Australian Dollar tumbles broadly today after weaker than expected job data. Overall risk-off sentiment is also pressuring commodity currencies. On the other hand, Yen and Swiss Franc are strengthening together with Dollar. As for the week, Swiss Franc and Sterling are currently the best performer, thanks to additional support from buying against Euro. Aussie and Canadian are the worst while Dollar and Euro are mixed with Yen.

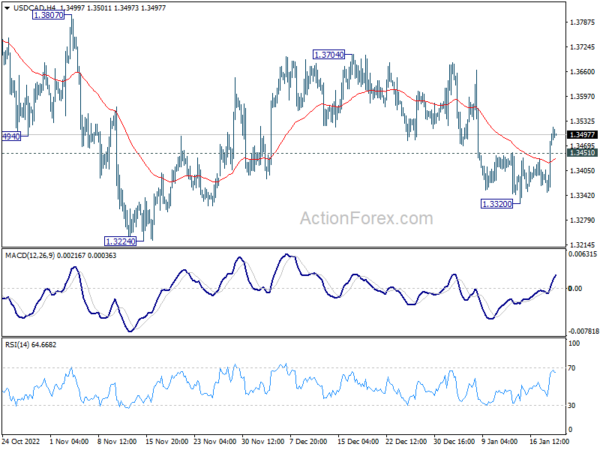

Technically, USD/CAD’s break of 1.3451 minor resistance argues that pull back from 1.3704 has completed at 1.3302, well ahead of 1.3223 low. Further rally should be seen back to retest 1.3704 resistance. Firm break there will resume the rebound from 1.3223. Let’s see if such development will come with more rebound in Dollar, at least against other commodity currencies.

In Asia, at the time of writing, Nikkei is down -1.52%. Hong Kong HSI is down -0.03%. China Shanghai SSE is up 0.19%. Singapore Strait Times is down -0.44%. Japan 10-year JGB yield is down -0.0153 at 0.407. Overnight, DOW dropped -1.81%. S&P 500 dropped -1.56%. NASDAQ dropped -1.24%. 10-year yield dropped -0.160 to 3.375.

Fed Harker: Hikes of 25 appropriate going forward

Philadelphia Fed President Patrick Harker said yesterday, “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed.” “Hikes of 25 basis points will be appropriate going forward,” he said. And, “let’s get above 5% and sit there for a while”.

While risks to inflation remain on the upside, he noted, “we are starting to see inflation come down across a spectrum of goods.” He expects core inflation to decline to 3.5% this year, and 2.5% next, then get back to target in 2025. He also said the economy should grow 1% this year, without falling into recession.

Fed Logan backs slowing down in complex environment

Dallas Fed President Lorie Logan said it’s a “good idea to slow down” in “today’s complex economic and financial environment”.

“That’s why I supported the decision last month to reduce the pace of rate increases. And the same considerations suggest slowing the pace further at the upcoming meeting,” she added.

“A slower pace is just a way to ensure we make the best possible decisions,” she said. “We can and, if necessary, should adjust our overall policy strategy to keep financial conditions restrictive even as the pace slows.”

She added that Fed should not “lock in” on a terminal rate. “My own view is that we will likely need to continue gradually raising the fed funds rate until we see convincing evidence that inflation is on track to return to our 2 percent target in a sustainable and timely way,” she said.

“The most important risk I see is that if we tighten too little, the economy will remain overheated, and we will fail to keep inflation in check,” Logan said.

Japan exports up 11.5% yoy in Dec, imports up 20.6% yoy

In December, Japan exports rose 11.5% yoy to JPY 8787B, marking the slowest growth rate in 2022. Exports to China fell -6.2% yoy in value and down -24% yoy in volume. Imports rose 20.6% yoy to JPY 10236B, led by oil, coal and liquefied natural gas.

Trade deficit came to JPY -1.45T, extending the run of deficits to 17 months. For the whole of 2022, trade balance came in at JPY -19.97T deficit, the second straight annual shortfall, and the largest since 1979.

In seasonally adjusted term, exports dropped -3.5% mom to JPY 8352B. Imports dropped -3.4% mom to JPY 10076B. Trade deficit narrowed slightly to JPY -1.72T, larger than expectation of JPY -1.63T.

Australia employment down -14.6k in Dec, unemployment rate unchanged at 3.5%

Australia employment declined -14.6k in December, much worse than expectation of 21.2k growth. Full-time jobs rose 17.6k while part-time jobs fell -32.2k. Unemployment rate was unchanged at 3.5%. Participation rate dropped -0.2% to 66.6%. Monthly hours worked dropped -0.5%.

