US futures trade higher after a batch of solid economic data. Positive risk sentiment are lifting commodity currencies in general, in particular Aussie. Dollar and Yen are turning softer while European majors are mixed, with Euro lagging behind. In the weekly picture, while Aussie is still the strongest, Dollar and Yen are the weakest. Euro is indeed the second best, but it apparently lacks follow through buying.

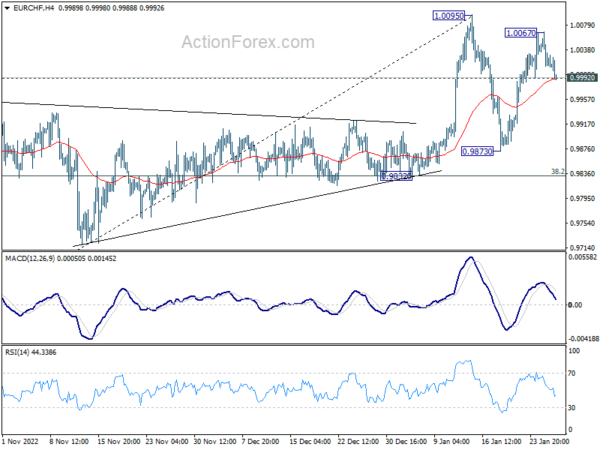

Technically, some attention will remain on EUR/CHF for the rest of the week. Firm break of 0.9992 and 4 hour 55 EMA will indicate that corrective pattern from 1.0095 is already in the third leg, towards 0.9873. Such development could be accompanied by more downside in Euro elsewhere, including against Dollar.

In Europe, at the time of writing, FTSE is up 0.48%. DAX is up 0.20%. CAC is up 0.94%. Germany 10-year yield is up 0.0164 at 2.173. Earlier in Asia, Nikkei dropped -0.12%. Hong Kong HSI rose 2.37%. Singapore Strait Times rose 0.73%. Japan 10-year JGB yield rose 0.0212 to 0.465.

US GDP grew 2.9% annualized in Q4

US GDP grew 2.9% annualized in Q4, slightly above expectation of 2.8%. The increase in real GDP reflected increases in private inventory investment, consumer spending, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment and exports. Imports, which are a subtraction in the calculation of GDP, decreased.

For 2022, GDP grew 2.1%, compared with an increase of 5.9% in 2021. The increase in real GDP in 2022 primarily reflected increases in consumer spending, exports, private inventory investment, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment and federal government spending. Imports increased.

US durable goods orders rose 5.6% mom, ex-transport orders down -0.1% mom

US durable goods orders rose 5.6% mom to USD 286.9B in December, above expectation of 2.5% mom. Ex-transport orders dropped -0.1% mom to USD 178.8B, below expectation of 0.0% mom. Ex-defense orders rose 6.3% mom to USD 269.6B. Transportation equipment rose 16.7% mom to USD 108.1B.

US goods trade deficit widened to USD -90.3B in Dec

US exports of goods dropped -1.6% mom to USD 166.8B in December. Imports of goods rose 1.9% mom to USD 257.1B. Goods trade deficit rose 8.8% mom to USD -90.3B, versus expectation of USD -88.8B.

Wholesale inventories rose 0.1% mom to USD 934.1B. Retail inventories rose 0.5% mom to USD 742.2B.

US initial jobless claims dropped to 186k

US initial jobless claims dropped -6k to 186k in the week ending January 21, below expectation of 211k. Four-week moving average of initial claims dropped -9k to 197.5k.

Continuing claims rose 20k to 1675k in the week ending January 14. Four-week moving average of continuing claims dropped -11k to 1664k.

German EM Habeck: We have broken the inflation trend

German Economy Minister Robert Habeck told Bundestag that inflation will remain high at the beginning of this year. But, “we have broken the inflation trend.”

According to the government’s annual economic report published yesterday, inflation is projected to be at 6% in 2023, revised down by prior forecast of 7%. The economy is projected to growth 0.2% this year, much better than autumn forecast of -0.4% contraction.

Habeck also noted that in 2024, inflation will be lower than in 2023 and growth will be higher.

IMF proposes options for BoJ to allow further flexibility and increases in long-term yields

IMF said in a statement that “accommodative monetary policy stance remains appropriate” for BoJ. But it warned of the “exceptionally high uncertainty around baseline inflation projections with risks tilted to the upside”.

Upside risks include “delayed effects of exchange rate depreciation, border reopening, second round effects of imported inflation, fiscal support, and higher-than-expected wage growth.” Downside risks are mainly from slowdown in the global economy.

“Given the two-sided risks to inflation, more flexibility in long-term yields would help to avoid abrupt changes later… providing clear guidance on the pre-conditions for a gradual policy rate change in the future would help anchor market expectations and strengthen the credibility of the BoJ’s commitment”.

