Yen falls broadly after BoJ defied some speculations and kept yield cap unchanged today. The announcement also sent Nikkei sharply higher while shot 10-year JGB yield down. Nevertheless, it’s still a bit early to confirm reversals in Yen crosses. Meanwhile, commodity currencies are trading firmer today. European majors are on the weaker side. In particular, Euro looks relatively vulnerable in crosses on reports that ECB is considering to slow down rate hike in March. Dollar is mixed for now, and looks forward to retail sales and PPI data.

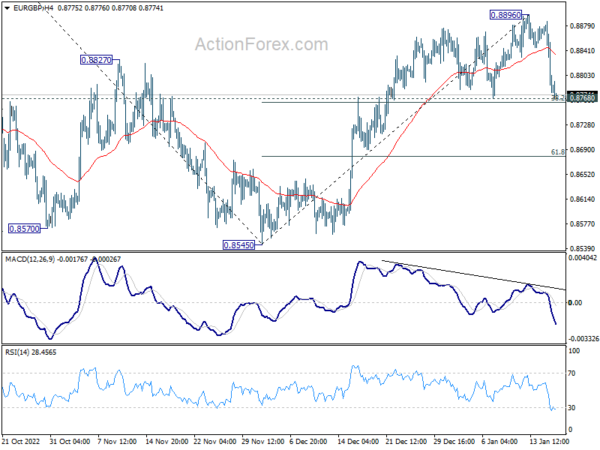

Technically, one focus today is on whether Euro’s selloff will gain further momentum. Firm break of 0.8768 support in EUR/GBP, which is close to 38.2% retracement of 0.8545 to 0.8896 at 0.8762, will argue that whole rebound from 0.9545 has completed. Deeper fall would be seen back to 61.8% retracement at 0.8679, and possibly further to retest 0.8545 low. If happens, such development would likely be accompanied by deeper selloff in EUR/CHF towards 0.9720 support too.

In Asia, at the time of writing, Nikkei is up 2.54%. Hong Kong HSI is up 0.10%. China Shanghai SSE is up 0.13%. Singapore Strait Times is up 0.20%. Japan 10-year yield is down -0.0802 at 0.424, after diving to as low as 0.368. Overnight, DOW dropped -1.14%. S&P 500 dropped -0.20%. NASDAQ rose 0.14%. 10-year yield rose 0.024 to 3.535.

BoJ keeps yield cap unchanged, downgrades growth forecast

BoJ kept the yield curve control unchanged today, disappointing some who bet for a tweak. Short term policy interest rate is held at -0.10%. The central will continue to purchase JGBs, without setting an upper limit, to keep 10-year yield at around 0%. The range 10-year JGB yield allowed to fluctuate is also kept at around plus and minus 0.50%. The decision was made by unanimous vote.

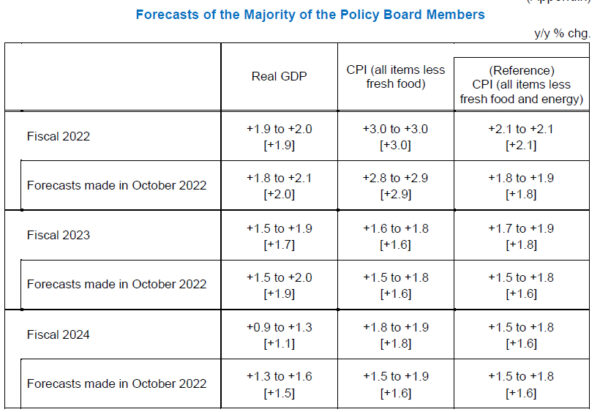

In the Outlook for Economic Activity and Prices:

- Forecasts of real GDP growth were downgraded across horizon, with fiscal 2022 down from 2.0% to 1.9%, fiscal 2023 down from 1.9% to 1.7%, fiscal 2024 down from 1.5% to 1.1%.

- Forecast of CPI core (all item less fresh food) for fiscal 2022 was raised from 2.9% to 3.0%, fiscal 2023 unchanged at 1.6%, and fiscal 2024 raised from 1.6% to 1.8%.

- Forecast of CPI core-core (all item less fresh food and energy) for fiscal 2022 was raised from 1.8% to 2.1%, fiscal 2023 raised from 1.6% to 1.8%, and fiscal 2024 unchanged at 1.6%.

Fed Barkin: You just can’t declare victory too soon

Richmond Fed President Thomas Barkin told Fox Business yesterday that recent inflation reports have been encourage. But the median CPI is “still too high” and, “you just can’t declare victory too soon.”

“I would want to see inflation compellingly back to our target” before easing up on rate hikes, he said. Meanwhile the terminal rate will be dependent on the “path of inflation”.

Looking ahead

UK CPI will be the main focus in European while Eurozone will also released CPI final. Later in the day, US retail sales and PPI will take center stage, with industrial production and business inventories. Canada will release IPPI and RMPI. Fed will also publish the Beige Book economic report.