Lauren Ford, head of labour statistics at the ABS, said: “The falls in employment and hours worked in December followed strong growth through 2022, with an annual employment growth rate of 3.4 per cent and hours worked increasing by 3.2 per cent.

“The strong employment growth through 2022, along with high participation and low unemployment, continues to reflect a tight labour market.

“In December, we saw the number of people working reduced hours due to illness increasing by 86,000 to 606,000, which is over 50 per cent higher than we would usually see at this time of the year.”

Looking ahead

ECB meeting accounts is the main focus in European session. Eurozone current account and Swiss PPI will be released too. Later in the day, US will release jobless claims, housing starts and building permits, Philly Fed survey. Canada will release wholesale sales.

AUD/USD Daily Report

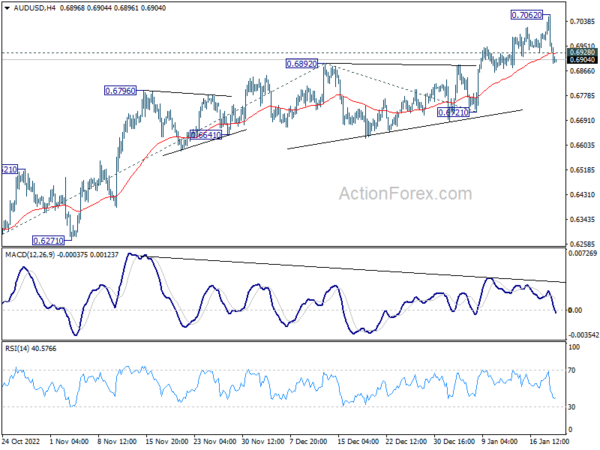

Daily Pivots: (S1) 0.6897; (P) 0.6980; (R1) 0.7025; More…

AUD/USD dropped notably after hitting 0.7062 and intraday bias is turned neutral first. Some consolidations could be seen but further rally is in favor as long as 0.6721 support holds. Above 0.7062 will resume rise from 0.6169 to 61.8% projection of 0.6169 to 0.6892 from 0.6721 at 0.7168 next. However, firm break of 0.6721 will indicate short term topping, and turn bias back to the downside.

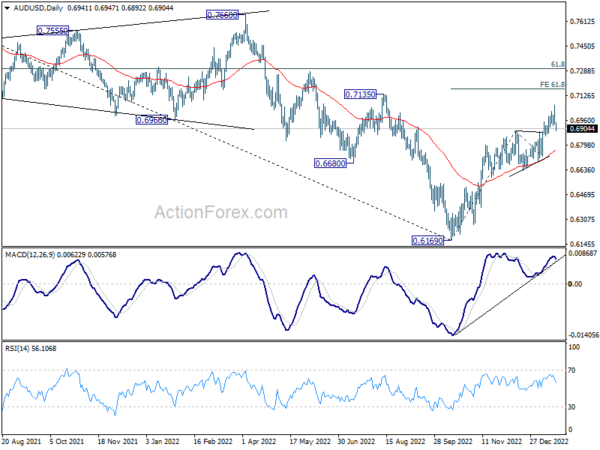

In the bigger picture, corrective decline from 0.8006 (2021 high) should have completed with three waves down to 0.6169 (2022 low). Further rally should be seen to 61.8% retracement of 0.8006 to 0.6169 at 0.7304. Sustained break there will pave the way to retest 0.8006. This will now remain the favored case as long as 0.6721 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Dec | -1.72T | -1.63T | -1.73T | -1.78T |

| 00:01 | GBP | RICS Housing Price Balance Dec | -42% | -30% | -25% | -26% |

| 00:30 | AUD | Employment Change Dec | -14.6K | 21.2K | 64.0K | 58.3K |

| 00:30 | AUD | Unemployment Rate Dec | 3.50% | 3.40% | 3.40% | 3.50% |

| 07:30 | CHF | Producer and Import Prices M/M Dec | -0.40% | -0.50% | ||

| 07:30 | CHF | Producer and Import Prices Y/Y Dec | 3.10% | 3.80% | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | -11.6B | -0.4B | ||

| 12:30 | EUR | ECB Meeting Accounts | ||||

| 13:30 | CAD | Wholesale Sales M/M Nov | 2.00% | 2.10% | ||

| 13:30 | USD | Initial Jobless Claims (Jan 13) | 212K | 205K | ||

| 13:30 | USD | Building Permits Dec | 1.37M | 1.34M | ||

| 13:30 | USD | Housing Starts Dec | 1.36M | 1.43M | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | -11.2 | -13.8 | ||

| 15:30 | USD | Natural Gas Storage | -76B | 11B | ||

| 16:00 | USD | Crude Oil Inventories | -2.1M | 19.0M |