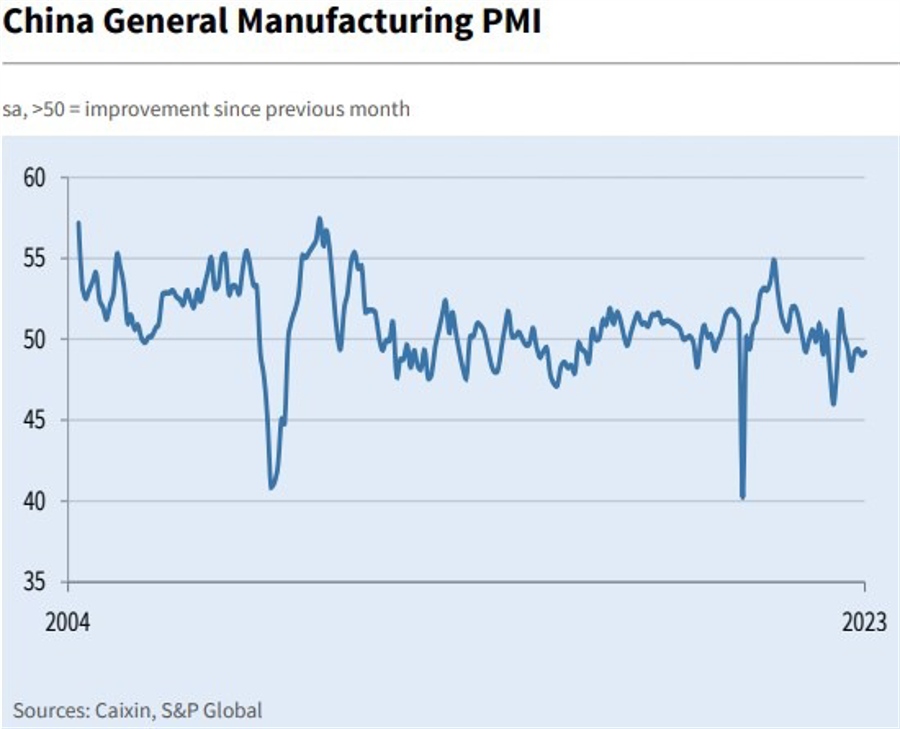

The official Chinese PMIs for January were published yesterday, much improved from December. These are from China’s National Bureau of Statistics (NBS) and the China Federation of Logistics and Purchasing (CFLP):

Now we have the privately surveyed manufacturing PMI from China. These are different surveys, there is a greater representation of large and SEO firms in the official PMIs.

Caixin China General Manufacturing PMI in January to 49.2

- 49.0 in December

- remaining in contractionary territory for the sixth consecutive mont

In brief from commentary to the report:

- Both manufacturing supply and demand continued to shrink last month, as Covid infections remained high.

- Output and total new orders shrank for the fifth and sixth straight months, respectively, but the contraction was milder than in December.

- Due to mounting recession risks overseas, external demand remained weak, with the reading for new export orders also contracting for the sixth consecutive month.

- Employment continued to shrink, the subindex in contractionary territory for the 10th month running

- backlogs of work rose for the first time since May 2022, the rate of expansion was only marginal

- Prices remained stable in January. Input and output prices diverged for the fourth consecutive month. The rise in input prices was mainly driven by elevated raw material costs, metals in particular, whereas output prices dropped given the sluggish market activity. Meanwhile, output prices at consumer goods makers climbed slightly.

eur

This article was originally published by Forexlive.com. Read the original article here.