USD/JPY Daily Outlook

Daily Pivots: (S1) 127.71; (P) 128.44; (R1) 128.88; More…

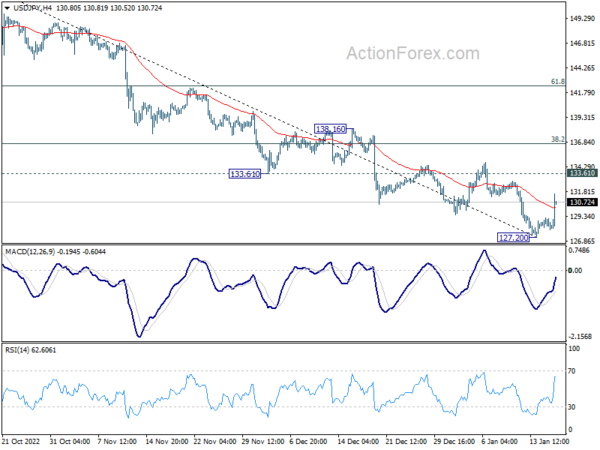

USD/JPY rebounds notably but there is no confirmation of reversal yet. Intraday bias remains neutral first. On the upside, firm break of 133.61 support turned resistance will firstly confirm short term bottoming at 127.20. More importantly, whole correction from 151.93 might have completed too. Bias will then be turned back to the upside for 38.2% retracement of 151.93 to 127.20 at 136.64 first. However, break of 127.20 will resume the decline form 151.93 to 121.43 fibonacci level next.

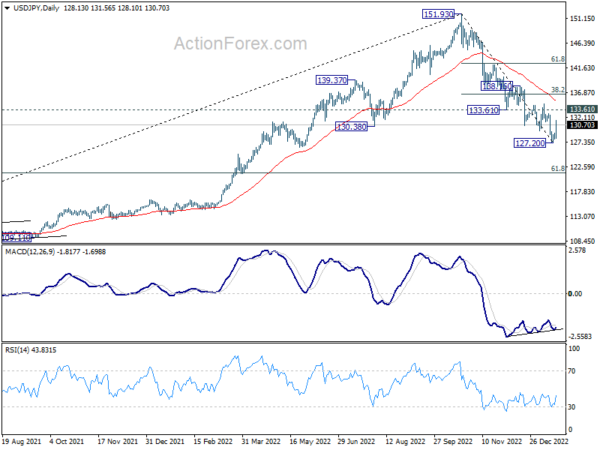

In the bigger picture, the firm break of 55 week EMA (now at 131.59) raises the chance of medium term bearish reversal, but that’s not confirmed yet. Strong support could be seen around 61.8% retracement of 102.58 to 151.93 at 121.43 and 38.2% retracement of 38.2% retracement of 75.56 to 151.93 at 122.75 to bring rebound. But break of 134.76 resistance is needed to indicate bottoming first. Otherwise further fall will remain in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Nov | -8.30% | -0.90% | 5.40% | |

| 02:40 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 04:30 | JPY | Industrial Production M/M Nov F | 0.20% | -0.10% | -0.10% | |

| 07:00 | GBP | CPI M/M Dec | 0.40% | 0.40% | ||

| 07:00 | GBP | CPI Y/Y Dec | 10.60% | 10.70% | ||

| 07:00 | GBP | Core CPI Y/Y Dec | 6.60% | 6.30% | ||

| 07:00 | GBP | RPI M/M Dec | 1.00% | 0.60% | ||

| 07:00 | GBP | RPI Y/Y Dec | 13.90% | 14.00% | ||

| 09:00 | EUR | Italy Trade Balance (EUR) Nov | -1.80B | -2.12B | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 9.20% | 9.20% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec F | 5.20% | 5.20% | ||

| 13:30 | CAD | Raw Material Price Index Dec | -0.80% | |||

| 13:30 | CAD | Industrial Product Price M/M Dec | -0.40% | |||

| 13:30 | USD | Retail Sales M/M Dec | -0.80% | -0.60% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Dec | -0.50% | -0.20% | ||

| 13:30 | USD | PPI Core M/M Dec | 0.10% | 0.40% | ||

| 13:30 | USD | PPI Core Y/Y Dec | 5.90% | 6.20% | ||

| 13:30 | USD | PPI M/M Dec | -0.10% | 0.30% | ||

| 13:30 | USD | PPI Y/Y Dec | 6.80% | 7.40% | ||

| 14:15 | USD | Industrial Production M/M Dec | -0.10% | -0.20% | ||

| 14:15 | USD | Capacity Utilization Dec | 79.60% | 79.70% | ||

| 15:00 | USD | Business Inventories Nov | 0.40% | 0.30% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 31 | 31 | ||

| 19:00 | USD | Fed’s Beige Book |