Risk-on rallies appear to be taking a breather ahead of the weekend. While US stocks jumped overnight, Asian markets are just mixed. Focuses will turn to US PCE inflation data today. Dollar might try to bounce if there is upside surprise in the report. Yet, the big events are the three central bank meetings next week – Fed, ECB, and BoE, plus ISMs and NFP. So, any moves could be temporary.

Technically, Gold is clearly losing upside momentum as seen in both 4 hour and daily MACD. While another rise cannot be ruled out, Gold might not have enough momentum to hit target of 161.8% projection of 1616.51 to 1786.83 from 1728.48 at 2004.05, or not even 2000 handle. Break of 1896.38 support will confirm topping and bring correction to 55 day EMA (now at 1829.03). If happens, that would be used as a signal to confirm Dollar’s bounce.

In Asia, at the time of writing, Nikkei is up 0.10%. Hong Kong HSI is down -0.05%. Singapore Strait Times is up 0.43%. Japan 10-year JGB yield is up 0.0126 at 0.478. Overnight, DOW rose 0.61%. S&P 500 rose 1.10%. NASDAQ rose 1.76%. 10-year yield rose 0.031 to 3.493.

Japan Tokyo CPI core rose to 3.4% yoy, highest in 42 years

In Japan, Tokyo CPI core (all items ex-fresh food), accelerated from 4.0% yoy to 4.3% yoy in January, above expectation of 4.2% yoy. That’s also the fastest annual increase in nearly 42 years since May 1981.

Headline CPI (all items) rose from 4.0% yoy to 4.4% yoy, matched expectations. CPI core-core (all items ex-fresh food, energy) rose from 2.7% yoy to 3.0% yoy.

NZ ANZ business confidence rose to -52, inflation pressures remains intense

New Zealand ANZ Business Confidence improved from -70.2 to -52.0 in January. Own activity outlook rose form -25.6 to -15.8.

Looking at some details, exports intentions rose from -10.0 to -5.4. Investment investment intentions rose form -20.5 to -13.7. Employment intentions rose from -16.3 to -11.1.Pricing intentions rose from 59.1 to 62.4. Cost expectations rose from 84.4 to 91.3. Profit expectations rose from -52.7 to -42.6. Inflation expectations dropped from 6.23 to 5.99.

ANZ said: “Inflation pressures remain intense. Pricing intentions rose 3 points, and cost expectations rose 7 points. Inflation expectations remain stuck around the 6% mark. There’s good reason for the RBNZ to keep hiking a while yet (we are picking +50bp in February).”

Looking ahead

Eurozone will release M3 money supply in European session. But main focus will be on US personal income and spending with PCE inflation later in the day.

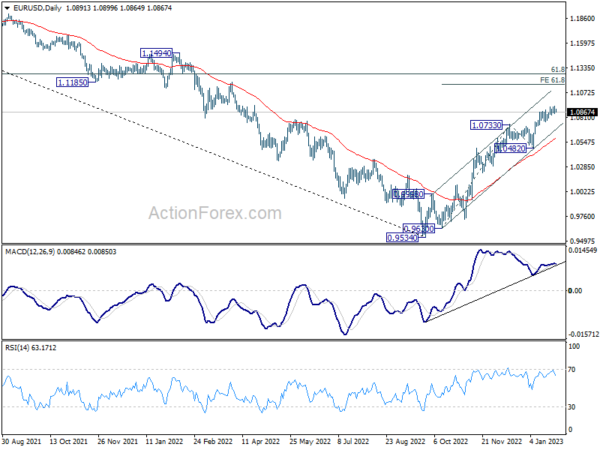

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0852; (P) 1.0891; (R1) 1.0931; More…

EUR/USD is losing upside momentum as seen in bearish divergence condition in 4 hour MACD. But further rise could still be seen as long as 1.0765 support holds, to 61.8% projection of 0.9630 to 1.0733 from 1.0482 at 1.1164 next. On the downside, though, break of 1.0765 support should now confirm short term topping, and turn bias back to the downside for 55 day EMA (now at 1.0591).

In the bigger picture, current development suggests that the rally from 0.9534 low (2022 low) is a medium term up trend rather than a correction. Further rise is in favor to 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 next. This will remain the favored case as long as 1.0482 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jan | 4.30% | 4.20% | 4.00% | |

| 00:00 | NZD | ANZ Business Confidence Jan | -52 | -70.2 | ||

| 00:30 | AUD | Import Price Index Q/Q Q4 | 1.80% | 1.60% | 3.00% | |

| 00:30 | AUD | PPI Q/Q Q4 | 0.70% | 1.90% | 1.90% | |

| 00:30 | AUD | PPI Y/Y Q4 | 5.80% | 6.30% | 6.40% | |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Dec | 4.60% | 4.80% | ||

| 13:30 | USD | Personal Spending Dec | -0.10% | 0.10% | ||

| 13:30 | USD | Personal Income M/M Dec | 0.20% | 0.40% | ||

| 13:30 | USD | PCE Price Index M/M Dec | 0.10% | |||

| 13:30 | USD | PCE Price Index Y/Y Dec | 5.50% | |||

| 13:30 | USD | Core PCE Price Index M/M Dec | 0.30% | 0.20% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Dec | 4.70% | |||

| 15:00 | USD | Pending Home Sales M/M Dec | -1.00% | -4.00% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan F | 64.6 | 64.6 |