“BoJ could consider the following options to allow further flexibility and increases in long-term yields: widening the 10-year target band and/or raising the 10-year target, shortening the yield curve target, or shifting from a JGB yield target to a quantity target of JGB purchases”.

BoJ Opinions: Necessary to take some time to examine effect of YCC change

In the Summary of Opinions at BoJ’s January 17-18 monetary policy meeting, it’s repeated noted that it’s important to continue with current monetary easing as well as yield curve control.

The modification of YCC at the December meeting was “aimed solely at making monetary easing more sustainable”. It is “necessary” to “take some time” to examine the effects of the change in YCC.

One member noted the “upward pressure” on long-term interest rates and the distortions on the yield curve. And, BoJ “should curb interest rate rises across the entire yield curve through measures”.

Regarding prices, CPI is expected to fall below 2% from fiscal 2023, and there is “still a long way to go to achieve the price stability target”.

But opinions were more upbeat as one noted that “momentum for wage hikes has grown, and it is possible that a certain degree of base pay increases will be realized”. But it still takes time for wages to see a “sustained increase”.

Firms’ stance has “shifted toward actively raising their selling prices” as seen in the outlook for output prices. Pace of rises in prices of both goods and services is “accelerating”. It’s possible that the significant price shocks since last week will “change the norm for prices”.

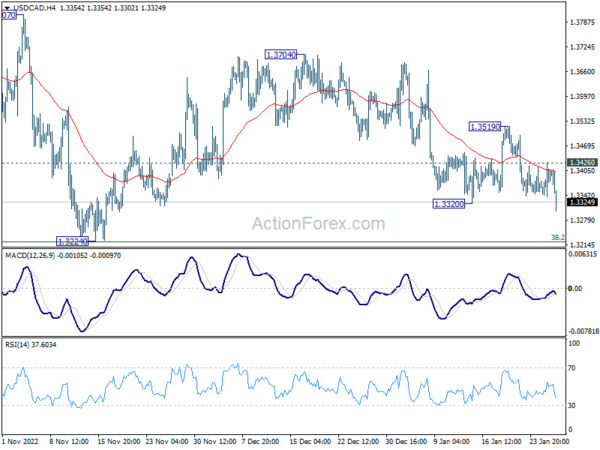

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3345; (P) 1.3387; (R1) 1.3433; More….

USD/CAD’s decline resumed by breaking through 1.3320 and intraday bias is back on the downside. Fall from 1.3704 would target 1.3224 key support level. Strong support is still expected from there to bring rebound. But decisive break would carry larger bearish implication. On the upside, above 1.3426 minor resistance will turn intraday bias neutral first.

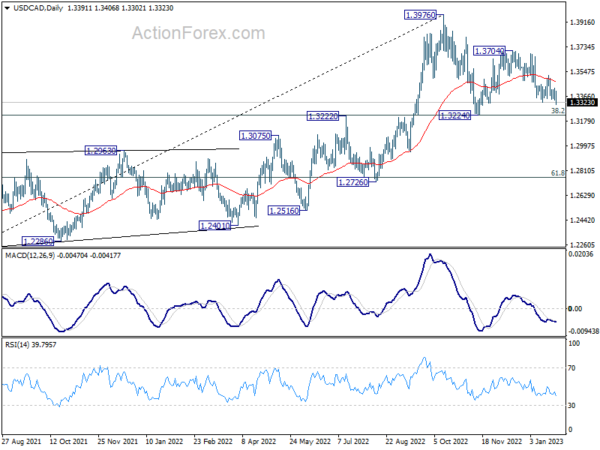

In the bigger picture, as long as 1.3222 cluster support (38.2% retracement of 1.2005 to 1.3976 at 1.3223) holds, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 high at a later stage. However, firm break of 1.3222/3 will indicate that the trend might have reversed. Deeper fall would be seen to next cluster support at 1.2726 (61.8% retracement at 1.2758).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 1.50% | 1.60% | 1.70% | |

| 13:30 | USD | Initial Jobless Claims (Jan 20) | 186K | 211K | 190K | 192K |

| 13:30 | USD | GDP Annualized Q4 P | 2.90% | 2.80% | 3.20% | |

| 13:30 | USD | GDP Price Index Q4 P | 3.50% | 6.20% | 4.40% | |

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -90.3B | -88.8B | -83.3B | |

| 13:30 | USD | Wholesale Inventories Dec P | 0.10% | 0.50% | 1.00% | |

| 13:30 | USD | Durable Goods Orders Dec | 5.60% | 2.50% | -2.10% | |

| 13:30 | USD | Durable Goods Orders ex Trans Dec | -0.10% | 0.00% | 0.20% | 0.10% |

| 15:00 | USD | New Home Sales Dec | 615K | 640K | ||

| 15:30 | USD | Natural Gas Storage | -79B | -82B |