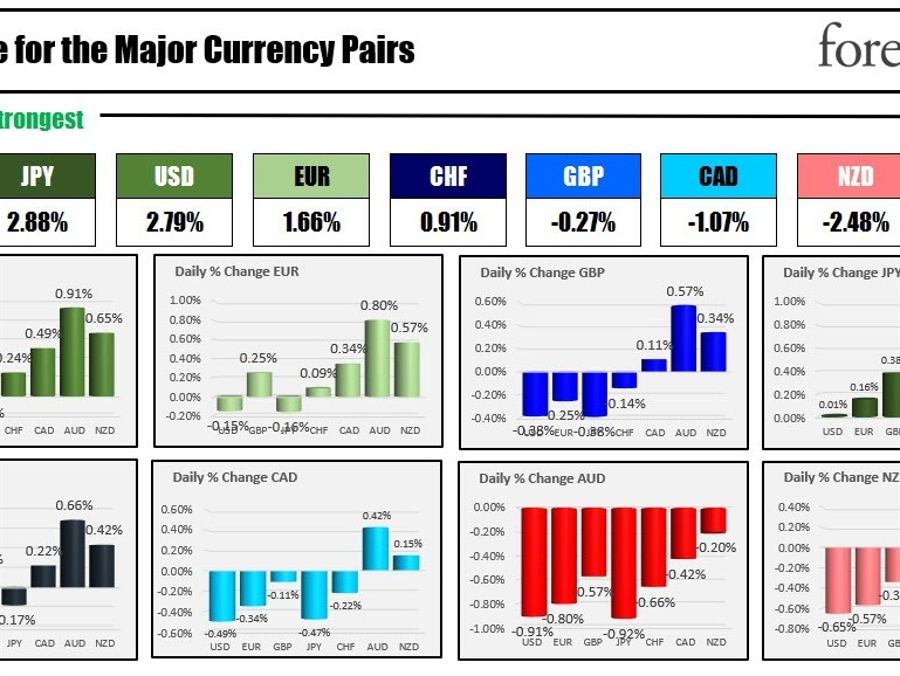

The strongest to the weakest of the major currencies

The JPY is the strongest and the AUD is the weakest as the NA session begins.

The Fed will start their two day meeting today and conclude with their rate decision tomorrow followed by the Fed Chair press conference at 2:30 PM ET. The BOE will next announce their rate change on Thursday at 7 AM ET and the ECB will announce at 8:15 AM ET.

Meanwhile, today, the US employment cost index for the quarter will be released at 8:30 AM (est. 1.1% down from 1.2% last quarter) along with Canada GDP. The S&P/Case Schiller house price index will be reported at 9 AM ET with 6.8% YoY down from 8.6% as the gains from last year get whittled away. The US consumer confidence will also be released today at 10 AM with a gain to 109.1 from 108.3 expected.

On the earnings this morning:

- Exxon reported better earnings and revenues today.

- McDonalds also beat on top and bottom line.

- Pfizer beat on EPS but was short of revenues.

- Marathon Petroleum beat on EPS and revenues.

- Caterpillar fell short on EPS but beat on revenues

- GM beat on top and bottom lines

- UPS beat on EPS but fell short on Revenues

US stocks are lower as implied by the futures but off the earlier pre-market lows. The US yields are lower ahead of the Fed meeting.

In other markets, the snapshot of the market is showing:

- Spot gold is down $-15.68 or -0.84% at $1907.10

- Spot silver is trading down down $0.29 or -1.23% at $23.27

- WTI crude oil is trading down $-0.71 at $77.19

- Bitcoin is trading at $22929 in early NY trading

The premarket for US stocks, the futures are implying the major indices will open lower. The major indices are down for the 2nd consecutive trading day

- Dow Industrial Average is trading down -48 points after falling 260.99 points yesterday

- S&P index is down -5 points after yesterday’s -52.81 point decline

- NASDAQ index is down -40 points after yesterday’s -227.90 point tumble

In the European equity markets, the major indices are trading mostly lower

- German DAX, -0.36%

- France’s CAC, -0.27%

- UK’s FTSE 100, -0.52%

- Spain’s Ibex, -0.28%

- Italy’s FTSE MIB +0.4%

In the Asian-Pacific market, major indices are lower

- Japan’s Nikkei fell -0.39%

- New Zealand 50 index fell -0.55%

- Australia’s S&P/ASX index fell -0.07%

- Hang Seng index fell -1.03%

- Shanghai index fell -0.42%

In the US debt market yields are marginally lower

- 2 year 4.244%, unchanged

- 5 year 3.659%, -0.5 basis points

- 10 year 3.535% -0.7 basis points

- 30 year 3.654% unchanged

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)