 minor resistance will turn bias neutral first. But overall, corrective pattern from 0.7156 should extend for a while.

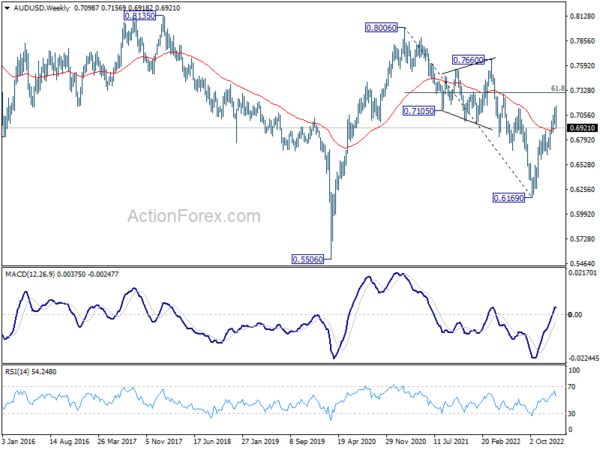

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

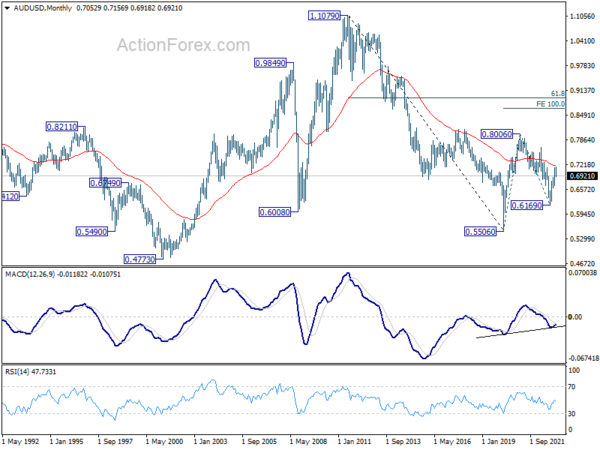

In the long term picture, current development suggests that fall from 0.8006 was merely a correction to the rise from 0.5506 (2020 low). Sustained trading above 55 month EMA (now at 0.7193) will raise the chance of up trend resumption through 0.8006 at a later stage.